| (78 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

==Introduction== | ==Introduction== | ||

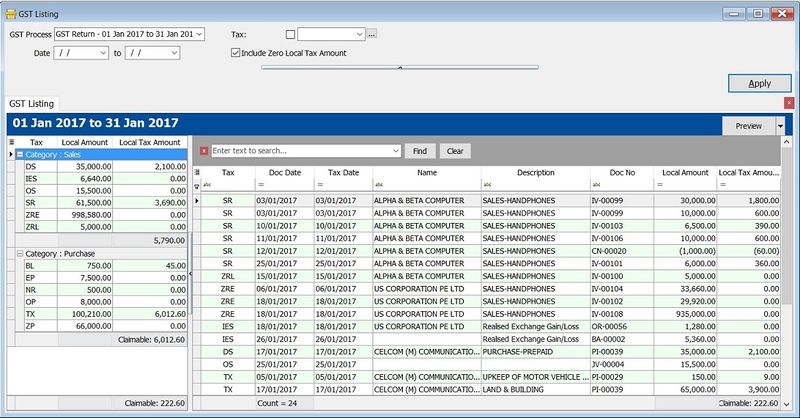

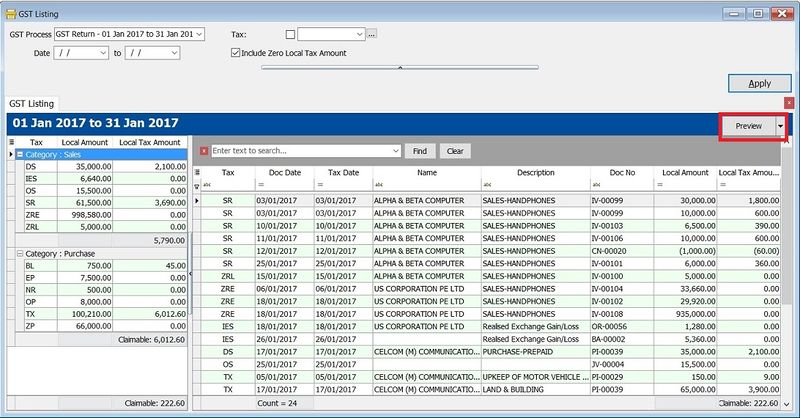

:To | :To generate a summary and details of the GST transactions after process the GST Returns. It is easy to cross check against with GST-03. | ||

==GST Listing== | ==GST Listing== | ||

''[GST | Print GST Listing...]'' | ''[GST | Print GST Listing...]'' | ||

<br /> | <br /> | ||

::[[File: GST-GST | ::[[File: GST-GST ListingV1-01.jpg | 800px]] | ||

<br /> | <br /> | ||

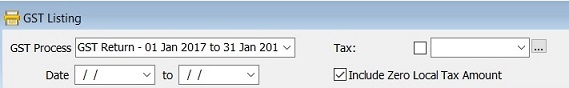

===GST Listing-Parameter=== | ===GST Listing-Parameter=== | ||

::[[File: GST-GST | ::[[File: GST-GST ListingV1-02.jpg| 600px]] | ||

<br /> | <br /> | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! Parameter !! Type || Explanation | ! Parameter !! Type || Explanation | ||

|- | |||

| GST Process || Lookup || To select the GST Process period. | |||

|- | |- | ||

| Date || Date || To range the date to retrieve the data after apply it. | | Date || Date || To range the date to retrieve the data after apply it. | ||

|- | |- | ||

| Tax || Lookup || To select the tax code. | | Tax || Lookup || To select the tax code. | ||

