Special-GST Treatment: Non-deductible Expenditure: Difference between revisions

No edit summary |

|||

| Line 61: | Line 61: | ||

<br /> | <br /> | ||

===Data Entry=== | |||

1. Insert new row and enter the GST on total Import Duty (Rm1,500 + Rm600.00 = Rm2,100) direct into Taxable Amount column (C2)<br /> | |||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

Revision as of 04:19, 1 December 2015

How to enter and to retrieve the non-deductible expenditure?

Introduction

This guide will teach you the way to key-in the data entry and help you to analyse the non-deductible expenditure related to GST. It is follow to the latest 2015 amendment in Income Tax Act 1967.

GST Expenditure (Effective from YA 2015)

1. para 39(1)(o): GST input tax paid or to be paid not allowed as deduction if:-

- a. Non-registered person with turnover exceed GST threshold of Rm500,000.

- b. Registered person fail to claim input tax credit his entitled to claim.

2. section 39(1)(p): Output tax absorbed by GST by registered person is not allowed as tax deduction.

3. GST block input tax & deductible expenses:-

Block Tax GST input Tax Tax deductible? Passenger car (Cost and maintenance) Blocked Deductible (to claim capital allowance) Club subscription fee Blocked Non-deductible Medical insurance/personal accident insurance Blocked Deductible Family benefits Blocked Depend (check with your auditors or tax consultant) Entertainment expenses (Potential customer) Blocked Non-deductible Entertainment expenses (Supplier) (p Blocked Allowed 50% deduction

How does this work?

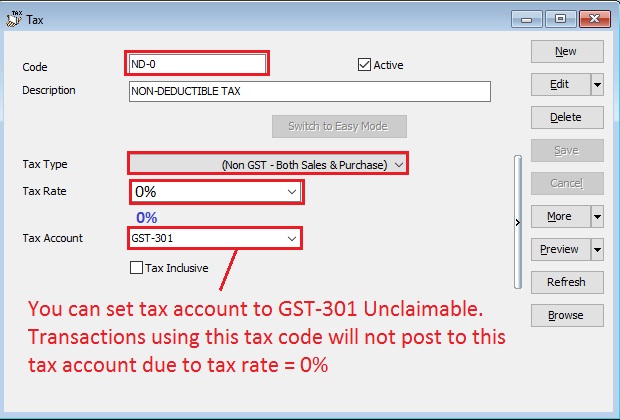

Setup New Tax Code

[GST | Maintain Tax ...]

1. Click New.

2. Follow the below SETTINGS to create.

Field Name Field Contents Code ND-0 (Recommended code) Description Non-Deductible Tax Type (Non GST - Both Sales & Purchase) Tax Rate 0% (please key-in) Tax Account GST-301 (This field is compulsory. Due to tax rate is 0%, therefore no posting) Tax Inclusive Untick

3. Click Save. See below screenshot.

NOTE :

Do not click the tax rate arrow key down if the tax account is not defined yet.

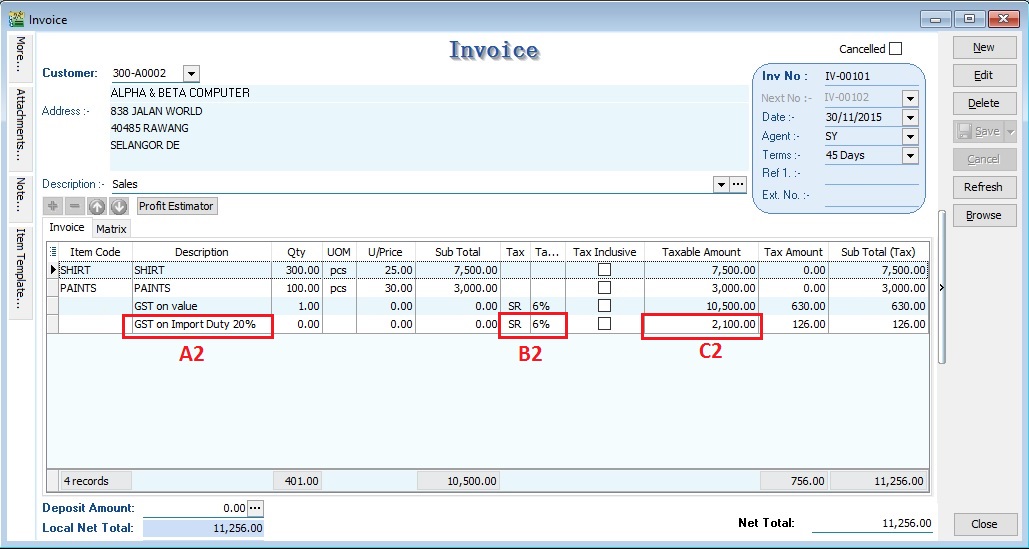

Data Entry

1. Insert new row and enter the GST on total Import Duty (Rm1,500 + Rm600.00 = Rm2,100) direct into Taxable Amount column (C2)

Description Taxable Amount Tax Code Tax Amount SubTotal(Tax) GST on Import Duty 20% 2,100.00 SR 126.00 126.00

NOTE :

A2 : Key-in "GST on Import Duty" into description.

B2 : Must select tax code.

C2 : Key-in the Total Import Duty value into Taxable Amount.

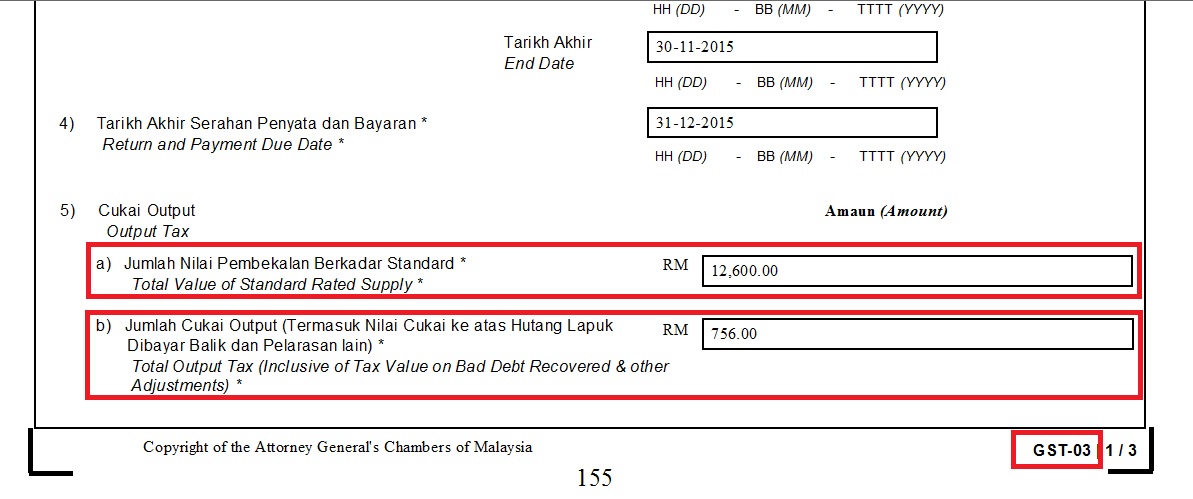

GST Return

[ GST | New GST Return...]

1. Process GST Return for the month

2. Click on print GST-03

RESULTS :

5a Total value of supplies = 12,600.00

5b total output tax = 756.00