GST Treatment: Free Industrial Zone(FIZ) and Licensed Manufacturing Warehouse(LMW)

Free Industrial Zone(FIZ) and Licensed Manufacturing Warehouse(LMW)

Introduction

This guide will teach you the way to key-in the data entry related to GST treatment on FIZ and LMW.

Subject to GST:

FIZ Local sell to FIZ Local → SR

FIZ local sell to LMW Local → SR

FIZ/LMW local sell to non-FIZ/LMW → SR

FIZ/LMW Local sell to Oversea → ZR

For example,

Item Item Description Qty Unit Price

(RM)Value(RM) Import Duty

(RM)1. Shirts 300 pcs 25.00 7,500.00 1,500.00 2. Paints 100 pcs 30.00 3,000.00 600.00 Total 10,500 2,100.00

Assuming 20% import duty (RM10,500 x 20% = 2,100.00)

GST on value + Import Duty are subject to GST (SR) = (10,500.00 + 2,100.00) x 6% = 756.00

Therefore, the Tax Invoice will be presented as per below:

Item Item Description Qty Unit Price

(RM)Value

(RM)1. Shirt 300 pcs 25.00 7,500.00 2. Paints 100 pcs 30.00 3,000.00 GST (SR-6%) 756.00 Total Amount Payable 11,256.00

How to enter the Tax Invoice if there is a FIZ/LMW transactions to another party?

[Sales | Invoice...]

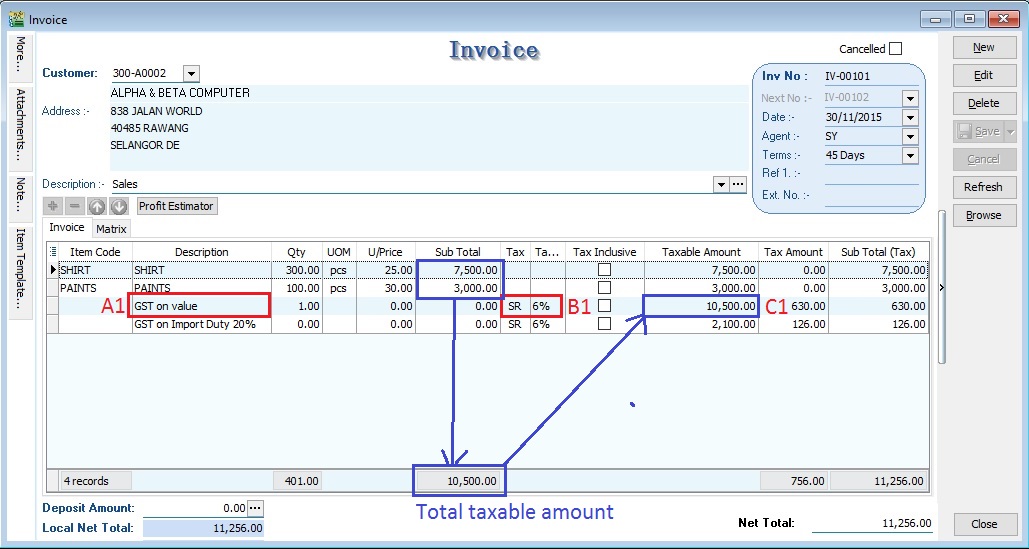

According to the example mentioned in above.

1. Insert and select the stock items sold with empty tax code. Because the stock items are under FIZ/LMW control.

Item Code Description Qty Unit Price Subtotal Tax Code Tax Amount SHIRT SHIRTS 300 pcs 25.00 7,500.00 <BLANK> 0.00 7,500.00 PAINTS PAINTS 100 pcs 30.00 3,000.00 <BLANK> 0.00 3,000.00