| Line 25: | Line 25: | ||

<br /> | <br /> | ||

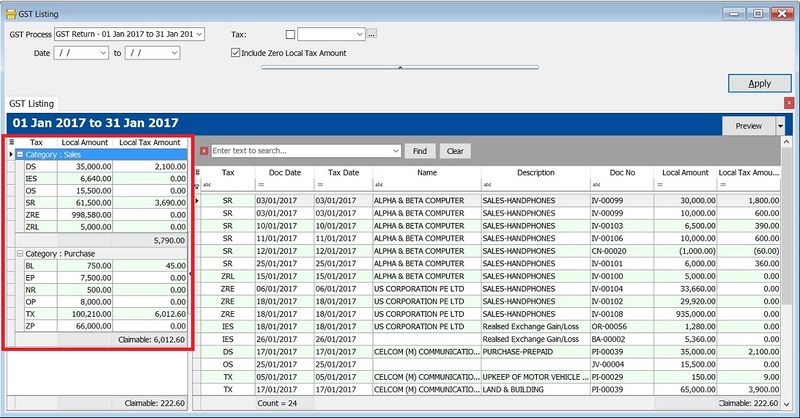

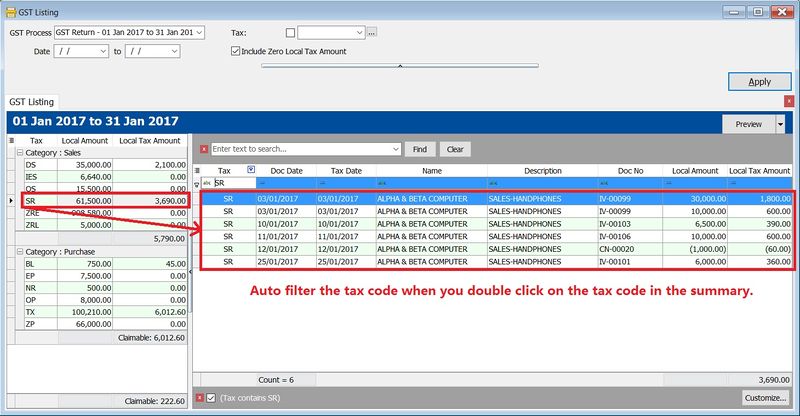

===GST Listing- | ===GST Listing-Summary=== | ||

:1. | ::[[File: GST-GST ListingV1-03.jpg| 800px]] | ||

:2. | <br /> | ||

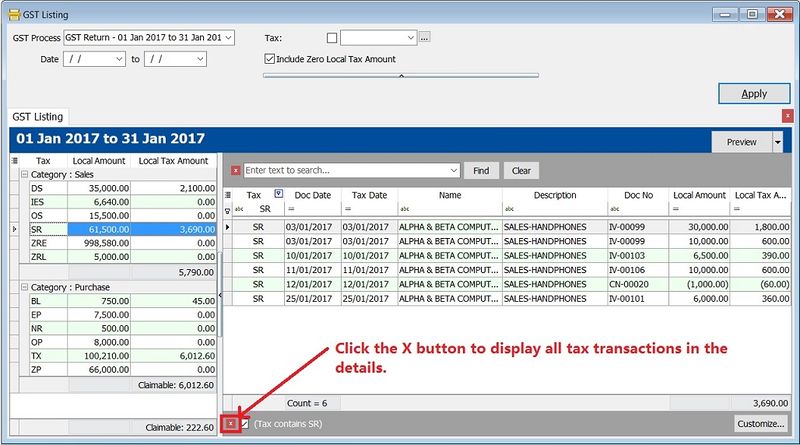

:3. | :1. '''Double click''' on the tax code (eg. SR) in the Summary. | ||

:2. It will auto filter the GST transactions by tax code (SR) in the Details. | |||

::[[File: GST-GST | ::[[File: GST-GST ListingV1-03a.jpg| 800px]] | ||

<br /> | |||

:3. '''Deselect''' the tax code (SR), click on the X button. See the screenshot below. | |||

::[[File: GST-GST ListingV1-03b.jpg| 800px]] | |||

<br /> | <br /> | ||

===GST Listing-Detail | ===GST Listing-Detail=== | ||

:1. | ::[[File: GST-GST ListingV1-04.jpg| 800px]] | ||

:2. You | <br /> | ||

::[[File: GST-GST | :1. '''Find Panel''' is very useful to search in any columns by the keywords entered by you. | ||

::[[File: GST-GST ListingV1-04b.jpg| 400px]] | |||

<br /> | |||

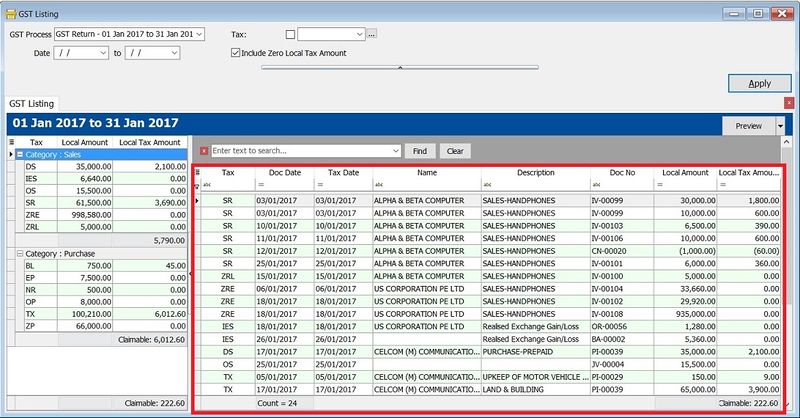

:2. It help to search the transactions contain the keywords, eg. '''"UPKEEP", "TX" or "ZP"'''. You just need to enter the keywords directly with a space in between each keywords. See the screenshot below. | |||

