| Line 6: | Line 6: | ||

===Input Tax Recoverable Ratio (IRR)=== | ===Input Tax Recoverable Ratio (IRR)=== | ||

: Formula:<br /> | : Formula:<br /> | ||

::'''IRR = (T-O)/(T+E-O)'''<br /> | ::'''IRR = (T-O) / (T+E-O)'''<br /> | ||

::T = SR + ZRL + ZRE + DS + OS + RS + GS | ::T = SR + ZRL + ZRE + DS + OS + RS + GS | ||

::E = ES <br /> | ::E = ES <br /> | ||

::O = ES43 (Incidental financial supplies) | ::O = ES43 (Incidental financial supplies) | ||

:::ES | :::ES (Disposal of assets which are exempted eg. residential house) | ||

:::SR (Disposal of assets) | |||

:::DS (Self-recipient accounting transactions, ie. any supplies users make to themselves eg. imported services etc.) | |||

:::OS (Out of scope transactions which are not taxable in Malaysia) | |||

<br /> | |||

===De Minus Rule (DMR)=== | |||

: To satisfy the De Minus Rule: | |||

::1. DMR <= 5% and | |||

::2. Total Exempt Supply (ES) <= Rm5,000.00 per month | |||

<br /> | |||

:Formula: | |||

::DMR = ES / ES + (SR + ZRL + ZRE + DS + OS + RS + GS) | |||

<br /> | |||

===Input Tax Claimable Logic (Based on DMR)=== | |||

: Below is the summary of the calculation logic based on DMR to determine the input tax claimable. | |||

: | |||

{| class="wikitable" | |||

|- | |||

! Tax Code !! Tax Rate !! Fulfill DMR? !! Input Tax Claimable (ITC) | |||

|- | |||

| TX-RE || 6% || Yes || ITC x 100% | |||

|- | |||

| TX-RE || 6% || No || Example | |||

|- | |||

| || || || | |||

|- | |||

| TX-E43 || 6% || N/A || ITC x 100% | |||

|- | |||

| || || || | |||

|- | |||

| TX-N43 || 6% || Yes || ITC x 100% | |||

|- | |||

| TX-N43 || 6% || No || ITC x 0% | |||

|}<br /> | |||

==Partial Exempt in SQL Financial Accounting== | |||

===Example 1=== | |||

:Mixed Co. Sdn Bhd., whose current tax year ends on 31 December 2016, has in his taxable period of April 2015, made some mixed supplies and at the same time incurred residual input tax as follows. | |||

{| class="wikitable" | |||

|- | |||

! !! !! RM | |||

|- | |||

| t || Value of all taxable supplies, exclusive of tax || 200,000.00 | |||

|- | |||

| e || Value all of exempt supplies || 40,000.00 | |||

|- | |||

| o || Value of a capital goods disposal off (exclusive of tax) || 50,000.00 | |||

|- | |||

| o || Value of incidental exempt supplies || 20,000.00 | |||

|- | |||

| || Residual Input Tax Incurred || 10,000.00 | |||

|} | |||

:Based on the above example to enter into SQL Financial Accounting, the below result generated from GST-Listing: | |||

::[[File:Partial Exempt-01.jpg | 700px]] | |||

Revision as of 04:04, 11 April 2016

Introduction

- This guide will explains how Partial Exemption, Apportionment and Annual Adjustment are made in respect of residual input tax which is attributable to both taxable and exempt supplies in SQL Financial Accounting.

Partial Exemption Rules

Input Tax Recoverable Ratio (IRR)

- Formula:

- IRR = (T-O) / (T+E-O)

- T = SR + ZRL + ZRE + DS + OS + RS + GS

- E = ES

- O = ES43 (Incidental financial supplies)

- ES (Disposal of assets which are exempted eg. residential house)

- SR (Disposal of assets)

- DS (Self-recipient accounting transactions, ie. any supplies users make to themselves eg. imported services etc.)

- OS (Out of scope transactions which are not taxable in Malaysia)

- IRR = (T-O) / (T+E-O)

De Minus Rule (DMR)

- To satisfy the De Minus Rule:

- 1. DMR <= 5% and

- 2. Total Exempt Supply (ES) <= Rm5,000.00 per month

- Formula:

- DMR = ES / ES + (SR + ZRL + ZRE + DS + OS + RS + GS)

Input Tax Claimable Logic (Based on DMR)

- Below is the summary of the calculation logic based on DMR to determine the input tax claimable.

| Tax Code | Tax Rate | Fulfill DMR? | Input Tax Claimable (ITC) |

|---|---|---|---|

| TX-RE | 6% | Yes | ITC x 100% |

| TX-RE | 6% | No | Example |

| TX-E43 | 6% | N/A | ITC x 100% |

| TX-N43 | 6% | Yes | ITC x 100% |

| TX-N43 | 6% | No | ITC x 0% |

Partial Exempt in SQL Financial Accounting

Example 1

- Mixed Co. Sdn Bhd., whose current tax year ends on 31 December 2016, has in his taxable period of April 2015, made some mixed supplies and at the same time incurred residual input tax as follows.