2. Inser new row and enter the GST on total supply value (Rm7500 + Rm3000 = Rm10,500) direct into Taxable Amount column (C1)

| Description | Taxable Amount | Tax Code | Tax Amount | SubTotal(Tax) |

|---|---|---|---|---|

| GST on value Rm10,500.00 | 10,500.00 | SR | 630.00 | 630.00 |

3. Insert new row and enter the GST on total Import Duty (Rm1,500 + Rm600.00 = Rm2,100) direct into Taxable Amount column (C1)

| Description | Taxable Amount | Tax Code | Tax Amount | SubTotal(Tax) |

|---|---|---|---|---|

| GST on Total Import Duty 20% | 2,100.00 | SR | 126.00 | 126.00 |

NOTE :

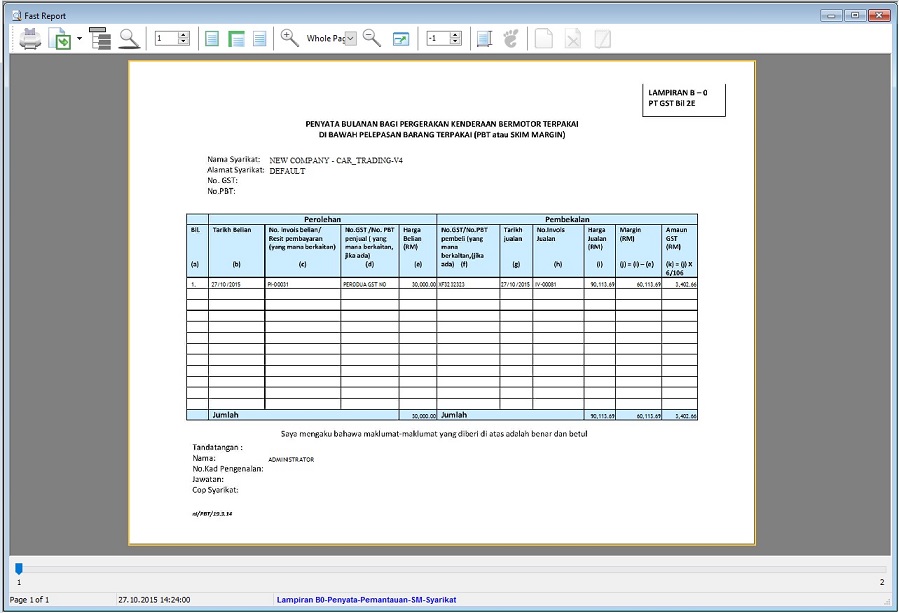

1. This information is required to show in Lampiran 07 -Monthly Report for Relief for Secondhand Goods or Margin Scheme (MS).

2. Auto update to project purchase detail (Purchase No, Purchase Date and Cost) if tax amount is zero

GST Return

[Sales | Invoice…]

