(Created page with "==Introduction== :To open and view the GST Returns that has been processed. ==Open GST Return== ''[GST | Open GST Return...]'' <br /> :1. See the screenshot below:<br /> ::...") |

No edit summary |

||

| (15 intermediate revisions by the same user not shown) | |||

| Line 8: | Line 8: | ||

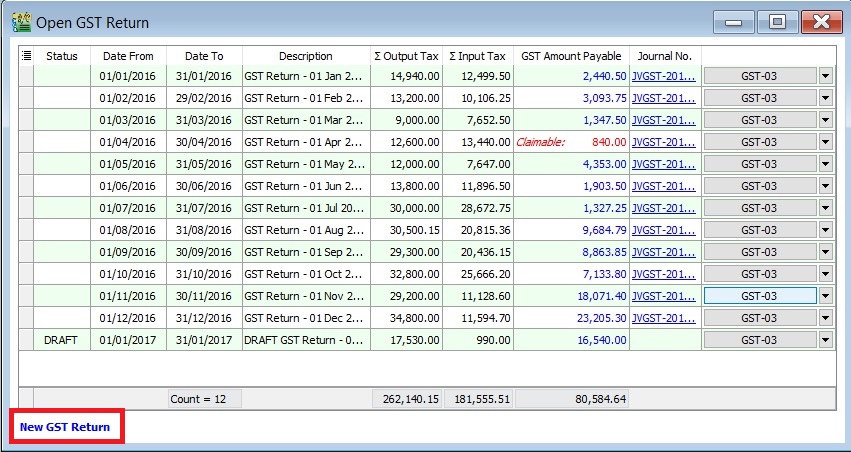

:1. See the screenshot below:<br /> | :1. See the screenshot below:<br /> | ||

::[[File: GST-Open GST Return-01.jpg| 30PX]] | ::[[File: GST-Open GST Return-01.jpg| 30PX]] | ||

<br /> | |||

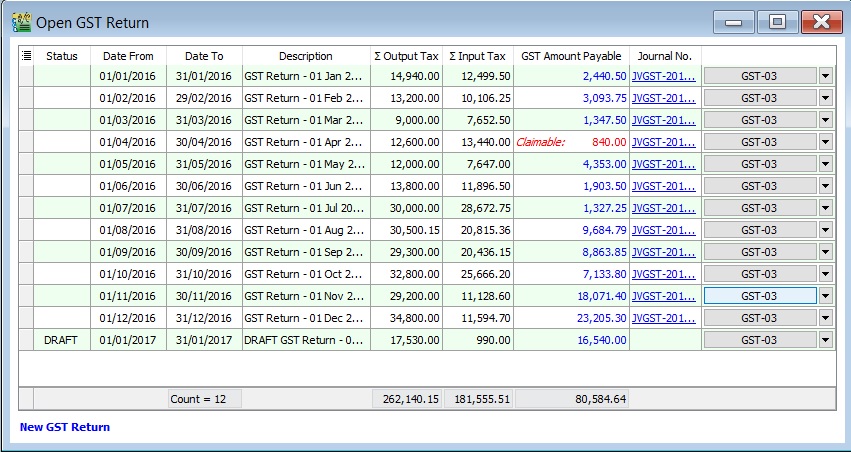

:2. You can insert more available fields.<br /> | :2. You can insert more available fields.<br /> | ||

| Line 15: | Line 16: | ||

! Field Name !! Field Type !! Explanation | ! Field Name !! Field Type !! Explanation | ||

|- | |- | ||

| Process From | | Status || String || To show the GST Return status, ie. DRAFT, DE-REGISTER. <br /> | ||

|- | |||

| Process Date || Date || To show process date. | |||

|- | |||

| Date From || Date || To show date from. | |||

|- | |- | ||

| | | Date To || Date || To show date to. | ||

|- | |- | ||

| | | Description || String || To show the description entered. | ||

|- | |- | ||

| | | Ref 1 || String || To show the ref 1 entered. | ||

|- | |- | ||

| | | Ref 2 || String || To show the ref 2 entered. | ||

|- | |- | ||

| | | User || String || To display the User process the GST Return. | ||

|- | |- | ||

| | | Closed || Boolean || Always ticked to close. | ||

|- | |- | ||

| | | LPA for Partial Exemption || Boolean || Longer period adjustment (LPA) for partial exemption (Mixed Supplies) | ||

|- | |||

| De-register || Boolean || Ticked if the taxable period has de-register date. | |||

|- | |||

| Amendment || Boolean || To show the GST Return has ticked this option. <br /> | |||

