| Line 51: | Line 51: | ||

* You can set the tax as default at the following | * You can set the tax as default at the following | ||

:* GL | Maintain Account... | :* GL | Maintain Account... | ||

:* Customer | Maintain Customer... | :* Customer | Maintain Customer... | Tax | ||

:* Supplier | Maintain Supplier... | :* Supplier | Maintain Supplier... | Tax | ||

:* Stock | Maintain Stock Item... | :* Stock | Maintain Stock Item... | Output Tax/Input Tax | ||

:* Tools | Options | Customer | :* Tools | Options | Customer | Default Output Tax | ||

:* Tools | Options | Supplier | :* Tools | Options | Supplier | Default Input Tax | ||

* Therefore, item inserted will be automatically calculate the tax amount based on the subtotal. See below screenshot. | * Therefore, item inserted will be automatically calculate the tax amount based on the subtotal. See below screenshot. | ||

| Line 61: | Line 61: | ||

<br /> | <br /> | ||

==Default System Tax Seq== | |||

Default System Tax Seq are as follow | |||

===For Sales & Purchase=== | |||

# Maintain Customer/Supplier | |||

# Maintain Item Code | |||

# Tools | Options | Customer/Supplier | |||

===For AR & AP=== | |||

# Maintain Customer/Supplier | |||

# Maintain Account | |||

# Tools | Options | Customer/Supplier | |||

===For GL=== | |||

# Maintain Account | |||

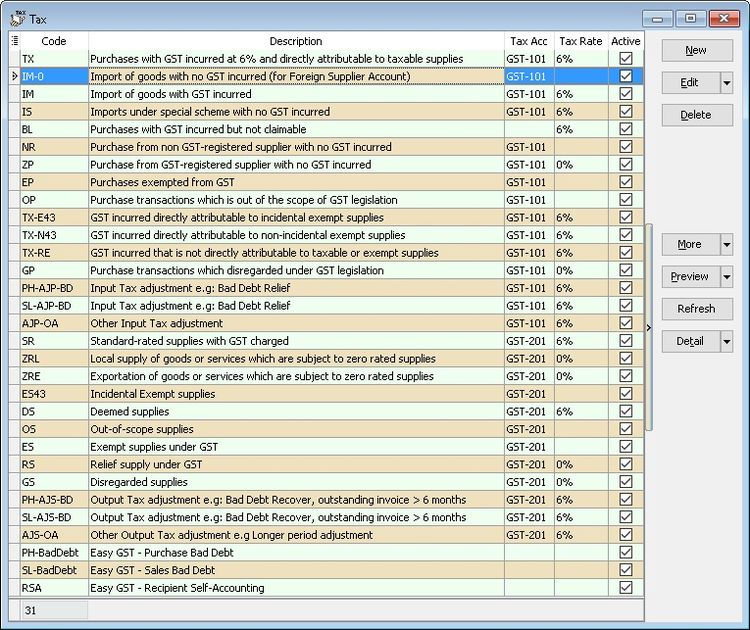

Revision as of 03:23, 23 October 2015

Menu: Tools | Maintain Tax... or

Menu: GST | Maintain Tax...

Introduction

- This to Maintain all the available tax given by Government or user can self add or modified

Create New Tax

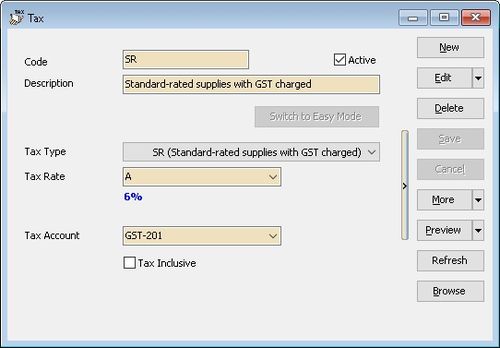

- Screenshot below is the Maintain Tax entry form.

Field Name Explanation & Properties Code - Enter the tax code to be shown in report

Active - Checked : Active & able to select from the Tax List in data entry

- UnChecked : InActive & unable to select from the Tax List in data entry

Description - Enter the tax description.

Tax Type - Select the Tax Type for the Tax Code to be created

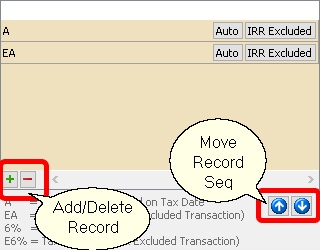

Tax Rate User can self determine the rate or set Auto

- A : Auto Tax Rate. System will auto change to new rate if there is update in GST Rate (Must update SQL Accounting)

- E : Mean to be excluded from IRR calculation (useful for OS Tax Code & Mixed Supplies Industry)

- EA : Combine of A & E

- 6% : User self determine by fixed rate (eg here is 6%)

- E6% : User self determine fixed rate for be excluding from IRR calculation

Default 1st row is the Default selection in data entry

Tax Account - Select an appropriate GL Account from Maintain Account.

Tax Inclusive - Checked : Default is Tax Inclusive

- UnChecked : Default is Tax Exclusive

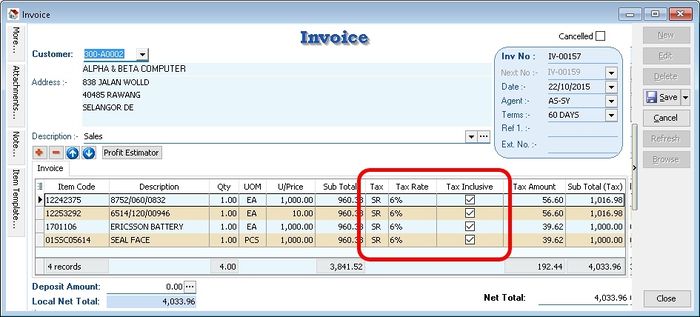

Use of Tax

- You can set the tax as default at the following

- GL | Maintain Account...

- Customer | Maintain Customer... | Tax

- Supplier | Maintain Supplier... | Tax

- Stock | Maintain Stock Item... | Output Tax/Input Tax

- Tools | Options | Customer | Default Output Tax

- Tools | Options | Supplier | Default Input Tax

- Therefore, item inserted will be automatically calculate the tax amount based on the subtotal. See below screenshot.

Default System Tax Seq

Default System Tax Seq are as follow

For Sales & Purchase

- Maintain Customer/Supplier

- Maintain Item Code

- Tools | Options | Customer/Supplier

For AR & AP

- Maintain Customer/Supplier

- Maintain Account

- Tools | Options | Customer/Supplier

For GL

- Maintain Account