| Line 86: | Line 86: | ||

<br /> | <br /> | ||

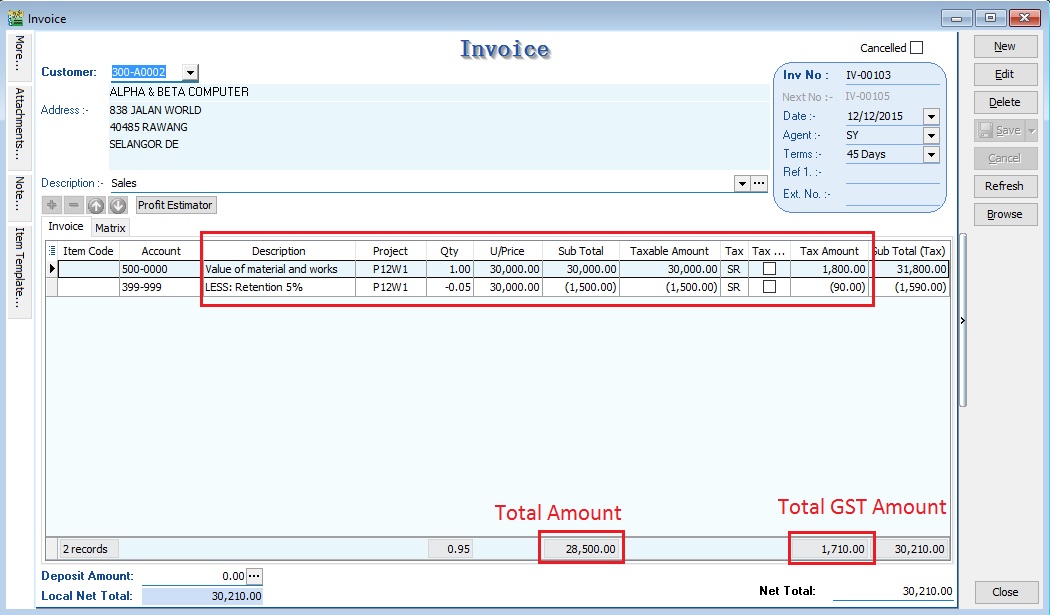

:: <big>'''1st Interim Tax Invoice'''</big> | :: <big>'''1st Interim - Tax Invoice'''</big> | ||

::[[File:Construction-Invoice-01.jpg | 240PX]] | ::[[File:Construction-Invoice-01.jpg | 240PX]] | ||