::[[File: GST-GST ListingV1-04c.jpg| 800px]] | |||

<br /> | |||

==Find Panel Helper== | |||

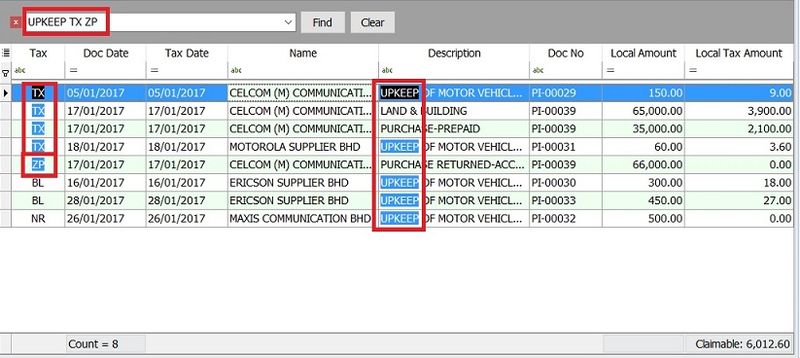

:1. With this function, you can easily narrow down the search to identify the errors before the GST Returns submission. | |||

:2. Let said I wish to find the word '''UPKEEP'''. | |||

:3. Type the '''UPKEEP''' in the find panel. | |||

::[[File: GST-GST ListingV1-04d.jpg| 800px]] | |||

<br /> | |||

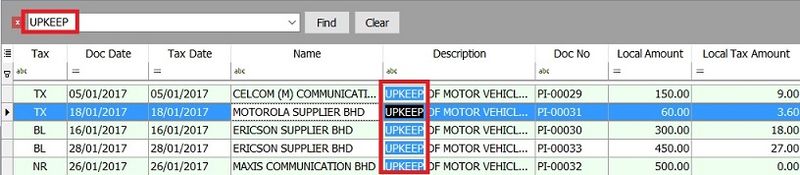

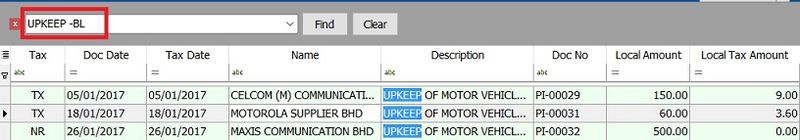

:4. If you want to '''exclude''' the '''BL''' tax code, then you have to enter as '''UPKEEP -BL''' in the find panel. | |||

::[[File: GST-GST ListingV1-04e.jpg| 800px]] | |||

<br /> | |||

:'''Explanation of Extended Search Syntax :''' | |||

::{| class="wikitable" | |||

|- | |||

! Example Search Syntax !! Filter Operator !! Explanation | |||

|- | |||

| apple pineapple mango || OR || Any transaction lines contains apple, pineapple, '''OR''' mango will be search out. | |||

|- | |||

| apple +pineapple || AND || Transaction lines which have combination of apple '''AND''' pineapple will be search out. | |||

|- | |||

| apple -mango || EXCLUDE || Transaction lines which have the word apple but '''EXCLUDE''' mango. Result is apple and pineapple will be search out. | |||

|- | |||

| "pineapple apple" || EXACT WORD || Search for the exact words of '''"pineapple apple"'''. | |||

|} | |||

'''NOTE:''' | |||

Spacing is very important to make your search more accurate. | |||

<br /> | <br /> | ||

| Line 42: | Line 76: | ||

:1. Click on '''Preview'''. | :1. Click on '''Preview'''. | ||

:2. Select a report to preview or print or export. | :2. Select a report to preview or print or export. | ||

