(Created page with "<big>SQL MyTTx User Guide</big> ==Introduction== :'''TTx''' is a tax charged and levied on a '''tourist''' staying at any '''accommodation premises''' made available by an '...") |

No edit summary |

||

| Line 1: | Line 1: | ||

==Introduction== | ==Introduction== | ||

:'''TTx''' is a tax charged and levied on a '''tourist''' staying at any '''accommodation premises''' made available by an '''operator''' at the rate fixed by the Minister. It is the duty of the tourist to pay TTx to the operator. | :'''TTx''' is a tax charged and levied on a '''tourist''' staying at any '''accommodation premises''' made available by an '''operator''' at the rate fixed by the Minister. It is the duty of the tourist to pay TTx to the operator. | ||

Revision as of 03:06, 14 August 2017

Introduction

- TTx is a tax charged and levied on a tourist staying at any accommodation premises made available by an operator at the rate fixed by the Minister. It is the duty of the tourist to pay TTx to the operator.

- Tourist means any person, whether he is a Malaysian national or otherwise, visiting any place in Malaysia for any of the following purposes, namely:

- a) pleasure, recreation or holiday;

- b) culture;

- c) religion;

- d) visiting friends or relatives;

- e) sports;

- f) business;

- g) meetings, conferences, seminars or conventions;

- h) studies or research;

- i) any other purpose which is not related to an occupation that is remunerated from the place visited.

- Accommodation premises means any building, including hostels, hotels, inns, boardinghouses, rest houses and lodging houses, held out by the proprietor, owner or manager, either wholly or partly, as offering lodging or sleeping accommodation to tourists for hire or any other form of reward, whether or not food or drink is also offered.

- Therefore, we have designed a database structure specially for business which has provide accommodation to tourists.

Modules Require

- SQL Accounting Basic

- DIY field

- DIY script

- See below the overview of MyTTx process flow:

Setup MyTTx Database

Last Customisation Update : 14 Aug 2017

- 1. Get the NEW database structure for MyTTx (in backup format) from this link

- 2. Restore this backup.

- 3. Enter the user ID and password with “ADMIN” to login.

History New/Updates/Changes

Last Customisation Update : '

- Not available

MyTTx List

Maintain Stock Items

[Stock | Maintain Stock Item…]

- 1. MyTTx list settings are:

No. Code Description Stock Group Base UOM Ref.Price Output Tax Stock Control 1. TTx TTx TTx ROOM/NIGHT 10.00 NS (applicable to GST Registered person) Untick 2. TTxE TTx Exempted TTx ROOM/NIGHT 0.00 NS (applicable to GST Registered person) Untick

Room & Service Charge Setup

[Stock | Maintain Stock Item…]

