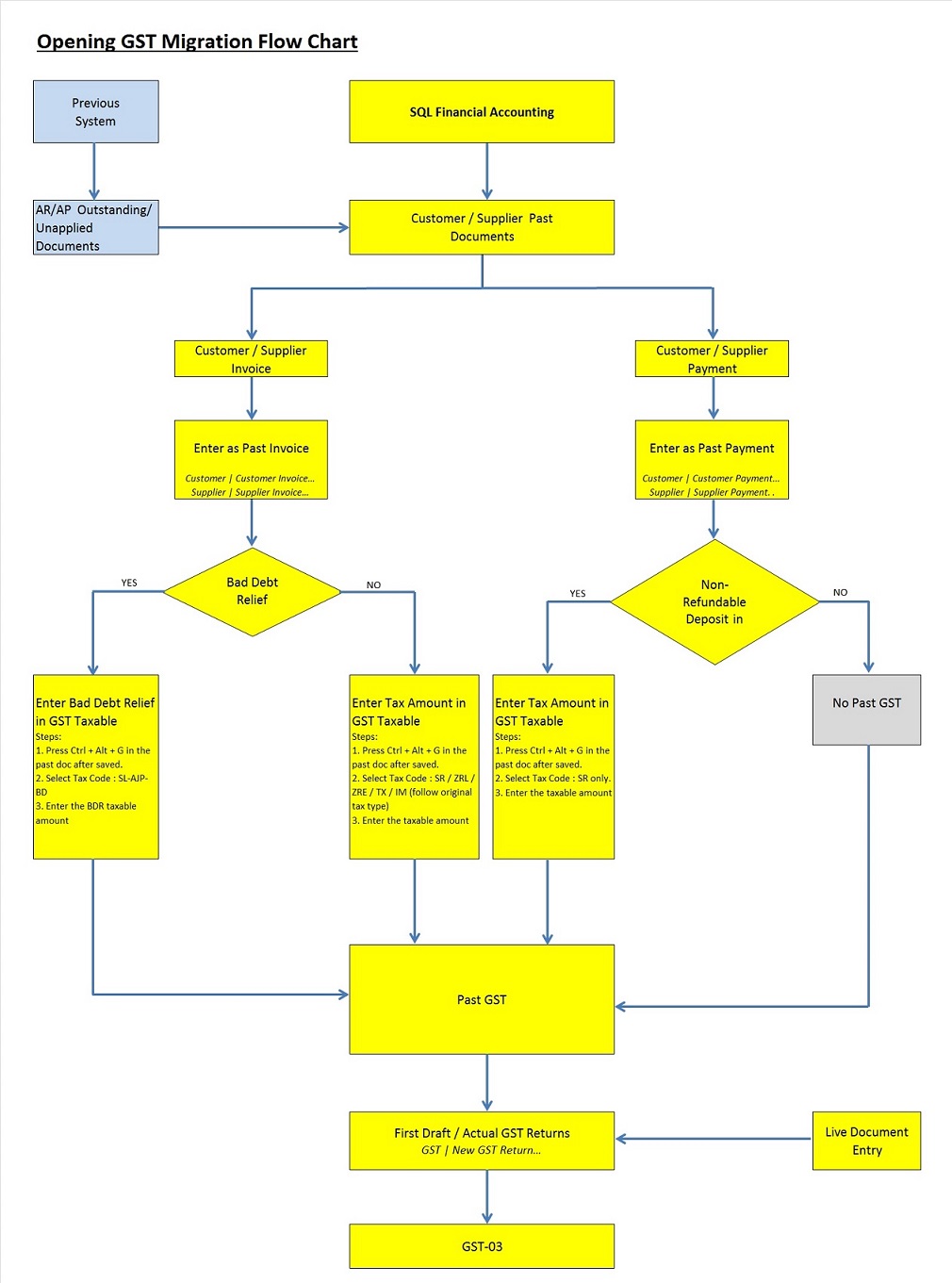

Migration System Features-How to handle the GST Past Documents Opening Balance for Customer and Supplier

From eStream Software

How to handle the GST Past Documents Opening Balance for Customer and Supplier?

Introduction

- This guide will teach you the way to handle the past outstanding documents for Customer and Supplier from previous accounting system. We are ensure that the data migration part go smooth with GST matters happened in previous system likes bad debt relief and non-refundable deposit.

