No edit summary |

|||

| (14 intermediate revisions by the same user not shown) | |||

| Line 6: | Line 6: | ||

::The recipient has to pay tax for the imported services he received and the same time claim input tax in his GST return. Reverse charge mechanism is an accounting procedure where a recipient (as the customer) of the supply, acts as both, the supplies and the recipient of the services. | ::The recipient has to pay tax for the imported services he received and the same time claim input tax in his GST return. Reverse charge mechanism is an accounting procedure where a recipient (as the customer) of the supply, acts as both, the supplies and the recipient of the services. | ||

<br /> | <br /> | ||

:'''Example:''' | :'''Example:''' | ||

::1. Royalty fee charged in Malaysia by non resident business situated outside Malaysia from Jan - Dec 2016 = '''USD 200,000''' | ::1. Royalty fee charged in Malaysia by non resident business situated outside Malaysia from Jan - Dec 2016 = '''USD 200,000''' | ||

| Line 20: | Line 19: | ||

::Claim GST Input = Rm30,000.00 | ::Claim GST Input = Rm30,000.00 | ||

<br /> | <br /> | ||

:'''Time of Supply''' | :'''Time of Supply''' | ||

::1. When supply are paid for (Date of payment made) - no longer | ::1. When supply are paid for (Date of payment made) - no longer | ||

::2. | ::2. Start from '''01 Jan 2016''', which ever is the earlier:- | ||

::::a. Payment made; or | ::::a. Payment made; or | ||

::::b. Invoice date. | ::::b. Invoice date. | ||

<br /> | |||

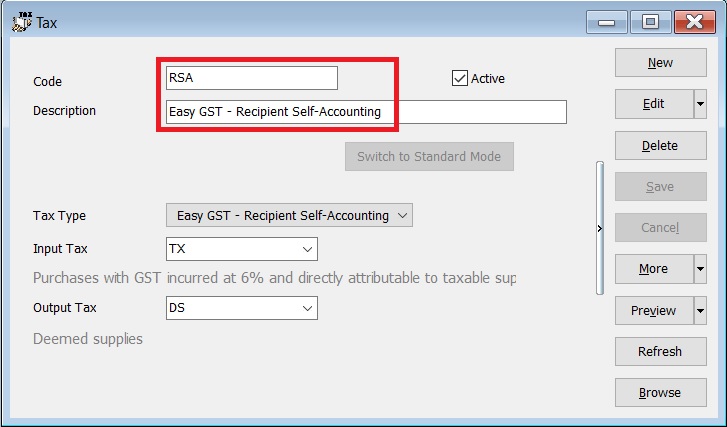

==Maintain Tax== | |||

''Menu: GST | Maintain Tax...'' | |||

:1. RSA tax code is preset in the SQL Financial Accounting. | |||

:2. It is use for the purpose of '''Reverse Charge Mechanism''' or '''Recipient Self Accounting'''. | |||

:3. RSA tax code setting. See the screenshot below. | |||

::[[File: GST Treatment-RSA-01.jpg]] | |||

<br /> | <br /> | ||

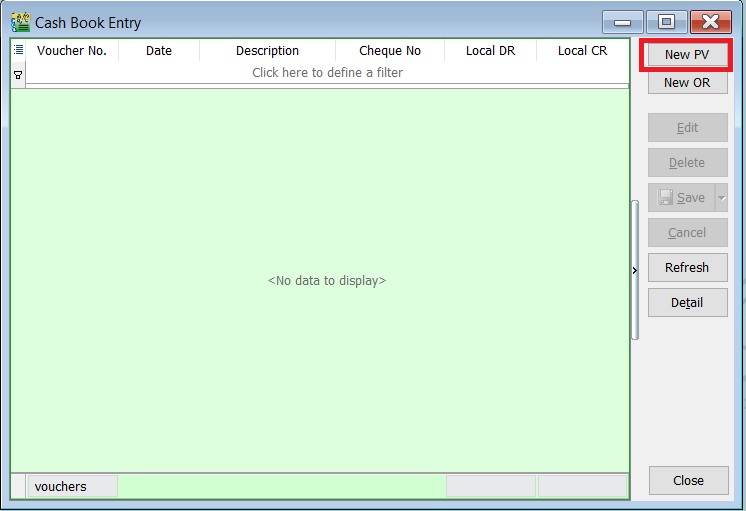

==Payment made before the invoice== | ==Payment made before the invoice== | ||

''Menu: GL | Cash Book Entry (PV)...'' | ''Menu: GL | Cash Book Entry (PV)...'' | ||

