GST Treatment: Free Industrial Zone(FIZ) and Licensed Manufacturing Warehouse(LMW)

Free Industrial Zone(FIZ) and Licensed Manufacturing Warehouse(LMW)

Introduction

This guide will teach you the way to key-in the data entry related to GST treatment on FIZ and LMW.

Subject to GST:

FIZ Local sell to FIZ Local → SR

FIZ local sell to LMW Local → SR

FIZ/LMW local sell to non-FIZ/LMW → SR

FIZ/LMW Local sell to Oversea → ZR

For example,

| Item | Item Description | Qty | Unit Price (RM) |

Value(RM) | Import Duty (RM) |

|---|---|---|---|---|---|

| 1. | Shirts | 300 pcs | 25.00 | 7,500.00 | 1,500.00 |

| 2. | Paints | 100 pcs | 30.00 | 3,000.00 | 600.00 |

| Total | 10,500 | 2,100.00 |

Assuming 20% import duty (RM10,500 x 20% = 2,100.00)

GST on value + Import Duty are subject to GST (SR) = (10,500.00 + 2,100.00) x 6% = 756.00

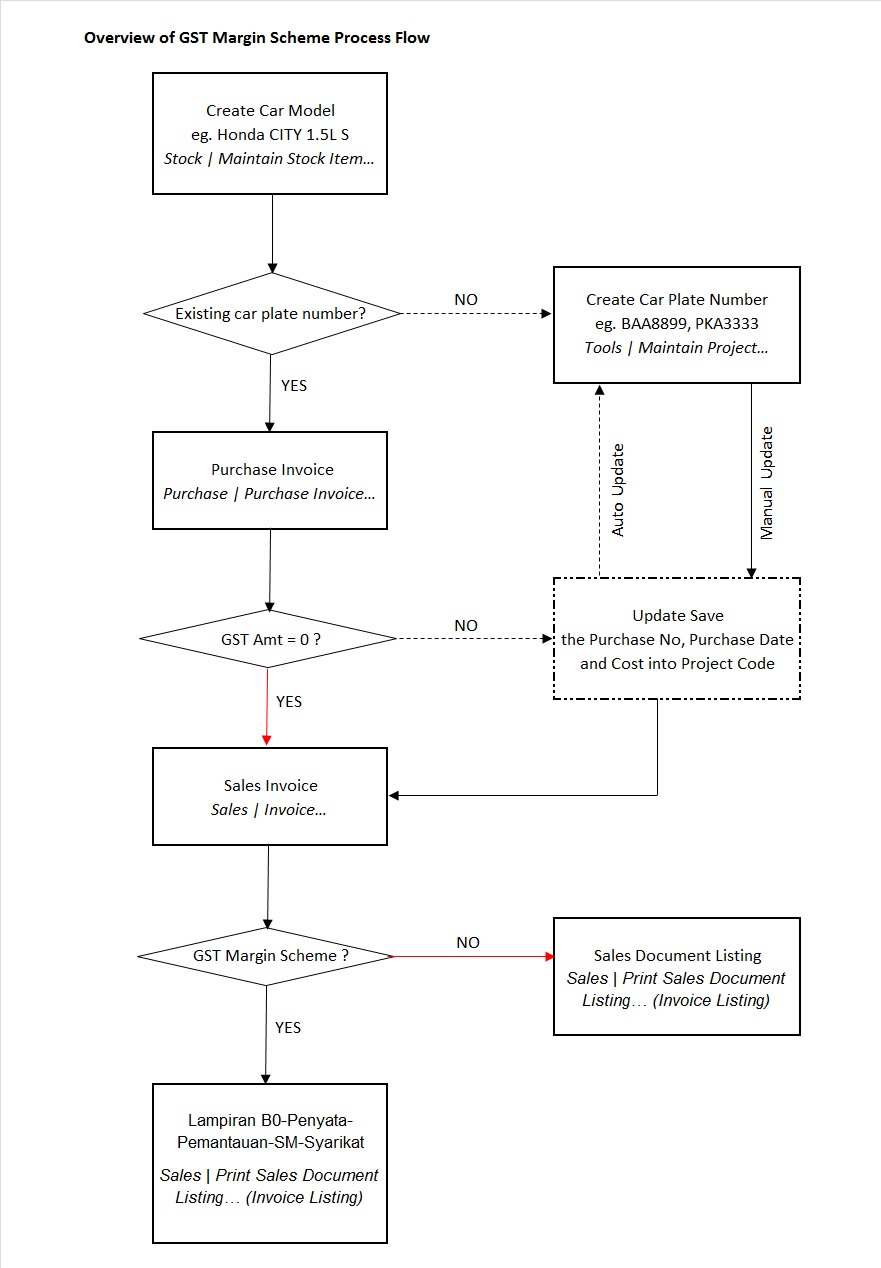

