| (12 intermediate revisions by the same user not shown) | |||

| Line 3: | Line 3: | ||

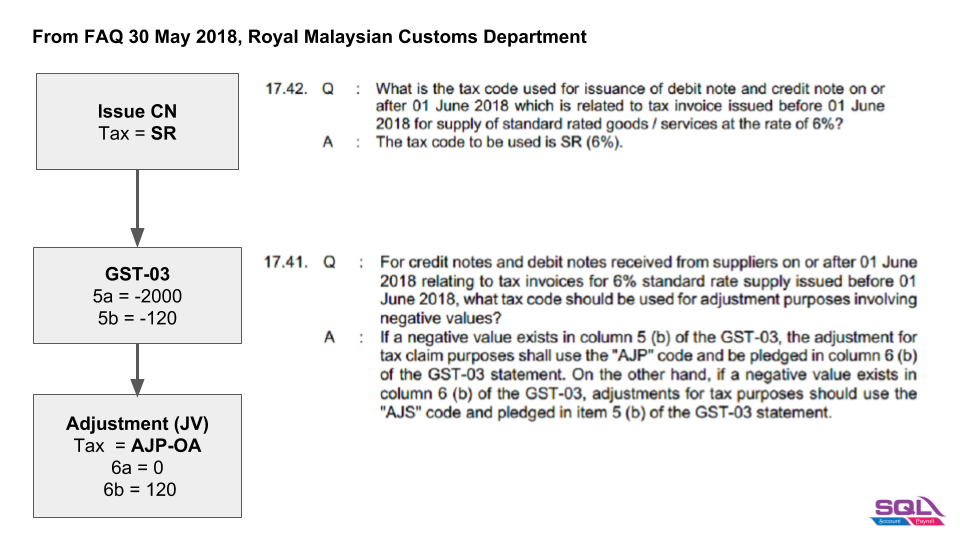

:2. TAP system not accept negative value. | :2. TAP system not accept negative value. | ||

: | [[File:GST-03 negative flow.png]] | ||

<br /> | <br /> | ||

| Line 24: | Line 10: | ||

''Menu: GL | Journal Entry...'' | ''Menu: GL | Journal Entry...'' | ||

:::{| class="wikitable" | :1. '''Output Tax (Negative)''' | ||

::{| class="wikitable" | |||

|- | |- | ||

! | ! GST-03 !! style="text-align:right;"| Value | ||

|- | |- | ||

| 5a || style="text-align:right;"| - | | 5a || style="text-align:right;"| -2,000 | ||

|- | |- | ||

| 5b || style="text-align:right;"| -120 | | 5b || style="text-align:right;"| -120 | ||

|} | |} | ||

:'''Journal Adjustment:''' | :2. '''Journal Adjustment:''' | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! GL Code!! Tax !! Tax Rate !! style="text-align:right;"| Local DR !! style="text-align:right;"| Local CR !! style="text-align:right;"| Local DR(Tax) !! style="text-align:right;"| Local CR(Tax) !! GST-03 | ! GL Code!! Tax !! Tax Rate !! style="text-align:right;"| Local DR !! style="text-align:right;"| Local CR !! style="text-align:right;"| Local DR(Tax) !! style="text-align:right;"| Local CR(Tax) !! GST-03 | ||

|- | |- | ||

| GST-103 || ''' | | GST-103 || '''AJP-OA''' || '''6%''' || style="text-align:right;"| 2,000 || || style="text-align:right;"| 2,120 || || '''6a = 0 <br /> 6b = 120''' | ||

|- | |- | ||

| GST-103 || ''' | | GST-103 || '''SR''' || '''6%''' || || style="text-align:right;"| 2,000 || || style="text-align:right;"| 2,120 || '''5a = 0 <br /> 5b = 0''' | ||

