| Line 17: | Line 17: | ||

| IES || 0% || Incidental exempt supplies under GST legislations. '''(Note: Replace ES43)''' | | IES || 0% || Incidental exempt supplies under GST legislations. '''(Note: Replace ES43)''' | ||

|} | |} | ||

<br /> | |||

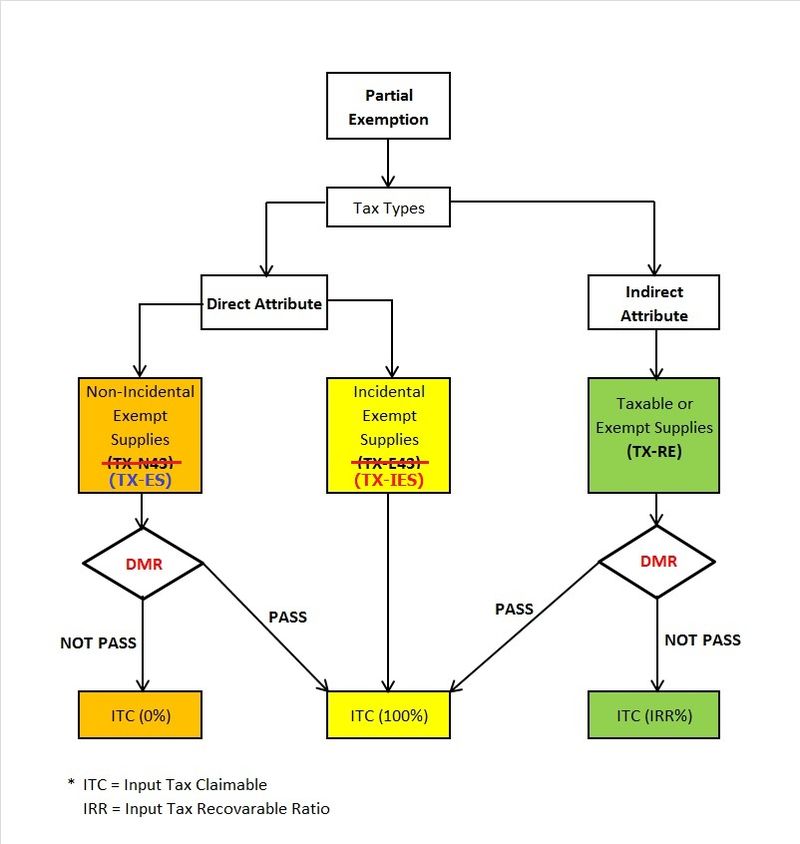

==Partial Exemption Rules== | ==Partial Exemption Rules== | ||

Revision as of 08:02, 5 August 2016

Introduction

- This guide will explains how Partial Exemption, Apportionment and Annual Adjustment are made in respect of residual input tax which is attributable to both taxable and exempt supplies in SQL Financial Accounting.

Changes of Tax Code

- Source from the GUIDE ON ACCOUNTING SOFTWARE ENHANCEMENT TOWARDS GST COMPLIANCE dated 01 Aug 2016.

Tax Code Tax Rate Description TX-ES 6% Purchase with GST incurred directly attributable to nonincidental exempt supplies. (Note: Replace TX-N43) TX-IES 6% Purchase with GST incurred directly attributable to incidental exempt supplies. (Note: Replace TX-E43) TX-RE 6% Purchase with GST incurred that is not directly attributable to taxable or exempt supplies. (Applicable for partially exempt trader/mixed supplier only) IES 0% Incidental exempt supplies under GST legislations. (Note: Replace ES43)

Partial Exemption Rules

De Minimis Rule (DmR)

- To satisfy the De Minus Rule:

- 1. Total Exempt Supply (ES) <= Average Rm5,000.00 per month; AND

- 2. DMR <= 5%

- Formula:

- DmR = [E / (T + E)] x 100%

Supplies Tax Code Description T (SR + ZRL + ZDA + ZRE + DS + OS + RS + GS) The total value (exclusive of GST) of all taxable supplies which are the sum of all standard-rated supplies, zero-rated supplies (Local), zero-rated supplies (Export), deemed taxable supplies, supplies made outside Malaysia which would be taxable if made in Malaysia, relief supplies, and disregarded supplies made in the taxable period. E (ES) The total value (exclusive of GST) of exempt supplies made in the taxable period which NOT include incidental exempt supplies.

NOTE : (i) IES is only for incidental supplies, therefore will not be part of the de minimis rule formula (DmR). (ii) This formula functions is only to test the percentage and value that qualify for de minimis rule. (iii) Accounting software users should apply DmR on their TX-ES transactions.

