(→Steps) |

|||

| Line 131: | Line 131: | ||

:06. Select '''Payment Method Account Code''' | :06. Select '''Payment Method Account Code''' | ||

:07. Tick '''Post As 1 Record''' if you wanted to post all transaction as 1 Cash Sales (Recommended) | :07. Tick '''Post As 1 Record''' if you wanted to post all transaction as 1 Cash Sales (Recommended) | ||

{| class="wikitable" style="margin: 1em auto 1em auto;" | |||

|- | |||

! Option !! Description | |||

|- | |||

| True (Tick) || System will Post to SQL Accounting As 1 Cash Sales (Recommended) | |||

|- | |||

| False (UnTick) || System will Post 1 by 1 InvNo to Cash Sales | |||

|} | |||

:08. Select the Date (applicable if '''Post As 1 Record''' is Selected) | :08. Select the Date (applicable if '''Post As 1 Record''' is Selected) | ||

:09. Click '''Verify''' to check any Duplicate Cash Sales Number | :09. Click '''Verify''' to check any Duplicate Cash Sales Number | ||

Revision as of 01:41, 30 April 2016

Introduction

Is External Shareware Program which to import Cash Register Electronic Journal (EJ) file to

- Sales Cash Sales

- Customer Payment

Supported Model

Sharp

Format 1

- XE-A147

- XE-A137

Format 2

- XE-A207

- XE-A217

- XE-A307

- ER-A411/ER-A421

Import Program

- Version (1.0.0.0) - 24 Apr 2016

- http://www.estream.com.my/downloadfile/Fairy/SQLAccCashRegister-setup.exe

History New/Updates/Changes

--Build 0--

Setting

Cash Register Machine

Below is the setting to be set in your Cash Register Machine

- Updated 19 Mar 2016

- All setting can be done at PGM mode → Setting → function text

- For Currency can be done at PGM mode → Setting → Optional → Basic system

| Description | Function | Text |

|---|---|---|

| Currency Symbol | CURRENCY TEXT | RM |

| GST Standard Rate Symbol | TXBL1 SYMBOL | S |

| GST Zero Rate Symbol | TXBL2 SYMBOL | Z |

| Taxable subtotal (SubTotalWithTax) | TAX1 ST | GST TAX AMT |

| Taxable subtotal (SubTotalWithTax) | TAX2 ST | ZERO TAX AMT |

| VAT(GSTAmt) | VAT 1 | GST 6% |

| VAT(GSTAmt) | VAT 2 | GST 0% |

| Rounding | DIFFER | ROUNDING |

| DocAmt | Total | ***TOTAL |

| Total Before Service Charge | Subtotal | SUBTOTAL |

| Service Charge | SER.CHRG | SER.CHRG |

| Total After Service Charge before GST | NET 1 | NET |

| Cash Payment | CASH | CASH |

|

SQL Accounting

May refer to Point 1 at Things To Consider Before Import/Post

Cash Register Import

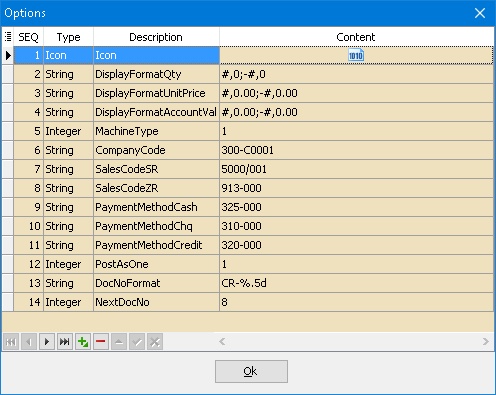

Menu: Tools | Options...

| Function | Description |

|---|---|

| DisplayFormatQty | Display Format For Quantity Field |

| DisplayFormatUnitPrice | Display Format For Unit Price Field |

| DisplayFormatAccountValue | Display Format For Amount Field |

| *MachineType | Last used Machine Type |

| *CompanyCode | Last used Customer Code |

| *SalesCodeSR | Last used Sales Code for SR |

| *SalesCodeZR | Last used Sales Code for ZR |

| *PaymentMethodCash | Last used Payment Method Code |

| *PostAsOne | Posting Type |

| DocNoFormat | Document Number Format for PostAsOne = 1 |

| NextDocNo | Next Document Number for PostAsOne = 1 |

|

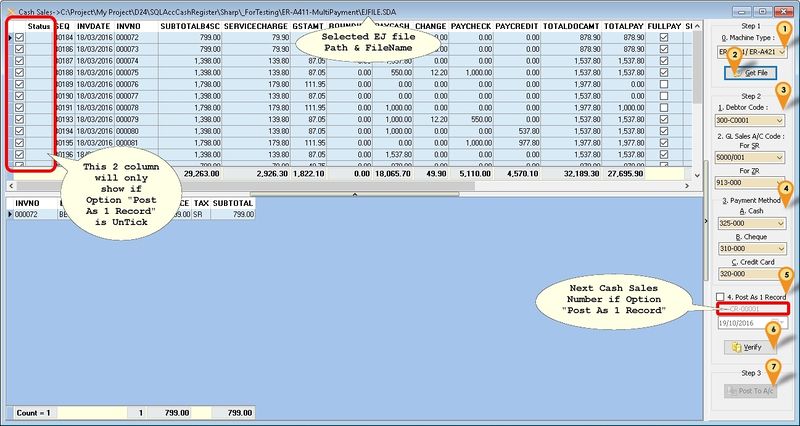

Steps

Menu: Cash Sales...

- 01. Select Machine Type

- 02. Click Get File & browse to the folder & look for EJFILE.SDA

- 03. Select Debtor Code

- 04. Select Sales Account Code for SR

- 05. Select Sales Account Code for ZR

- 06. Select Payment Method Account Code

- 07. Tick Post As 1 Record if you wanted to post all transaction as 1 Cash Sales (Recommended)

| Option | Description |

|---|---|

| True (Tick) | System will Post to SQL Accounting As 1 Cash Sales (Recommended) |

| False (UnTick) | System will Post 1 by 1 InvNo to Cash Sales |

- 08. Select the Date (applicable if Post As 1 Record is Selected)

- 09. Click Verify to check any Duplicate Cash Sales Number

- 10. Click Post To A/c button to Post.

FAQ

May refer to FAQ

See also

- Others Customisation