:1. Click on the '''New''' | :1. Click on the '''New PV''' to create new payment voucher. | ||

: | ::[[File: GST Treatment-RSA-02.jpg]] | ||

: | <br /> | ||

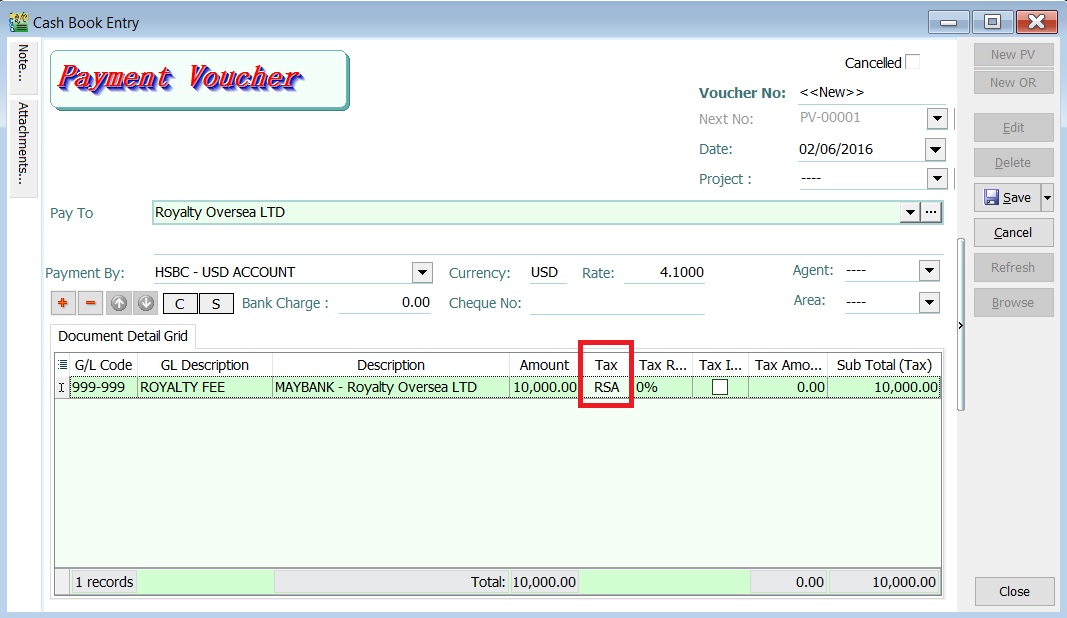

: | :2. Enter the '''payment date''', eg. 02/06/2016. | ||

: | :3. Select '''RSA''' in tax column. | ||

::[[File: GST- | ::[[File: GST Treatment-RSA-03.jpg]] | ||

<br /> | <br /> | ||

: | '''NOTE:''' | ||

::[[File: GST- | Tax amount will be calculated after process the GST Returns. | ||

<br /> | |||

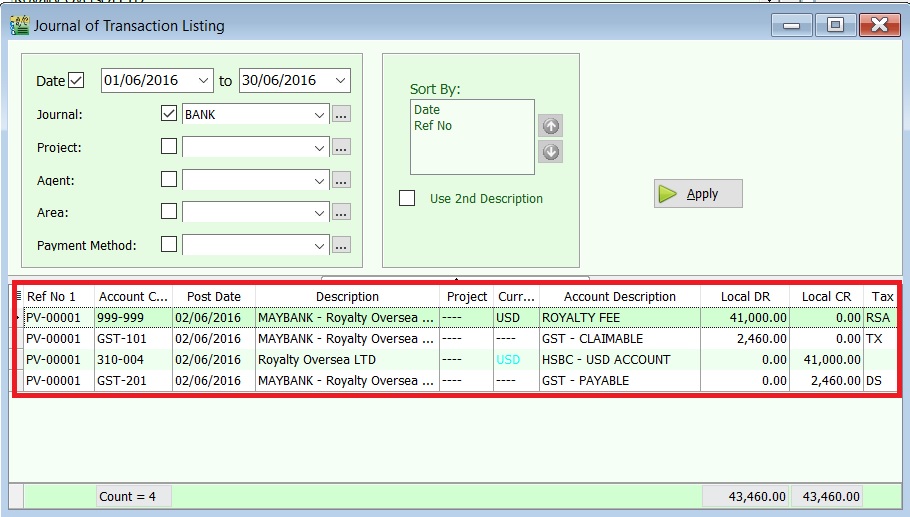

:4. After GST Returns processed, you can check the double entry posting from GL | Print Journal of Transactions Listing... | |||