The application for de minimis rule as stated below: (i) Application of incidental exempt supplies to the de minimis rule. (ii) Applying the de minimis rule in a taxable period. (iii) Applying the de minimis rule in a tax year or longer period.

Input Tax Recoverable Ratio (IRR)

- Formula:

- IRR = (T-O1) / (T+E-O2)

- IRR = (T-O1) / (T+E-O2)

IRR % The recoverable percentage of residual input tax or known as Input Tax Recoverable Rate (IRR) T (SR + ZRL+ ZDA + ZRE + DS + OS + RS + GS) The total value (exclusive of GST) of all taxable supplies which are the sum of all standard-rated supplies, zero-rated supplies (Local), zero-rated supplies (Export), deemed taxable supplies, supplies made outside Malaysia which would be taxable if made in Malaysia, relief supplies, and isregarded supplies made in the taxable period. E (ES) The total value (exclusive of GST) of exempt supplies made in the taxable period. O1 - The total value (exclusive of GST) of all excluded taxable supplies. O2 - The total value (exclusive of GST) of all excluded taxable supplies and all excluded exempt supplies.

- The supplies related to O1 of the IRR formula are as follows:

Tax Code Description SR The value of any supply of capital assets used by the taxable person for the purposes of his business (e.g., an asset or part of an asset is disposed of as Transfer of Going Concern). DS Supplies made by a recipient in accordance with Approved Trader Manufacturer Scheme (ATMS) where self-recipient accounting is made by recipient. DS Supplies of imported services where reverse charge mechanism (RSA) is made by recipient. OS Supplies made outside Malaysia which would not taxable if made in Malaysia.

- The supplies related to O2 of the IRR formula are as follows:

Tax Code Description SR The value of any supply of capital assets used by the taxable person for the purposes of his business (e.g., an asset or part of an asset is disposed of as Transfer of Going Concern). DS Supplies made by a recipient in accordance with Approved Trader Manufacturer Scheme (ATMS) where self-recipient accounting is made by recipient. DS Supplies of imported services where reverse charge mechanism (RSA) is made by recipient. OS Supplies made outside Malaysia which would not taxable if made in Malaysia. ES Exempt supplies of land for general use (Land used for burial, playground or religious building), and disposal of capital asset which is subject to exempt supplies.

Note:

(i) IES is only for incidental exempt supplies, therefore will not be part of the Input Tax Recoverable Ratio (IRR) formula.

(ii) For other excluded transactions ("O1 & O2"), users need to analyse their transactions in ES, SR, DS & OS,

then make necessary adjustment before they can apply the correct ratio.

(iii) Accounting software users should apply IRR on their TX-RE transactions.

(iv) The above formula is based on the value of supplies made which is the standard method used to apportion the residual input tax.

If the person wishes to use other methods to apportion the residual input tax, he is required to get approval from customs.

For further details please refer to GST Guide on Partial Exemption)

Input Tax Claimable Logic to TX-RE, TX-E43 & TX-N43 (Based on DMR)

- Below is the summary of the calculation logic based on DMR to determine the input tax claimable.

Tax Code Tax Rate Fulfill DMR? Input Tax Claimable (ITC) TX-RE 6% Yes ITC x 100% TX-RE 6% No ITC x IRR TX-E43 6% N/A ITC x 100% TX-N43 6% Yes ITC x 100% TX-N43 6% No ITC x 0%

How to exlude the IRR for the capital goods disposal off?

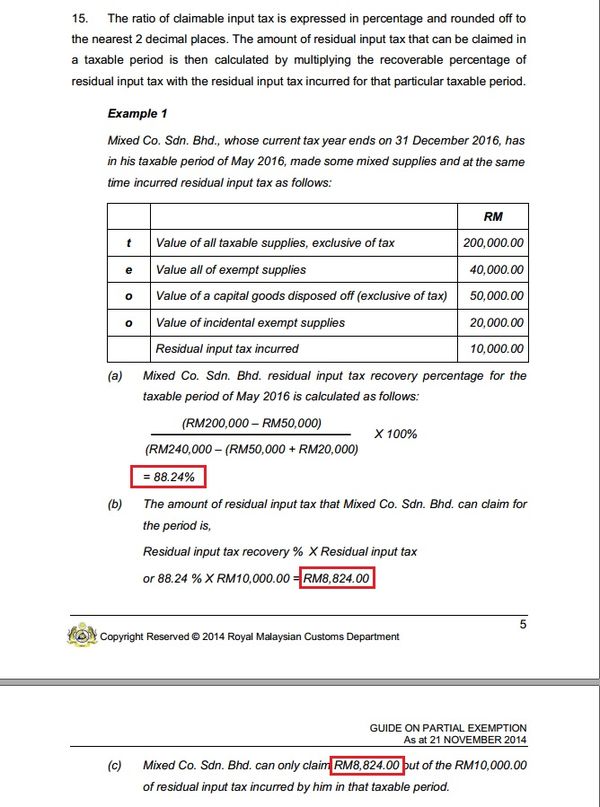

- For example, Mixed Co. Sdn Bhd., whose current tax year ends on 31 December 2016, has in his taxable period of April 2015, made some mixed supplies and at the same time incurred residual input tax as follows.

