GST Treatment: How to report GST-03 item 16 Capital Goods Acquired for Purchase of machinery from Oversea

From eStream Software

CASE 1 : Purchase of Machinery (Fixed Asset) from oversea

- Let said the oversea supplier has send the bill amount USD15,000 (USD15,000 x 4.2 = Rm63,000 will recorded in the Account Book).

- Understand that Custom will use GST valuation to compute the GST amt and stated in K1 form. Assume that GST Valuation after custom duty = Rm75,000 and GST amt Rm75,000 x 6% = Rm4,500.

- Question:

- Which amount should I reported in GST-03 item 16 Capital Goods Acquired? Rm63,000 or Rm75,000?

- Which amount should I reported in GST-03 item 16 Capital Goods Acquired? Rm63,000 or Rm75,000?

- Answer from RMCD:

- GST-03 item 16 Capital Goods Acquired = Rm75,000.

- GST-03 item 16 Capital Goods Acquired = Rm75,000.

How to handle this in SQL Accounting?

- 1. Oversea supplier bill enter at purchase/supplier invoice as usual.

Account Local DR Local CR Machinery 63,000.00 Oversea supplier 63,000.00

- 2. When come to forwarder bill after declare out the import goods. You must follow our GST Import Goods guideline. Refer to this link [1]

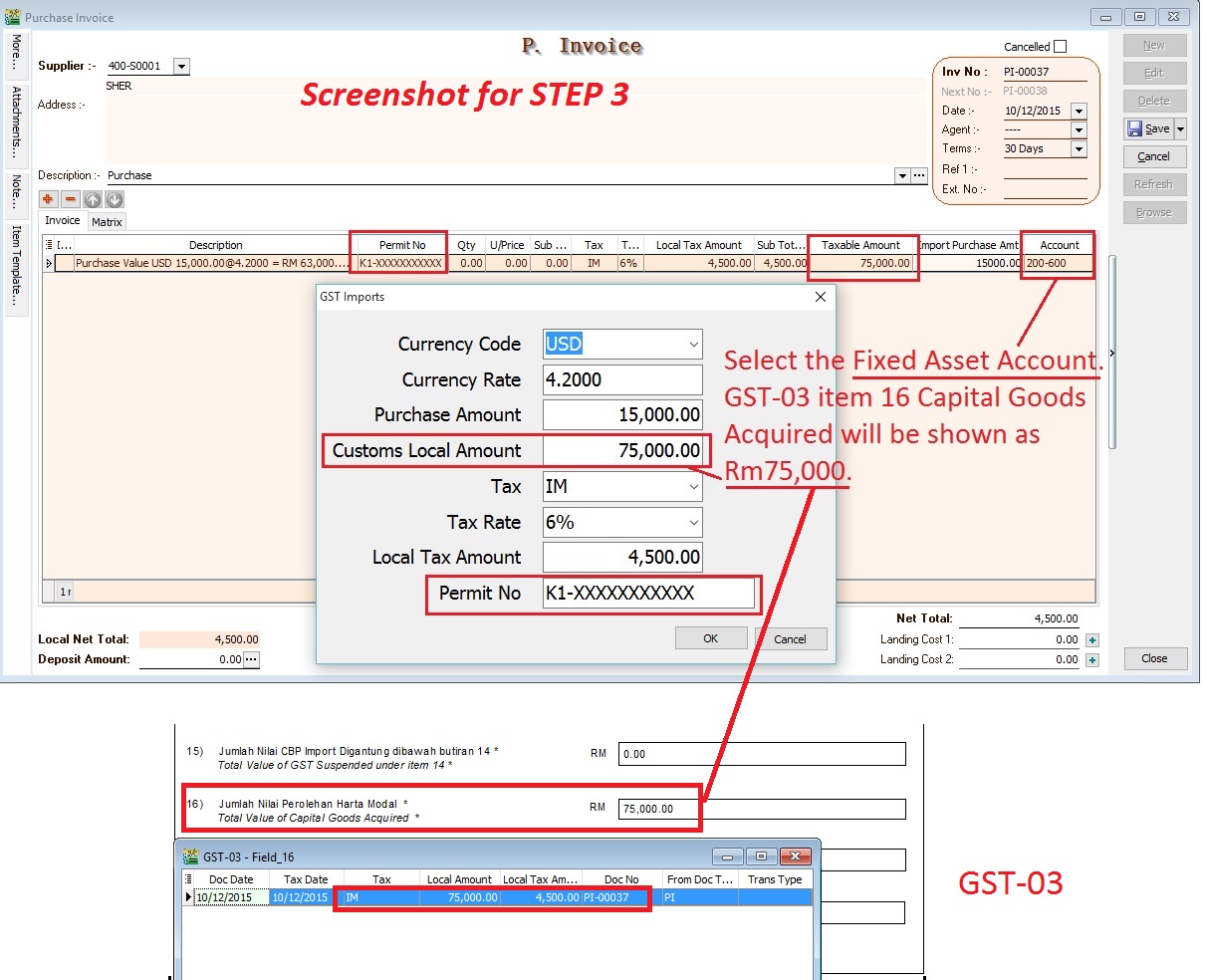

- 3. You just have to select Fixed Asset Account at the item line updated from the GST Imports screen. (Don't worry, Rm75,000 fixed asset will not post into your account book). See the screenshot attached.

NOTE: For GST-03 purpose, this is to report into item 16 Capital Goods Acquired for the import of machinery value as stated in the K1 form. Your account book still recorded as Rm63,000 in step 1.