<br /> | <br /> | ||

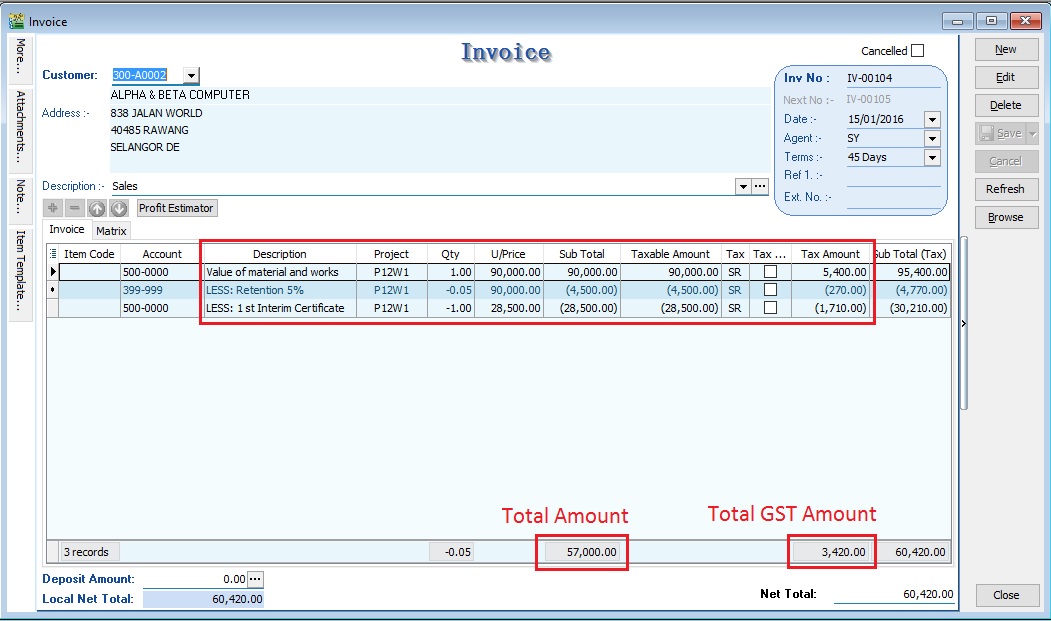

:: <big>'''2nd Interim Tax Invoice'''</big> | :: <big>'''2nd Interim - Tax Invoice'''</big> | ||

::[[File:Construction-Invoice-02.jpg | 240PX]] | ::[[File:Construction-Invoice-02.jpg | 240PX]] | ||

<br /> | <br /> | ||

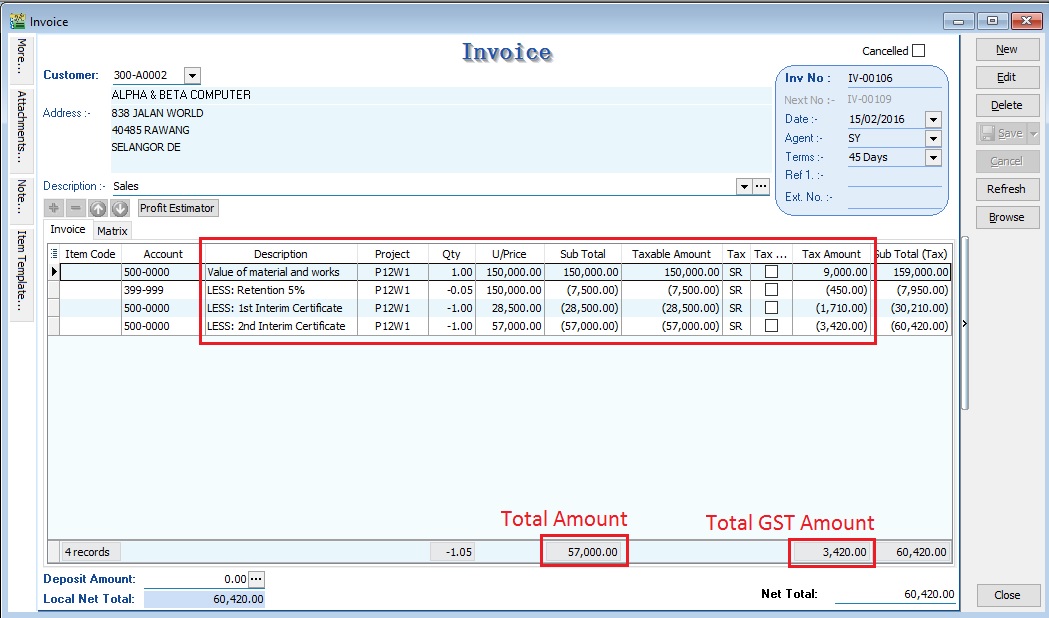

:: <big>'''3rd Interim Tax Invoice'''</big> | :: <big>'''3rd Interim - Tax Invoice'''</big> | ||

::[[File:Construction-Invoice-03.jpg | 240PX]] | ::[[File:Construction-Invoice-03.jpg | 240PX]] | ||

