GST Treatment: Free Industrial Zone(FIZ) and Licensed Manufacturing Warehouse(LMW)

From eStream Software

Free Industrial Zone(FIZ) and Licensed Manufacturing Warehouse(LMW)

Introduction

- This guide will teach you the way to key-in the data entry related to GST treatment on FIZ and LMW.

- Under GST system, a person operating in a FIZ or having LMW status is treated as any person carrying out a business in Malaysia where normal rules of GST apply. This means that acquisition of goods locally or imported by the person operating in a FIZ or having LMW status is subject to GST. However, the person operating in a FIZ or having LMW status is eligible to apply for Approved Trader

- Scheme (ATS) to allow the Director General to suspend the payment of GST on imported goods at the time of importation. For further details, please refer to the

guide on Approved Trader Scheme (ATS) and SQL Accounting on ATS

- Subject to GST:

- FIZ Local sell to FIZ Local → SR

- FIZ local sell to LMW Local → SR

- FIZ/LMW local sell to non-FIZ/LMW → SR

- FIZ/LMW Local sell to Oversea → ZR

- FIZ Local sell to FIZ Local → SR

- For example,

Item Item Description Qty Unit Price

(RM)Value(RM) Import Duty

(RM)1. Shirts 300 pcs 25.00 7,500.00 1,500.00 2. Paints 100 pcs 30.00 3,000.00 600.00 Total 10,500.00 2,100.00

- Assuming 20% import duty (RM10,500 x 20% = 2,100.00)

- GST on value + Import Duty are subject to GST (SR) = (10,500.00 + 2,100.00) x 6% = 756.00

- Therefore, the Tax Invoice will be presented as per below:

Item Item Description Qty Unit Price

(RM)Value

(RM)1. Shirt 300 pcs 25.00 7,500.00 2. Paints 100 pcs 30.00 3,000.00 GST (SR-6%) 756.00 Total Amount Payable 11,256.00

How to enter the Tax Invoice if there is a FIZ/LMW transactions to another party?

[Sales | Invoice...]

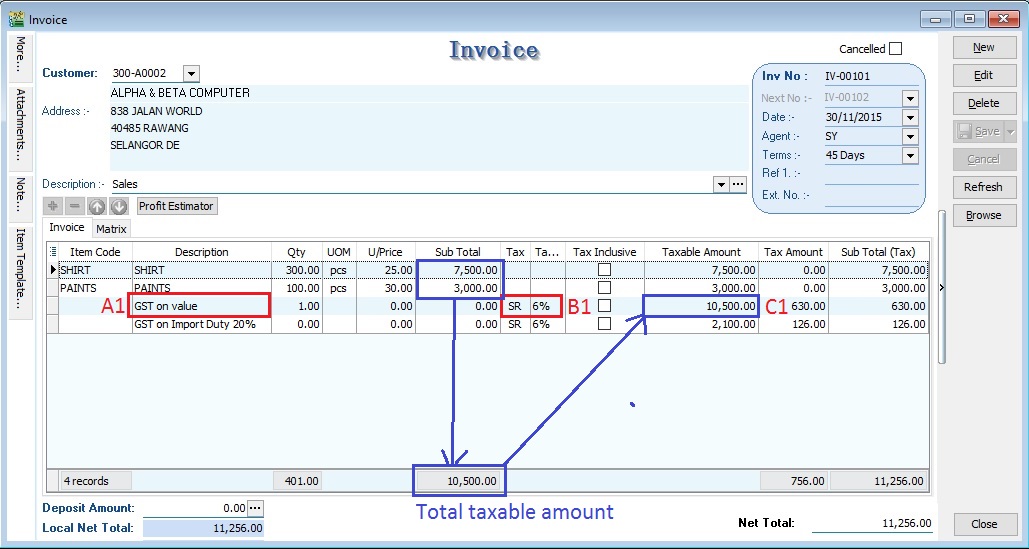

According to the example mentioned in above.

1. Insert and select the stock items sold with empty tax code. Because the stock items are under FIZ/LMW control.

Item Code Description Qty Unit Price Subtotal Tax Code Tax Amount SubTotal(Tax) SHIRT SHIRTS 300 pcs 25.00 7,500.00 <BLANK> 0.00 7,500.00 PAINTS PAINTS 100 pcs 30.00 3,000.00 <BLANK> 0.00 3,000.00

2. Inser new row and enter the GST on total supply value (Rm7500 + Rm3000 = Rm10,500) direct into Taxable Amount column (C1)

Description Taxable Amount Tax Code Tax Amount SubTotal(Tax) GST on value Rm10,500.00 10,500.00 SR 630.00 630.00

NOTE :

A1 : Key-in "GST on value" into description.

