How to enter and to retrieve the non-deductible expenditure?

Introduction

This guide will teach you the way to key-in the data entry and help you to analyse the non-deductible expenditure related to GST. It is follow to the latest 2015 amendment in Income Tax Act 1967.

GST Expenditure (Effective from YA 2015)

1. para 39(1)(o): GST input tax paid or to be paid not allowed as deduction if:-

- a. Non-registered person with turnover exceed GST threshold of Rm500,000.

- b. Registered person fail to claim input tax credit his entitled to claim.

2. section 39(1)(p): Output tax absorbed by GST by registered person is not allowed as tax deduction.

3. GST block input tax & deductible expenses:-

Block Tax GST input Tax Tax deductible? Passenger car (Cost and maintenance) Blocked Deductible (to claim capital allowance) Club subscription fee Blocked Non-deductible Medical insurance/personal accident insurance Blocked Deductible Family benefits Blocked Depend (check with your auditors or tax consultant) Entertainment expenses (Potential customer) Blocked Non-deductible Entertainment expenses (Supplier) (p Blocked Allowed 50% deduction

How does this work?

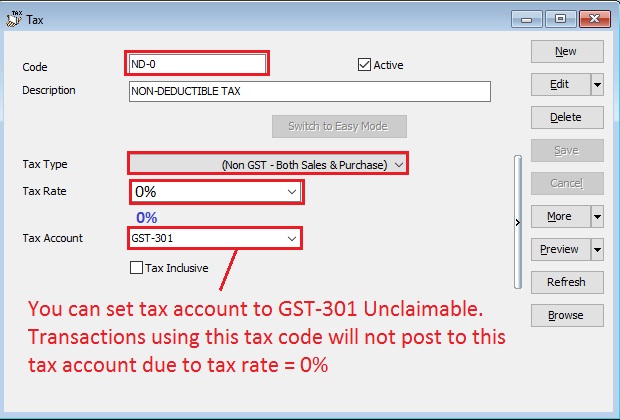

Setup New Tax Code

[GST | Maintain Tax ...]

1. Click New.

2. Follow the below SETTINGS to create.

Field Name Field Contents Code ND-0 (Recommended code) Description Non-Deductible Tax Type (Non GST - Both Sales & Purchase) Tax Rate 0% (please key-in) Tax Account GST-301 (This field is compulsory. Due to tax rate is 0%, therefore no posting) Tax Inclusive Untick

3. Click Save. See below screenshot.

NOTE :

Do not click the tax rate arrow key down if the tax account is not defined yet.

