Payroll | Open Pending Payroll...

Introduction

- This is for user to prepare the transaction (eg Overtime, Deduction) before Process the Payroll...

- Available Pending Type Transactions

Wages Allowance Tax Deduction Overtime Deduction Advance Paid Claims Loan CP38 Advance Deduct Bonus Paid Leave Director Fees Unpaid Leave Tax Benefit Commission

- After all the Pending had enter user may go either below step to for next step except Pending Advance Paid

- For Pending Advance Paid must use New_Payroll | Ad Hoc Process then only can use New Payroll | Final Process

Steps

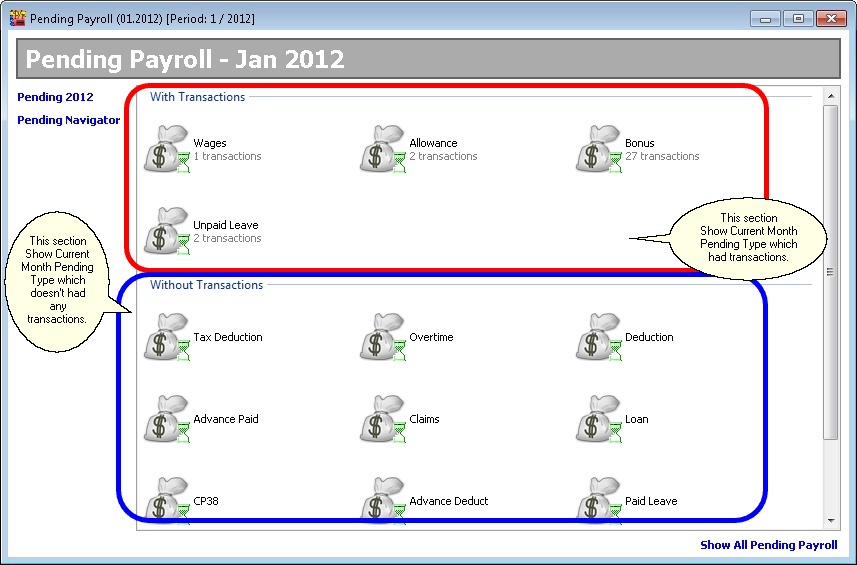

Pending YYYY

- YYYY represent as Year (eg if in 2013 will show as Pending 2013).

- To show the pending in Monthly (with & without Transactions).

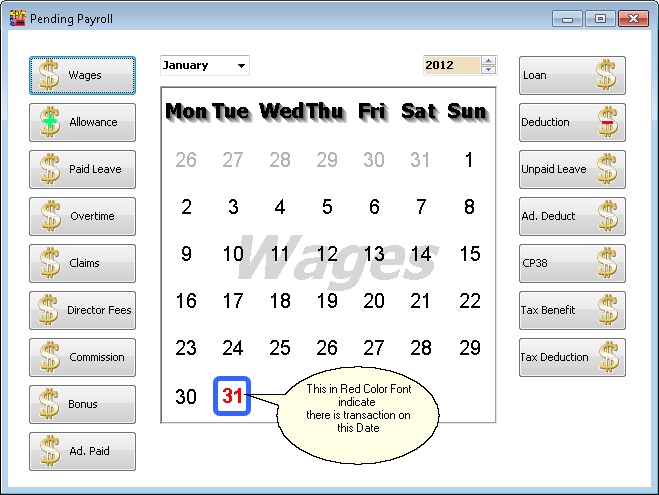

Show which Pending Type had transactions in day view.

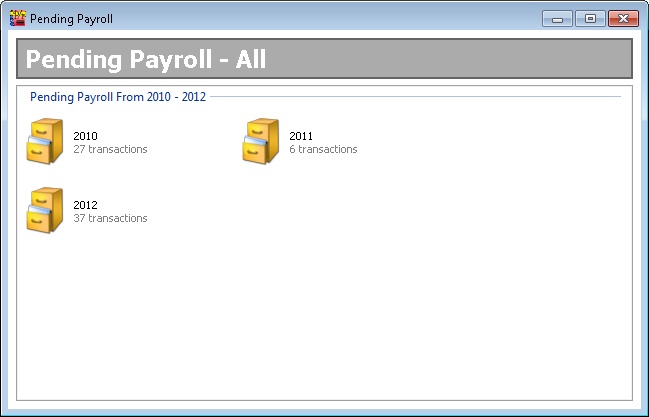

Show all Pending Payroll

To show the pending in Yearly (with Transactions).

