GST Treatment: Free Industrial Zone(FIZ) and Licensed Manufacturing Warehouse(LMW): Difference between revisions

From eStream Software

| (19 intermediate revisions by the same user not shown) | |||

| Line 3: | Line 3: | ||

==Introduction== | ==Introduction== | ||

This guide will teach you the way to key-in the data entry related to GST treatment on FIZ and LMW. <br /> | :This guide will teach you the way to key-in the data entry related to GST treatment on FIZ and LMW. <br /> | ||

Under GST system, a person operating in a FIZ or having LMW status is treated as any person carrying out a business in Malaysia where normal rules of GST apply. This means that acquisition of goods locally or imported by the person operating in a FIZ or having LMW status is subject to GST. However, the person operating in a FIZ or having LMW status is eligible to apply for Approved Trader | :Under GST system, a person operating in a FIZ or having LMW status is treated as any person carrying out a business in Malaysia where normal rules of GST apply. This means that acquisition of goods locally or imported by the person operating in a FIZ or having LMW status is subject to GST. However, the person operating in a FIZ or having LMW status is eligible to apply for Approved Trader Scheme (ATS) to allow the Director General to suspend the payment of GST on imported goods at the time of importation. For further details, please refer to the guide on Approved Trader Scheme (ATS) and [http://www.sql.com.my/document/sqlacc_docs/PDF/GST36-Input_Entry_for_ATS.pdf SQL Accounting on ATS] | ||

Scheme (ATS) to allow the Director General to suspend the payment of GST on imported goods at the time of importation. For further details, please refer to the | |||

guide on Approved Trader Scheme (ATS) and [http://www.sql.com.my/document/sqlacc_docs/PDF/GST36-Input_Entry_for_ATS.pdf SQL Accounting on ATS] | |||

<br /> | <br /> | ||

Subject to GST:<br /> | :Subject to GST:<br /> | ||

FIZ Local sell to FIZ Local → SR<br /> | :1. Based on '''transaction value'''. GST = transaction value x (SR or ZR) %): | ||

FIZ local sell to LMW Local → SR<br /> | ::a. FIZ Local sell to FIZ Local → SR<br /> | ||

FIZ/LMW local sell to non-FIZ/LMW → SR<br /> | ::b. FIZ local sell to LMW Local → SR<br /> | ||

::c. FIZ/LMW Local sell to Oversea → ZR<br /> | |||

<br /> | |||

For example, | :2. Based on '''the value of imported goods'''. GST = (Custom Value + Import Duty) x SR %: | ||

::a. FIZ/LMW local sell to non-FIZ/LMW → SR<br /> | |||

<br /> | |||

:For example '''(FIZ/LMW local sell to non-FIZ/LMW)''', | |||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! Item !! Item Description !! Qty !! Unit Price<br />(RM) !! Value(RM) !! '''Import Duty<br />(RM)''' | ! Item !! Item Description !! Qty !! style="text-align:center;"| Unit Price<br />(RM) !! style="text-align:right;"| Value(RM) !! style="text-align:right;"| '''Import Duty<br />(RM)''' | ||

|- | |- | ||

| 1. || Shirts || 300 pcs || 25.00 || 7,500.00 || '''1,500.00''' | | 1. || Shirts || 300 pcs || style="text-align:center;"| 25.00 || style="text-align:right;"| 7,500.00 || style="text-align:right;"| '''1,500.00''' | ||

|- | |- | ||

| 2. || Paints || 100 pcs || 30.00 || 3,000.00 || | | 2. || Paints || 100 pcs || style="text-align:center;"| 30.00 || style="text-align:right;"| 3,000.00 || style="text-align:right;"| '''600.00''' | ||

|- | |- | ||

| || || || Total || 10,500 || '''2,100.00''' | | || || || Total || style="text-align:right;"| 10,500.00 || style="text-align:right;"| '''2,100.00''' | ||

|} | |} | ||

<br /> | <br /> | ||

''Assuming 20% import duty (RM10,500 x 20% = 2,100.00)'' | :''Assuming 20% import duty (RM10,500 x 20% = 2,100.00)'' | ||

