(Created page with "==Introduction== :Enable to set the GST start date (register) and end date (de-register). ==GST Effective Date== ''[GST | GST Effective Date...]'' <br /> :1. In the Start GS...") |

No edit summary |

||

| (8 intermediate revisions by the same user not shown) | |||

| Line 6: | Line 6: | ||

<br /> | <br /> | ||

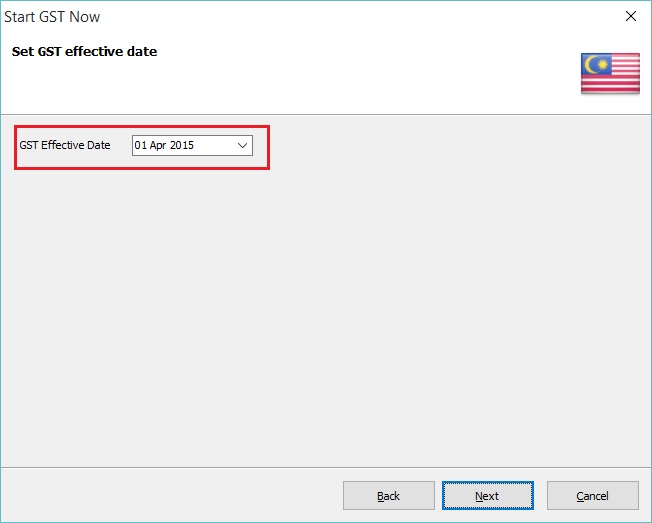

:1. | :1. Below the screenshot is the Start GST wizard, you are required to set the GST Effective Date.<br /> | ||

::[[File: GST-GST Effective-01.jpg| 30PX]] | ::[[File: GST-GST Effective Date-01.jpg| 30PX]] | ||

<br /> | <br /> | ||

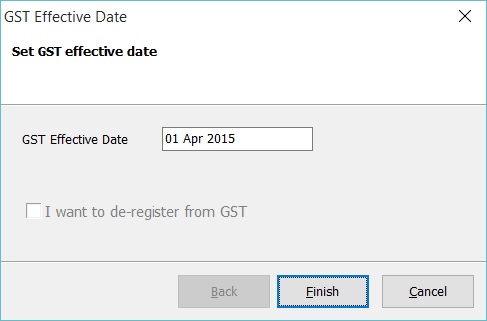

:2. You can | :2. You can check the GST Effective Date under the menu GST | GST Effective Date...<br /> | ||

::[[File: GST- | ::[[File: GST-GST Effective Date-02.jpg| 30PX]] | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! Field Name !! Field Type !! Explanation | ! Field Name !! Field Type !! Explanation | ||

|- | |- | ||

| | | GST Effective Date || Date || GST start date. | ||

|- | |- | ||

| | | I want to de-register from GST || Boolean || To set de-register date from GST. | ||

|} | |} | ||

<br /> | <br /> | ||

==How To Set De-Register?== | |||

''[GST | GST Effective Date...]'' | |||

<br /> | |||

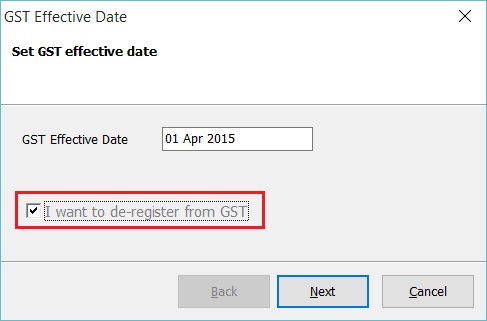

:1. At the GST effective date screen, tick on '''I want to de-register from GST'''. | |||

::[[File: GST-GST Effective Date-03.jpg| 30PX]]<br /> | |||

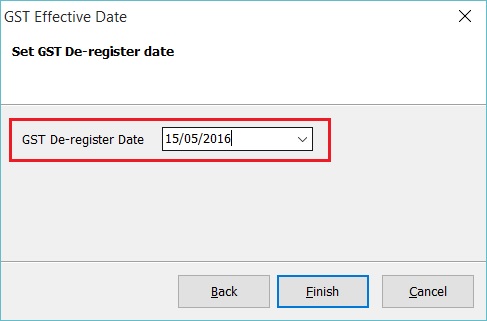

:2. '''Next''', type-in the de-register date. Let's assume '''ABC Sdn Bhd'' ceased to be a registered person on 15 May 2016. | |||

::[[File: GST-GST Effective Date-04.jpg| 30PX]]<br /> | |||

:3. Click '''Finish''' to confirm the de-register date. | |||

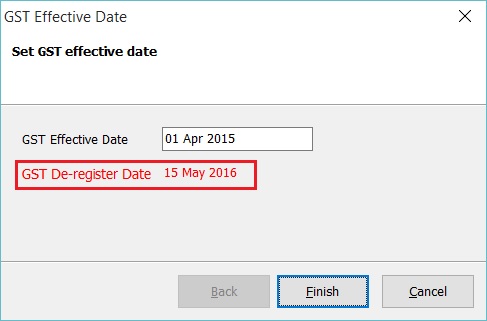

:4. '''GST De-register Date : 15 May 2016''' will displayed below the GST effective date. See the screenshot below. | |||