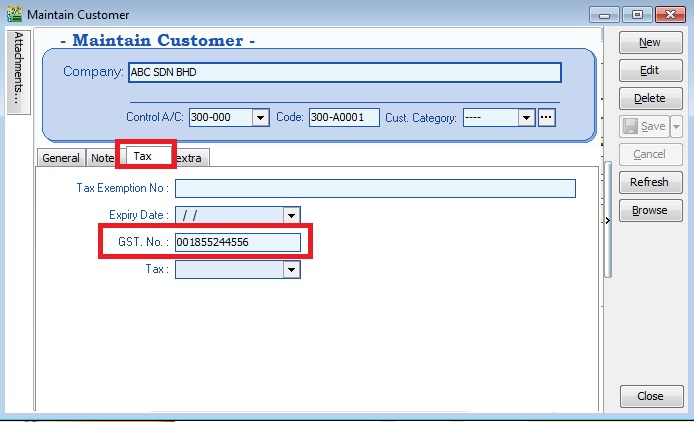

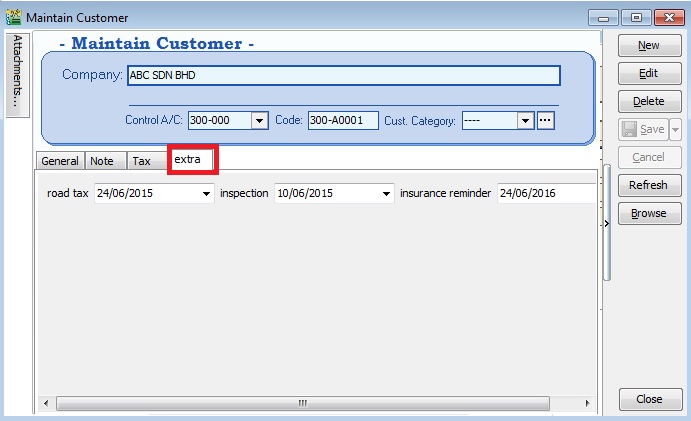

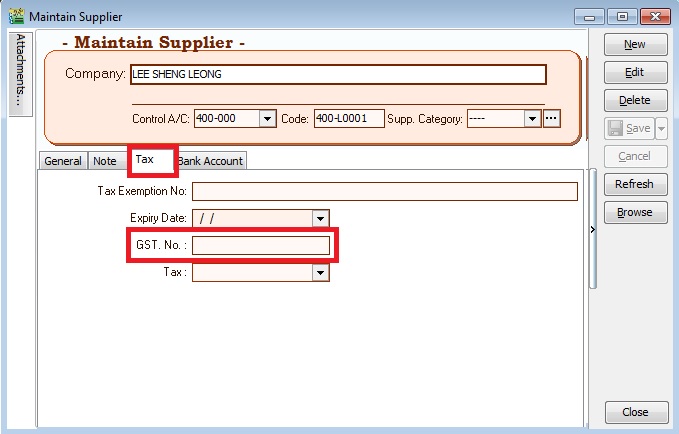

- 1. Create new seller name (eg. company name or person name).

- 2. Click on Tax tab to input the GST No (if applicable).

Maintain Stock Item

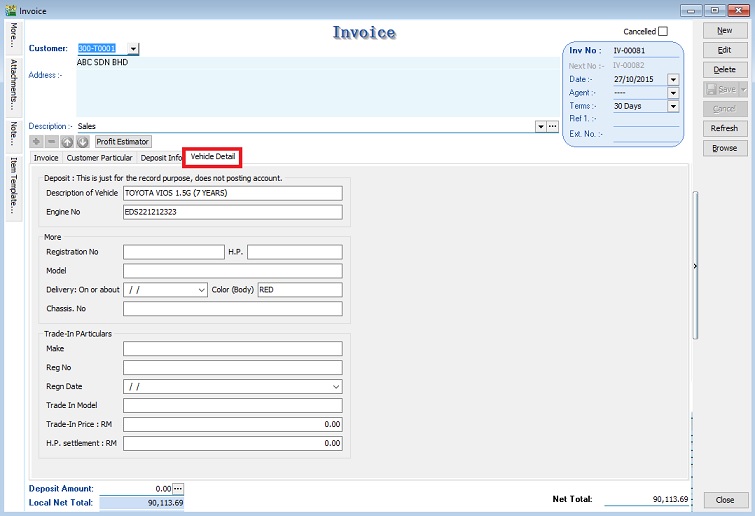

[Stock | Maintain Stock Item…]

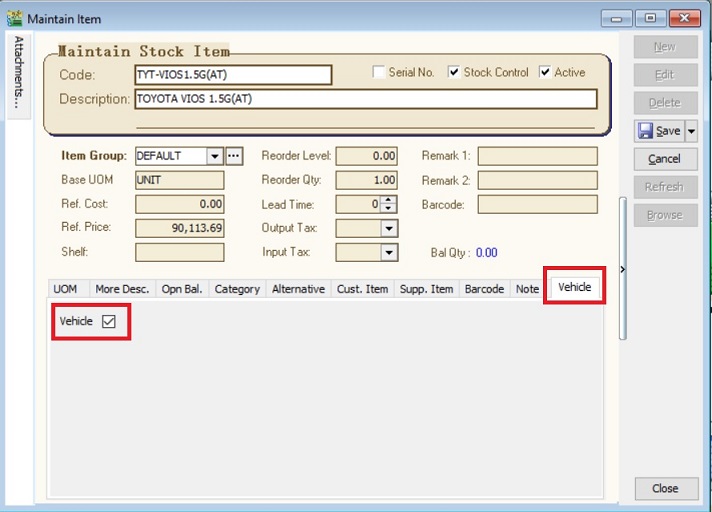

- 1. Create the car model at Maintain Stock Item. For example, TOYOTA VIOS 1.5G(AT)

- 2. Click on Vehicle tab to define this item is a "Vehicle".