See below the overview of Margin Scheme process flow:

Setup Margin Scheme Database

Last Customisation Update : 27 Oct 2015

1. Get the NEW database structure for Margin Scheme (in backup format) from this link

GST Margin New Database

2. Restore this backup.

3. Enter the user ID and password with “ADMIN” to login.

History New/Updates/Changes

- Move Cars Information to Maintain Project

- Auto Capture Initial Cost on Select Project

Setup Master Data

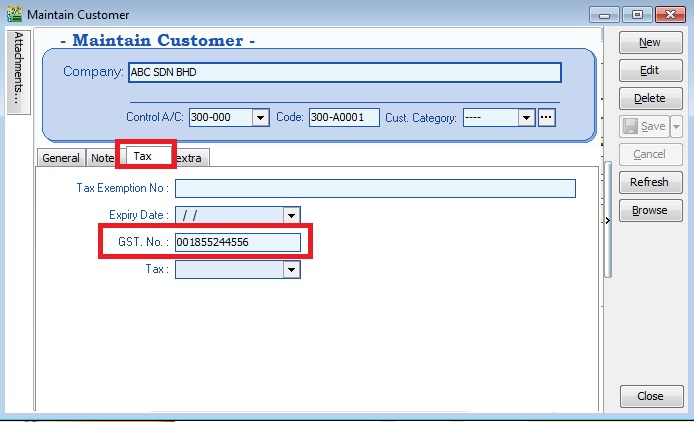

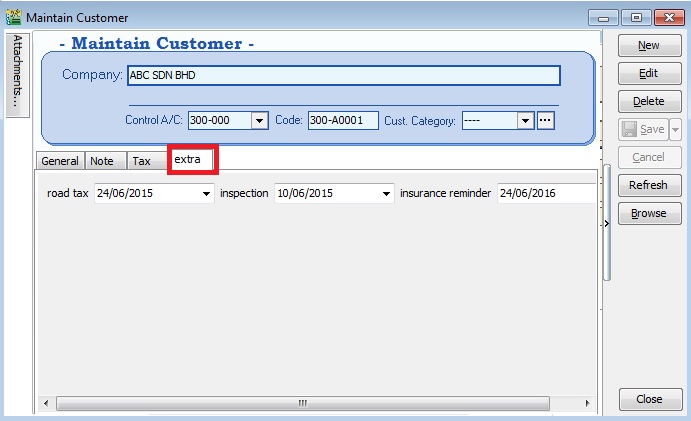

Maintain Customer

[Customer | Maintain Customer…]

1. Create new buyer name (eg. company name or person name).

2. Click on Tax tab to input the GST No (if applicable).

3. Click on extra tab. You can enter the road tax, inspection and insurance reminder date for reference.

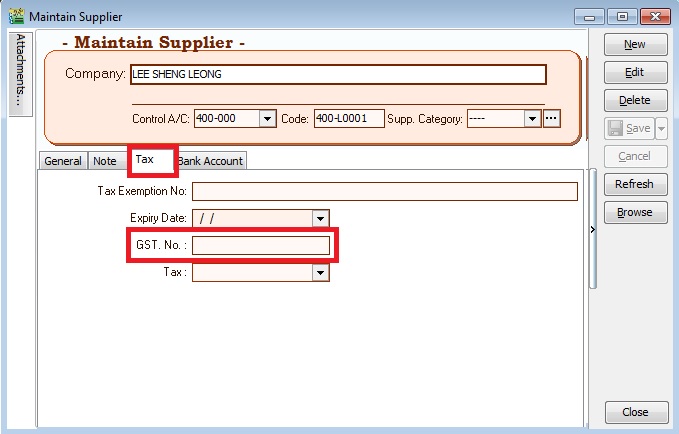

Maintain Supplier

[Supplier | Maintain Supplier…]