::[[File: GST-GST Effective Date-05.jpg| 30PX]]<br /> | |||

:5. Click '''Finish''' to exit.<br /> | |||

'''Tips:''' | '''Tips:''' | ||

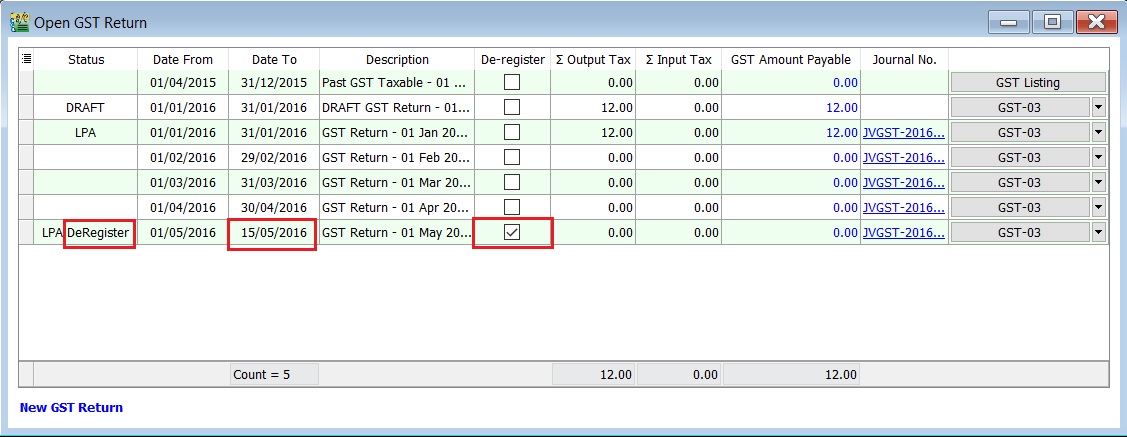

You can click ''' | You can found the De-Register markings in the GST Returns. See the screenshot below. | ||

[[File: GST-GST Effective Date-06.jpg| 30PX]]<br /> | |||

<br /> | |||

==How To Cancel De-Register Date?== | |||

''[GST | GST Effective Date...]'' | |||

<br /> | |||

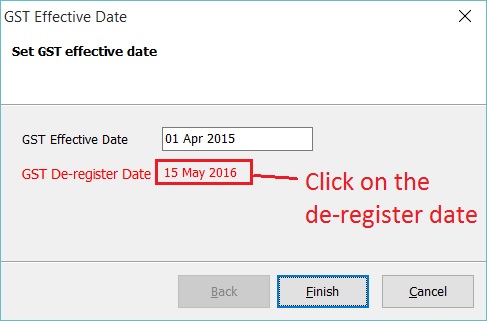

:1. At the GST effective date screen, click on the '''De-Register Date'''. | |||

::[[File: GST-GST Effective Date-07.jpg| 30PX]]<br /> | |||

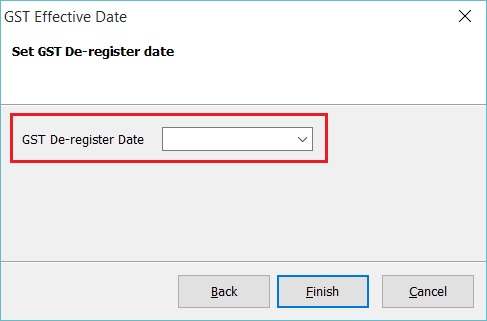

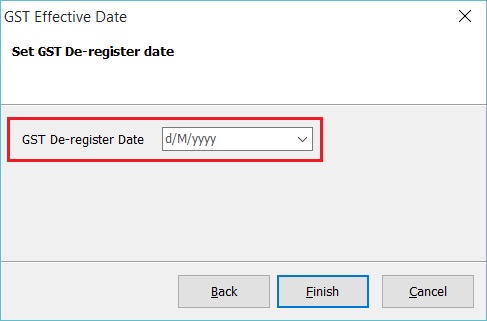

:2. Leave the De-Register date '''blank''' or become '''d/M/yyyy'''. See the screenshot below. | |||

::[[File: GST-GST Effective Date-08.jpg| 30PX]]<br /> | |||

::[[File: GST-GST Effective Date-09.jpg| 30PX]]<br /> | |||

:3. Click '''Finish''' to confirm remove the de-register date. | |||

<br /> | |||

Latest revision as of 08:40, 6 January 2016

Introduction

- Enable to set the GST start date (register) and end date (de-register).

GST Effective Date

[GST | GST Effective Date...]

Field Name Field Type Explanation GST Effective Date Date GST start date. I want to de-register from GST Boolean To set de-register date from GST.

How To Set De-Register?

[GST | GST Effective Date...]

- 1. At the GST effective date screen, tick on I want to de-register from GST.

- 2. Next', type-in the de-register date. Let's assume ABC Sdn Bhd ceased to be a registered person on 15 May 2016.

- 3. Click Finish to confirm the de-register date.

- 4. GST De-register Date : 15 May 2016 will displayed below the GST effective date. See the screenshot below.

- 5. Click Finish to exit.

Tips: You can found the De-Register markings in the GST Returns. See the screenshot below.

How To Cancel De-Register Date?

[GST | GST Effective Date...]

- 1. At the GST effective date screen, click on the De-Register Date.

- 2. Leave the De-Register date blank or become d/M/yyyy. See the screenshot below.

- 3. Click Finish to confirm remove the de-register date.