RM) T Value of all taxable supplies, exclusive of tax 200,000.00 E Value all of exempt supplies 40,000.00 O1 & O2 Value of a capital goods disposal off (exclusive of tax) 50,000.00 O2 Value of incidental exempt supplies 20,000.00 Residual Input Tax Incurred 10,000.00

Steps

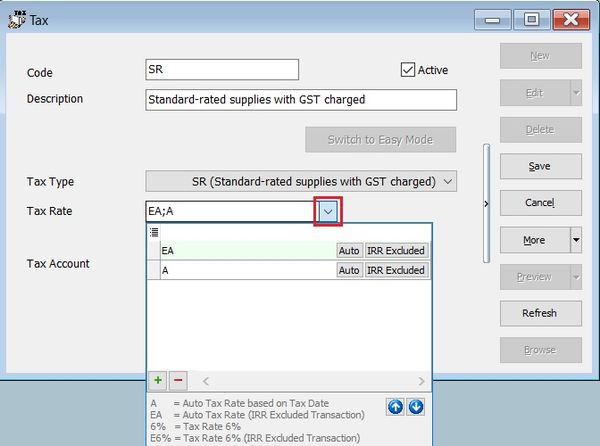

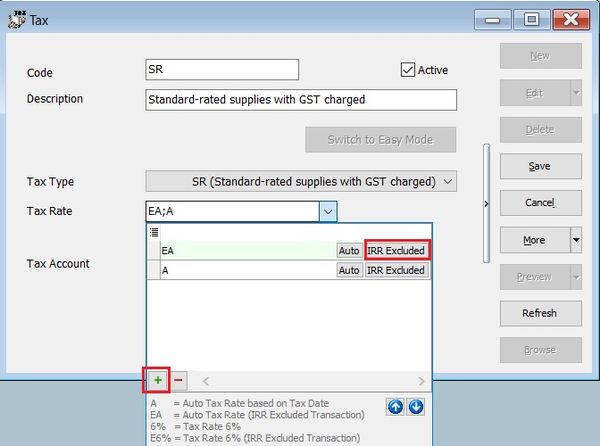

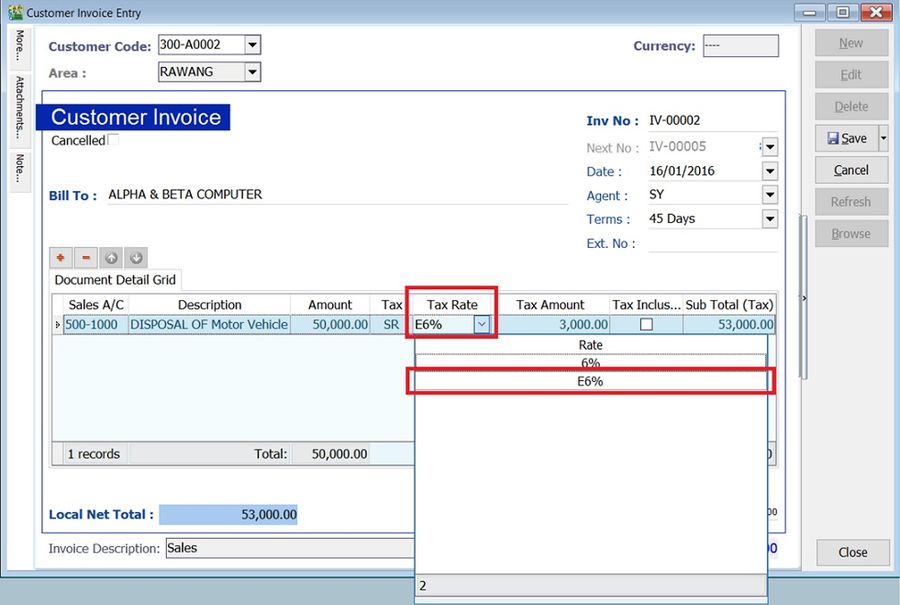

- 1. Go to GST | Maintain Tax...

- 2. Edit the SR tax code.