<br /> | <br /> | ||

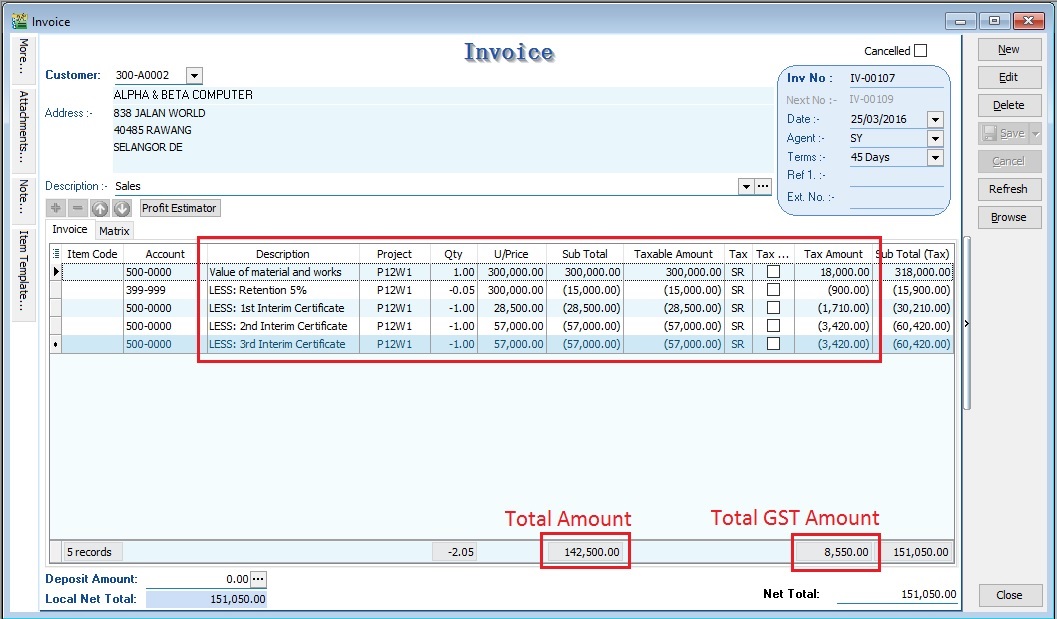

:: <big>'''4th Interim Tax Invoice'''</big> | :: <big>'''4th Interim = Tax Invoice'''</big> | ||

::[[File:Construction-Invoice-04.jpg | 240PX]] | ::[[File:Construction-Invoice-04.jpg | 240PX]] | ||