Pending Transactions Types

- Just click the + button on top of the Screen (The Green + and Money icon) to Insert record(s).

- After done just Click the Blue Diskette icon on top of the Screen to save the record.

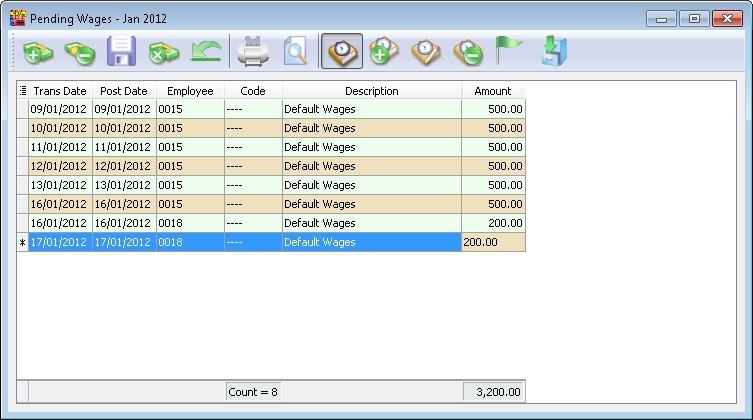

Pending Wages

- This is useful for employee is pay by number of day they work (i.e. user can add the day when the selected employee is come to work).

Field Name Properties Trans Date - Wages Transaction Date.

- Field Type : Date.

Post Date - Wages Process Date.

- Field Type : Date.

Employee - Employee Code.

- Field Type : Alphanumerical.

- Length : 30.

Code - Wages Type.

- Field Type : Alphanumerical.

- Length : 20.

Description - Wages Type Description.

- Field Type : Alphanumerical.

- Length : 160.

Amount - Wages amount.

- Field Type : Decimal.

- Length : 18.

- Precision : 2.

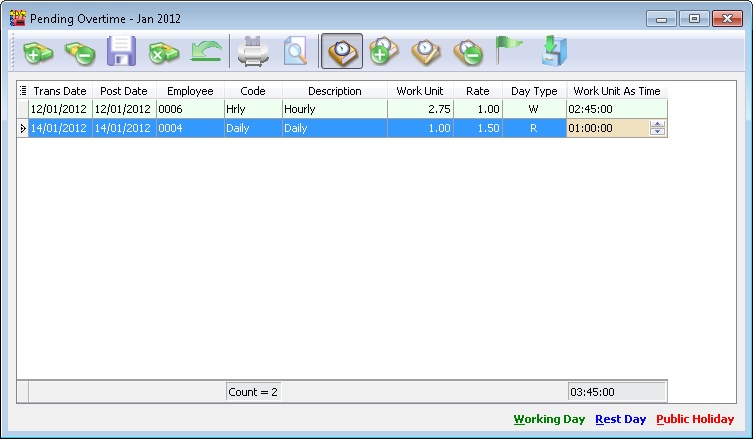

Pending Overtime

Field Name Properties Trans Date - Overtime Transaction Date.

- Field Type : Date.

Post Date - Overtime Process Date.

- Field Type : Date.

Employee - Employee Code.

- Field Type : Alphanumeric.

- Length : 30.

Code - Overtime Type.

- Field Type : Alphanumeric.

- Length : 20.

Description - Overtime Type Description.

- Field Type : Alphanumeric.

- Length : 160.

Work Unit - Overtime "Quantity".

- It can be in Hours or Day depend what Overtime Type selected and Unit type is set at Maintain Overtime.

- Field Type : Decimal.

- Length : 18.

- Precision : 8.

Rate - Overtime Rate.

- Field Type : Decimal.

- Length : 18.

- Precision : 8.

Day Type - Day Type of Overtime is "taken".

- It follow the Post Date to determine the Day Type which is set at Maintain Calender.

- Field Type : Alpha.

- Length : 1.

Work Unit As Time - User can enter as time (HH:MM:SS).

- The example above for employee 0006 is 2 hours 45 min).

- Field Type : Time.

