1. I have posted the depreciation until December 2021. How to record my new asset?: Difference between revisions

From eStream Software

No edit summary |

No edit summary |

||

| (One intermediate revision by the same user not shown) | |||

| Line 1: | Line 1: | ||

<br /> | <br /> | ||

A) Method 1 : | '''A) Method 1 : Simple follow Last Asset Net Book Value from Balance Sheet''' | ||

<br /> | <br /> | ||

Maintain the Asset Item as below: | Maintain the Asset Item as below: | ||

| Line 14: | Line 13: | ||

'''OR''' | '''OR''' | ||

B) Method 2: | '''B) Method 2: Follow Original Cost and Acquire Date''' | ||

<br /> | <br /> | ||

Maintain the Asset Item as below: | Maintain the Asset Item as below: | ||

Latest revision as of 10:48, 31 October 2022

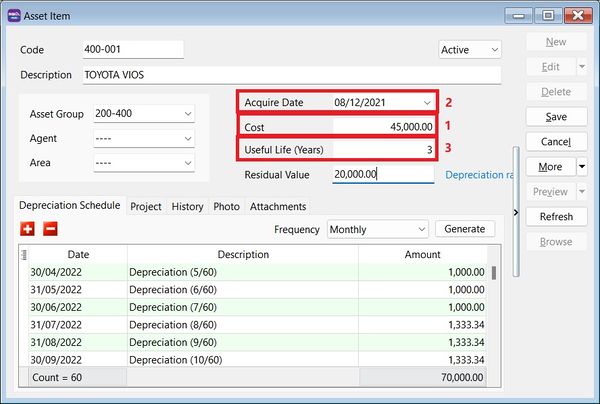

A) Method 1 : Simple follow Last Asset Net Book Value from Balance Sheet

Maintain the Asset Item as below:

- Key in the Cost as Net Book Value (as at 31/12/2021).

- Acquire Date, eg. 01/01/2022

- Useful life = Balance of useful life to be depreciate

- Start Process Depreciation from 01/01/2022

OR

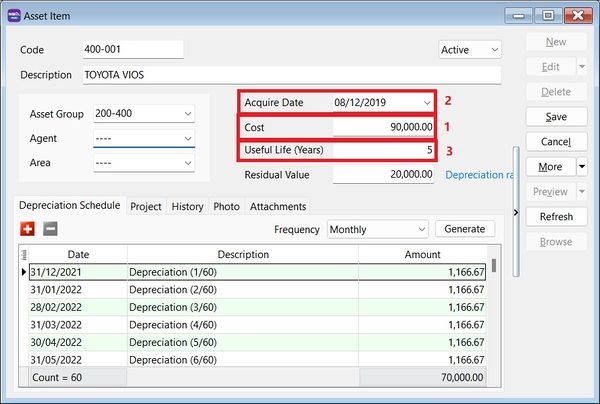

B) Method 2: Follow Original Cost and Acquire Date

Maintain the Asset Item as below:

- Key in the Cost as Original Cost

- Acquire Date set as Original Purchase Date

- Useful life = Full useful life

- Process Depreciation until 31/12/2021.

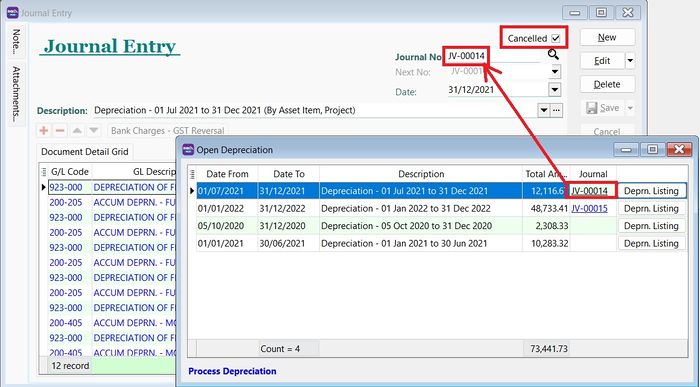

- Tick Cancelled to the Journal posted from Step 4