(Created page with "==Scenario== * Invoice Date Jan 2016 * Bad Debts Relief - Jul 2016 to Sep 2016 * Payment Oct 2016 * Bad Debts Recover - Oct 2016 to Dec 2016 * Payment Bounce - Jan 2017 * Repl...") |

|||

| Line 20: | Line 20: | ||

===Supplier Side=== | ===Supplier Side=== | ||

At GST Period Jan 2017 | At GST Period Jan 2017 | ||

DR GST-102 - Purchase Deferred | :DR GST-102 - Purchase Deferred | ||

CR GST-201 - GST-Payable (PH-AJS-BD) | ::CR GST-201 - GST-Payable (PH-AJS-BD) | ||

[[File:BounceSupplier-01.jpg|center]] | [[File:BounceSupplier-01.jpg|center]] | ||

[[File:BounceSupplier-02.jpg|800px|center]] | [[File:BounceSupplier-02.jpg|800px|center]] | ||

Revision as of 03:52, 28 October 2016

Scenario

- Invoice Date Jan 2016

- Bad Debts Relief - Jul 2016 to Sep 2016

- Payment Oct 2016

- Bad Debts Recover - Oct 2016 to Dec 2016

- Payment Bounce - Jan 2017

- Replace New Cheque - Apr 2017

Solution

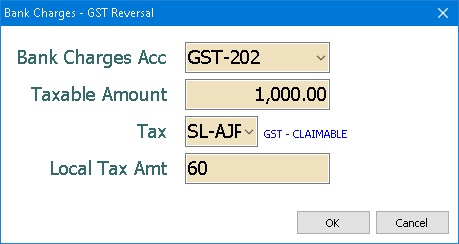

By using the GL Journal Voucher - Bank Charges - GST Reversal button

Customer Side

At GST Period Jan 2017

- DR GST-101 - GST-Claimable (SL-AJP-BD)

- CR GST-202 - Sales Deferred

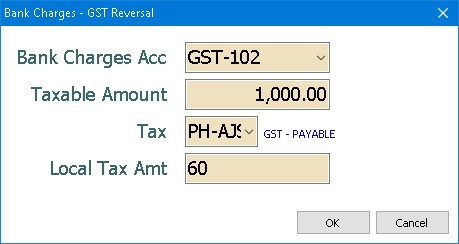

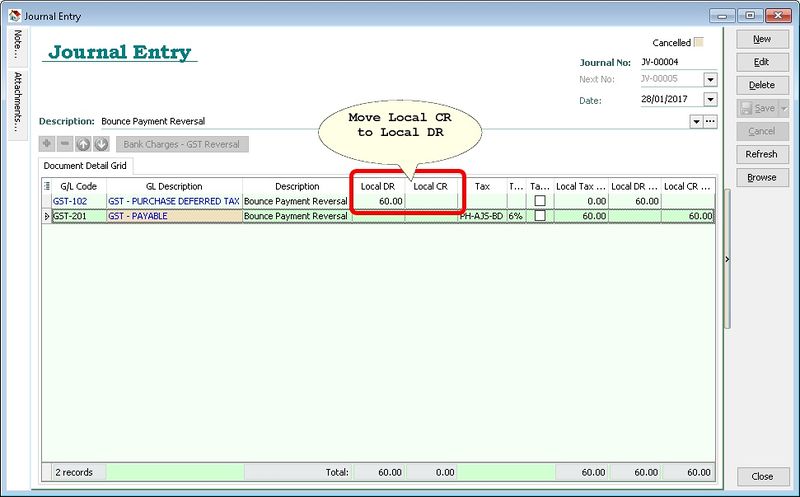

Supplier Side

At GST Period Jan 2017

- DR GST-102 - Purchase Deferred

- CR GST-201 - GST-Payable (PH-AJS-BD)