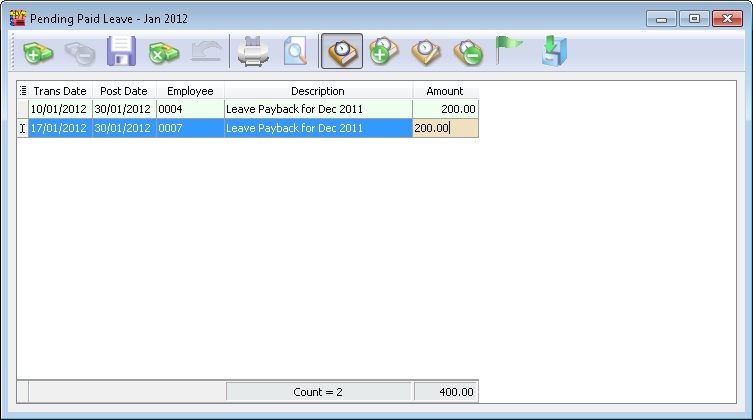

Pending Paid Leave

Field Name Properties Trans Date - Paid Leave Transaction Date.

- Field Type : Date.

Post Date - Paid Leave Process Date.

- Field Type : Date.

Employee - Employee Code.

- Field Type : Alphanumeric.

- Length : 30.

Description - Paid Leave Description.

- Field Type : Alphanumeric.

- Length : 160.

Amount - Paid Leave amount.

- Field Type : Decimal.

- Length : 18.

- Precision : 2.

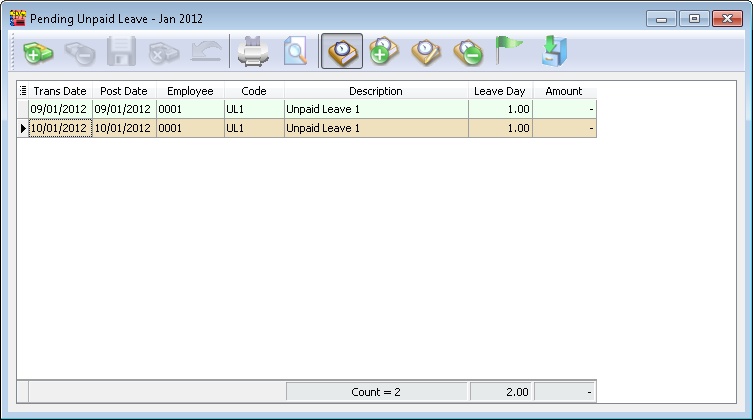

Pending Unpaid Leave

Field Name Properties Trans Date - Unpaid Leave Transaction Date.

- Field Type : Date.

Post Date - Unpaid Leave Process Date.

- Field Type : Date.

Employee - Employee Code.

- Field Type : Alphanumeric.

- Length : 30.

Code - Unpaid Leave Type.

- Field Type : Alphanumeric.

- Length : 20.

Description - Unpaid Leave Type Description.

- Field Type : Alphanumeric.

- Length : 160.

Leave Day - Number of Unpaid Leave Day Taken.

- Field Type : Decimal.

- Length : 18.

- Precision : 8.

Amount - Unpaid Leave amount.

- May leave it empty if wanted calculated by system.

- Field Type : Decimal.

- Length : 18.

- Precision : 2.

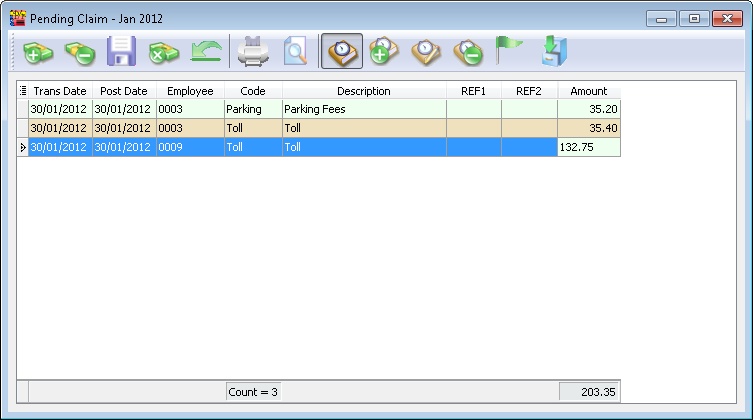

Pending Claim

Field Name Properties Trans Date - Claim Transaction Date.

