Special-GST Treatment: Non-deductible Expenditure: Difference between revisions

| Line 30: | Line 30: | ||

<br /> | <br /> | ||

==How to | ==How to do?== | ||

''[Sales | Invoice...]''<br /> | ''[Sales | Invoice...]''<br /> | ||

===New Tax Code=== | |||

According to the example mentioned in above.<br /> | According to the example mentioned in above.<br /> | ||

1. Insert and select the stock items sold with empty tax code. Because the stock items are under FIZ/LMW control. <br /> | 1. Insert and select the stock items sold with empty tax code. Because the stock items are under FIZ/LMW control. <br /> | ||

Revision as of 03:13, 1 December 2015

How to enter and to retrieve the non-deductible expenditure?

Introduction

This guide will teach you the way to key-in the data entry and help you to analyse the non-deductible expenditure related to GST. It is follow to the latest 2015 amendment in Income Tax Act 1967.

GST Expenditure (Effective from YA 2015)

1. para 39(1)(o): GST input tax paid or to be paid not allowed as deduction if:-

- a. Non-registered person with turnover exceed GST threshold of Rm500,000.

- b. Registered person fail to claim input tax credit his entitled to claim.

2. section 39(1)(p): Output tax absorbed by GST by registered person is not allowed as tax deduction.

3. GST block input tax & deductible expenses:-

Block Tax GST input Tax Tax deductible? Passenger car (Cost and maintenance) Blocked Deductible (to claim capital allowance) Club subscription fee Blocked Non-deductible Medical insurance/personal accident insurance Blocked Deductible Family benefits Blocked Depend (check with your auditors or tax consultant) Entertainment expenses (Potential customer) Blocked Non-deductible Entertainment expenses (Supplier) (p Blocked Allowed 50% deduction

How to do?

[Sales | Invoice...]

New Tax Code

According to the example mentioned in above.

1. Insert and select the stock items sold with empty tax code. Because the stock items are under FIZ/LMW control.

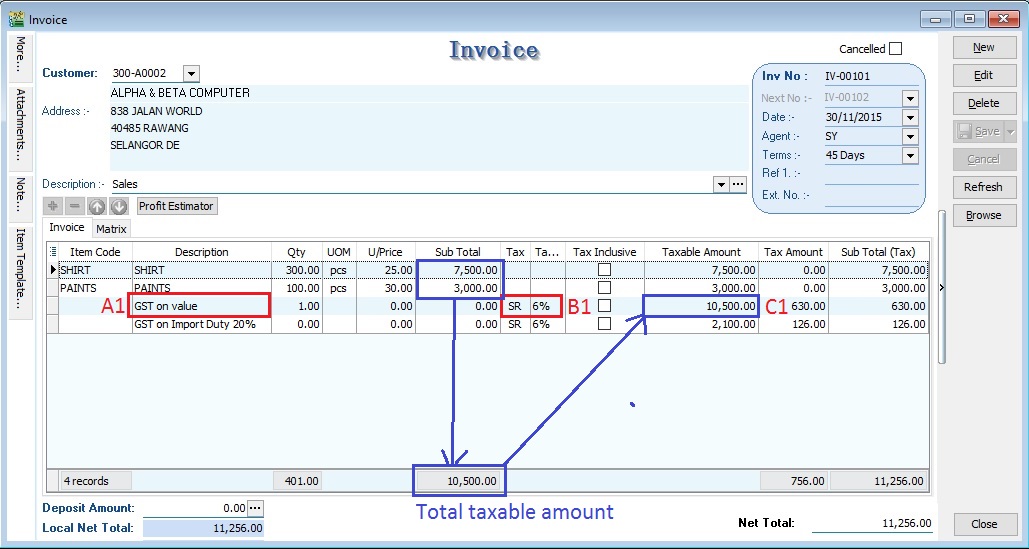

Item Code Description Qty Unit Price Subtotal Tax Code Tax Amount SubTotal(Tax) SHIRT SHIRTS 300 pcs 25.00 7,500.00 <BLANK> 0.00 7,500.00 PAINTS PAINTS 100 pcs 30.00 3,000.00 <BLANK> 0.00 3,000.00

2. Inser new row and enter the GST on total supply value (Rm7500 + Rm3000 = Rm10,500) direct into Taxable Amount column (C1)

Description Taxable Amount Tax Code Tax Amount SubTotal(Tax) GST on value Rm10,500.00 10,500.00 SR 630.00 630.00

NOTE :

A1 : Key-in "GST on value" into description.

B1 : Must select tax code.