<br /> | <br /> | ||

GST on value + Import Duty are subject to GST (SR) = (10,500.00 + 2,100.00) x 6% = '''756.00''' | :GST on value + Import Duty are subject to GST (SR) = (10,500.00 + 2,100.00) x 6% = '''756.00''' | ||

<br /> | <br /> | ||

Therefore, the Tax Invoice will be presented as per below:<br /> | :Therefore, the Tax Invoice will be presented as per below:<br /> | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! Item !! Item Description !! Qty !! Unit Price<br />(RM) !! Value<br />(RM) | ! Item !! Item Description !! Qty !! style="text-align:center;"| Unit Price<br />(RM) !! style="text-align:right;"| Value<br />(RM) | ||

|- | |- | ||

| 1. || Shirt || 300 pcs || 25.00 || 7,500.00 | | 1. || Shirt || 300 pcs || style="text-align:center;"| 25.00 || style="text-align:right;"| 7,500.00 | ||

|- | |- | ||

| 2. || Paints || 100 pcs || 30.00 || 3,000.00 | | 2. || Paints || 100 pcs || style="text-align:center;"| 30.00 || style="text-align:right;"| 3,000.00 | ||

|- | |- | ||

| || GST (SR-6%) || || || | | || GST (SR-6%) || || || style="text-align:right;"| 756.00 | ||

|- | |- | ||

| || Total Amount Payable || || || 11,256.00 | | || Total Amount Payable || || || style="text-align:right;"| 11,256.00 | ||

|} | |} | ||

<br /> | |||

==How to enter the Tax Invoice if there is a FIZ/LMW transactions to another party? == | ==How to enter the Tax Invoice if there is a FIZ/LMW transactions to another party? == | ||

''[Sales | Invoice...]''<br /> | ''[Sales | Invoice...]''<br /> | ||

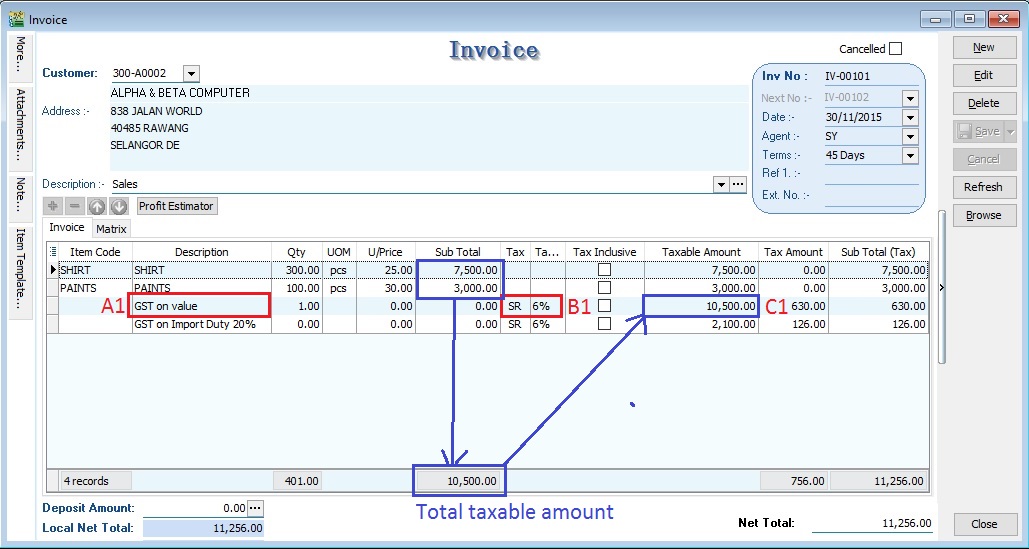

According to the example mentioned in above.<br /> | :According to the example mentioned in above.<br /> | ||