1. Create new seller name (eg. company name or person name).

2. Click on Tax tab to input the GST No (if applicable).

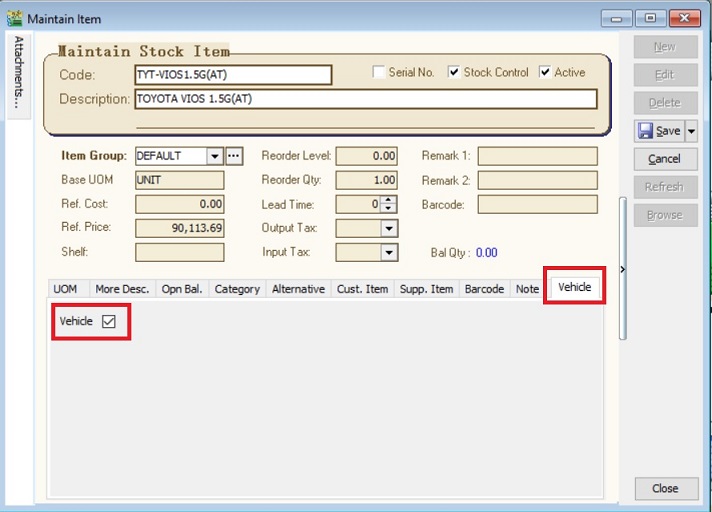

Maintain Stock Item

[Stock | Maintain Stock Item…]