C1 : Key-in the Total Supply Value into Taxable Amount.

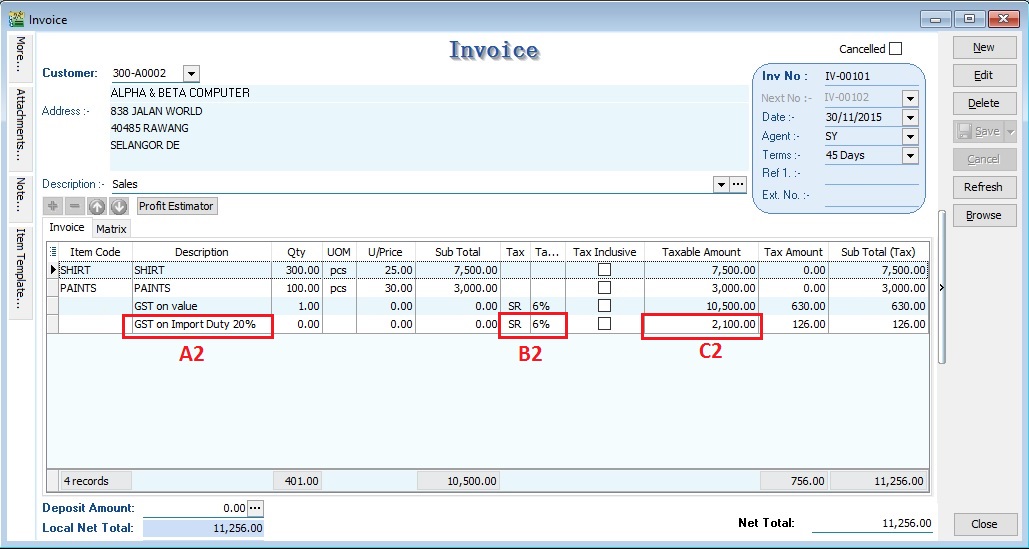

3. Insert new row and enter the GST on total Import Duty (Rm1,500 + Rm600.00 = Rm2,100) direct into Taxable Amount column (C2)

Description Taxable Amount Tax Code Tax Amount SubTotal(Tax) GST on Import Duty 20% 2,100.00 SR 126.00 126.00

NOTE :

A2 : Key-in "GST on Import Duty" into description.

B2 : Must select tax code.

C2 : Key-in the Total Import Duty value into Taxable Amount.

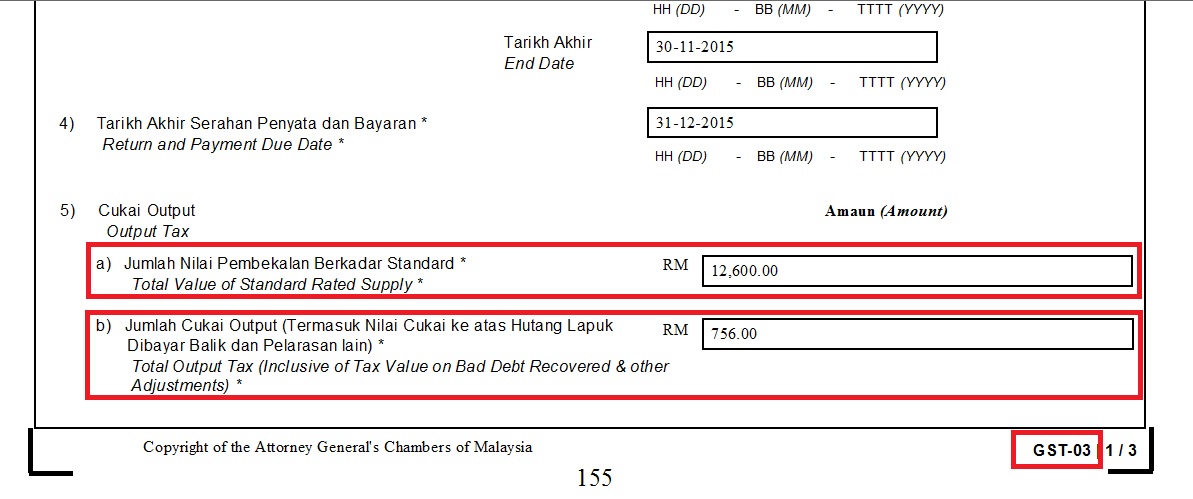

GST Return

[ GST | New GST Return...]

1. Process GST Return for the month

2. Click on print GST-03

RESULTS :

5a Total value of supplies = 12,600.00

5b total output tax = 756.00