Data Entry for Non-Deductible

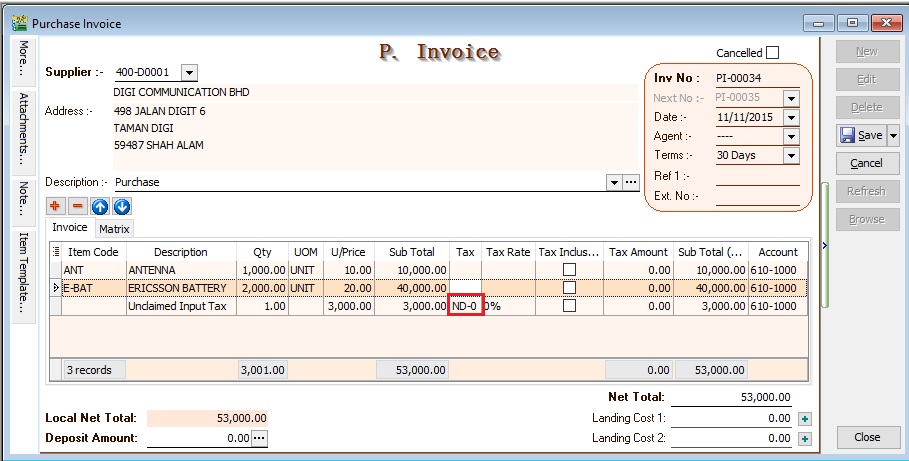

For Purchase Invoice

1. Insert a new detail row to key-in the total input tax not going to claim.

2. Select the tax code "ND-0".

3. See below screenshot.

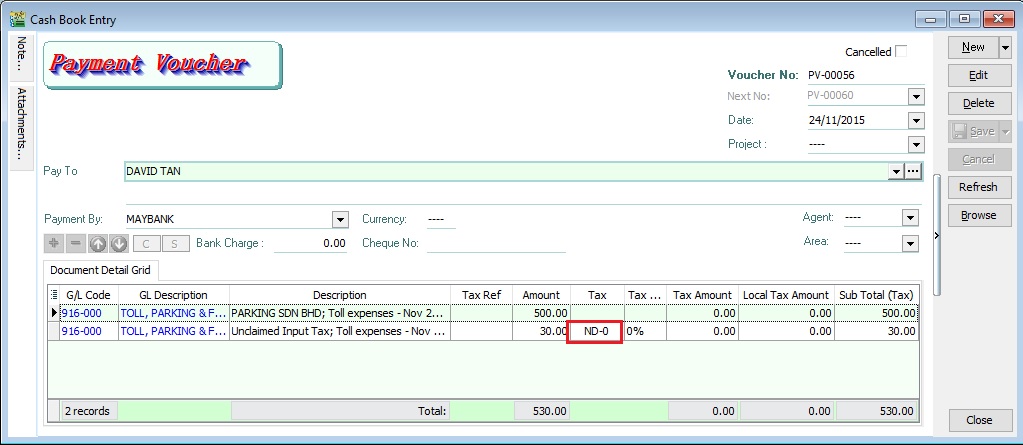

For GL Cash Book

1. Insert a new detail row to key-in the total input tax not going to claim.

2. Select the tax code "ND-0".

3. See below screenshot.

NOTE: Please ensure you understand the Non-Deductible expenditure from your auditors before you apply this guide.

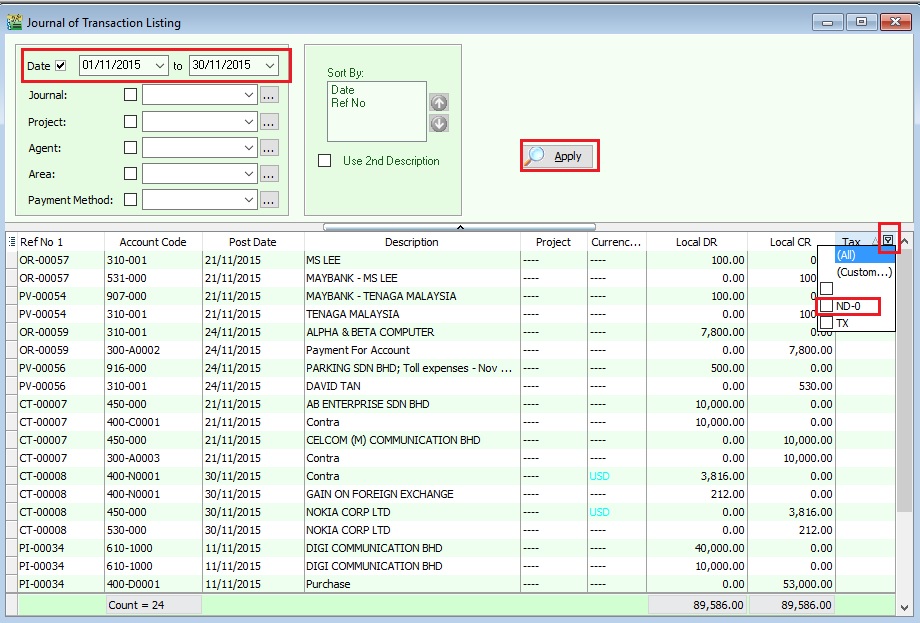

How to analyse the total tax amount from Non-Deductible?

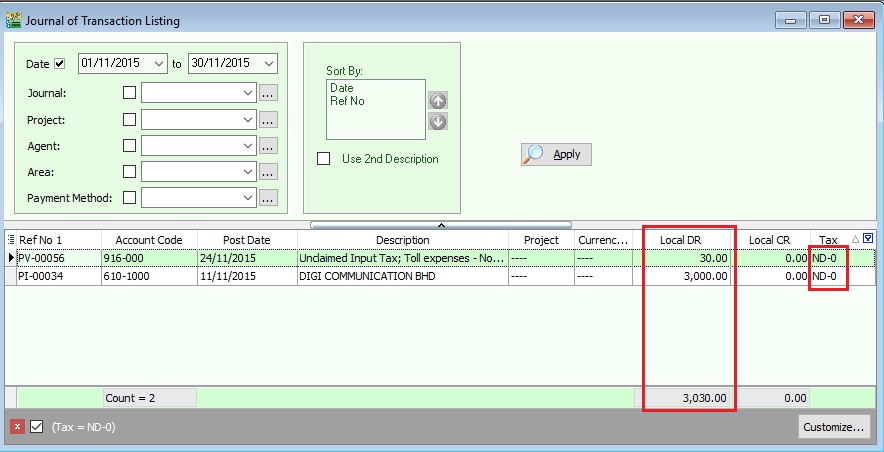

[ GL | Print Journal of Transaction Listing...]

1. Select the date range to APPLY.

2. Filter at the Tax grid column. See screenshot below.

3. You can see the transactions filtered by ND-0.

4. From this instance, the total non-deductible tax amount is Rm3030.00