1. Insert and select the stock items sold with empty tax code. Because the stock items are under FIZ/LMW control. <br /> | :1. Insert and select the stock items sold with empty tax code. Because the stock items are under FIZ/LMW control. <br /> | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! Item Code !! Description !!Qty !! Unit Price !! Subtotal !! Tax Code !! Tax Amount !! SubTotal(Tax) | ! Item Code !! Description !!Qty !! style="text-align:center;"| Unit Price !! style="text-align:right;"| Subtotal !! Tax Code !! style="text-align:right;"| Tax Amount !! style="text-align:right;"| SubTotal(Tax) | ||

|- | |- | ||

| SHIRT || SHIRTS ||300 pcs || 25.00 || 7,500.00 || <BLANK> || 0.00 || 7,500.00 | | SHIRT || SHIRTS ||300 pcs || style="text-align:center;"| 25.00 || style="text-align:right;"| 7,500.00 || <BLANK> || style="text-align:right;"| 0.00 || style="text-align:right;"| 7,500.00 | ||

|- | |- | ||

| PAINTS || PAINTS || 100 pcs || 30.00 || 3,000.00 || <BLANK> || 0.00 || 3,000.00 | | PAINTS || PAINTS || 100 pcs || style="text-align:center;"| 30.00 || style="text-align:right;"| 3,000.00 || <BLANK> || style="text-align:right;"| 0.00 || style="text-align:right;"| 3,000.00 | ||

|}<br /> | |}<br /> | ||

2. Inser new row and enter the GST on total supply value (Rm7500 + Rm3000 = Rm10,500) direct into Taxable Amount column (C1)<br /> | :2. Inser new row and enter the GST on total supply value (Rm7500 + Rm3000 = Rm10,500) direct into Taxable Amount column (C1)<br /> | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! Description !! Taxable Amount !! Tax Code !! Tax Amount !! SubTotal(Tax) | ! Description !! style="text-align:right;"| Taxable Amount !! Tax Code !! style="text-align:right;"| Tax Amount !! style="text-align:right;"| SubTotal(Tax) | ||

|- | |- | ||

| GST on value Rm10,500.00 || 10,500.00 || SR || 630.00 || 630.00 | | GST on value Rm10,500.00 || style="text-align:right;"| 10,500.00 || SR || style="text-align:right;"| 630.00 || style="text-align:right;"| 630.00 | ||