::[[File: GST-GST | ::[[File: GST-GST ListingV1-05.jpg| 800px]] | ||

<br /> | <br /> | ||

| Line 53: | Line 87: | ||

| 02 || GST Detail 2 || To show the '''document item details description''' in GST Listing. | | 02 || GST Detail 2 || To show the '''document item details description''' in GST Listing. | ||

|- | |- | ||

| 03 || GST Detail 3 - GST- | | 03 || GST Detail 3 - GST F5-(SG) || For Singapore GST, To show the '''GST-03 details''' in GST Listing. | ||

|- | |- | ||

| 04 || GST | | 04 || GST Detail 3 - GST-03 || For Malaysia GST, to show the '''GST-03 details''' in GST Listing. | ||

|- | |- | ||

| 05 || GST | | 05 || GST Detail 4 - Mixed Supplies || Applicable to Mixed Supplies. To show the calculations for DmR and Longer Period Adjustment. | ||

|- | |- | ||

| 06 || GST | | 06 || GST Lampiran 2 || GST detail listing for standard rated. It is upon as requested by RMCD. | ||

|- | |- | ||

| 07 || GST Summary Sheet - MY || GST Summary Sheet format. | | 07 || GST Lampiran 2-with ZR || Another GST detail listing for the standard rated and zero rated separately. | ||

|- | |||

| 08 || GST Lampiran 4 - Ringkasan Maklumat Permohanan Tuntutan Pelepasan Hutang Lapuk || Lampiran 4 as requested by Kastam Officer | |||

|- | |||

| 09 || GST Listing - Yearly GST Analysis || To analyse the '''yearly''' tax amount and taxable amount. | |||

|- | |||

| 10 || GST Summary Sheet - MY || GST Summary Sheet format. | |||

|- | |||

| 11 || GST-Lampiran B-0 PT GST Bil 2B (ATS) (IS) || A special GST detail listing for Approved Trader Scheme (Refer to GST-03 item 14 & 15). | |||

|- | |||

| 12 || GST-Penyata Eksport (ZRE) || A special GST detail listing for Zero Rated Export supply (Refer to GST-03 item 11). | |||

|- | |||

| 13 || GST-Penyata Pembekalan Dikecualikan (ES & IES) || A special GST detail listing for Exempted Supplies (refer to GST-03 item 12). | |||

|- | |||

| 14 || GST-Penyata Pembekalan Tempatan Berkadar Sifar (ZRL) || A special GST detail listing for Zero Rated Local supply (refer to GST-03 item 10). | |||