|} | |} | ||

| Line 49: | Line 36: | ||

==Negative in 6a6b== | ==Negative in 6a6b== | ||

''Menu: GL | Journal Entry...'' | ''Menu: GL | Journal Entry...'' | ||

:'''Journal Adjustment:''' | |||

:1.'''Input Tax (Negative)''' | |||

::{| class="wikitable" | |||

|- | |||

! Items !! style="text-align:right;"| Value | |||

|- | |||

| 6a || style="text-align:right;"| -1,000 | |||

|- | |||

| 6b || style="text-align:right;"| -60 | |||

|} | |||

:2.'''Journal Adjustment:''' | |||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! GL Code!! Tax !! Tax Rate !! style="text-align:right;"| Local DR !! style="text-align:right;"| Local CR !! style="text-align:right;"| Local DR(Tax) !! style="text-align:right;"| Local CR(Tax) !! GST-03 | ! GL Code!! Tax !! Tax Rate !! style="text-align:right;"| Local DR !! style="text-align:right;"| Local CR !! style="text-align:right;"| Local DR(Tax) !! style="text-align:right;"| Local CR(Tax) !! GST-03 | ||

|- | |- | ||

| GST-103 || ''' | | GST-103 || '''TX''' || '''6%''' || style="text-align:right;"| 1,000 || || style="text-align:right;"| 1,060 || || '''6a = 0 <br /> 6b = 0''' | ||

|- | |- | ||

| GST-103 || ''' | | GST-103 || '''AJS-OA''' || '''6%''' || || style="text-align:right;"| 1,000 || || style="text-align:right;"| 1,060 || '''5a = 0 <br /> 5b = 60''' | ||

|} | |} | ||

Latest revision as of 03:57, 27 July 2018

Introduction

- 1. Negative value in 5a5b and 6a6b.

- 2. TAP system not accept negative value.

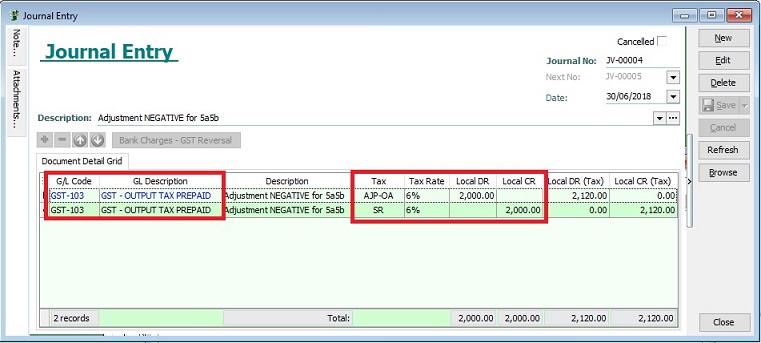

Negative in 5a5b

Menu: GL | Journal Entry...

- 1. Output Tax (Negative)

GST-03 Value 5a -2,000 5b -120

- 2. Journal Adjustment:

GL Code Tax Tax Rate Local DR Local CR Local DR(Tax) Local CR(Tax) GST-03 GST-103 AJP-OA 6% 2,000 2,120 6a = 0

6b = 120GST-103 SR 6% 2,000 2,120 5a = 0

5b = 0

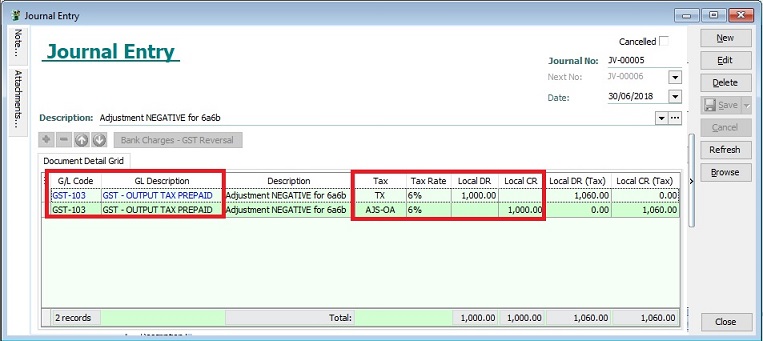

Negative in 6a6b

Menu: GL | Journal Entry...

- 1.Input Tax (Negative)

Items Value 6a -1,000 6b -60

- 2.Journal Adjustment:

GL Code Tax Tax Rate Local DR Local CR Local DR(Tax) Local CR(Tax) GST-03 GST-103 TX 6% 1,000 1,060 6a = 0

6b = 0GST-103 AJS-OA 6% 1,000 1,060 5a = 0

5b = 60