1. Create the car model at Maintain Stock Item. For example, TOYOTA VIOS 1.5G(AT)

2. Click on Vehicle tab to define this item is a "Vehicle".

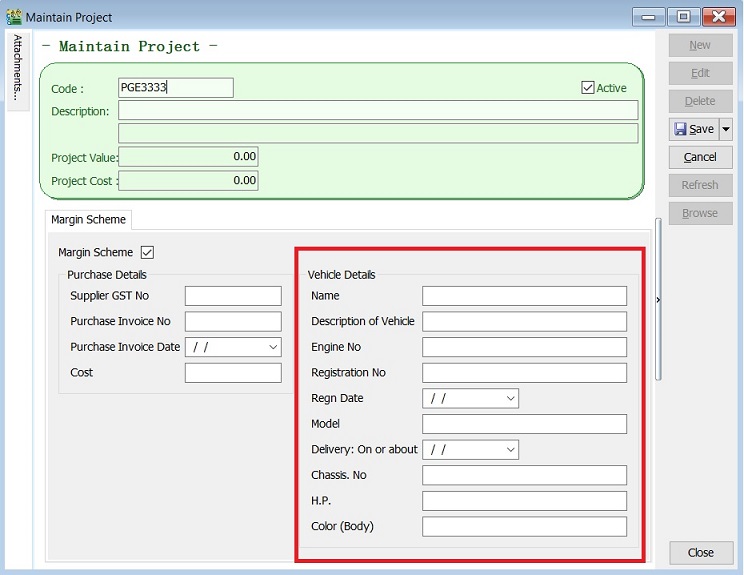

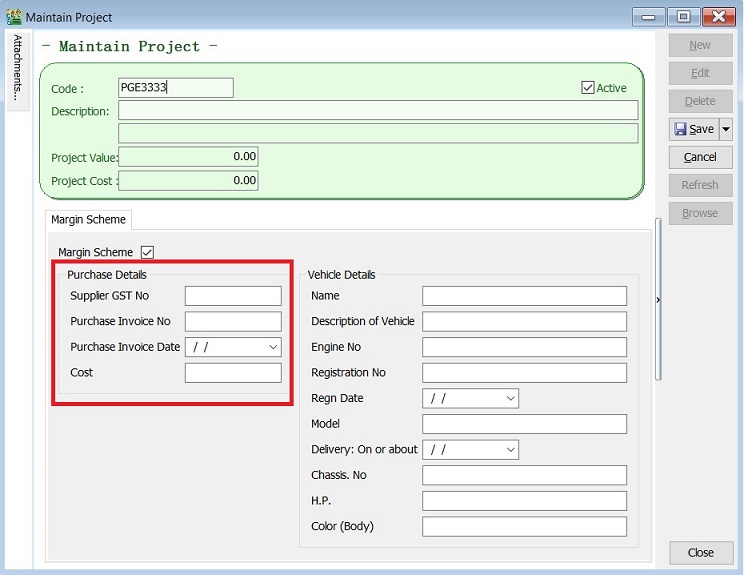

Maintain Project

[Tools | Maintain Project…]

1. Create the second car plate number in Maintain Project.

2. Update the Vehicle detail.

3. Leave BLANK to Purchase Invoice Date, Purchase Invoice No and Cost. It will auto update when you are select the project code and save at the Purchase Invoice.

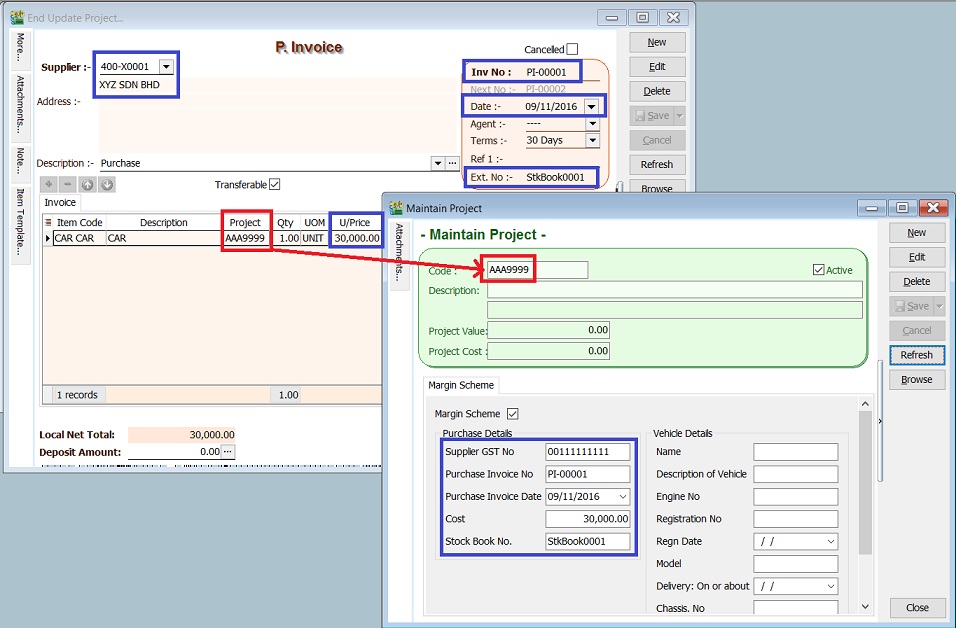

Record Purchase of Second Hand Car Value

[Purchase | Purchase Invoice…]

1. Enter the purchase value of second car at Purchase Invoice. (eg. RM30,000 )

2. You must select the correct car plate number from Project. (eg. PGE3333)

3. Supplier GST No, Purchase invoice number, date and cost will be update automatically after you have save the purchase invoice.

| Purchase Detail | Update from |

|---|---|

| Supplier GST No | Maintain Supplier |

| Purchase Invoice No | Purchase Invoice |

| Purchase Invoice Date | Purchase Invoice |

| Cost | Purchase Invoice |

NOTE :

1. This information is required to show in Lampiran 07 -Monthly Report for Relief for Secondhand Goods or Margin Scheme (MS).