::[[File: GST Treatment-RSA-04.jpg]] | |||

<br /> | |||

::'''Double Entry - RSA: ''' | |||

::{| class="wikitable" | |||

|- | |||

! Account Code!! Account Description !! Tax Code !! style="text-align:right;"| Local DR !! style="text-align:right;"| Local CR !! Taxable Period | |||

|- | |||

| GST-101 || GST - Claimable || TX || style="text-align:right;"| 2,460.00 || style="text-align:right;"| 0.00 || June 2016 '''(follow payment date)''' | |||

|- | |||

| GST-201 || GST - Payable || DS || style="text-align:right;"| 0.00 || style="text-align:right;"| 2,460.00 || June 2016 '''(follow payment date)''' | |||

|} | |||

<br /> | <br /> | ||

==Invoice first payment later== | ==Invoice first payment later== | ||

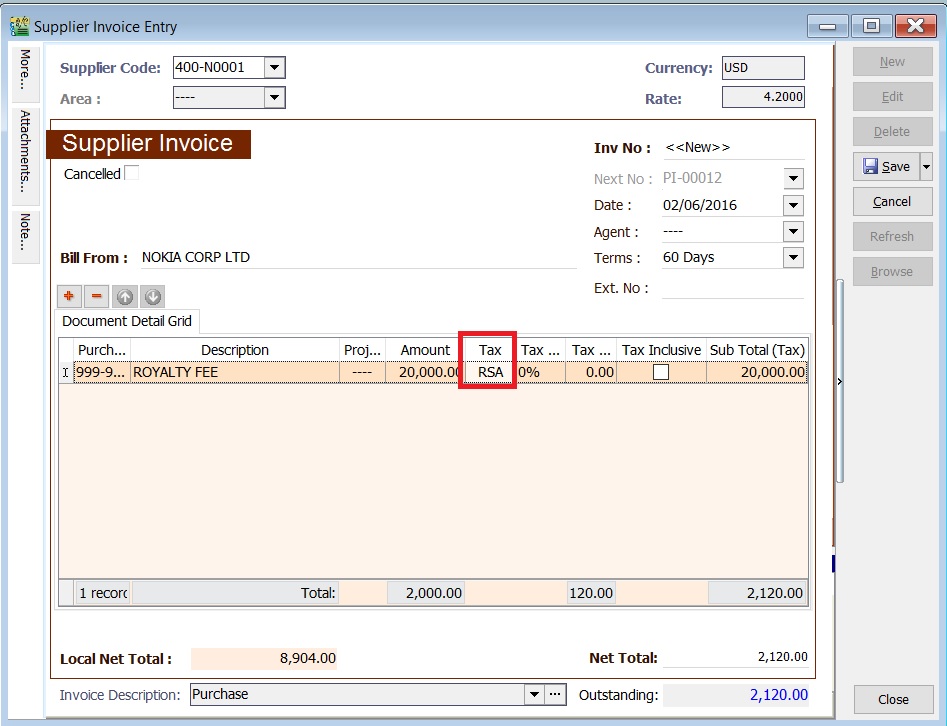

''Menu: Supplier | Supplier Invoice...'' | ''Menu: Supplier | Supplier Invoice...'' | ||

:1. Click on the '''New''' | :1. Click on the '''New''' to create new supplier invoice. | ||

