Migration System Features-How to handle the GST Past Documents Opening Balance for Customer and Supplier: Difference between revisions

From eStream Software

| Line 10: | Line 10: | ||

<br /> | <br /> | ||

== | ==How to enter the GST Past Documents?== | ||

===Financial Start Period and System Conversation Date=== | ===Financial Start Period and System Conversation Date=== | ||

''[Tools | Options...General Ledger]''<br /> | ''[Tools | Options...General Ledger]''<br /> | ||

| Line 71: | Line 71: | ||

| To enter GST Taxable for the Customer Past Non-Refundable Deposit || a. Go to Customer / Customer Payment...<br /> b. Refer the above step 1. <br /> c. Tax code commonly apply to this matter is '''SR'''. | | To enter GST Taxable for the Customer Past Non-Refundable Deposit || a. Go to Customer / Customer Payment...<br /> b. Refer the above step 1. <br /> c. Tax code commonly apply to this matter is '''SR'''. | ||

|}<br /> | |}<br /> | ||

===GST Taxable Listing for Past Documents=== | |||

''[GST | Print GST Taxable Listing (Manual)...]''<br /> | |||

:1. Select the date range to apply. <br /> | |||

:2. See screenshot below.<br /> | |||

: '''Screenshot 4: GST Taxable Listing:''' | |||

::[[File:Opening GST-Taxable-Listing.jpg | 140PX]]<br /> | |||

<br /> | |||

==See also== | ==See also== | ||

Revision as of 09:19, 22 December 2015

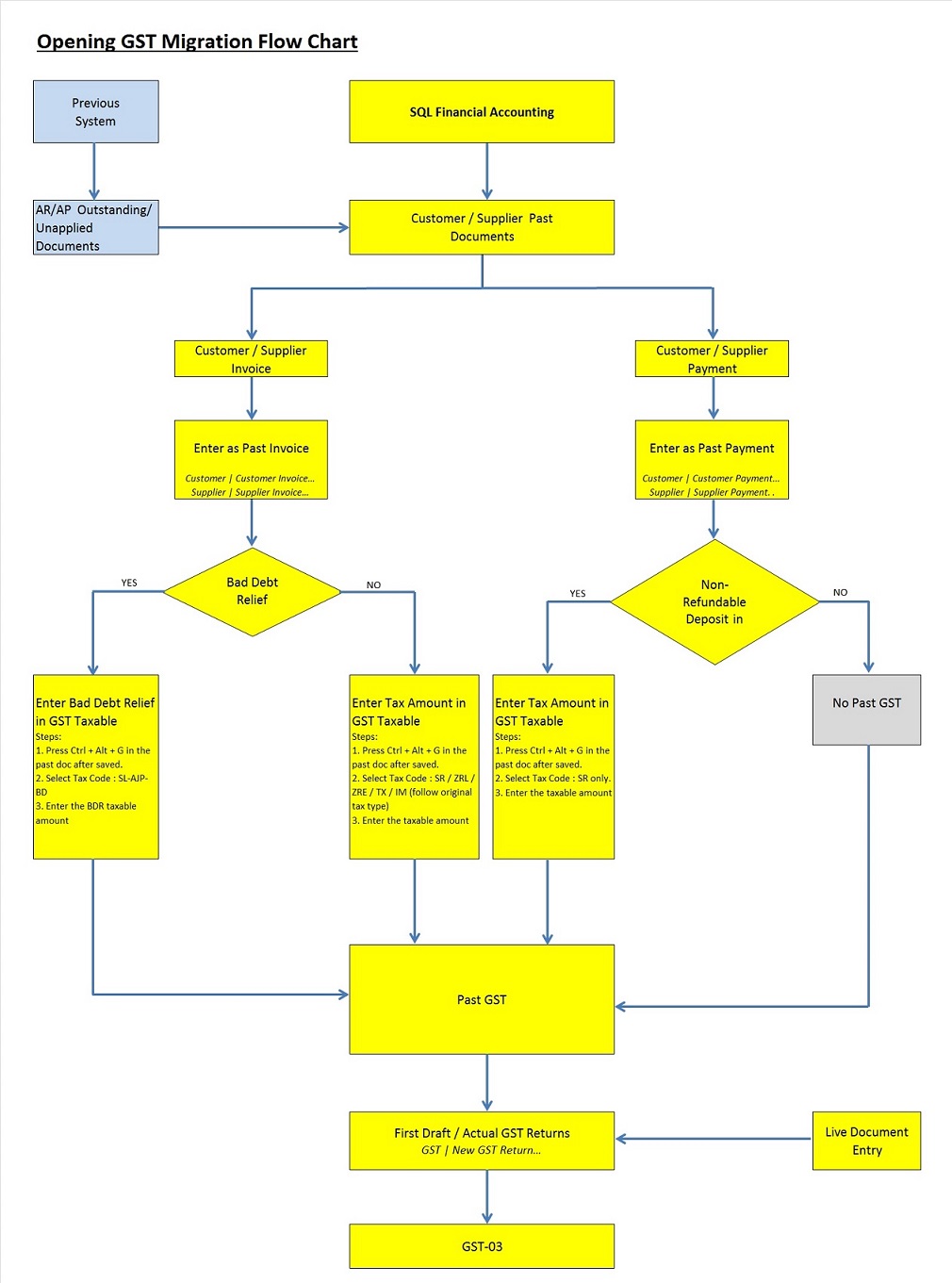

How to handle the GST Past Documents Opening Balance for Customer and Supplier?

Introduction

- This guide will teach you the way to handle the past outstanding documents for Customer and Supplier from previous accounting system. We are ensure that the data migration part go smooth with GST matters happened in previous system likes bad debt relief and non-refundable deposit.

How to enter the GST Past Documents?

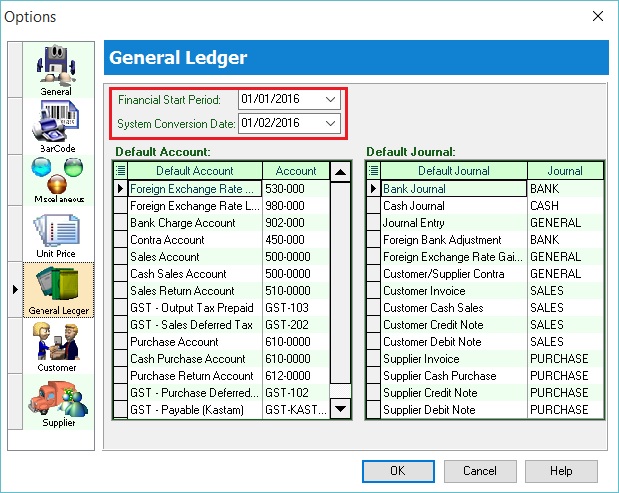

Financial Start Period and System Conversation Date

[Tools | Options...General Ledger]

- 1. Let's said under the Tools | Options... I have set the following:-

- Financial Start Period : 01 Jan 2016

- System Conversion Date : 01 Feb 2016 (Cut-off Date for Opening Entry)

- Financial Start Period : 01 Jan 2016

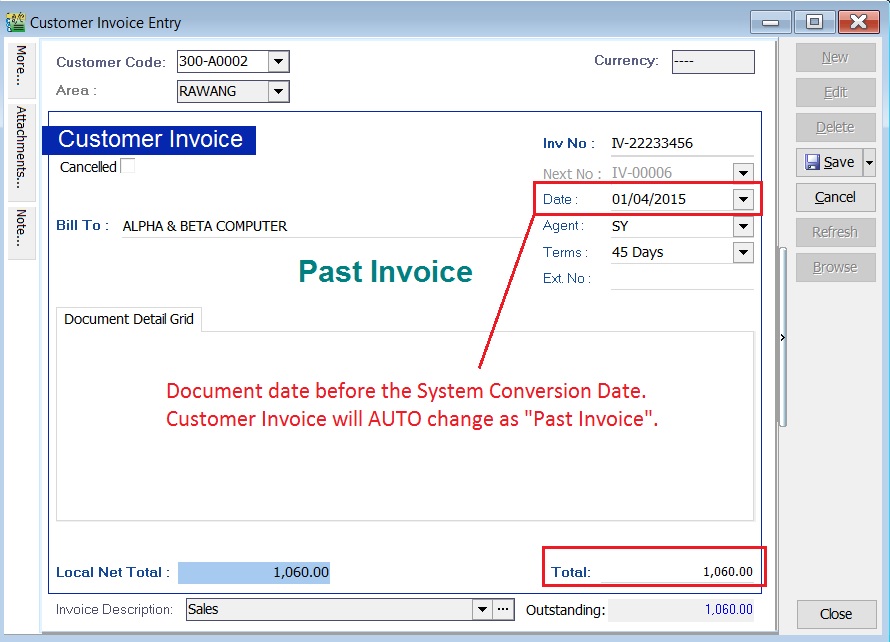

Enter the Past Documents (AR & AP)

- 1. Create new customer/supplier invoice.

