No edit summary |

|||

| (3 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

''Menu: Tools | Maintain Tax...'' or <br /> | ''Menu: Tools | Maintain Tax...'' or <br /> | ||

''Menu: GST | Maintain Tax...'' | ''Menu: SST/GST | Maintain Tax...'' | ||

==Introduction== | ==Introduction== | ||

| Line 66: | Line 66: | ||

# Maintain Customer/Supplier | # Maintain Customer/Supplier | ||

# Maintain Item Code | # Maintain Item Code | ||

# Tools | Options | Customer/Supplier | # Tools | Options | Customer/Supplier => For Version 836.761 & below | ||

# Maintain Tax with IsDefault is Tick => For Version 837.762 & above | |||

===For AR & AP=== | ===For AR & AP=== | ||

# Maintain Customer/Supplier | # Maintain Customer/Supplier | ||

# Maintain Account | # Maintain Account | ||

# Tools | Options | Customer/Supplier | # Tools | Options | Customer/Supplier => For Version 836.761 & below | ||

# Maintain Tax with IsDefault is Tick => For Version 837.762 & above} | |||

===For GL=== | ===For GL=== | ||

# Maintain Account | # Maintain Account | ||

Latest revision as of 09:29, 1 February 2019

Menu: Tools | Maintain Tax... or

Menu: SST/GST | Maintain Tax...

Introduction

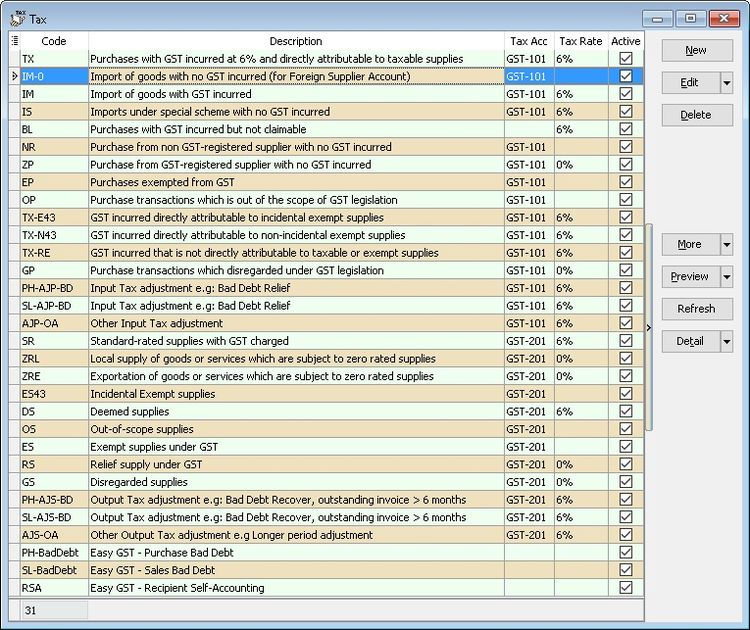

- This to Maintain all the available tax given by Government or user can self add or modified

Create New Tax

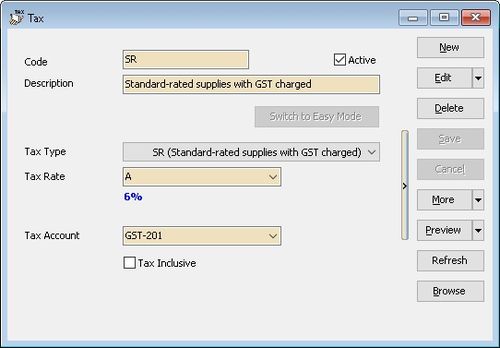

- Screenshot below is the Maintain Tax entry form.

| Field Name | Explanation & Properties |

|---|---|

| Code |

|

| Active |

|

| Description |

|

| Tax Type |

|

| Tax Rate |

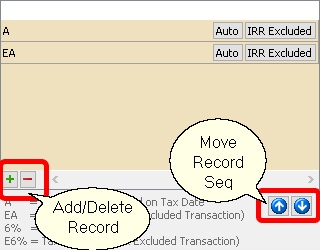

User can self determine the rate or set Auto

Default 1st row is the Default selection in data entry |

| Tax Account |

|

| Tax Inclusive |

|

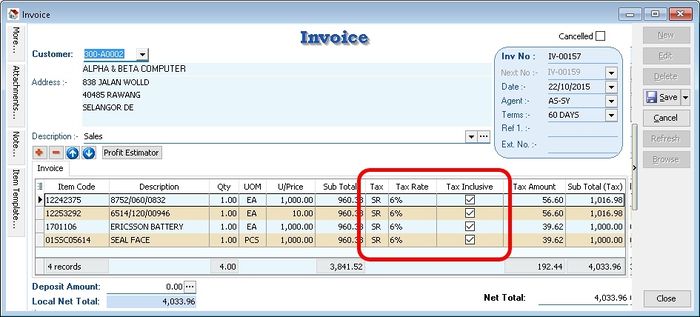

Use of Tax

- You can set the tax as default at the following

- GL | Maintain Account...

- Customer | Maintain Customer... | Tax

- Supplier | Maintain Supplier... | Tax

- Stock | Maintain Stock Item... | Output Tax/Input Tax

- Tools | Options | Customer | Default Output Tax

- Tools | Options | Supplier | Default Input Tax

- Therefore, item inserted will be automatically calculate the tax amount based on the subtotal. See below screenshot.

Default System Tax Seq

Default System Tax Seq are as follow

For Sales & Purchase

- Maintain Customer/Supplier

- Maintain Item Code

- Tools | Options | Customer/Supplier => For Version 836.761 & below

- Maintain Tax with IsDefault is Tick => For Version 837.762 & above

For AR & AP

- Maintain Customer/Supplier

- Maintain Account

- Tools | Options | Customer/Supplier => For Version 836.761 & below

- Maintain Tax with IsDefault is Tick => For Version 837.762 & above}

For GL

- Maintain Account