- Field Type : Date.

Post Date - Claim Process Date.

- Field Type : Date.

Employee - Employee Code.

- Field Type : Alphanumeric.

- Length : 30.

Code - Claim Type.

- Field Type : Alphanumeric.

- Length : 20.

Description - Claim Type Description.

- Field Type : Alphanumeric.

- Length : 160.

Ref1 - Claim Reference 1.

- Field Type : Alphanumeric.

- Length : 20.

Ref2 - Claim Reference 2.

- Field Type : Alphanumeric.

- Length : 20.

Amount - Claim amount.

- Field Type : Decimal.

- Length : 18.

- Precision : 2.

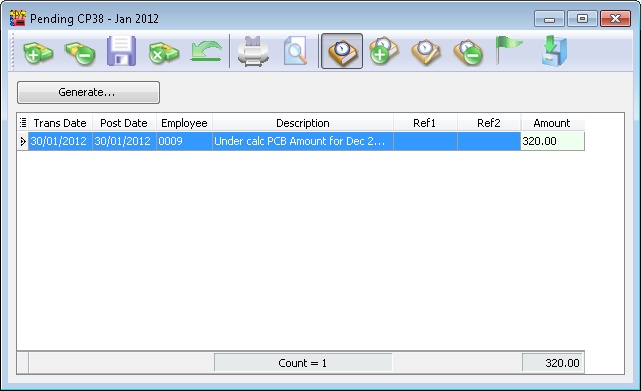

Pending CP38

Field Name Properties Trans Date - CP38 Transaction Date.

- Field Type : Date.

Post Date - CP38 Process Date.

- Field Type : Date.

Employee - Employee Code.

- Field Type : Alphanumeric.

- Length : 30.

Description - CP38 Description.

- Field Type : Alphanumeric.

- Length : 160.

Ref1 - CP38 Reference 1.

- Field Type : Alphanumeric.

- Length : 20.

Ref2 - CP38 Reference 2.

- Field Type : Alphanumeric.

- Length : 20.

Amount - CP38 amount.

- Field Type : Decimal.

- Length : 18.

- Precision : 2.

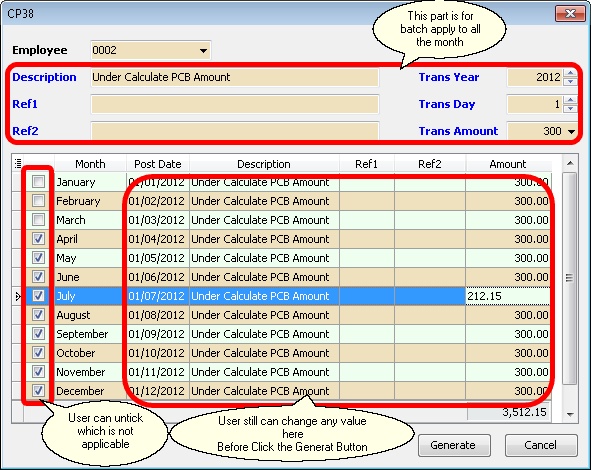

Generate Button For Batch Generate CP38. (See below picture)

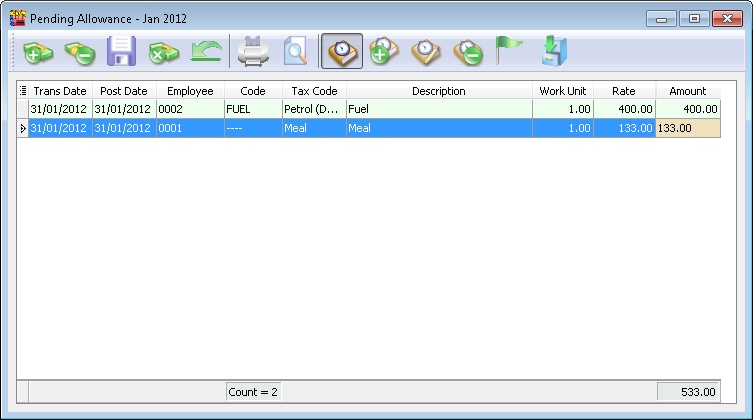

Pending Allowance

Field Name Properties Trans Date - Allowance Transaction Date.

- Field Type : Date.

Post Date - Allowance Process Date.

- Field Type : Date.

