Introduction

- This guide will explains how Partial Exemption, Apportionment and Annual Adjustment are made in respect of residual input tax which is attributable to both taxable and exempt supplies in SQL Financial Accounting.

Partial Exemption Rules

Input Tax Recoverable Ratio (IRR)

- Formula:

- IRR = (T-O)/(T+E-O)

- T = SR + ZRL + ZRE + DS + OS + RS + GS

- E = ES

- O = ES43 (Incidental financial supplies)

- ES

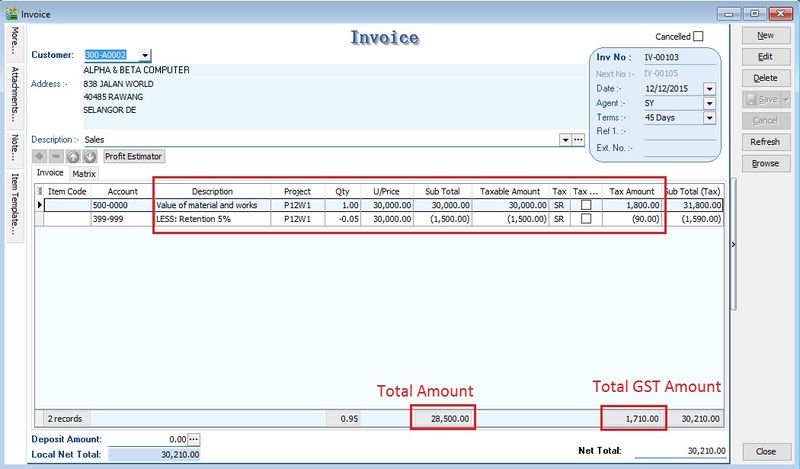

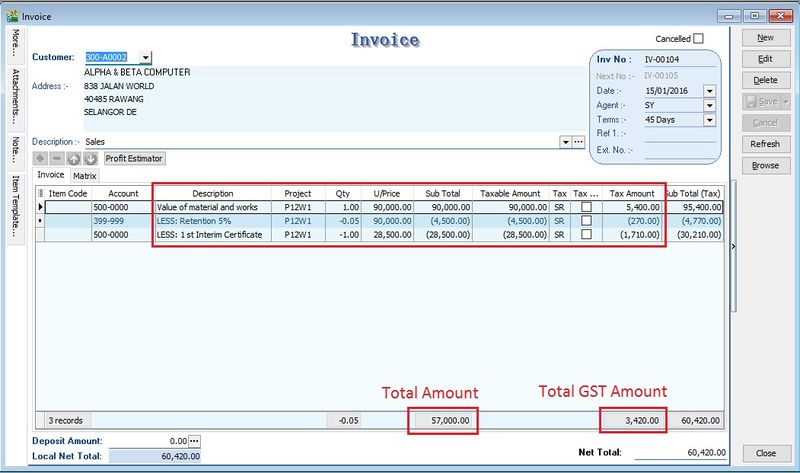

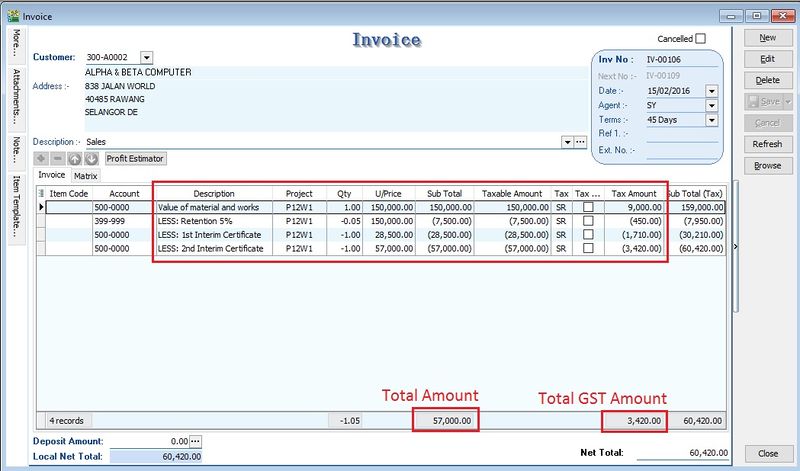

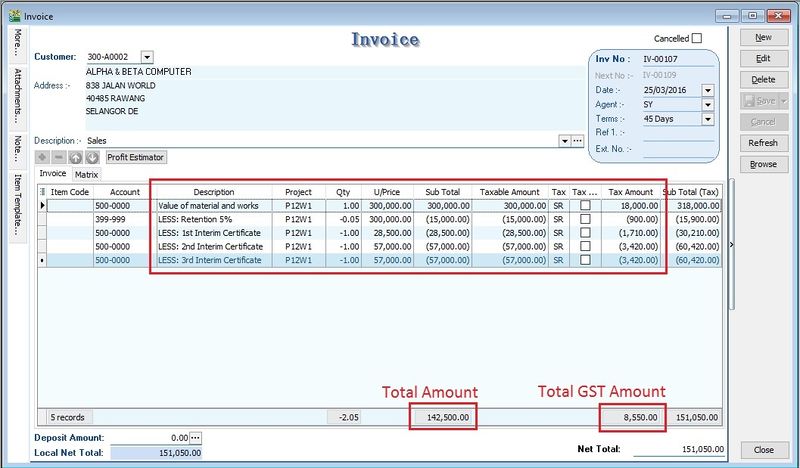

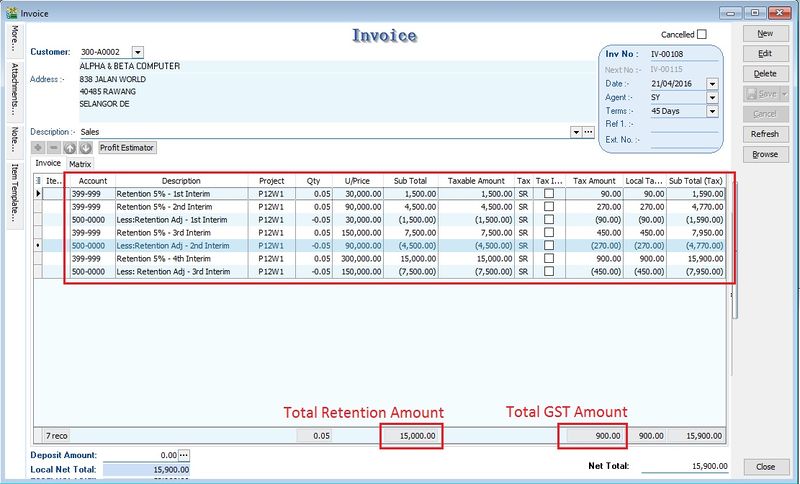

