(→Sales) |

|||

| Line 17: | Line 17: | ||

! No !! Tax Code || Description || Tax Rate || SST-02 column | ! No !! Tax Code || Description || Tax Rate || SST-02 column | ||

|- | |- | ||

| 01 || ST || Sales Tax 10% || 10% || B1_8 <br /> B2_11B | | 01 || ST || Sales Tax 10% charged to the taxable goods based on accrual/billing basis || 10% || B1_8 <br /> B2_11B | ||

|- | |- | ||

| 02 || ST5 || Sales Tax 5% || 5% || B1_8 <br /> B2_11A | | 02 || ST5 || Sales Tax 5% charged to the taxable goods based on accrual/billing basis || 5% || B1_8 <br /> B2_11A | ||

|} | |} | ||

<br /> | <br /> | ||

| Line 28: | Line 28: | ||

! No !! Tax Code || Description || Tax Rate || SST-02 column | ! No !! Tax Code || Description || Tax Rate || SST-02 column | ||

|- | |- | ||

| 01 || SU || Goods Own Used/Disposed 10% || 10% || B1_9 <br /> B2_11B | | 01 || SU || Goods Own Used/Disposed deemed taxable and charged at 10% based on accrual/billing basis || 10% || B1_9 <br /> B2_11B | ||

|- | |- | ||

| 02 || SU5 || Goods Own Used/Disposed 5% || 5% || B1_9 <br /> B2_11A | | 02 || SU5 || Goods Own Used/Disposed deemed taxable and charged at 5% based on accrual/billing basis || 5% || B1_9 <br /> B2_11A | ||

|} | |} | ||

<br /> | <br /> | ||

| Line 39: | Line 39: | ||

! No !! Tax Code || Description || Tax Rate || SST-02 column | ! No !! Tax Code || Description || Tax Rate || SST-02 column | ||

|- | |- | ||

| 01 || STE || Sales Tax Exempted || || | | 01 || STE || Sales Tax Exempted on goods as prescribed in the Sales Tax (Goods Exempted From Tax) Order 2018 || || n/a | ||

|- | |- | ||

| 02 || SE || Sales Tax Export | | 02 || SE || Sales Tax Exempted to Export, Special Area (SA), eg. Free Zone, LMW and Designated Area (DA), eg. Langkawi, Tioman, Labuan || || B18_A | ||

|- | |- | ||

| 03 || SEA || Sales Tax Exempted - Schedule A | | 03 || SEA || Sales Tax Exempted-Schedule A (Class of Person), eg. Government, Local Authority Dept, etc. Detail refer to Schedule A in Sales Tax (Person Exempted From Payment Of Tax) Order 2018 || || B18_B1 | ||

|- | |- | ||

| 04 || SEB || Sales Tax Exempted - Schedule B | | 04 || SEB || Sales Tax Exempted-Schedule B (Manufacturer of specific non taxable goods), eg. control products, medical. Detail refer to Schedule B in Sales Tax (Person Exempted From Payment Of Tax) Order 2018 || || B18_B2 | ||

|- | |- | ||

| 05 || SEC1 || Sales Tax Exempted - | | 05 || SEC1 || Sales Tax Exempted-Sch C (Item 1) on raw materials, components and packaging materials EXCLUDING PETROLEUM imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer || || B18_B3 (i) | ||

|- | |- | ||

| 06 || SEC2 || Sales Tax Exempted - | | 06 || SEC2 || Sales Tax Exempted-Sch C (Item 2) on raw materials, components and packaging materials imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer of PETROLEUM products || || B18_B3 (i) | ||

|- | |- | ||

| 07 || SEC3 || Sales Tax Exempted - | | 07 || SEC3 || Sales Tax Exempted-Sch C (Item 3) on raw materials, components and packaging materials EXLUDING PETROLEUM imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer || || B18_B3 (ii) | ||

|- | |- | ||

| 08 || SEC4 || Sales Tax Exempted - | | 08 || SEC4 || Sales Tax Exempted-Sch C (Item 4) on raw materials, components and packaging materials imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer of PETOLEUM products || || B18_B3 (ii) | ||