|}<br /> | |}<br /> | ||

| Line 75: | Line 77: | ||

<br /> | <br /> | ||

''NOTE : ''<br /> | '''NOTE : '''<br /> | ||

A1 : Key-in "GST on value" into description.<br /> | |||

B1 : Must select tax code.<br /> | |||

C1 : Key-in the Total Supply Value into Taxable Amount.<br /> | |||

<br /> | <br /> | ||

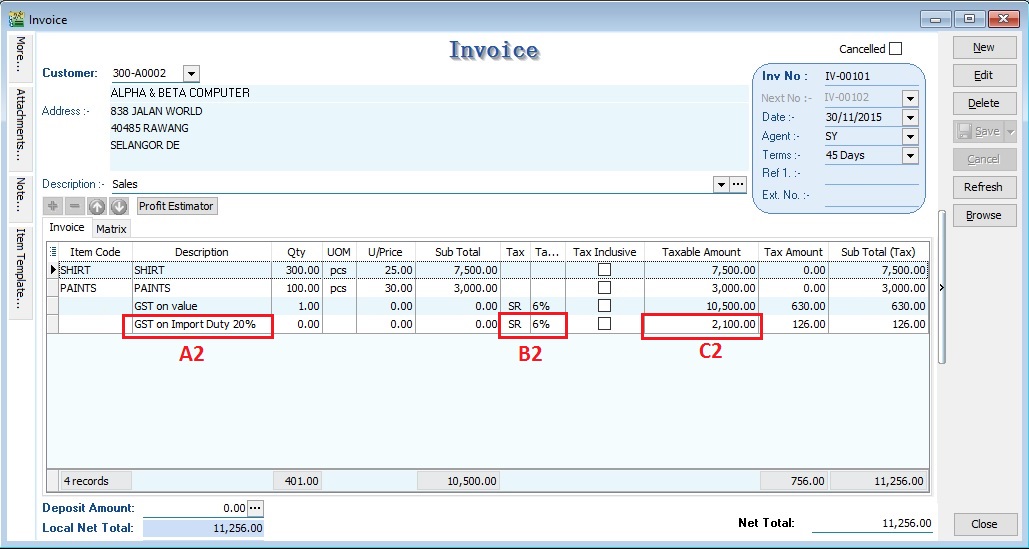

3. Insert new row and enter the GST on total Import Duty (Rm1,500 + Rm600.00 = Rm2,100) direct into Taxable Amount column (C2)<br /> | :3. Insert new row and enter the GST on total Import Duty (Rm1,500 + Rm600.00 = Rm2,100) direct into Taxable Amount column (C2)<br /> | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! Description !! Taxable Amount !! Tax Code !! Tax Amount !! SubTotal(Tax) | ! Description !! style="text-align:right;"| Taxable Amount !! Tax Code !! style="text-align:right;"| Tax Amount !! style="text-align:right;"| SubTotal(Tax) | ||

|- | |- | ||

| GST on Import Duty 20% || 2,100.00 || SR || 126.00 || 126.00 | | GST on Import Duty 20% || style="text-align:right;"| 2,100.00 || SR || style="text-align:right;"| 126.00 || style="text-align:right;"| 126.00 | ||

|}<br /> | |}<br /> | ||

| Line 92: | Line 94: | ||

<br /> | <br /> | ||

''NOTE : ''<br /> | '''NOTE : '''<br /> | ||

A2 : Key-in "GST on Import Duty" into description.<br /> | |||

B2 : Must select tax code.<br /> | |||

C2 : Key-in the Total Import Duty value into Taxable Amount.<br /> | |||

<br /> | <br /> | ||

| Line 101: | Line 103: | ||

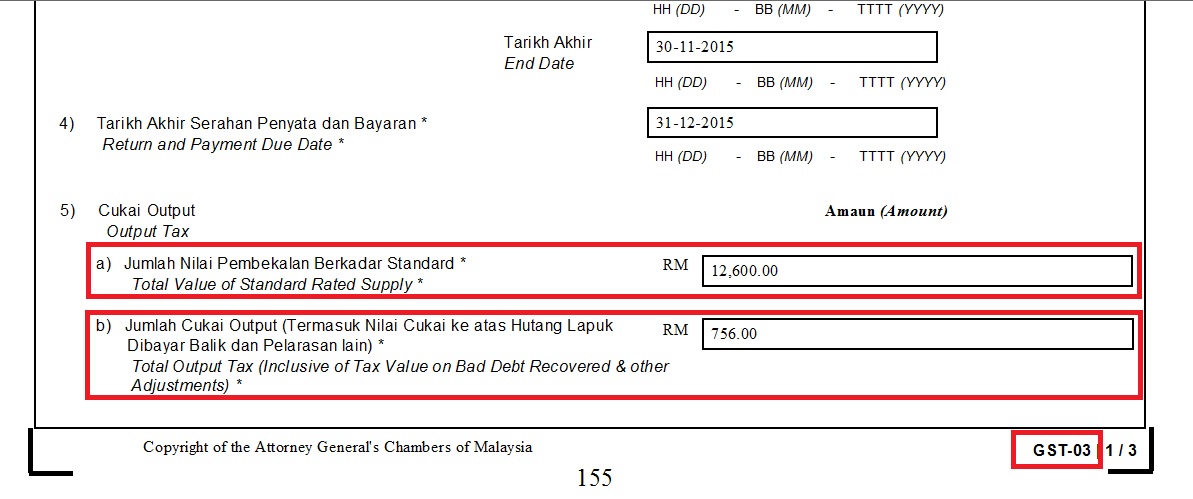

''[ GST | New GST Return...]''<br /> | ''[ GST | New GST Return...]''<br /> | ||

1. Process GST Return for the month<br /> | :1. Process GST Return for the month<br /> | ||

2. Click on print GST-03<br /> | :2. Click on print GST-03<br /> | ||

::[[File:FIZ&LMW-GST03-01.jpg | 240PX]] | ::[[File:FIZ&LMW-GST03-01.jpg | 240PX]] | ||

<br /> | <br /> | ||

''RESULTS : ''<br /> | '''RESULTS : '''<br /> | ||

5a Total value of supplies = 12,600.00''<br /> | |||

5b total output tax = 756.00''<br /> | |||

<br /> | <br /> | ||

==See also== | ==See also== | ||

* [[GST Treatment: ATS]] | |||

Latest revision as of 08:51, 21 March 2016

Free Industrial Zone(FIZ) and Licensed Manufacturing Warehouse(LMW)

Introduction

- This guide will teach you the way to key-in the data entry related to GST treatment on FIZ and LMW.