B1 : Must select tax code.

C1 : Key-in the Total Supply Value into Taxable Amount.

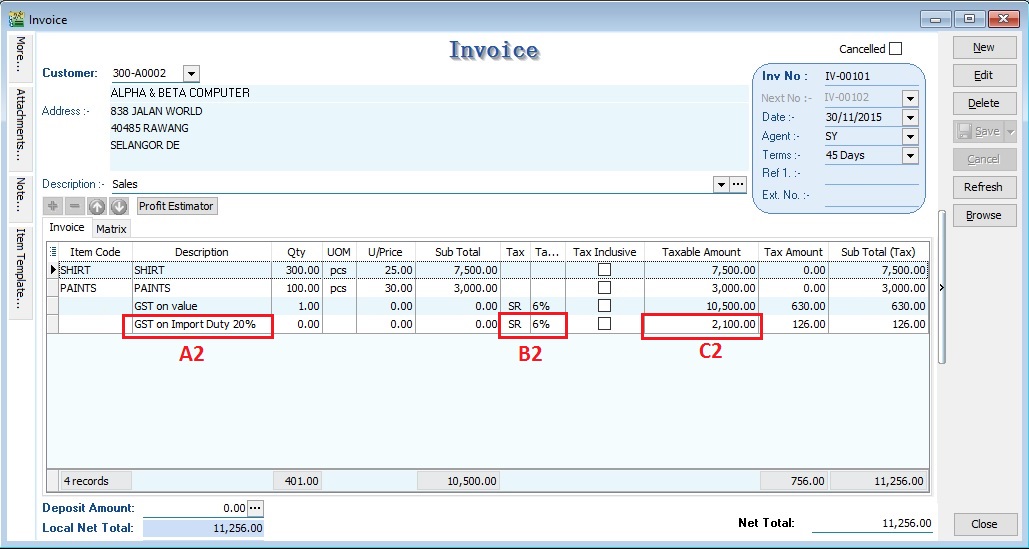

3. Insert new row and enter the GST on total Import Duty (Rm1,500 + Rm600.00 = Rm2,100) direct into Taxable Amount column (C2)

Description Taxable Amount Tax Code Tax Amount SubTotal(Tax) GST on Import Duty 20% 2,100.00 SR 126.00 126.00

NOTE :

A2 : Key-in "GST on Import Duty" into description.

B2 : Must select tax code.

C2 : Key-in the Total Import Duty value into Taxable Amount.

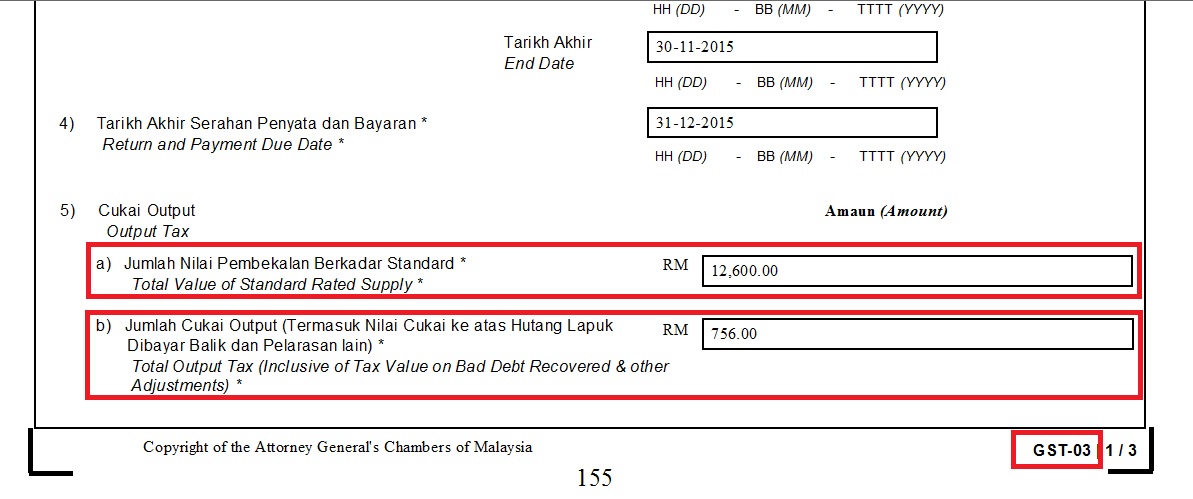

GST Return

[ GST | New GST Return...]

1. Process GST Return for the month

2. Click on print GST-03

RESULTS :

5a Total value of supplies = 12,600.00

5b total output tax = 756.00