2. Auto update to project purchase detail (Purchase No, Purchase Date and Cost) if tax amount is zero

Record Sale of Second Hand Car Value

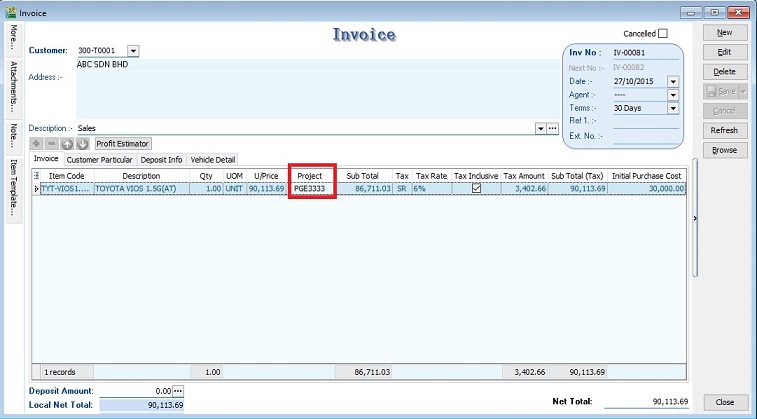

[Sales | Invoice…]

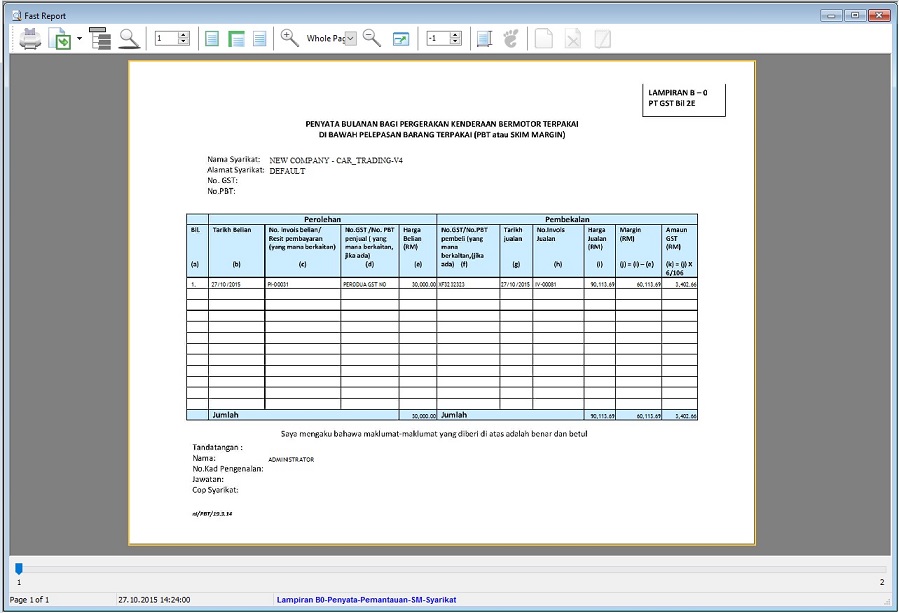

Margin Scheme Input

1. Enter the sale value of second car at Invoice. (eg.RM90,113.69)

2. You must select the correct car plate number from Project.(eg.PGE3333)

3. Initial Purchase Cost will auto upadate after select the project (car plate number).

4. Tax amount will be calculated based on Margin Scheme method.(See screenshot below)

- a. Sellng Price = 90,113.69

- b. Purchase Cost = 30,000.00

- c. Margin = 90,113.69 – 30,000.00 = 60,113.69

- d. Tax amount = 60,113.69 x 6/106 = 3,402.66

- a. Sellng Price = 90,113.69

6. Invoice no, invoice date, selling price, margin, and margin tax amount will be shown in Lampiran 07 -Monthly Report for Relief for Secondhand Goods or Margin Scheme (MS)