Employee - Employee Code.

- Field Type : Alphanumeric.

- Length : 30.

Code - Allowance Type.

- Field Type : Alphanumeric.

- Length : 20.

Tax Code - Tax Exempted Code.

- Field Type : Alphanumeric.

- Length : 20.

Description - Allowance Type Description.

- Field Type : Alphanumeric.

- Length : 160.

Work Unit - Allowance "Quantity".

- Field Type : Decimal.

- Length : 18.

- Precision : 8.

Rate - Allowance Rate.

- Field Type : Decimal.

- Length : 18.

- Precision : 8.

Amount - Allowance Total Amount.

- Field Type : Decimal.

- Length : 18.

- Precision : 2.

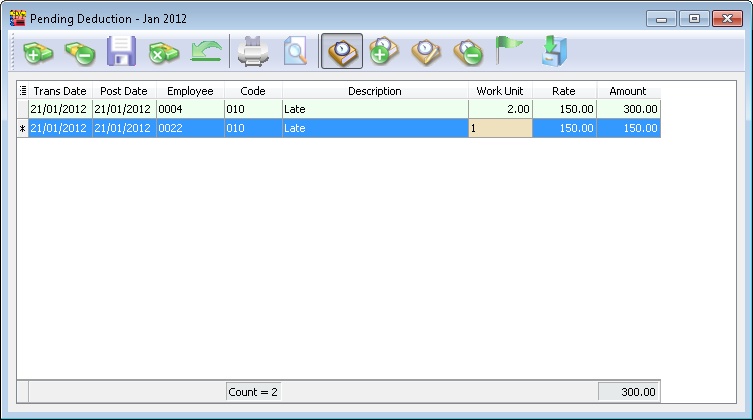

Pending Deduction & Pending Commission

Field Name Properties Trans Date - Deduction Transaction Date.

- Field Type : Date.

Post Date - Deduction Process Date.

- Field Type : Date.

Employee - Employee Code.

- Field Type : Alphanumeric.

- Length : 30.

Code - Deduction Type.

- Field Type : Alphanumeric.

- Length : 20.

Description - Deduction Type Description.

- Field Type : Alphanumeric.

- Length : 160.

Work Unit - Deduction "Quantity".

- Field Type : Decimal.

- Length : 18.

- Precision : 8.

Rate - Deduction Rate.

- Field Type : Decimal.

- Length : 18.

- Precision : 8.

Amount - Deduction Total Amount.

- Field Type : Decimal.

- Length : 18.

- Precision : 2.

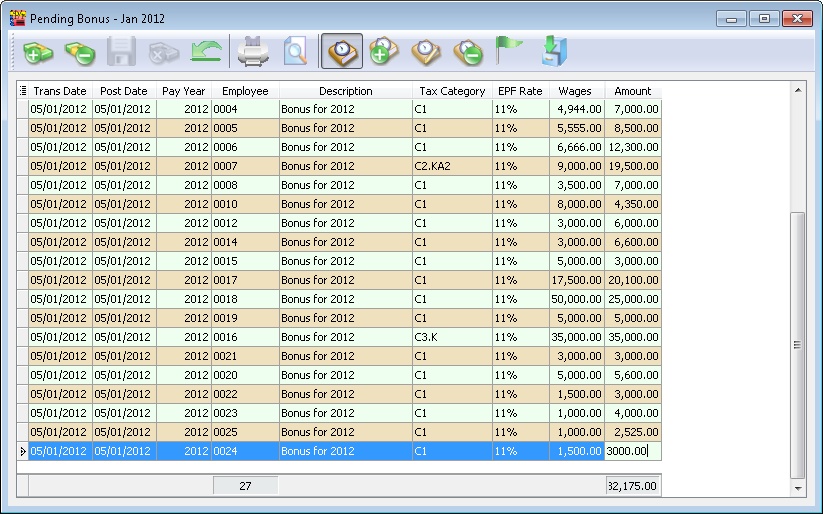

Pending Bonus & Pending Director Fees

Field Name Properties Trans Date - Bonus Transaction Date.

- Field Type : Date.

Post Date - Bonus Process Date.

- Field Type : Date.

Pay Year - Year the bonus pay for.

- Default it should be same year as Post Date.

- Field Type : Integer.

Employee - Employee Code.

