No edit summary |

|||

| Line 5: | Line 5: | ||

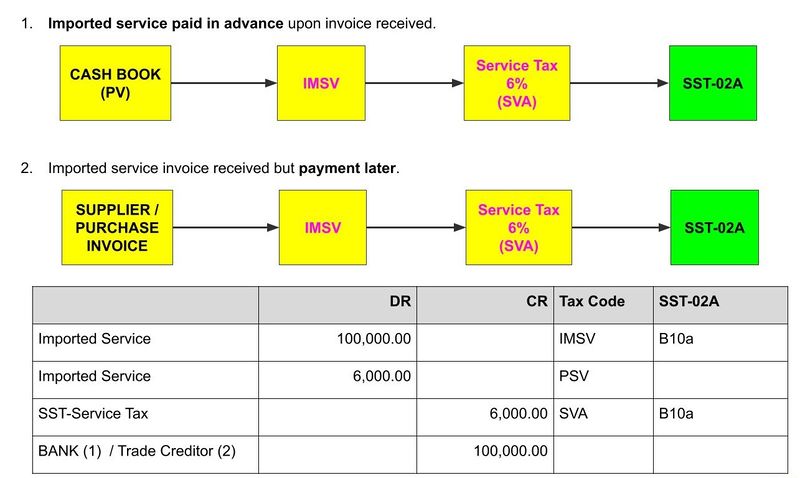

* for '''Sales Tax registered ONLY''', declare imported service in '''SST-02A''' | * for '''Sales Tax registered ONLY''', declare imported service in '''SST-02A''' | ||

* Tax code : '''IMSV''' | * Tax code : '''IMSV''' | ||

* Enter at '''Cash Book Entry (PV)''' or at S'''upplier/Purchase Invoice'''. See the illustration below: | |||

<br /> | <br /> | ||

:[[File:IMSV.jpg |800px]] | :[[File:IMSV.jpg |800px]] | ||

| Line 13: | Line 14: | ||

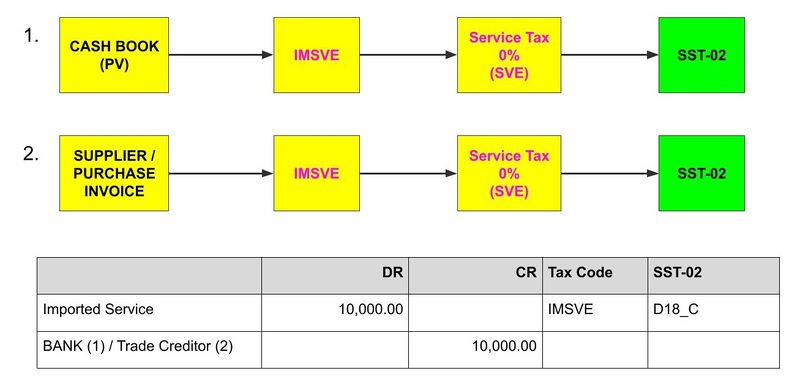

* Need to declare in SST-02 | * Need to declare in SST-02 | ||

* Tax code : '''IMSVE''' | * Tax code : '''IMSVE''' | ||

* Enter at '''Cash Book Entry (PV)''' or at S'''upplier/Purchase Invoice'''. See the illustration below: | |||

<br /> | <br /> | ||

:[[File:IMSVE.jpg |800px]] | :[[File:IMSVE.jpg |800px]] | ||

Revision as of 07:11, 18 October 2022

Imported Service Tax

Purchase service from oversea by any companies in Malaysia and it is subject to imported service tax 6%.

- for Service Tax registered ONLY, declare together with other service tax in SST-02

- for non-SST registered, declare imported service in SST-02A

- for Sales Tax registered ONLY, declare imported service in SST-02A

- Tax code : IMSV

- Enter at Cash Book Entry (PV) or at Supplier/Purchase Invoice. See the illustration below:

Imported Service Tax Exempted

Any company in Malaysia who acquires taxable services of Group G item (a), (b), (c), (d), (e), (f), (g), (h) and (i) from any company within the same group of companies outside Malaysia. It is Exempted.

- Need to declare in SST-02

- Tax code : IMSVE

- Enter at Cash Book Entry (PV) or at Supplier/Purchase Invoice. See the illustration below:

How to get print SST-02A?

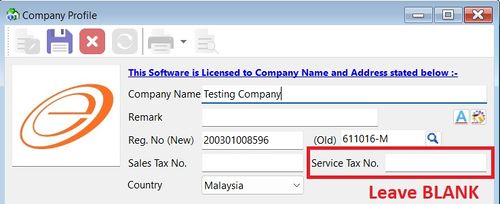

1. Go to File | Company Profile...

2. Make sure the Service Tax No field is BLANK.

Note: For Service Tax Registered company, it is declare together with other service tax in SST-02

3. Save it.

4. Logout and login again.

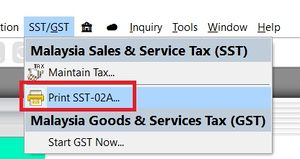

5. Go to menu : SST/GST | Print SST-02A...