<br /> | |||

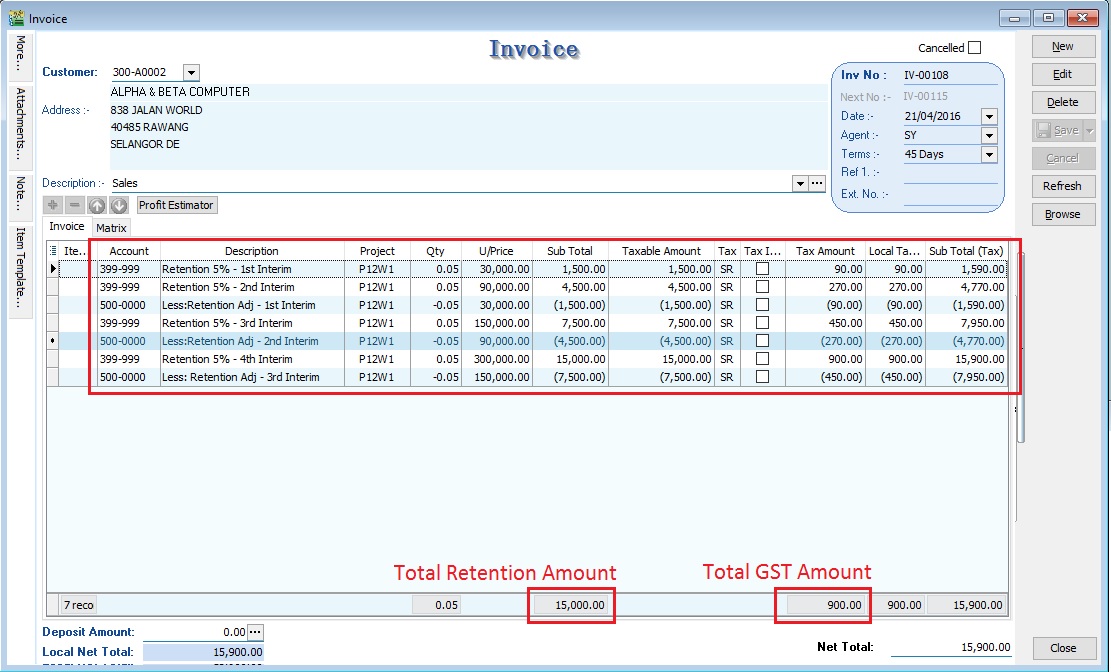

:: <big>'''Total Retention - Tax Invoice'''</big> | |||

::[[File:Construction-Invoice-05.jpg | 240PX]] | |||

<br /> | <br /> | ||

Revision as of 06:27, 15 December 2015

GST - Construction Business

Introduction

- This guide will teach you the way to enter the tax invoice to the Developer from Main Contractor.

- We have to look into and show the following items in order to calculate the GST amount in the Tax Invoice:

- Certified value - Progress claim value certified by Architect.

- Retention Amount - the amount of progress payment which is not paid until the conditions specified in the contract for the payment of such amounts have been met or until defects have been rectified.

- Progress payment

- For example, the Progress Payment:-

1st interim certificate Amount (Rm) Calculation Value of material and works (A1) 30,000.00 Less: Retention Sum (B1) (1,500.00) Rm30,000 x 5% Amount Paid (excl GST) 28,500.00 A1 - B1 GST Amount 1,710.00 Rm28,500 x 6% (SR)

2nd interim certificate Amount (Rm) Calculation Value of material and works (A2) 90,000.00 Less: Retention Sum (B2) (4,500.00) Rm90,000 x 5% Less : 1st Interim Certificate (C2) (28,500.00) Amount Paid (excl GST) 57,000.00 A2 - B2 - C2 GST Amount 3,420.00 Rm57,000 x 6% (SR)

3rd interim certificate Amount (Rm) Calculation Value of material and works (A3) 150,000.00 Less: Retention Sum (B3) (7,500.00) Rm150,000 x 5% Less : 1st Interim Certificate (C3) (28,500.00) Less : 2nd Interim Certificate (D3) (57,000.00) Amount Paid (excl GST) 57,000.00 A3 - B3 - C3 - D3 GST Amount 3,420.00 Rm57,000 x 6% (SR)

4th interim certificate Amount (Rm) Calculation Value of material and works (A4) 300,000.00 Less: Retention Sum (B4) (15,000.00) Rm300,000 x 5% Less : 1st Interim Certificate (C4) (28,500.00) Less : 2nd Interim Certificate (D4) (57,000.00) Less : 3rd Interim Certificate (E4) (57,000.00) Amount Paid (excl GST) 142,500.00 A4 - B4 - C4 - D4 - E4 GST Amount 8,550.00 Rm142,500 x 6% (SR)

- Lastly, the sum of retention Rm28,500 will be invoiced after the full inspection of work done.

- Therefore, GST amount for Retention sum = (Rm1,500 + Rm4,500 + Rm7,500 + Rm15,000) x 6% = Rm1,710

- Time to account for GST is at the either of the following:-

- when payment is received;

- when tax invoice is issued;

- if no tax invoice has been issued within 21 days after the certificate of work done is issued.

Tax Invoice Entry

[Sales | Invoice...]

- 1. Click New.

- 2. Enter the detail as per below example screenshot.

Highlight Changes

| Date | Initiated by | Remarks |

|---|---|---|

| 12 December 2015 | Loo | Initial document. |