- Field Type : Alphanumeric.

- Length : 30.

Tax Category - Employee Tax Category Code.

- May leave it as default.

- Field Type : Alphanumeric.

- Length : 10.

EPF Rate - EPF Rate for Bonus.

- May leave it as default.

- Field Type : Alphanumeric.

- Length : 10.

Wages - The selected Employee Wages amount.

- Field Type : Decimal.

- Length : 18.

- Precision : 2.

Amount - Bonus Amount.

- Field Type : Decimal.

- Length : 18.

- Precision : 2.

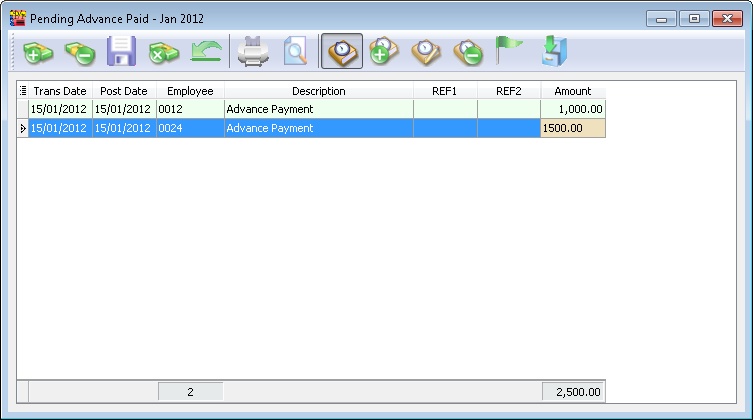

Pending Advance Paid, Pending Advance Deduct & Pending Loan

- Below Example information is applicable for

- Pending Advance Paid

- Pending Advance Deduct (Only View because it derive from Advance Paid after Ad Hoc Process)

- Pending Commission

Field Name Properties Trans Date - Advance Paid Transaction Date.

- Field Type : Date.

Post Date - Advance Paid Process Date.

- Field Type : Date.

Employee - Employee Code.

- Field Type : Alphanumeric.

- Length : 30.

Description - Advance Paid Description.

- Field Type : Alphanumeric.

- Length : 160.

Ref1 - Advance Paid Reference 1.

- Field Type : Alphanumeric.

- Length : 20.

Ref2 - Advance Paid Reference 2.

- Field Type : Alphanumeric.

- Length : 20.

Amount - Advance Paid amount.

- Field Type : Decimal.

- Length : 18.

- Precision : 2.

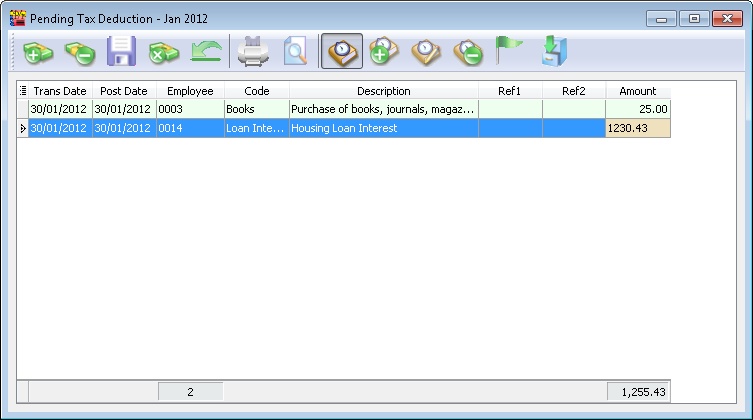

Pending Tax Benefit & Pending Tax Deduction

Field Name Properties Trans Date - Tax Deduction Transaction Date.

- Field Type : Date.

Post Date - Tax Deduction Process Date.

- Field Type : Date.

Employee - Employee Code.

- Field Type : Alphanumeric.

- Length : 30.

Code - Tax Deduction Code.

- Field Type : Alphanumeric.

- Length : 20.

Description - Tax Deduction Description.

- Field Type : Alphanumeric.

- Length : 160.

Ref 1 - Tax Deduction Reference 1.

- Field Type : Alphanumeric.

- Length : 20.

Ref 2 - Tax Deduction Reference 2.

- Field Type : Alphanumeric.

- Length : 20.

Amount - Tax Deduction amount.

- Field Type : Decimal.

- Length : 18.

- Precision : 2.