- 2. Enter the Invoice No.

- 3. Enter the Original Invoice Date. Date before the system conversation date, the document will converted to "Past Invoice" automatically.

- 4. Enter the Outstanding Invoice Balance into Total.

- 5. Save it.

- 6. See screenshot below.

- 7. Take note to the below table.

Action Where to Enter? To enter the Customer Past Tax Invoice a. Go to Customer / Customer Invoice...

b. Refer the above step 1.To enter the Supplier Past Tax Invoice a. Go to Supplier / Supplier Invoice...

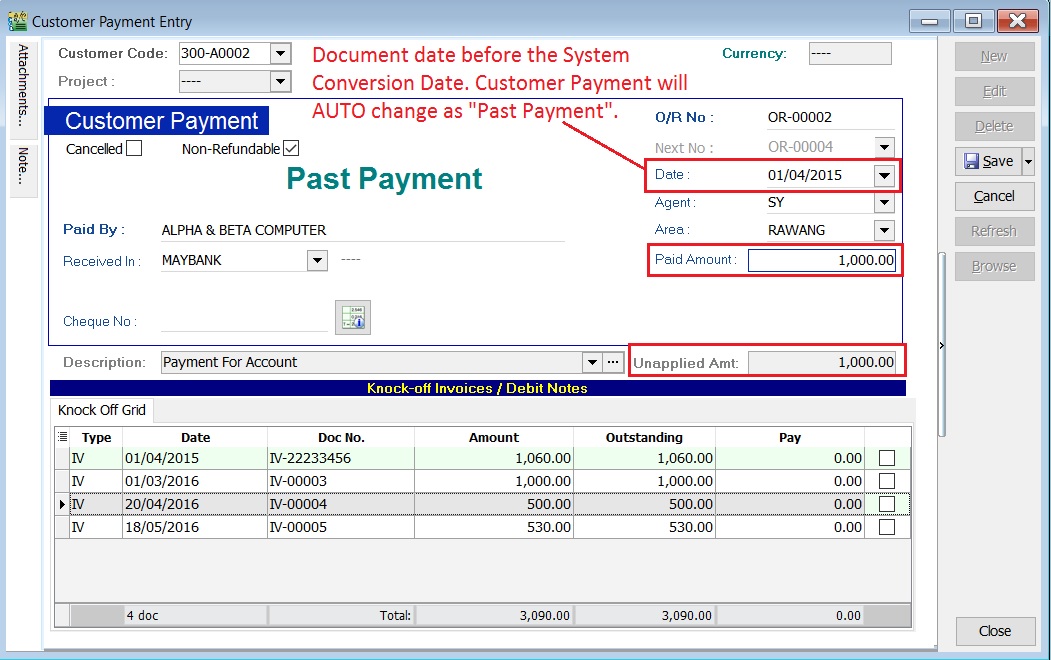

b. Refer the above step 1.To enter the Customer Past Non-Refundable Deposit a. Customer / Customer Payment...

b. Refer the above step 1.

c. Tick the Non-Refundable checkbox.