| RM | ||

|---|---|---|

| t | Value of all taxable supplies, exclusive of tax | 200,000.00 |

| e | Value all of exempt supplies | 40,000.00 |

| o | Value of a capital goods disposal off (exclusive of tax) | 50,000.00 |

| o | Value of incidental exempt supplies | 20,000.00 |

| Residual Input Tax Incurred | 10,000.00 |

- Based on the above example to enter into SQL Financial Accounting, the below result generated from GST-Listing:

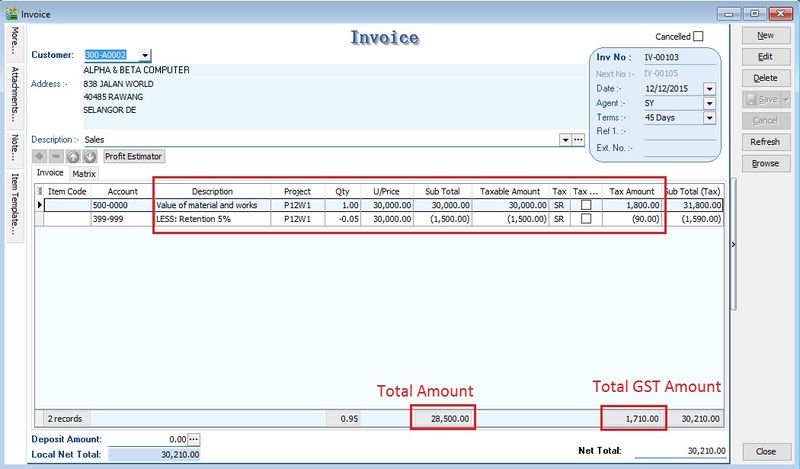

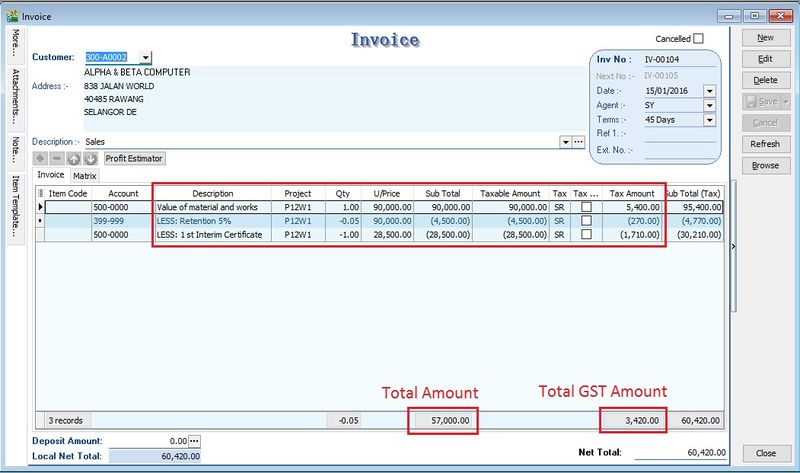

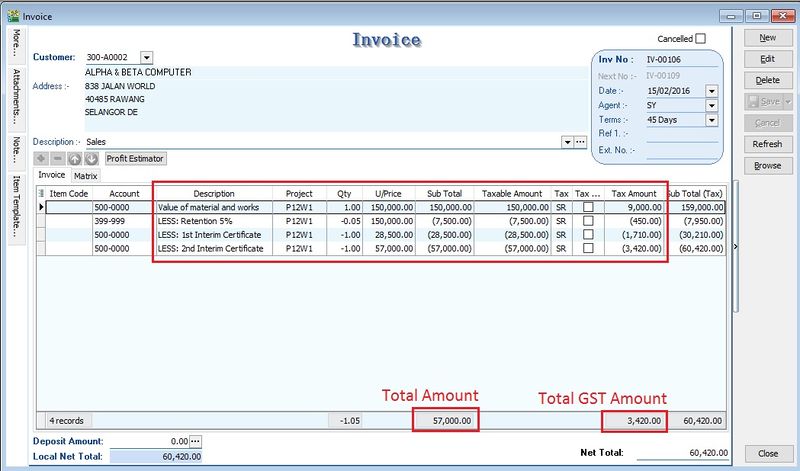

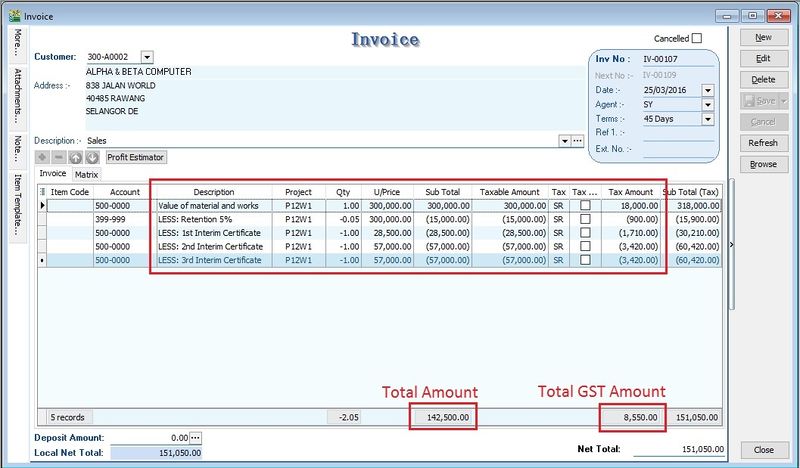

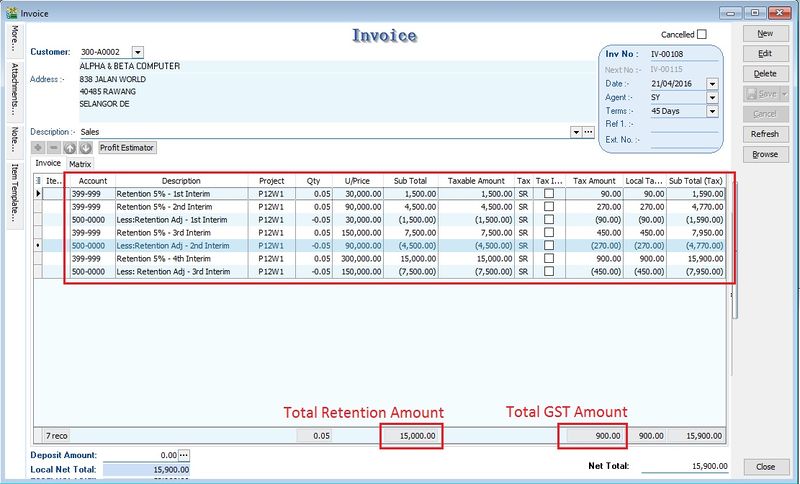