- 3. Click on the tax rate lookup. See the screenshot below.

Note: 1. Tax Rate set as EA or E6%. 2. E = Exclude from IRR formula.

- 5. Enter the disposal of asset in Customer Invoice.

- 6. Select tax code SR.

- 7. Select tax rate E6% to exclude from IRR calculation (It means "O" to the formula).

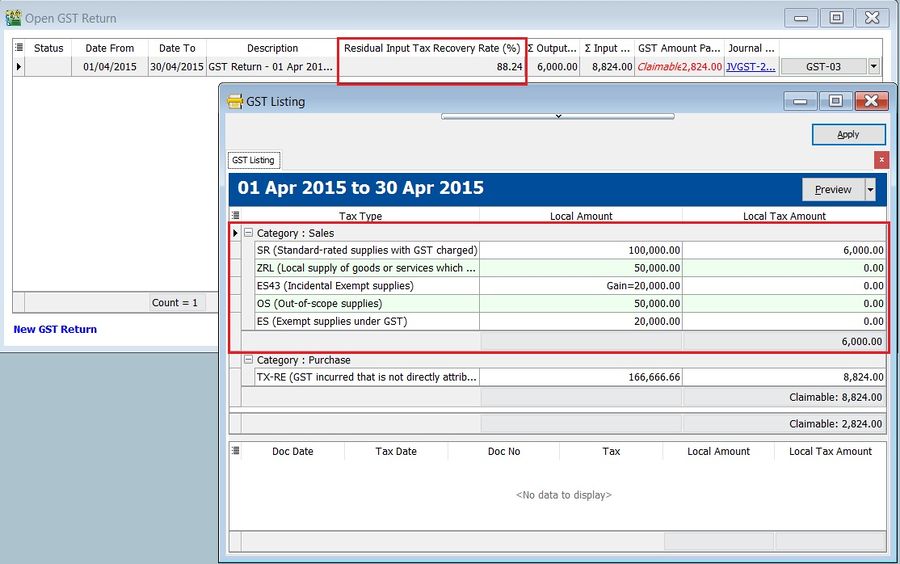

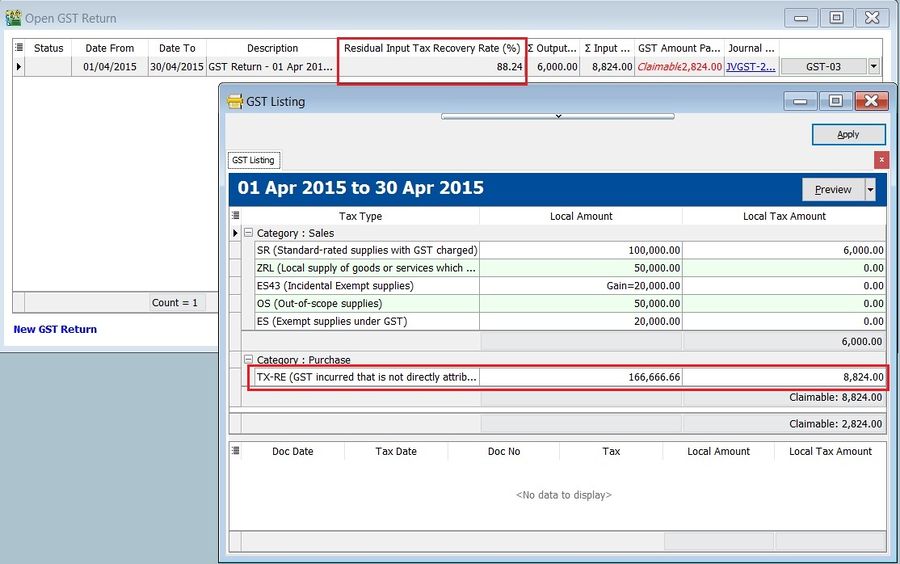

- 8. You will found the IRR calculated (88.24%) and the GST-Listing breakdown by tax code as shown in the screenshot below.

- IRR calculation:

Calculation RM t Value of all taxable supplies, exclusive of tax 100,000 (SR) + 50,000 (ZRL) + 50,000 (OS) 200,000 e Value all of exempt supplies 20,000 (ES) + 20,000 (ES43) 40,000 o Value of a capital goods disposal off (exclusive of tax) 50,000 (SR with tax rate E6%) 50,000 o Value of incidental exempt supplies 20,000 (ES43) 20,000 Residual Input Tax Incurred 166,666.66 X 6% (TX-RE) 10,000.00

RMCD Reference: We get the similar example from Partial Exempt guide by Royal Malaysian Customs Department. See the screenshot below. ::