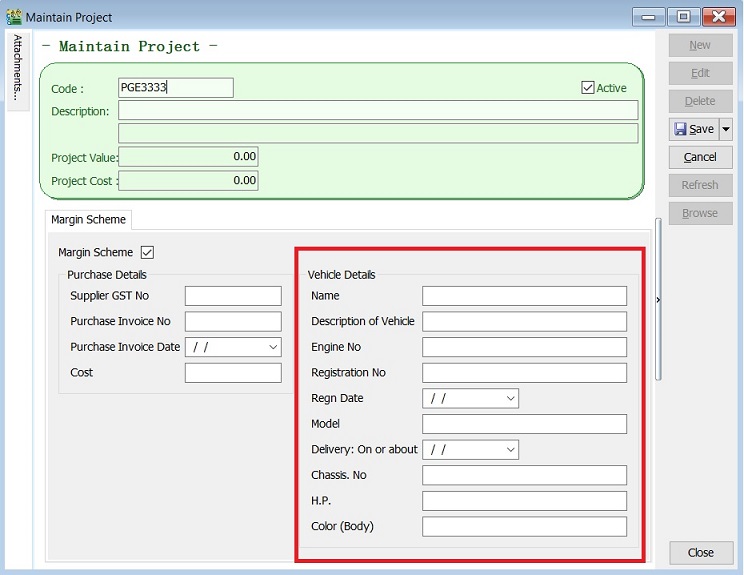

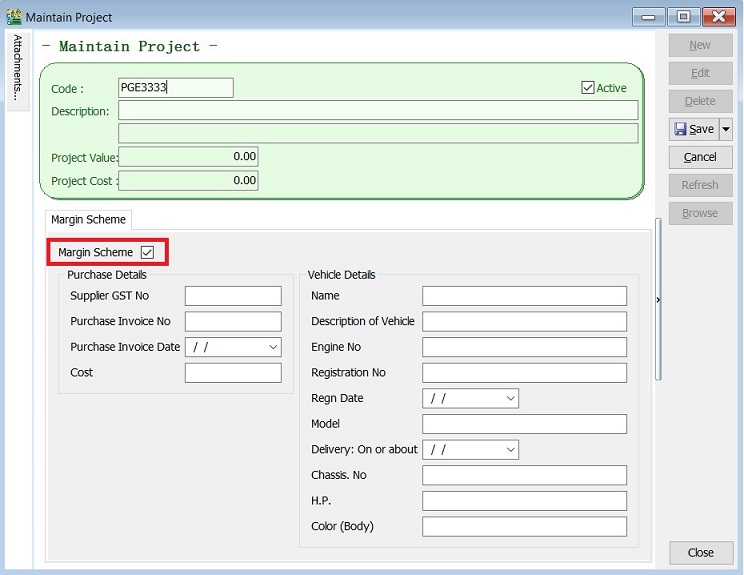

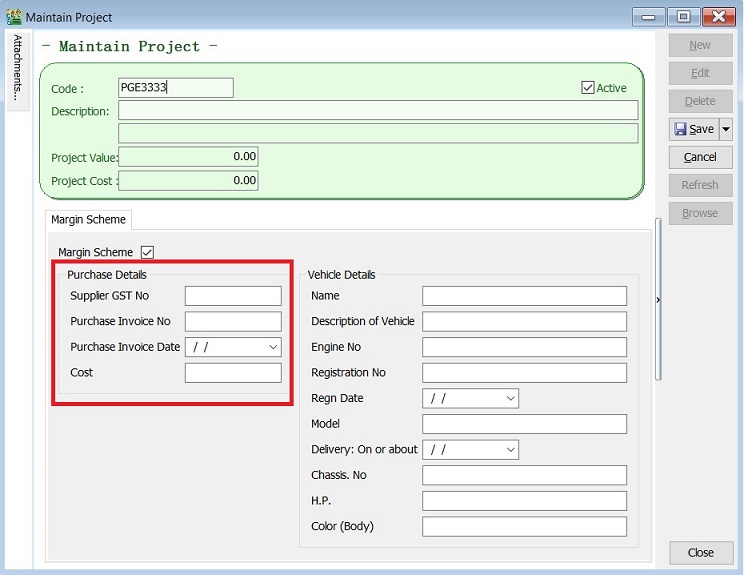

Maintain Project

[Tools | Maintain Project…]

- 4. Leave BLANK to Purchase Invoice Date, Purchase Invoice No and Cost. It will auto update when you are select the project code and save at the Purchase Invoice.

