GST-03 Item 12 (ES + ES43) : How to compare the Total Value of Exempt Supplies between GST-03 and Ledger: Difference between revisions

From eStream Software

| Line 6: | Line 6: | ||

<br /> | <br /> | ||

: | :In GST-03, | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

Revision as of 04:28, 28 January 2016

How to compare the Total Value of Exempt Supplies between GST-03 and Ledger?

Introduction

- This guide will help to check the data entry source posted for Item 12 Total Value of Exempt Supplies in GST-03.

- In GST-03,

Item No. Description Guidelines 12 Total Value of Exempt Supplies* ES43 + ES (Taxable Amount)

Note: Net Loss in Forex (ES43)= 0.00

What report to check the item 12 in GST-03?

GST Listing

[GST | Print GST Listing...]

GL Ledger

[GL | Print Ledger Report...]

How to analyse the total tax amount from Non-Deductible?

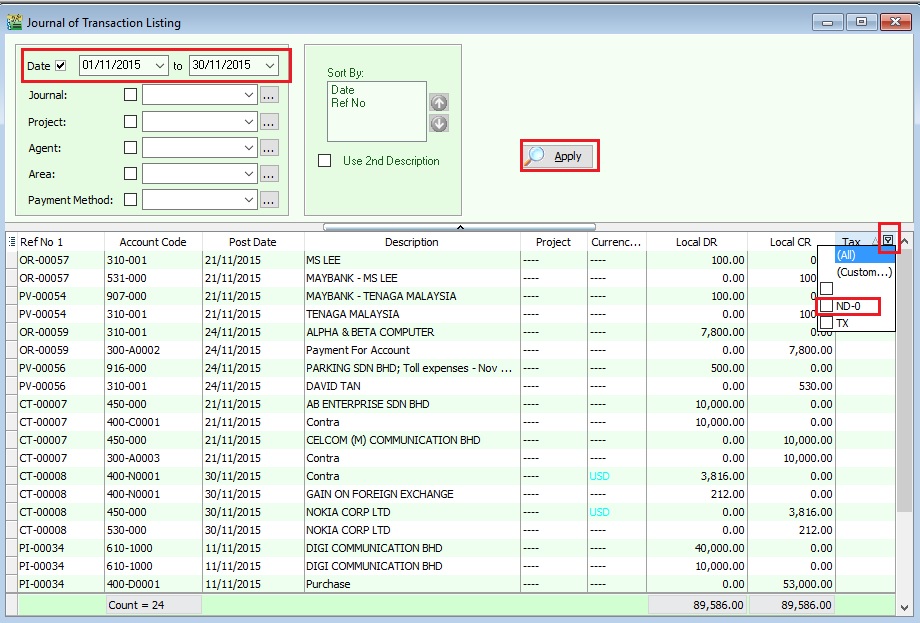

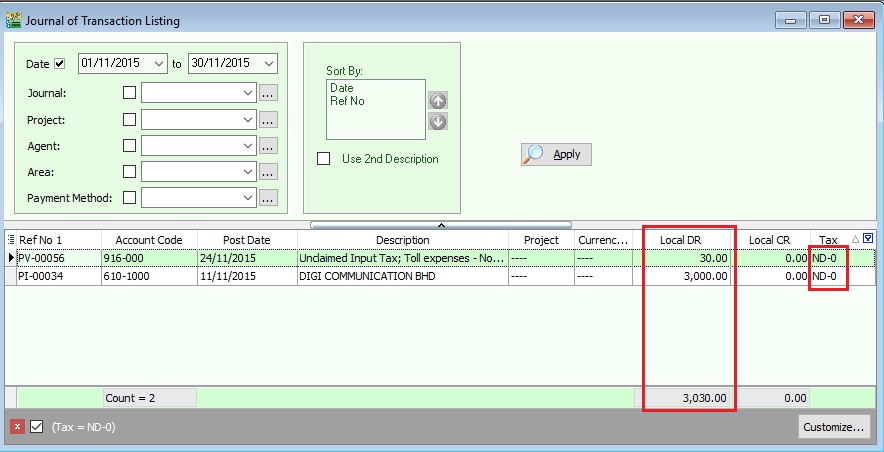

[ GL | Print Journal of Transaction Listing...]

- 4. From this instance, the total non-deductible expenditure amount is Rm3030.00