(Created page with "==Introduction== :Enable to set the GST start date (register) and end date (de-register). ==GST Effective Date== ''[GST | GST Effective Date...]'' <br /> :1. In the Start GS...") |

No edit summary |

||

| Line 7: | Line 7: | ||

:1. In the Start GST wizard, you are required to select the GST Effective Date. See the screenshot below:<br /> | :1. In the Start GST wizard, you are required to select the GST Effective Date. See the screenshot below:<br /> | ||

::[[File: GST-GST Effective-01.jpg| 30PX]] | ::[[File: GST-GST Effective Date-01.jpg| 30PX]] | ||

<br /> | <br /> | ||

Revision as of 06:56, 6 January 2016

Introduction

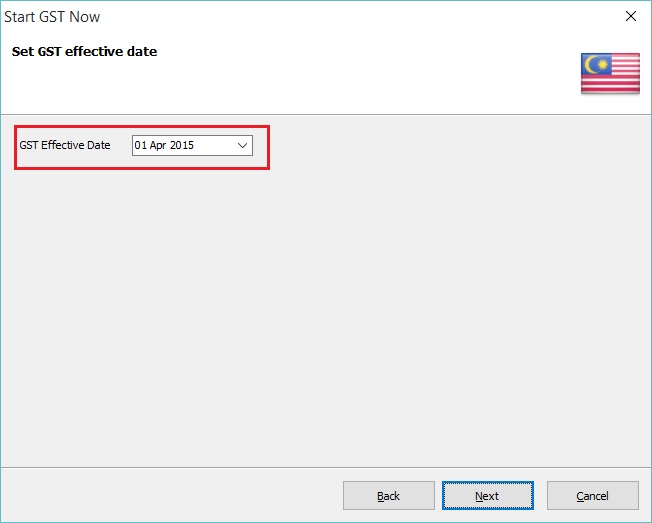

- Enable to set the GST start date (register) and end date (de-register).

GST Effective Date

[GST | GST Effective Date...]

- 1. In the Start GST wizard, you are required to select the GST Effective Date. See the screenshot below:

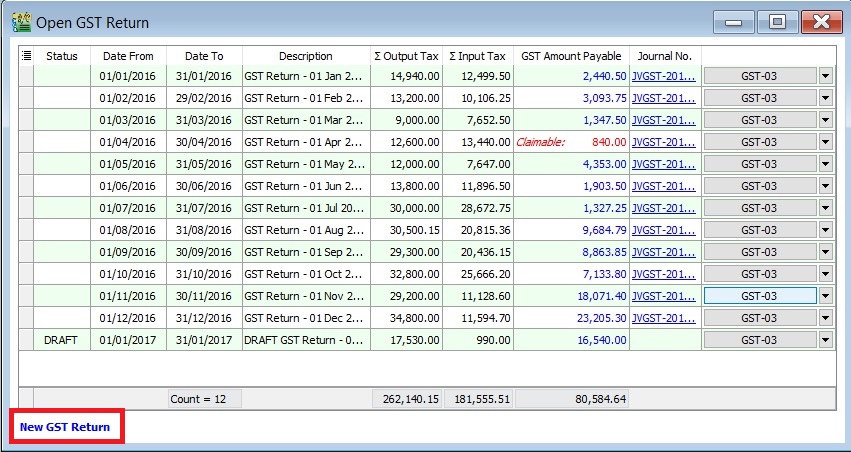

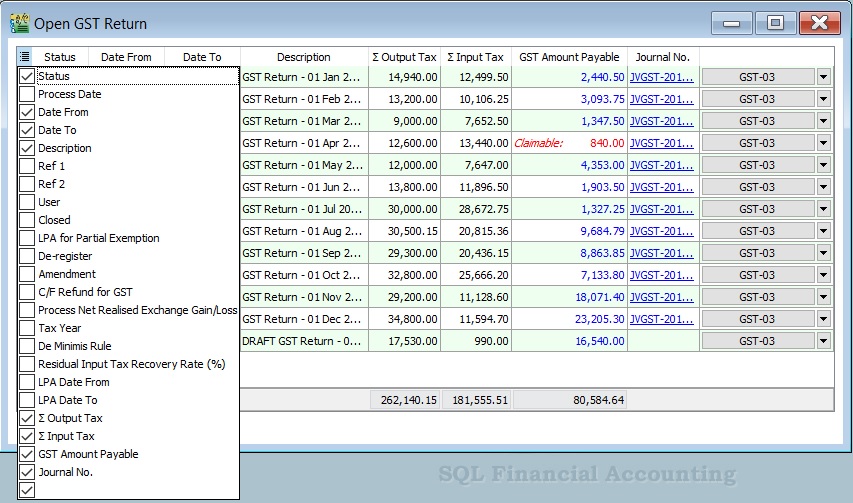

Field Name Field Type Explanation Status String To show the GST Return status, ie. DRAFT or LPA. Process Date Date To show process date. Date From Date To show date from. Date To Date To show date to. Description String To show the description entered. Ref 1 String To show the ref 1 entered. Ref 2 String To show the ref 2 entered. User String To display the User process the GST Return. Closed Boolean Always ticked to close. Longer Period Adjustment Boolean Ticked if status = LPA. De-register Boolean Ticked if the taxable period has de-register date. Amendment Boolean To show the GST Return has ticked this option. C/F Refund for GST Boolean To show the GST Return has ticked this option. Process Net Realised Exchange Gain/Loss Boolean No longer use because system auto handle this option. De Minimis Rule Boolean Ticked = Pass

Unticked = Not PassResidual Input Tax Recovery Rate (%) Float To display the IRR %. ∑ Output Tax Float To show the total output tax value. ∑ Input Tax Float To show the total input tax value. GST Amount Payable Float Net GST Payable or Claimable. Journal No. String Auto post the JVGST-XXXXX to reconcile the GST Payable and GST Claimable accounts. Button Options button : GST-03, Print GST Listing, Generate GST Audit File (GAF)

Tips: You can click New GST Return in Open GST Return screen. See below the screenshot.