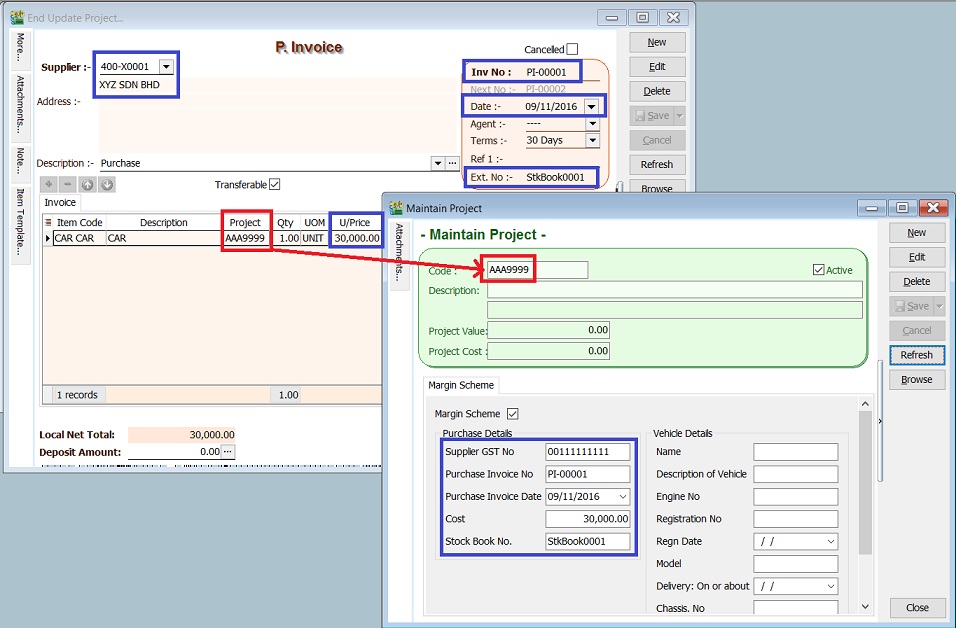

Record Purchase of Second Hand Car Value

[Purchase | Purchase Invoice…]

- 1. Enter the purchase value of second car at Purchase Invoice. (eg. RM30,000 )

- 2. You must select the correct car plate number from Project. (eg. PGE3333, AAA9999)

- 3. Supplier GST No, Purchase invoice number, date and cost will be update automatically after you have save the purchase invoice.

Project: Purchase Detail Update from Supplier GST No Maintain Supplier (GST No) Purchase Invoice No Purchase Invoice (Doc No) Purchase Invoice Date Purchase Invoice (Doc Date) Cost Purchase Invoice (Unit Price) Stock Book No. Purchase Invoice (Ext No)

NOTE :

1. This information is required to show in Lampiran 07 -Monthly Report for Relief for Secondhand Goods or Margin Scheme (MS).

2. Auto update to project purchase detail (Purchase No, Purchase Date and Cost) if tax amount is zero.

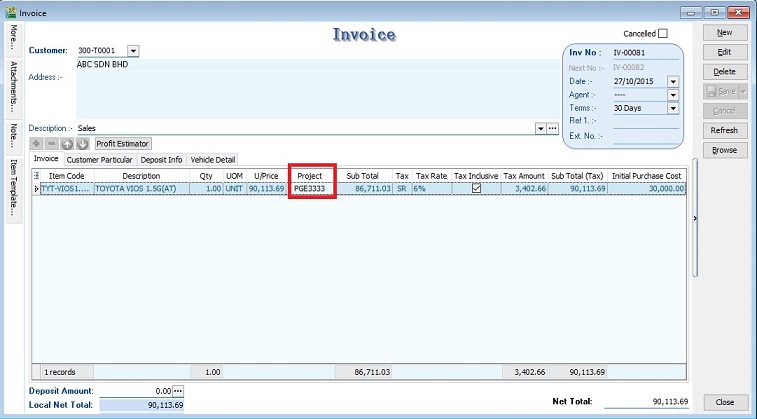

Record Sale of Second Hand Car Value

[Sales | Invoice…]