:2. Enter the ''' | :2. Enter the '''invoice date''', eg. 02/06/2016. | ||

:3. | :3. Select '''RSA''' in tax column. | ||

: | ::[[File: GST Treatment-RSA-05.jpg]] | ||

: | <br /> | ||

::[[File: GST- | '''NOTE:''' | ||

Tax amount will be calculated after process the GST Returns. | |||

<br /> | |||

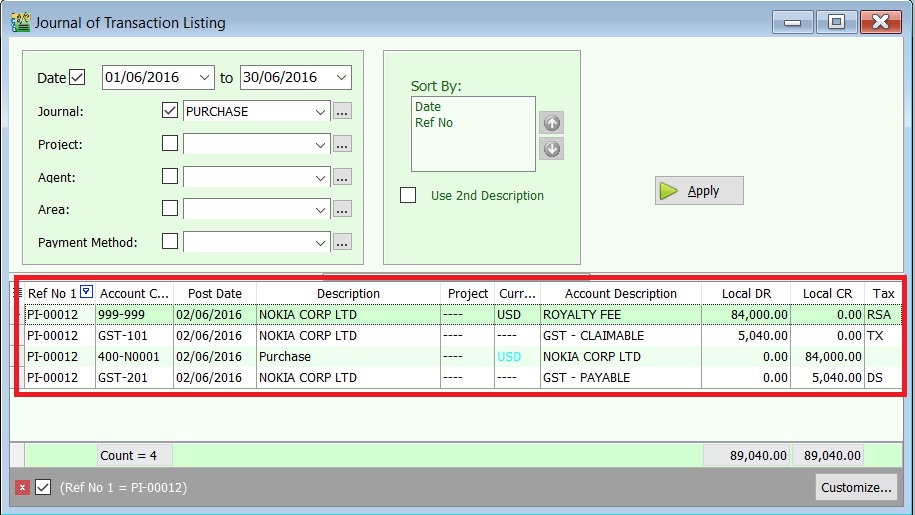

:4. After GST Returns processed, you can check the double entry posting from GL | Print Journal of Transactions Listing... | |||

::[[File: GST Treatment-RSA-06.jpg]] | |||

<br /> | <br /> | ||

: | ::'''Double Entry - RSA: ''' | ||

:: | ::{| class="wikitable" | ||

|- | |||

! Account Code!! Account Description !! Tax Code !! style="text-align:right;"| Local DR !! style="text-align:right;"| Local CR !! Taxable Period | |||

|- | |||

| GST-101 || GST - Claimable || TX || style="text-align:right;"| 5,040.00 || style="text-align:right;"| 0.00 || June 2016 '''(follow invoice date)''' | |||

|- | |||

| GST-201 || GST - Payable || DS || style="text-align:right;"| 0.00 || style="text-align:right;"| 5,040.00 || June 2016 '''(follow invoice date)''' | |||

|} | |||

<br /> | <br /> | ||

Latest revision as of 01:23, 1 August 2018

Introduction

- GST on Imported Services (Sec 13) is accounted by way of the reverse charge mechanism.

- Reverse Charge Mechanism (also known as Self Recipient Accounting-RSA)

- A supplier whoe does not belong in Malaysia and supplies services to a customer in Malaysia does not have to charge GST. However, the customer who received the services is required to account for GST by a reverse charge mechanism.

- The recipient has to pay tax for the imported services he received and the same time claim input tax in his GST return. Reverse charge mechanism is an accounting procedure where a recipient (as the customer) of the supply, acts as both, the supplies and the recipient of the services.

- Example:

- 1. Royalty fee charged in Malaysia by non resident business situated outside Malaysia from Jan - Dec 2016 = USD 200,000

- 2. Date of invoice = 10 March 2016

- 3. Bank prevailing rate = Rm2.50 (Date: 10 March 2016)

- Calculation for GST:

- 1. Consideration for the supply @Rm2.50 = Rm500,000.00 + GST 6%

- 2. GST to be accounted by recipient @6% GST = Rm30,000.00

- RSA:

- Account GST output = Rm30,000.00

- Claim GST Input = Rm30,000.00

- Time of Supply

- 1. When supply are paid for (Date of payment made) - no longer

- 2. Start from 01 Jan 2016, which ever is the earlier:-

- a. Payment made; or

- b. Invoice date.

Maintain Tax

Menu: GST | Maintain Tax...

- 1. RSA tax code is preset in the SQL Financial Accounting.

- 2. It is use for the purpose of Reverse Charge Mechanism or Recipient Self Accounting.

- 3. RSA tax code setting. See the screenshot below.

Payment made before the invoice

Menu: GL | Cash Book Entry (PV)...

NOTE: Tax amount will be calculated after process the GST Returns.

- 4. After GST Returns processed, you can check the double entry posting from GL | Print Journal of Transactions Listing...

- Double Entry - RSA:

Account Code Account Description Tax Code Local DR Local CR Taxable Period GST-101 GST - Claimable TX 2,460.00 0.00 June 2016 (follow payment date) GST-201 GST - Payable DS 0.00 2,460.00 June 2016 (follow payment date)

Invoice first payment later

Menu: Supplier | Supplier Invoice...

- 1. Click on the New to create new supplier invoice.

- 2. Enter the invoice date, eg. 02/06/2016.

- 3. Select RSA in tax column.

NOTE: Tax amount will be calculated after process the GST Returns.

- 4. After GST Returns processed, you can check the double entry posting from GL | Print Journal of Transactions Listing...

- Double Entry - RSA:

Account Code Account Description Tax Code Local DR Local CR Taxable Period GST-101 GST - Claimable TX 5,040.00 0.00 June 2016 (follow invoice date) GST-201 GST - Payable DS 0.00 5,040.00 June 2016 (follow invoice date)