- Under GST system, a person operating in a FIZ or having LMW status is treated as any person carrying out a business in Malaysia where normal rules of GST apply. This means that acquisition of goods locally or imported by the person operating in a FIZ or having LMW status is subject to GST. However, the person operating in a FIZ or having LMW status is eligible to apply for Approved Trader Scheme (ATS) to allow the Director General to suspend the payment of GST on imported goods at the time of importation. For further details, please refer to the guide on Approved Trader Scheme (ATS) and SQL Accounting on ATS

- Subject to GST:

- 1. Based on transaction value. GST = transaction value x (SR or ZR) %):

- a. FIZ Local sell to FIZ Local → SR

- b. FIZ local sell to LMW Local → SR

- c. FIZ/LMW Local sell to Oversea → ZR

- a. FIZ Local sell to FIZ Local → SR

- 2. Based on the value of imported goods. GST = (Custom Value + Import Duty) x SR %:

- a. FIZ/LMW local sell to non-FIZ/LMW → SR

- a. FIZ/LMW local sell to non-FIZ/LMW → SR

- For example (FIZ/LMW local sell to non-FIZ/LMW),

Item Item Description Qty Unit Price

(RM)Value(RM) Import Duty

(RM)1. Shirts 300 pcs 25.00 7,500.00 1,500.00 2. Paints 100 pcs 30.00 3,000.00 600.00 Total 10,500.00 2,100.00

- Assuming 20% import duty (RM10,500 x 20% = 2,100.00)

- GST on value + Import Duty are subject to GST (SR) = (10,500.00 + 2,100.00) x 6% = 756.00

- Therefore, the Tax Invoice will be presented as per below:

Item Item Description Qty Unit Price

(RM)Value

(RM)1. Shirt 300 pcs 25.00 7,500.00 2. Paints 100 pcs 30.00 3,000.00 GST (SR-6%) 756.00 Total Amount Payable 11,256.00

How to enter the Tax Invoice if there is a FIZ/LMW transactions to another party?

[Sales | Invoice...]

- According to the example mentioned in above.

- 1. Insert and select the stock items sold with empty tax code. Because the stock items are under FIZ/LMW control.

Item Code Description Qty Unit Price Subtotal Tax Code Tax Amount SubTotal(Tax) SHIRT SHIRTS 300 pcs 25.00 7,500.00 <BLANK> 0.00 7,500.00 PAINTS PAINTS 100 pcs 30.00 3,000.00 <BLANK> 0.00 3,000.00

- 2. Inser new row and enter the GST on total supply value (Rm7500 + Rm3000 = Rm10,500) direct into Taxable Amount column (C1)

Description Taxable Amount Tax Code Tax Amount SubTotal(Tax) GST on value Rm10,500.00 10,500.00 SR 630.00 630.00

NOTE :

A1 : Key-in "GST on value" into description.

B1 : Must select tax code.

C1 : Key-in the Total Supply Value into Taxable Amount.

- 3. Insert new row and enter the GST on total Import Duty (Rm1,500 + Rm600.00 = Rm2,100) direct into Taxable Amount column (C2)

Description Taxable Amount Tax Code Tax Amount SubTotal(Tax) GST on Import Duty 20% 2,100.00 SR 126.00 126.00

NOTE :

A2 : Key-in "GST on Import Duty" into description.

B2 : Must select tax code.

C2 : Key-in the Total Import Duty value into Taxable Amount.

GST Return

[ GST | New GST Return...]

- 1. Process GST Return for the month

- 2. Click on print GST-03

RESULTS :

5a Total value of supplies = 12,600.00

5b total output tax = 756.00