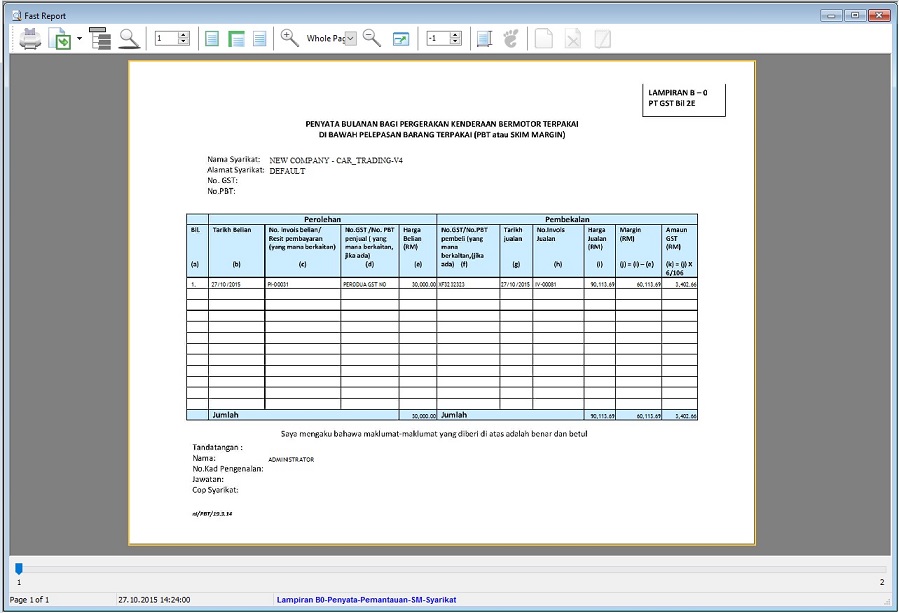

Margin Scheme Input

- 1. Enter the sale value of second car at Invoice. (eg.RM90,113.69)

- 2. You must select the correct car plate number from Project.(eg.PGE3333)

- 3. Initial Purchase Cost will auto upadate after select the project (car plate number).

- 4. Tax amount will be calculated based on Margin Scheme method.(See screenshot below)

- a. Sellng Price = 90,113.69

- b. Purchase Cost = 30,000.00

- c. Margin = 90,113.69 – 30,000.00 = 60,113.69

- d. Tax amount = 60,113.69 x 6/106 = 3,402.66

- a. Sellng Price = 90,113.69

- 6. Invoice no, invoice date, selling price, margin, and margin tax amount will be shown in Lampiran 07 -Monthly Report for Relief for Secondhand Goods or Margin Scheme (MS)

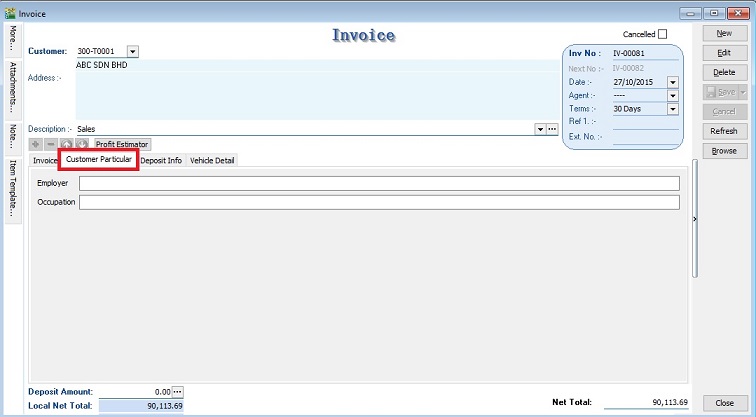

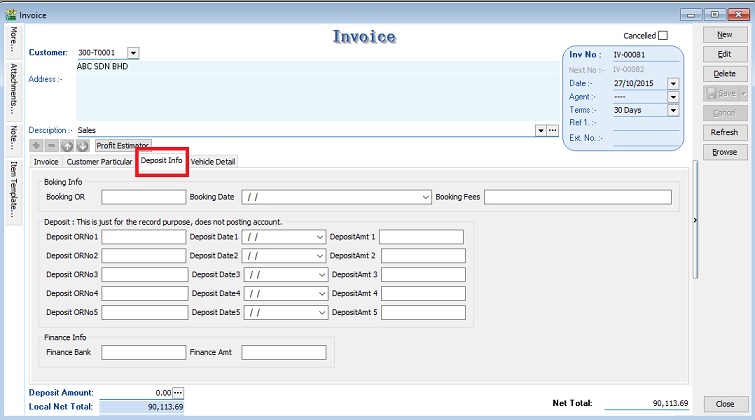

Other Information

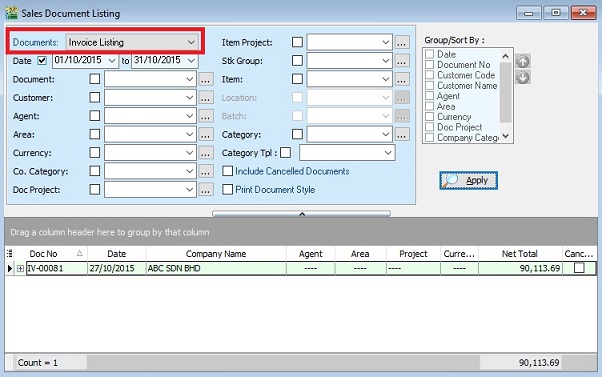

Print for GST Lampiran 07 (Lampiran B0-Penyata-Pemantauan-SM-Syarikat)

[Sales | Print Sales Document Listing…]

See also

- Others Customisation