Step by Step to enter the GST Past Documents

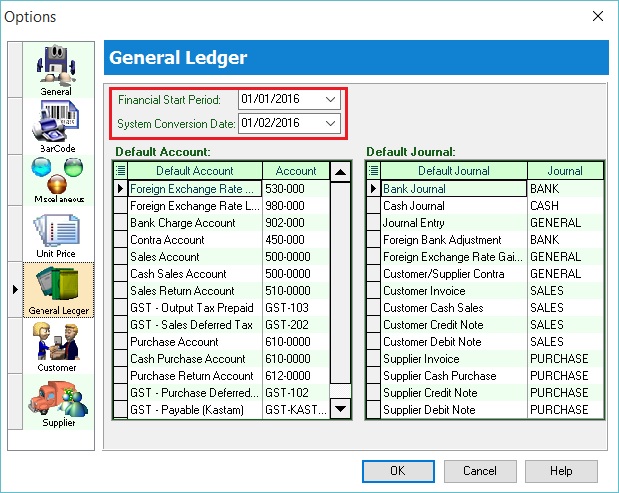

- 1. Let's said under the Tools | Options... I have set the following:-

- Financial Start Period : 01 Jan 2016

- System Conversion Date : 01 Feb 2016 (Cut-off Date for Opening Entry)

- Financial Start Period : 01 Jan 2016

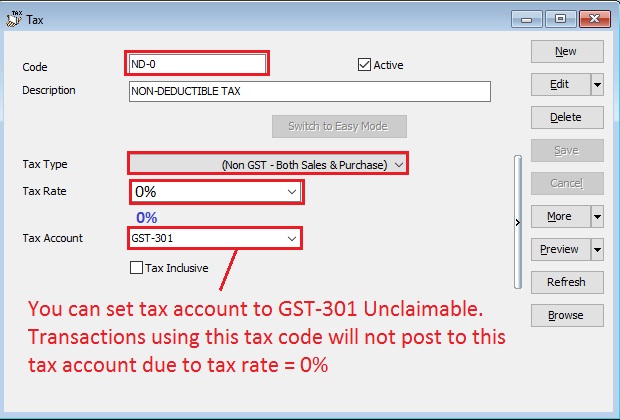

- 1. Click New.

- 2. Follow the below SETTINGS to create.

Field Name Field Contents Code ND-0 (Recommended code) Description Non-Deductible Tax Type (Non GST - Both Sales & Purchase) Tax Rate 0% (please key-in) Tax Account GST-301 (This field is compulsory. Due to tax rate is 0%, therefore no posting) Tax Inclusive Untick

NOTE :

Do not click the tax rate arrow key down if the tax account is not defined yet.

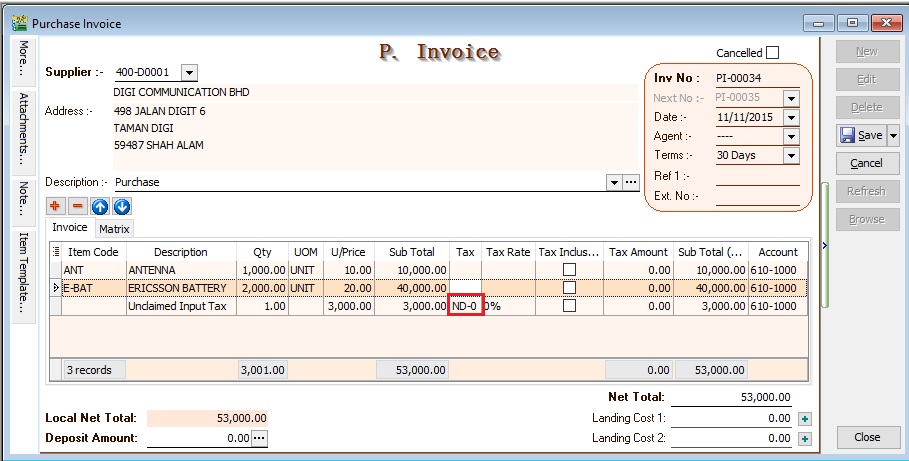

Data Entry for Non-Deductible

For Purchase Invoice

- 1. Insert a new detail row and key-in the total input tax not going to claim.

- 2. Select the tax code "ND-0".

- 3. See below screenshot.

