Introduction

- To analyse the detail of GST transactions group by tax type. It can be use to check against with GST-03.

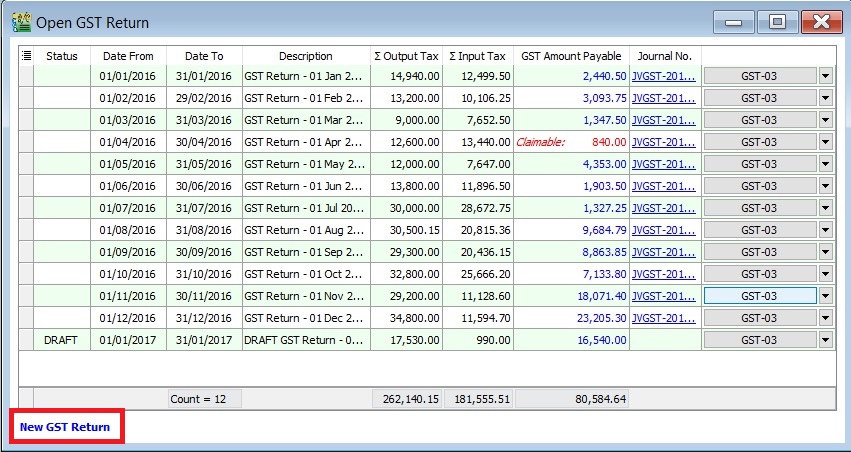

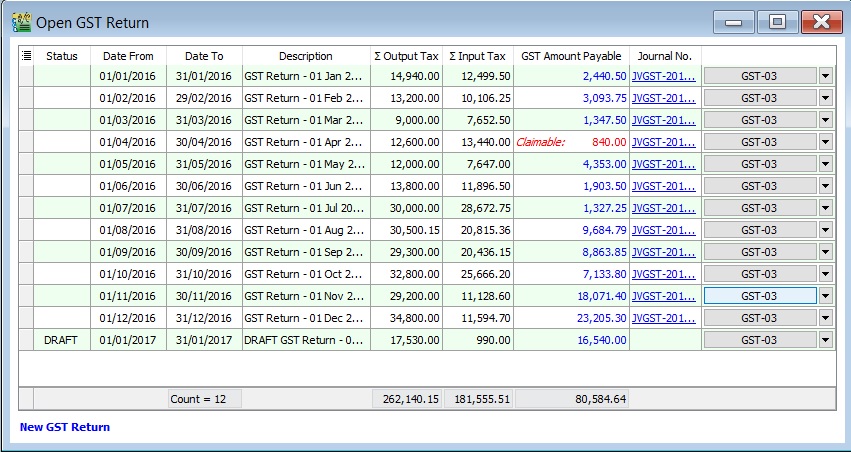

Open GST Return

[GST | Print GST Listing...]

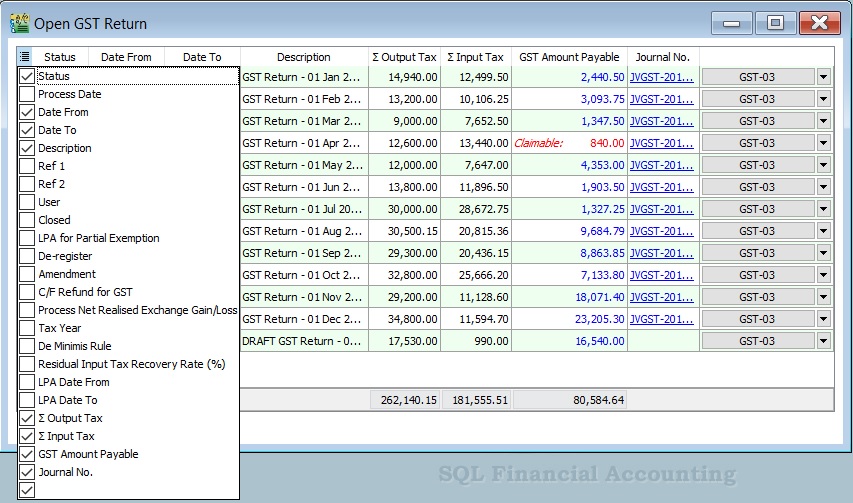

Field Name Field Type Explanation Status String To show the GST Return status, ie. DRAFT, DE-REGISTER, LPA. Process Date Date To show process date. Date From Date To show date from. Date To Date To show date to. Description String To show the description entered. Ref 1 String To show the ref 1 entered. Ref 2 String To show the ref 2 entered. User String To display the User process the GST Return. Closed Boolean Always ticked to close. Longer Period Adjustment Boolean Ticked if status = LPA. De-register Boolean Ticked if the taxable period has de-register date. Amendment Boolean To show the GST Return has ticked this option. C/F Refund for GST Boolean To show the GST Return has ticked this option. Process Net Realised Exchange Gain/Loss Boolean No longer use because system auto handle this option. De Minimis Rule Boolean Ticked = Pass

Unticked = Not PassResidual Input Tax Recovery Rate (%) Float To display the IRR %. ∑ Output Tax Float To show the total output tax value. ∑ Input Tax Float To show the total input tax value. GST Amount Payable Float Net GST Payable or Claimable. Journal No. String Auto post the JVGST-XXXXX to reconcile the GST Payable and GST Claimable accounts. Button Options button : GST-03, Print GST Listing, Generate GST Audit File (GAF)

Tips: You can click New GST Return in Open GST Return screen. See below the screenshot.