Migration System Features-How to handle the GST Past Documents Opening Balance for Customer and Supplier: Difference between revisions

From eStream Software

| Line 11: | Line 11: | ||

==Checklist before start enter the GST Past Documents== | ==Checklist before start enter the GST Past Documents== | ||

===Financial Start Period and System Conversation Date=== | |||

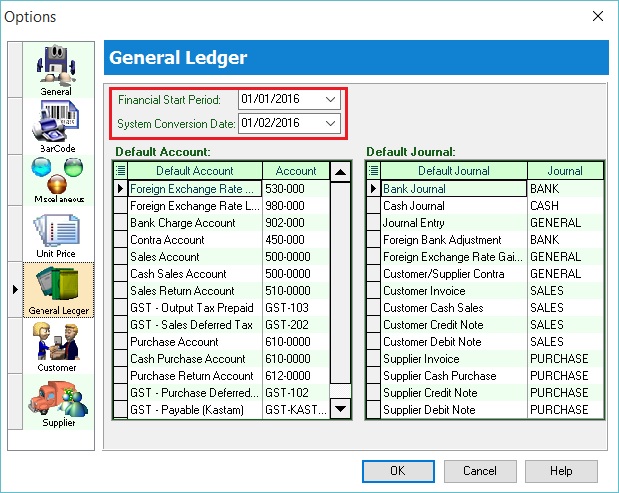

:1. Let's said under the Tools | Options... I have set the following:-<br /> | :1. Let's said under the Tools | Options... I have set the following:-<br /> | ||

:: Financial Start Period : 01 Jan 2016<br /> | :: '''Financial Start Period''' : 01 Jan 2016<br /> | ||

:: System Conversion Date : 01 Feb 2016 (Cut-off Date for Opening Entry)<br /> | :: '''System Conversion Date''' : 01 Feb 2016 (Cut-off Date for Opening Entry)<br /> | ||

:2. See below screenshot:<br /> | :2. See below screenshot:<br /> | ||

Revision as of 06:30, 22 December 2015

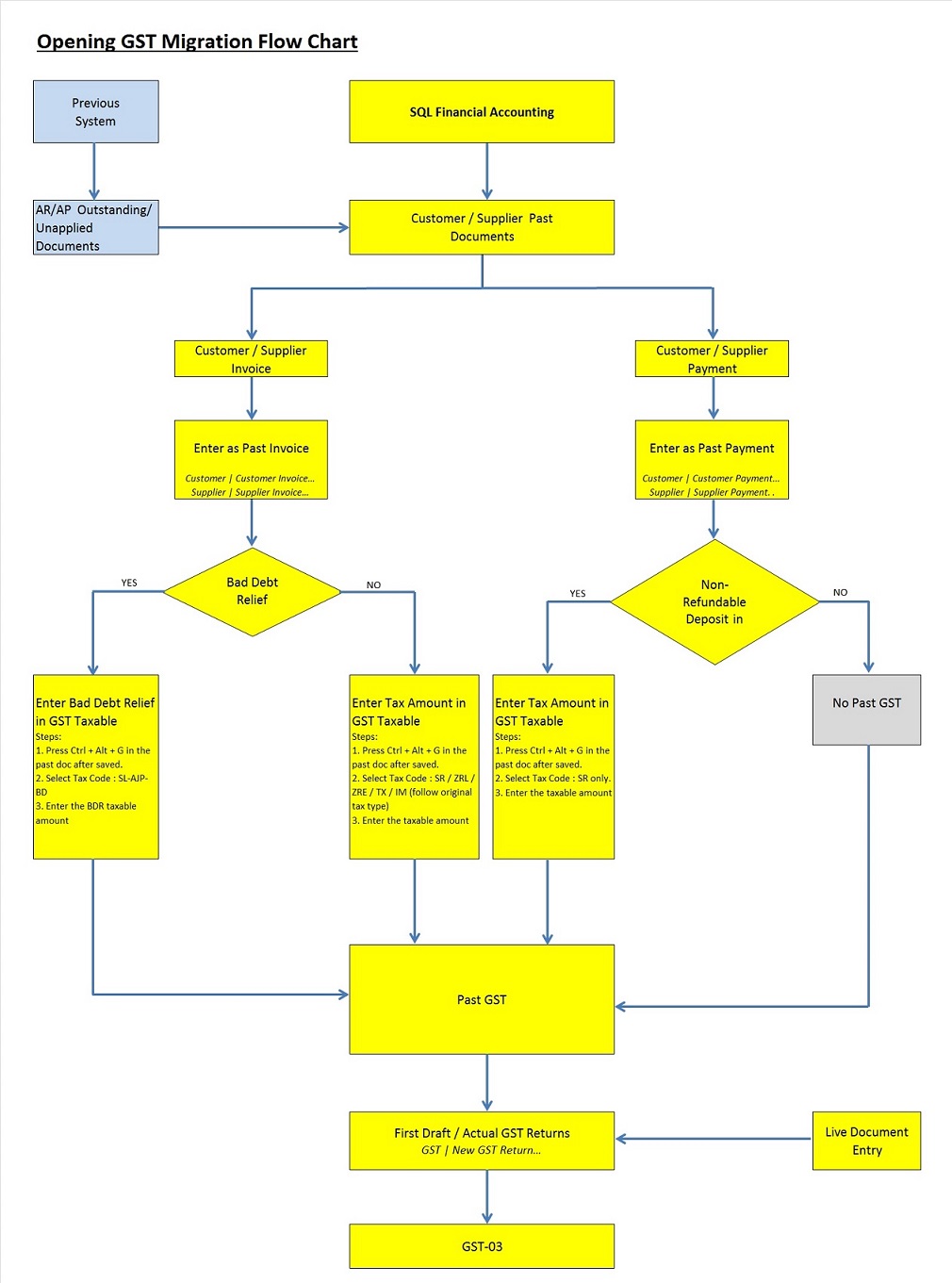

How to handle the GST Past Documents Opening Balance for Customer and Supplier?

Introduction

- This guide will teach you the way to handle the past outstanding documents for Customer and Supplier from previous accounting system. We are ensure that the data migration part go smooth with GST matters happened in previous system likes bad debt relief and non-refundable deposit.

Checklist before start enter the GST Past Documents

Financial Start Period and System Conversation Date

- 1. Let's said under the Tools | Options... I have set the following:-

- Financial Start Period : 01 Jan 2016

- System Conversion Date : 01 Feb 2016 (Cut-off Date for Opening Entry)

- Financial Start Period : 01 Jan 2016