|- | |- | ||

| 09 || SEC5 || Sales Tax Exempted - | | 09 || SEC5 || Sales Tax Exempted-Sch C (Item 5) on semi-finished taxable goods or finished taxable goods which are subsequently returned by a subcon to a reg. manufacturer after completion of subcontract work || || B18_B3 (iii) | ||

|} | |} | ||

<br /> | <br /> | ||

| Line 64: | Line 64: | ||

! No !! Tax Code || Description || Tax Rate || SST-02 column | ! No !! Tax Code || Description || Tax Rate || SST-02 column | ||

|- | |- | ||

| 01 || PEC1 || Purchase Tax Exempted - | | 01 || PEC1 || Purchase Tax Exempted-Sch C (Item 1) on raw materials, components and packaging materials EXCLUDING PETROLEUM imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer || || B19 | ||

|- | |- | ||

| 02 || PEC2 || Purchase Tax Exempted - | | 02 || PEC2 || Purchase Tax Exempted-Sch C (Item 2) on raw materials, components and packaging materials imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer of PETROLEUM products || || B19 | ||

|- | |- | ||

| 03 || PEC3 || Purchase Tax Exempted - | | 03 || PEC3 || Purchase Tax Exempted-Sch C (Item 3) on raw materials, components and packaging materials EXLUDING PETROLEUM imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer || || B20 | ||

|- | |- | ||

| 04 || | | 04 || PEC4 || Purchase Tax Exempted-Sch C (Item 4) on raw materials,components and packaging materials imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer of PETOLEUM products || || B20 | ||

|- | |- | ||

| 05 || | | 05 || PEC5 || Purchase Tax Exempted-Sch C (Item 5) on semi-finished taxable goods or finished taxable goods which are subsequently returned by a subcon to a reg. manufacturer after completion of subcontract work || || B21 | ||

|} | |} | ||

<br /> | <br /> | ||

Revision as of 04:04, 21 November 2019

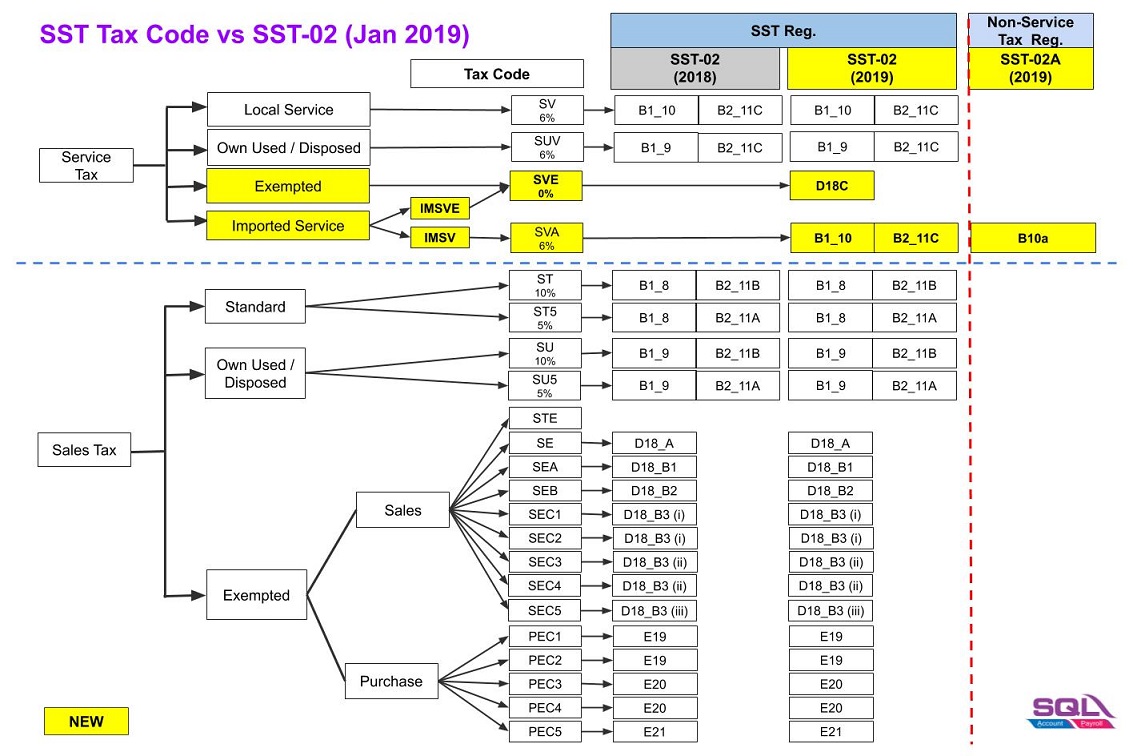

Introduction

- Explain the importance and usage of SST Tax Code reflect to SST-02.

