1. I have posted the depreciation until December 2021. How to record my new asset?

From eStream Software

Answer:

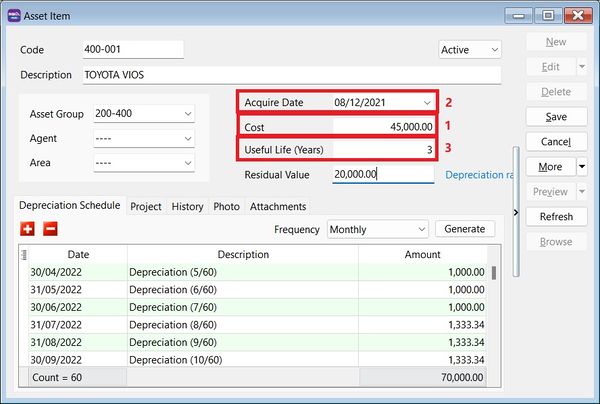

A) Method 1 :

Maintain the Asset Item as below:

- Key in the Cost as Net Book Value (as at 31/12/2021).

- Acquire Date, eg. 01/01/2022

- Useful life = Balance of useful life to be depreciate

- Start Process Depreciation from 01/01/2022

OR

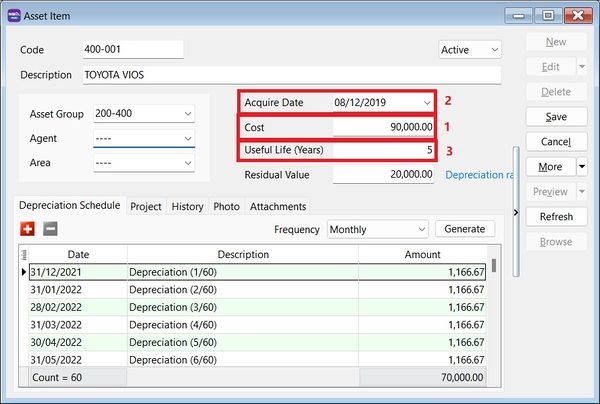

B) Method 2:

Maintain the Asset Item as below:

- Key in the Cost as Original Cost

- Acquire Date set as Original Purchase Date

- Useful life = Full useful life

- Process Depreciation until 31/12/2021.

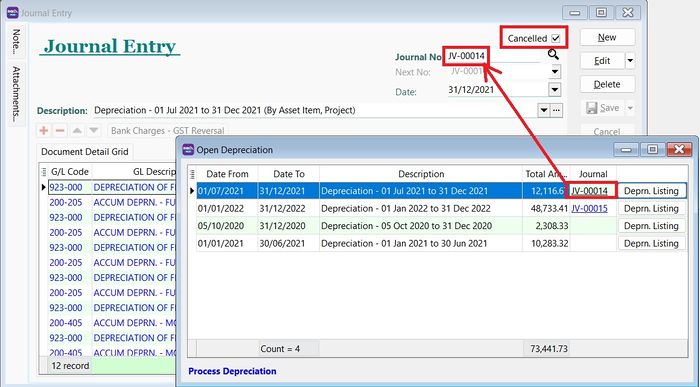

- Tick Cancelled to the Journal posted from Step 4