NOTE: GL Account : 399-999 - Retention (Create under the Current Asset) You have to adjust each progress retention sum by less the previous progress retention sum and reverse back to the account use for the value of material and works.

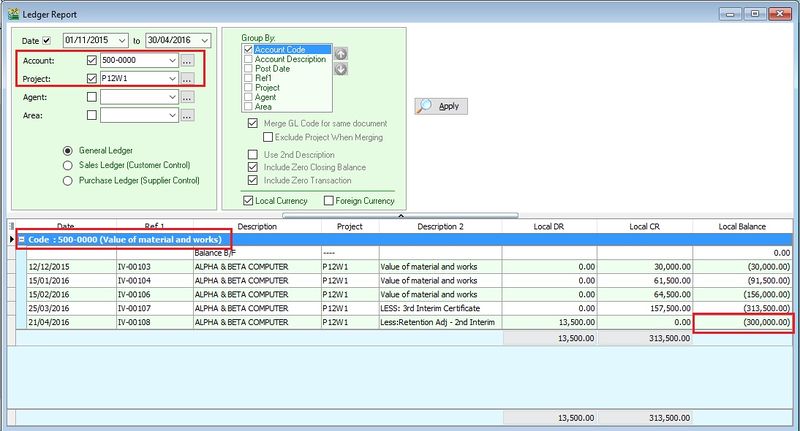

Value of Material and Works Report by Project

[GL | Print Ledger Report...]

- 1. To check the total value of material and works balance report. See the screenshot below.

- 2. You can see the total value of material and works adjusted with final result: Rm300,000.

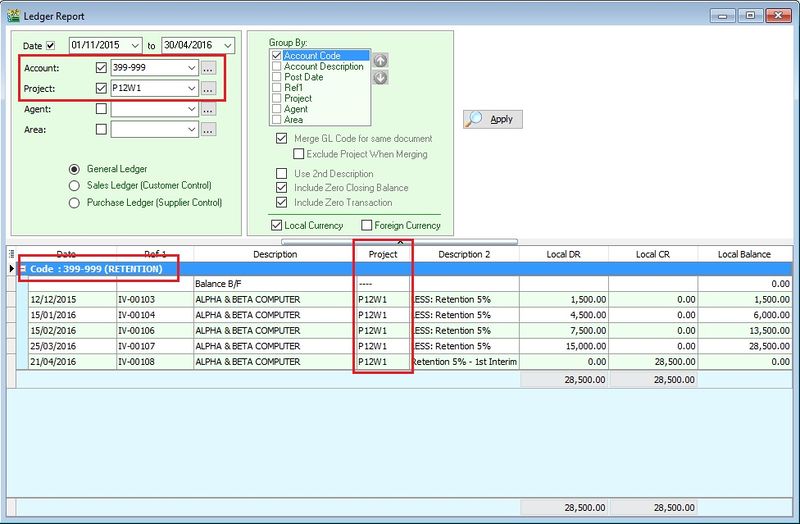

Retention Report by Project

[GL | Print Ledger Report...]

Highlight Changes

| Date | Initiated by | Remarks |

|---|---|---|

| 12 December 2015 | Loo | Initial document. |

| 16 December 2015 | Admin | Correct the retention sum to Rm15,000 |