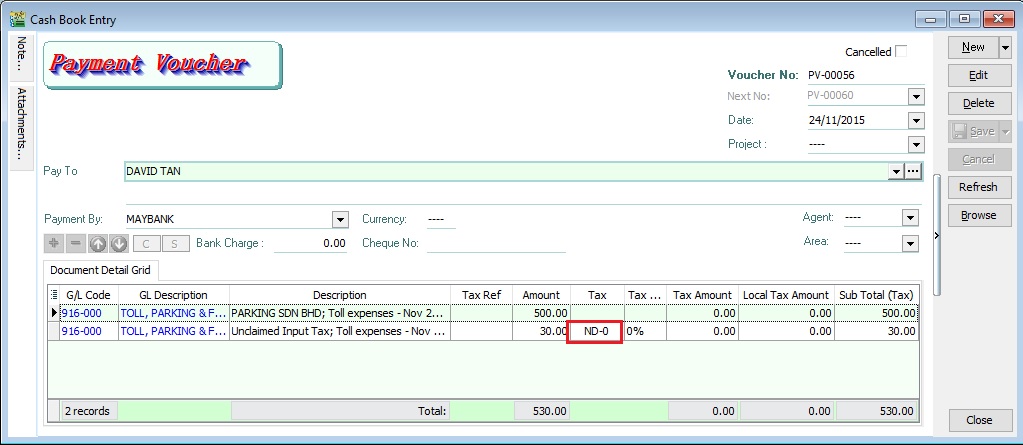

For GL Cash Book

- 1. Insert a new detail row and key-in the total input tax not going to claim.

- 2. Select the tax code "ND-0".

- 3. See below screenshot.

NOTE: Please ensure you understand the Non-Deductible expenditure from your auditors before you apply this guide.

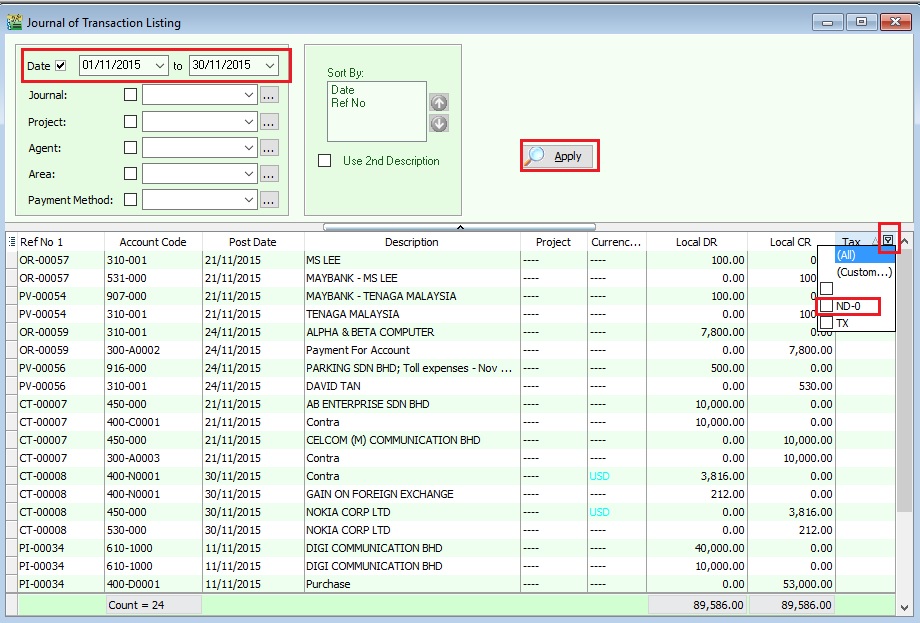

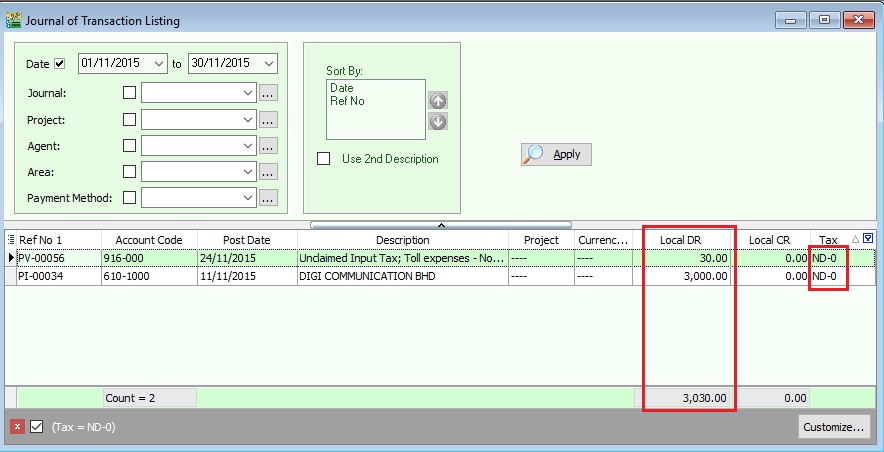

How to analyse the total tax amount from Non-Deductible?

[ GL | Print Journal of Transaction Listing...]

- 4. From this instance, the total non-deductible expenditure amount is Rm3030.00