Refer to :[http://gst.customs.gov.my/en/rg/SiteAssets/specific_guides_pdf/GST%20Guide%20on%20Amendment%20Return%2028GST-0329.pdf GST GUIDE ON AMENDMENT RETURN (GST-03) ] | |||

|- | |||

| C/F Refund for GST || Boolean || To show the GST Return has ticked this option. | |||

|- | |||

| Process Net Realised Exchange Gain/Loss || Boolean || No longer use because system auto handle this option. | |||

|- | |||

| Tax Year|| Boolean || Tax Year point. | |||

|- | |||

| De Minimis Rule || Boolean || Ticked = Pass<br /> Unticked = Not Pass | |||

|- | |||

| Residual Input Tax Recovery Rate (%) || Float || To display the IRR %. | |||

|- | |||

| LPA Date From || Date || LPA date from. | |||

|- | |||

| LPA Date To || Float || LPA date to. | |||

|- | |||

| ∑ Output Tax || Float || To show the total output tax value. | |||

|- | |||

| ∑ Input Tax || Float || To show the total input tax value. | |||

|- | |||

| GST Amount Payable || Float || Net GST Payable or Claimable. | |||

|- | |||

| Journal No. || String || Auto post the JVGST-XXXXX to reconcile the GST Payable and GST Claimable accounts. | |||

|- | |||

| || Button || Options button : GST-03, Print GST Listing, Generate GST Audit File (GAF) | |||

|} | |} | ||

<br /> | <br /> | ||

'''Tips:''' | |||

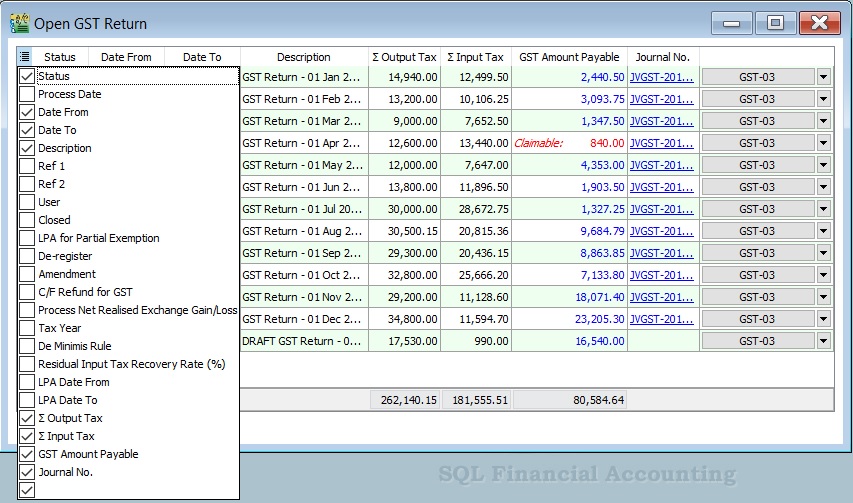

You can click '''New GST Return''' in Open GST Return screen. See below the screenshot. | |||

[[File: GST-Open GST Return-03.jpg| 30PX]] | |||

==See also== | |||

* [[Print GST Listing]] | |||

* [http://gst.customs.gov.my/en/rg/SiteAssets/specific_guides_pdf/GST%20Guide%20on%20Amendment%20Return%2028GST-0329.pdf GST GUIDE ON AMENDMENT RETURN (GST-03) ] | |||

Latest revision as of 04:13, 30 April 2016

Introduction

- To open and view the GST Returns that has been processed.

Open GST Return

[GST | Open GST Return...]

Field Name Field Type Explanation Status String To show the GST Return status, ie. DRAFT, DE-REGISTER.

Process Date Date To show process date. Date From Date To show date from. Date To Date To show date to. Description String To show the description entered. Ref 1 String To show the ref 1 entered. Ref 2 String To show the ref 2 entered. User String To display the User process the GST Return. Closed Boolean Always ticked to close. LPA for Partial Exemption Boolean Longer period adjustment (LPA) for partial exemption (Mixed Supplies) De-register Boolean Ticked if the taxable period has de-register date. Amendment Boolean To show the GST Return has ticked this option.

Refer to :GST GUIDE ON AMENDMENT RETURN (GST-03)

C/F Refund for GST Boolean To show the GST Return has ticked this option. Process Net Realised Exchange Gain/Loss Boolean No longer use because system auto handle this option. Tax Year Boolean Tax Year point. De Minimis Rule Boolean Ticked = Pass

Unticked = Not PassResidual Input Tax Recovery Rate (%) Float To display the IRR %. LPA Date From Date LPA date from. LPA Date To Float LPA date to. ∑ Output Tax Float To show the total output tax value. ∑ Input Tax Float To show the total input tax value. GST Amount Payable Float Net GST Payable or Claimable. Journal No. String Auto post the JVGST-XXXXX to reconcile the GST Payable and GST Claimable accounts. Button Options button : GST-03, Print GST Listing, Generate GST Audit File (GAF)

Tips: You can click New GST Return in Open GST Return screen. See below the screenshot.