(Created page with "<big>GST Bad Debt Relief</big> ==Introduction== A taxable person may claim bad debt relief subject to the requirements and conditions set forth under sec.58 of the GSTA 2014...") |

No edit summary |

||

| Line 27: | Line 27: | ||

==Check List related to Bad Debt Relief== | ==Check List related to Bad Debt Relief== | ||

===Maintain Tax=== | |||

''[GST | Maintain Tax...]'' | |||

{| class="wikitable" | |||

|- | |||

! Tax Code !! Description !! Tax Acc Entry !! Tax Acc Entry | |||

|- | |||

| PH-AJP-BD || Input Tax adjustment e.g: Bad Debt Relief || Example || Example | |||

|- | |||

| SL-AJP-BD || Input Tax adjustment e.g: Bad Debt Relief || Example || Example | |||

|- | |||

| PH-AJS-BD || Output Tax adjustment e.g: Bad Debt Recover, outstanding invoice > 6 months || Example || Example | |||

|- | |||

| SL-AJS-BD || Output Tax adjustment e.g: Bad Debt Recover, outstanding invoice > 6 months || Example || Example | |||

|} | |||

===Maintain Customer=== | |||

===Maintain Supplier=== | |||

<br /> | <br /> | ||

| Line 34: | Line 53: | ||

<br /> | <br /> | ||

== | ==GST Listing== | ||

::[[File: | 440PX]] | |||

<br /> | |||

==GST-03== | |||

::[[File: | 440PX]] | |||

<br /> | |||

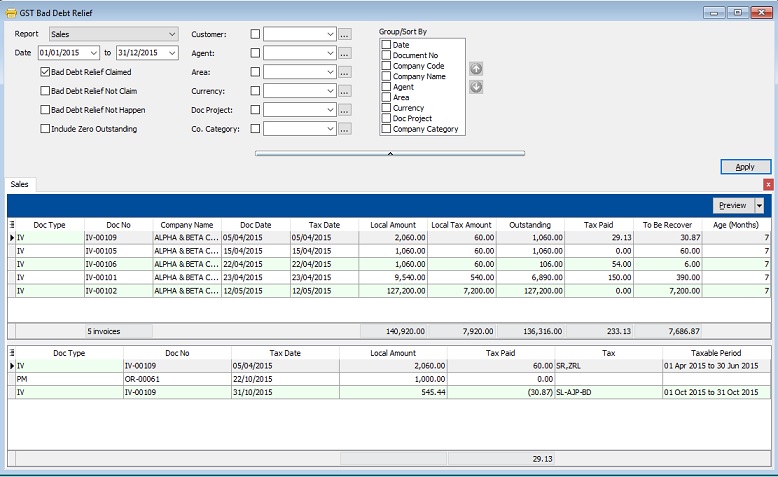

==GST Bad Debt Relief== | |||

''[GST | Print GST Bad Debt Relief…]'' | ''[GST | Print GST Bad Debt Relief…]'' | ||

| Line 61: | Line 93: | ||

''NOTE : ''<br /> | ''NOTE : ''<br /> | ||

''1 | ''1. ''<br /> | ||

''2. | ''2. ''<br /> | ||

<br /> | <br /> | ||

Revision as of 09:56, 2 November 2015

GST Bad Debt Relief

Introduction

A taxable person may claim bad debt relief subject to the requirements and conditions set forth under sec.58 of the GSTA 2014 and the person has not received any payment or part of the payment in respect of the taxable supply from the debtor after the sixth month from the date of supply.

The bad debt relief may be claimed if -

(a) requirements under s.58 GSTA and Part X of GST Regulations 2014 arefulfilled; and

(b) the supply is made by a GST registered person to another GST registered person

The bad debt relief shall be claimed immediately in the taxable period after the expiry of the sixth month from the date of supply.

If the bad debt relief is not claimed by the supplier in the immediate taxable period immediately after the expiry of the sixth month, then the taxable person

has to notify the Director General (DG) within 30 days after the expiry of the sixth month on his intention to claim at a later date.

A GST registered person who has made the input tax claim but fails to pay his supplier within six months from the date of supply shall account for output tax

immediately after the expiry of the sixth month (s.38(9) GSTA).

The word ‘month’ in sec.58 refers to calendar month or complete month –

Example: Invoice issued at 15 th January 2017. For monthly taxable period, the sixth month expires at the end of June and the bad debt relief shall be claimed in

July taxable period.

See below the overview of GST Bad Debt Relief system flow:

- [[File:| 30PX]]

Maintain Tax

[GST | Maintain Tax...]

| Tax Code | Description | Tax Acc Entry | Tax Acc Entry |

|---|---|---|---|

| PH-AJP-BD | Input Tax adjustment e.g: Bad Debt Relief | Example | Example |

| SL-AJP-BD | Input Tax adjustment e.g: Bad Debt Relief | Example | Example |

| PH-AJS-BD | Output Tax adjustment e.g: Bad Debt Recover, outstanding invoice > 6 months | Example | Example |

| SL-AJS-BD | Output Tax adjustment e.g: Bad Debt Recover, outstanding invoice > 6 months | Example | Example |

Maintain Customer

Maintain Supplier

Process GST Returns

GST Listing

- [[File: | 440PX]]

GST-03

- [[File: | 440PX]]

GST Bad Debt Relief

[GST | Print GST Bad Debt Relief…]

1. Enter the purchase value of second car at Purchase Invoice. (eg. RM30,000 )

2. You must select the correct car plate number from Project. (eg. PGE3333)

3. Supplier GST No, Purchase invoice number, date and cost will be update automatically after you have save the purchase invoice.

| Purchase Detail | Update from |

|---|---|

| Supplier GST No | Maintain Supplier |

| Purchase Invoice No | Purchase Invoice |

| Purchase Invoice Date | Purchase Invoice |

| Cost | Purchase Invoice |

NOTE :

1.

2.