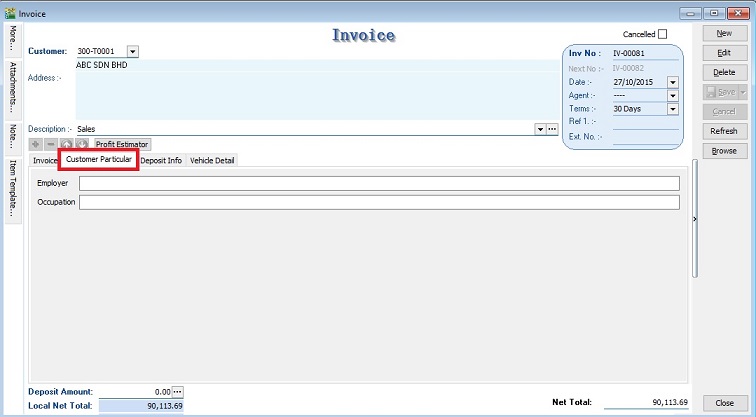

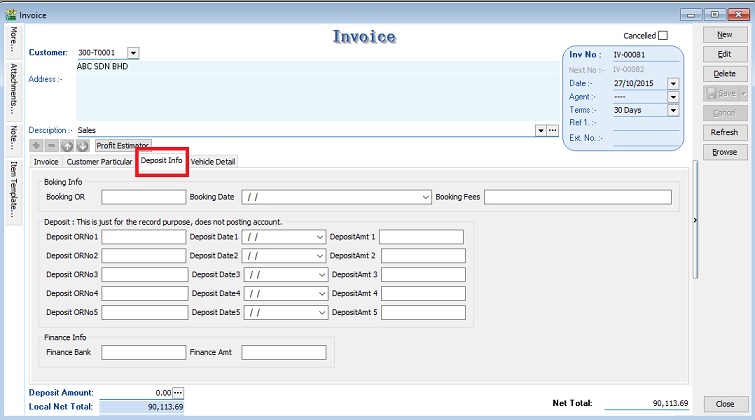

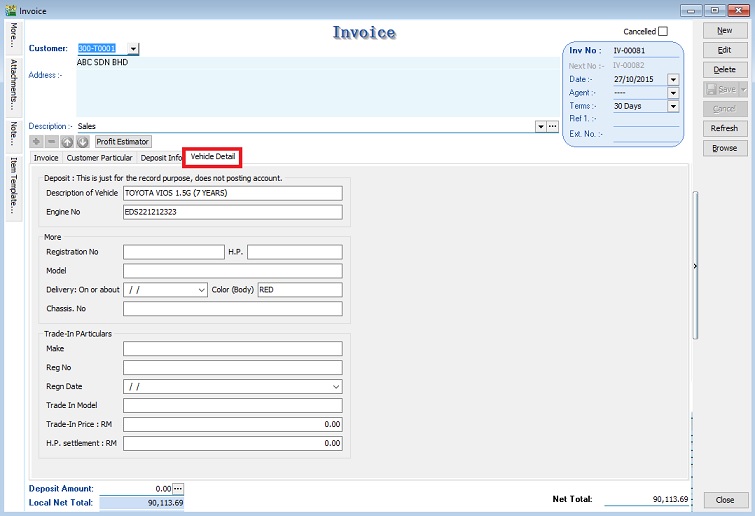

Other Information

1. Customer Particular tab.

2. Deposit Info (For record purpose, no posting to account).

3. Vehichle Detail (Auto retrieve from Vehicle Detail in Maintain Project).

Print for GST Lampiran 07 (Lampiran B0-Penyata-Pemantauan-SM-Syarikat)

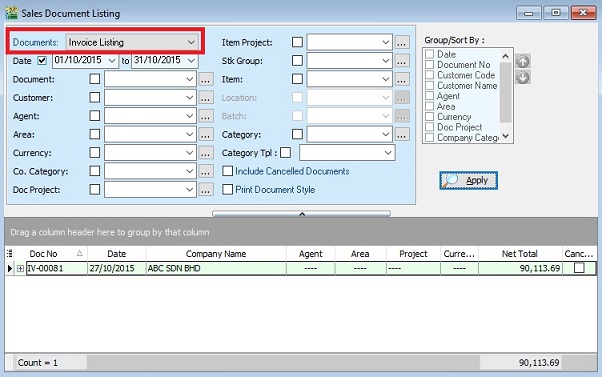

[Sales | Print Sales Document Listing…]

1. Select document to “Invoice Listing” and click APPLY.

2. Click on preview or print. Select the report name “Lampiran B0-Penyata-Pemantauan-SM-Syarikat”.

See also

- Others Customisation