|} | |} | ||

<br /> | <br /> | ||

| Line 72: | Line 120: | ||

4. _D = Annual Adjustment TX-RE | 4. _D = Annual Adjustment TX-RE | ||

5. _X = Realised Gain Loss | 5. _X = Realised Gain Loss | ||

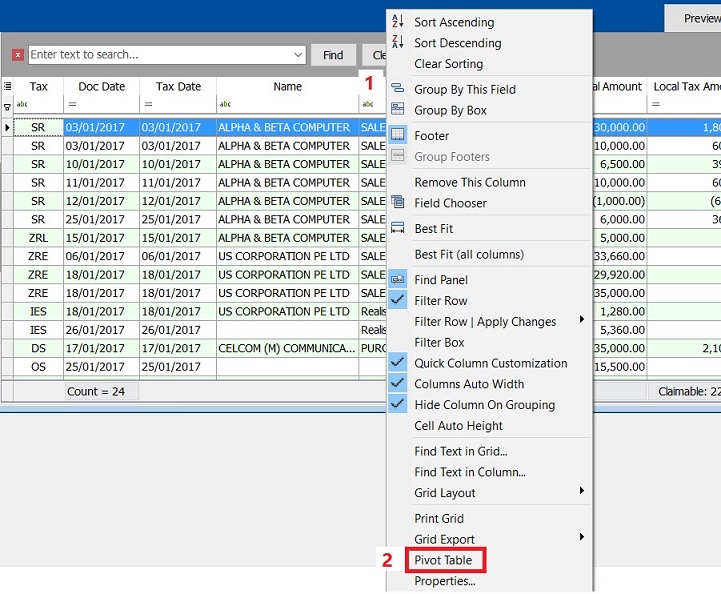

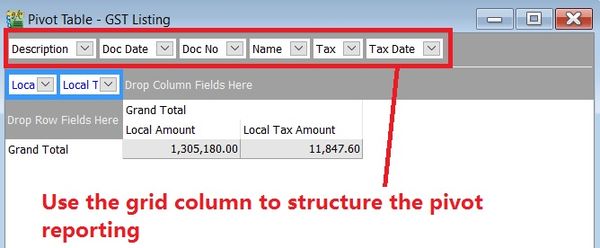

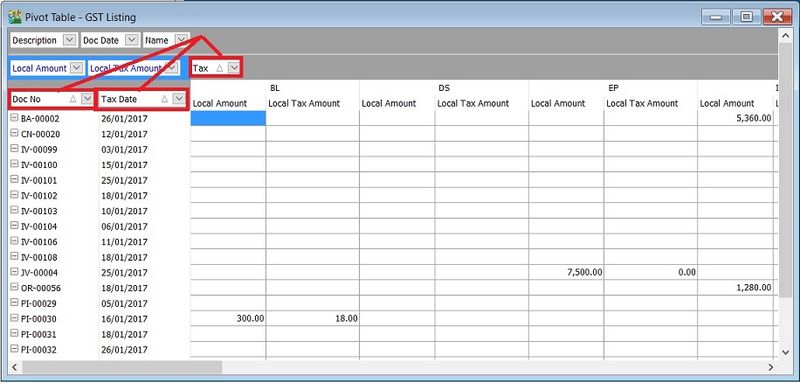

==Pivot Table== | ==Pivot Table== | ||

:1. | :1. Right click on any of the grid columns. | ||

::[[File: GST-GST | :2. From the menu, select '''Pivot Table'''. | ||

::[[File: GST-GST ListingV1-06.jpg| 800px]] | |||

<br /> | <br /> | ||

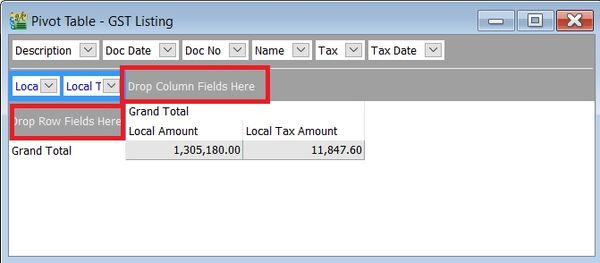

:3. At Pivot Table, there are 3 sections as below: | |||

:: a. '''Data Fields ''' - Data field will auto inserted when you launch the pivot table. | |||

:3 | |||

:: a. '''Data Fields ''' - Data | |||

:: b. '''Row Fields ''' - To structure the grouping for Rows. | :: b. '''Row Fields ''' - To structure the grouping for Rows. | ||

:: c. '''Column Fields''' - To structure the grouping for Columns. | :: c. '''Column Fields''' - To structure the grouping for Columns. | ||

::[[File: GST-GST | ::[[File: GST-GST ListingV1-08.jpg|600px]] | ||

<br /> | <br /> | ||

:3. Use the grid columns to structure the pivot format. See the screenshot below. | |||

::[[File: GST-GST ListingV1-07.jpg|600px]] | |||

::[[File: GST-GST | |||

<br /> | <br /> | ||

: | :4. Drag the grid column into Row fields or Column fields. | ||

::[[File: GST-GST | ::[[File: GST-GST ListingV1-09.jpg|800px]] | ||

<br /> | <br /> | ||

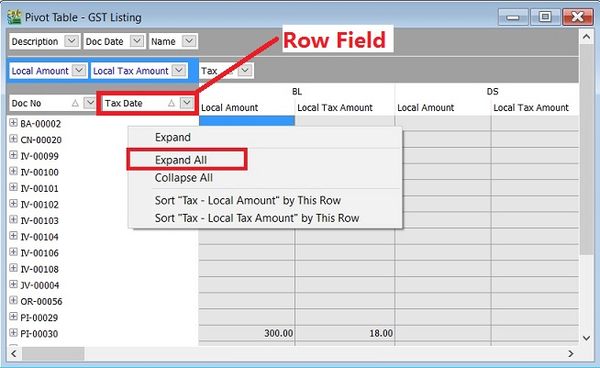

''' | '''Hint 1:''' | ||

1. Right click on the '''Row Field''' | |||

2. Select '''Expand All'''. | |||

[[File: GST-GST ListingV1-10.jpg|600px]] | |||

<br /> | <br /> | ||

'''Hint 2:''' | |||

1. Right click on the grey area. | |||

2. A small menu pop out. | |||

[[File: GST-GST ListingV1-11.jpg|600px]] | |||

a. '''Show Field List''' - Not really use to it. | |||

b. '''Show Prefilter Dialog''' - Insert filter conditions. | |||

c. '''Print Grid''' - To print the grid. | |||

d. '''Grid Export''' - To export the grid data into EXCEL, TEXT, HTML and XML. | |||

==See also== | ==See also== | ||

* [[New GST Return]] | * [[New GST Return]] | ||

* [[Open GST Return]] | * [[Open GST Return]] | ||

Latest revision as of 03:05, 14 January 2017

Introduction

- To generate a summary and details of the GST transactions after process the GST Returns. It is easy to cross check against with GST-03.