NOTE: GL Account : 399-999 - Retention (Create under the Current Asset) You have to adjust each progress retention sum by less the previous progress retention sum and reverse back to the account use for the value of material and works.

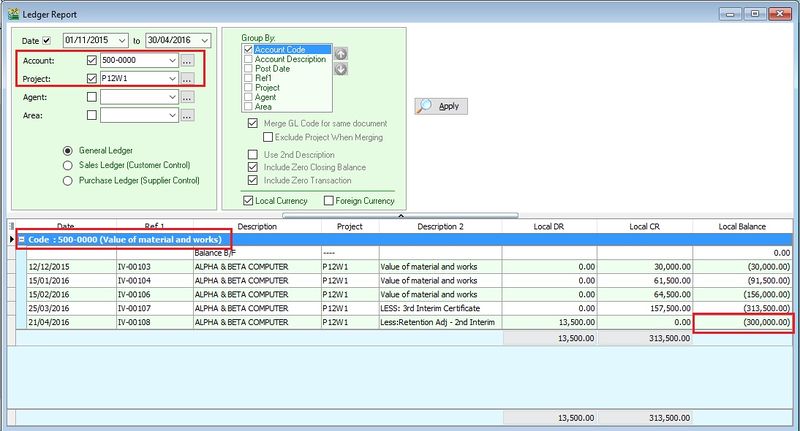

Value of Material and Works Report by Project

[GL | Print Ledger Report...]

- 1. To check the total value of material and works balance report. See the screenshot below.

- 2. You can see the total value of material and works adjusted with final result: Rm300,000.

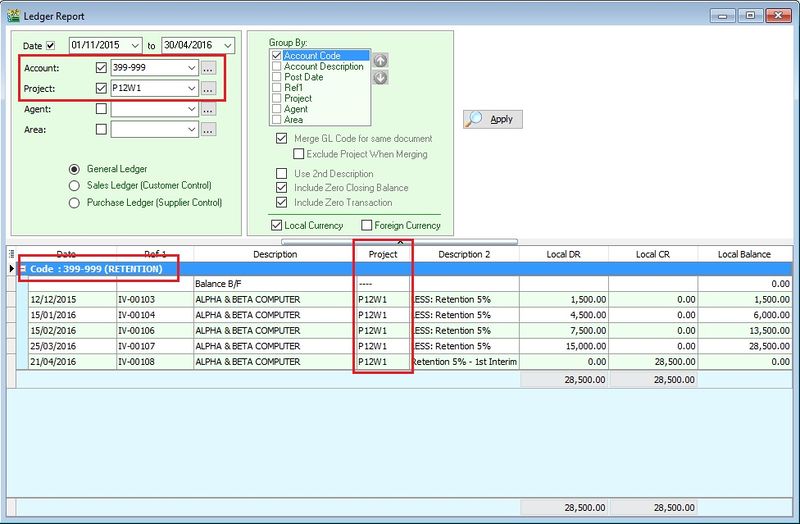

Retention Report by Project

[GL | Print Ledger Report...]

Highlight Changes

| Date | Initiated by | Remarks |

|---|---|---|

| 12 December 2015 | Loo | Initial document. |

| 16 December 2015 | Admin | Correct the retention sum to Rm15,000 |