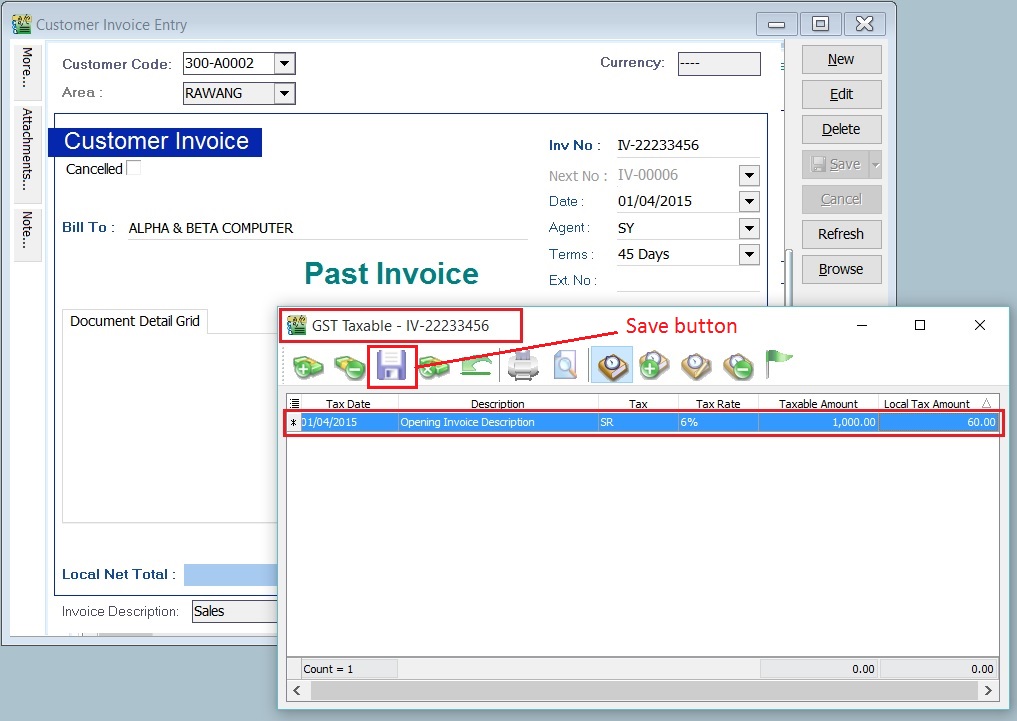

Enter the GST Taxable for Past Documents (AR & AP)

- 1. Open the past tax invoice document.

- 2. Press CTRL + ALT + G.... You able to assign the tax code (SR / ZRL / ZRE / TX / IM...etc), the taxable amount (eg. Rm 1,000.00) and the tax amount (eg. Rm 60.00) for past document.

- 3. Save it.

- 4. See screenshot below.

- 5. Take note to the below table.

Action Where to Enter? To enter GST Taxable for the Customer Past Tax Invoice a. Go to Customer / Customer Invoice...

b. Refer the above step 1.

c. Tax code commonly apply to this matter is SR / ZRL / ZRE / SL_AJP-BD (for bad debt relief claimed as input tax in old system).To enter GST Taxable for the Supplier Past Tax Invoice a. Go to Supplier / Supplier Invoice...

b. Refer the above step 1.

c. Tax code commonly apply to this matter is TX / IM / PH_AJS-BD (for bad debt relief paid as output tax in old system).To enter GST Taxable for the Customer Past Non-Refundable Deposit a. Go to Customer / Customer Payment...

b. Refer the above step 1.

c. Tax code commonly apply to this matter is SR.

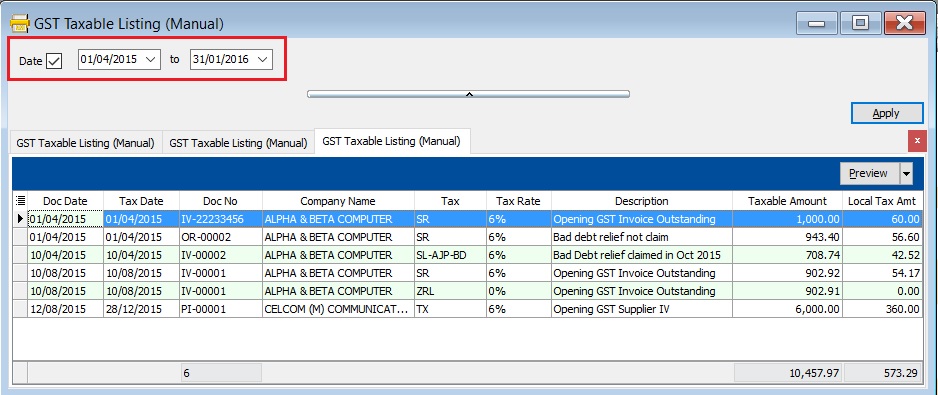

GST Taxable Listing for Past Documents

[GST | Print GST Taxable Listing (Manual)...]

- 1. Select the date range to apply.

- 2. See screenshot below.