GST Listing

[GST | Print GST Listing...]

GST Listing-Parameter

Parameter Type Explanation GST Process Lookup To select the GST Process period. Date Date To range the date to retrieve the data after apply it. Tax Lookup To select the tax code. Include Zero Local Tax Amount Boolean To show the zero local tax amount.

GST Listing-Summary

- 1. Double click on the tax code (eg. SR) in the Summary.

- 2. It will auto filter the GST transactions by tax code (SR) in the Details.

GST Listing-Detail

- 2. It help to search the transactions contain the keywords, eg. "UPKEEP", "TX" or "ZP". You just need to enter the keywords directly with a space in between each keywords. See the screenshot below.

Find Panel Helper

- 1. With this function, you can easily narrow down the search to identify the errors before the GST Returns submission.

- 2. Let said I wish to find the word UPKEEP.

- 3. Type the UPKEEP in the find panel.

- Explanation of Extended Search Syntax :

Example Search Syntax Filter Operator Explanation apple pineapple mango OR Any transaction lines contains apple, pineapple, OR mango will be search out. apple +pineapple AND Transaction lines which have combination of apple AND pineapple will be search out. apple -mango EXCLUDE Transaction lines which have the word apple but EXCLUDE mango. Result is apple and pineapple will be search out. "pineapple apple" EXACT WORD Search for the exact words of "pineapple apple".

NOTE: Spacing is very important to make your search more accurate.

Reports

No. Report Name Purpoase 01 GST Detail 1 To show the document description in GST Listing. 02 GST Detail 2 To show the document item details description in GST Listing. 03 GST Detail 3 - GST F5-(SG) For Singapore GST, To show the GST-03 details in GST Listing. 04 GST Detail 3 - GST-03 For Malaysia GST, to show the GST-03 details in GST Listing. 05 GST Detail 4 - Mixed Supplies Applicable to Mixed Supplies. To show the calculations for DmR and Longer Period Adjustment. 06 GST Lampiran 2 GST detail listing for standard rated. It is upon as requested by RMCD. 07 GST Lampiran 2-with ZR Another GST detail listing for the standard rated and zero rated separately. 08 GST Lampiran 4 - Ringkasan Maklumat Permohanan Tuntutan Pelepasan Hutang Lapuk Lampiran 4 as requested by Kastam Officer 09 GST Listing - Yearly GST Analysis To analyse the yearly tax amount and taxable amount. 10 GST Summary Sheet - MY GST Summary Sheet format. 11 GST-Lampiran B-0 PT GST Bil 2B (ATS) (IS) A special GST detail listing for Approved Trader Scheme (Refer to GST-03 item 14 & 15). 12 GST-Penyata Eksport (ZRE) A special GST detail listing for Zero Rated Export supply (Refer to GST-03 item 11). 13 GST-Penyata Pembekalan Dikecualikan (ES & IES) A special GST detail listing for Exempted Supplies (refer to GST-03 item 12). 14 GST-Penyata Pembekalan Tempatan Berkadar Sifar (ZRL) A special GST detail listing for Zero Rated Local supply (refer to GST-03 item 10).

NOTE: From Doc Types in GST Listing Detail are consists of: 1. _A = Unclaimable Non-Incidental Exempt Supplies (TX-N43) 2. _B = Unclaimable TX-RE 3. _C = Annual Adjustment Non-Incidental Exempt Supplies (TX-N43) 4. _D = Annual Adjustment TX-RE 5. _X = Realised Gain Loss

Pivot Table

- 3. At Pivot Table, there are 3 sections as below:

Hint 1: 1. Right click on the Row Field 2. Select Expand All.

Hint 2: 1. Right click on the grey area. 2. A small menu pop out.a. Show Field List - Not really use to it. b. Show Prefilter Dialog - Insert filter conditions. c. Print Grid - To print the grid. d. Grid Export - To export the grid data into EXCEL, TEXT, HTML and XML.