SST Tax Code

- SST tax code mapping to SST-02.

Sales

1) Standard

No Tax Code Description Tax Rate SST-02 column 01 ST Sales Tax 10% charged to the taxable goods based on accrual/billing basis 10% B1_8

B2_11B02 ST5 Sales Tax 5% charged to the taxable goods based on accrual/billing basis 5% B1_8

B2_11A

2) Deemed Supply (Own Used/Disposed)

No Tax Code Description Tax Rate SST-02 column 01 SU Goods Own Used/Disposed deemed taxable and charged at 10% based on accrual/billing basis 10% B1_9

B2_11B02 SU5 Goods Own Used/Disposed deemed taxable and charged at 5% based on accrual/billing basis 5% B1_9

B2_11A

3) Sales - Exempted

No Tax Code Description Tax Rate SST-02 column 01 STE Sales Tax Exempted on goods as prescribed in the Sales Tax (Goods Exempted From Tax) Order 2018 n/a 02 SE Sales Tax Exempted to Export, Special Area (SA), eg. Free Zone, LMW and Designated Area (DA), eg. Langkawi, Tioman, Labuan B18_A 03 SEA Sales Tax Exempted-Schedule A (Class of Person), eg. Government, Local Authority Dept, etc. Detail refer to Schedule A in Sales Tax (Person Exempted From Payment Of Tax) Order 2018 B18_B1 04 SEB Sales Tax Exempted-Schedule B (Manufacturer of specific non taxable goods), eg. control products, medical. Detail refer to Schedule B in Sales Tax (Person Exempted From Payment Of Tax) Order 2018 B18_B2 05 SEC1 Sales Tax Exempted-Sch C (Item 1) on raw materials, components and packaging materials EXCLUDING PETROLEUM imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer B18_B3 (i) 06 SEC2 Sales Tax Exempted-Sch C (Item 2) on raw materials, components and packaging materials imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer of PETROLEUM products B18_B3 (i) 07 SEC3 Sales Tax Exempted-Sch C (Item 3) on raw materials, components and packaging materials EXLUDING PETROLEUM imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer B18_B3 (ii) 08 SEC4 Sales Tax Exempted-Sch C (Item 4) on raw materials, components and packaging materials imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer of PETOLEUM products B18_B3 (ii) 09 SEC5 Sales Tax Exempted-Sch C (Item 5) on semi-finished taxable goods or finished taxable goods which are subsequently returned by a subcon to a reg. manufacturer after completion of subcontract work B18_B3 (iii)

4) Purchase - Exempted

No Tax Code Description Tax Rate SST-02 column 01 PEC1 Purchase Tax Exempted-Sch C (Item 1) on raw materials, components and packaging materials EXCLUDING PETROLEUM imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer B19 02 PEC2 Purchase Tax Exempted-Sch C (Item 2) on raw materials, components and packaging materials imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer of PETROLEUM products B19 03 PEC3 Purchase Tax Exempted-Sch C (Item 3) on raw materials, components and packaging materials EXLUDING PETROLEUM imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer B20 04 PEC4 Purchase Tax Exempted-Sch C (Item 4) on raw materials,components and packaging materials imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer of PETOLEUM products B20 05 PEC5 Purchase Tax Exempted-Sch C (Item 5) on semi-finished taxable goods or finished taxable goods which are subsequently returned by a subcon to a reg. manufacturer after completion of subcontract work B21

Service

1) Standard

No Tax Code Description Tax Rate SST-02 column 01 SV Service Tax 6% 6% B1_10

B2_11C

2) Deemed Supply (Own Used/Disposed)

No Tax Code Description Tax Rate SST-02 column 01 SUV Service Own Use 6% 6% B1_9

B2_11C