Margin Scheme Input

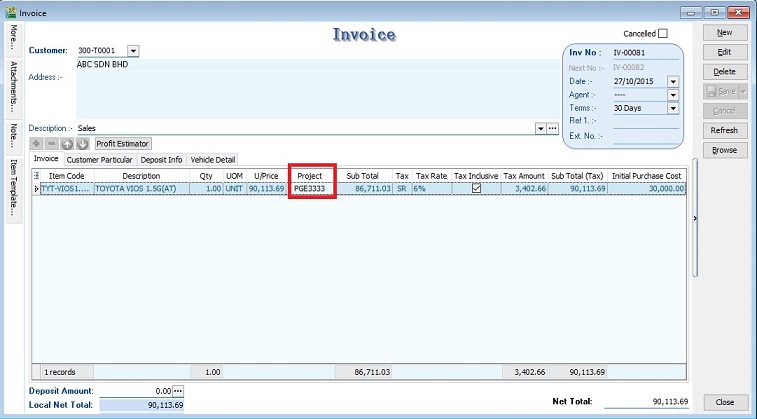

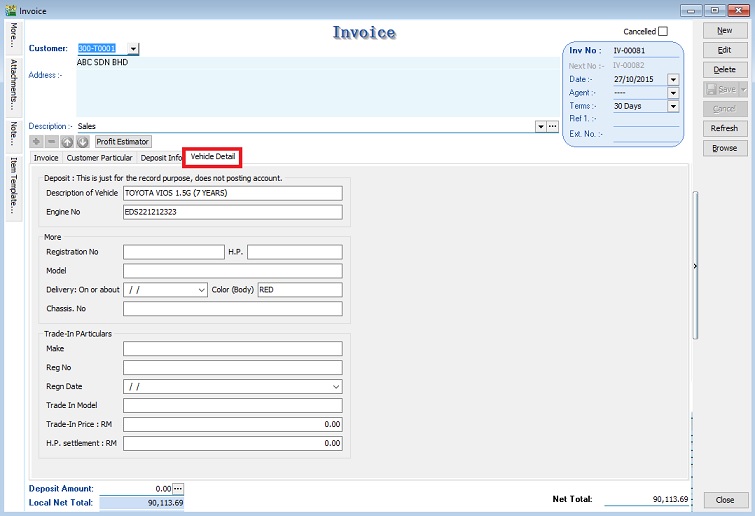

1. Enter the sale value of second car at Invoice. (eg.RM90,113.69)

2. You must select the correct car plate number from Project.(eg.PGE3333)

3. Initial Purchase Cost will auto upadate after select the project (car plate number).

4. Tax amount will be calculated based on Margin Scheme method.(See screenshot below)

- a. Sellng Price = 90,113.69

- b. Purchase Cost = 30,000.00

- c. Margin = 90,113.69 – 30,000.00 = 60,113.69

- d. Tax amount = 60,113.69 x 6/106 = 3,402.66

- a. Sellng Price = 90,113.69

6. Invoice no, invoice date, selling price, margin, and margin tax amount will be shown in Lampiran 07 -Monthly Report for Relief for Secondhand Goods or Margin Scheme (MS)

Other Information

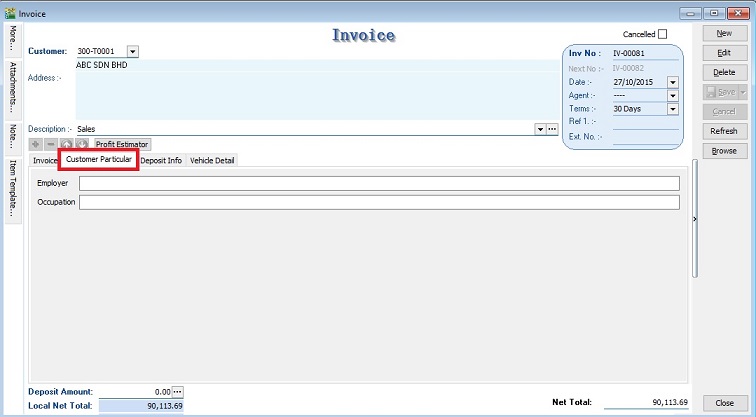

1. Customer Particular tab.

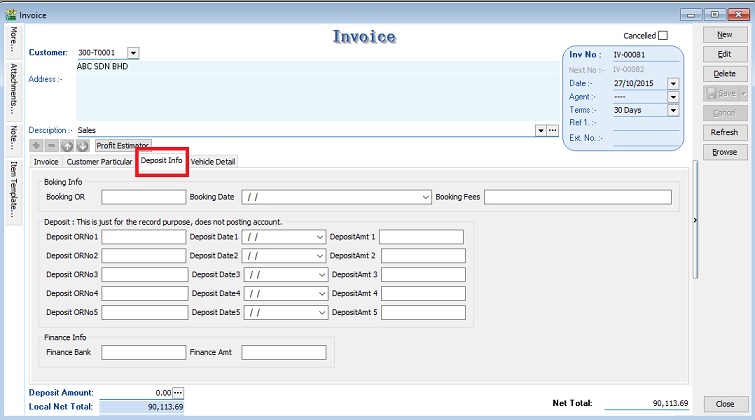

2. Deposit Info (For record purpose, no posting to account).

3. Vehichle Detail (Auto retrieve from Vehicle Detail in Maintain Project).

Print for GST Lampiran 07 (Lampiran B0-Penyata-Pemantauan-SM-Syarikat)

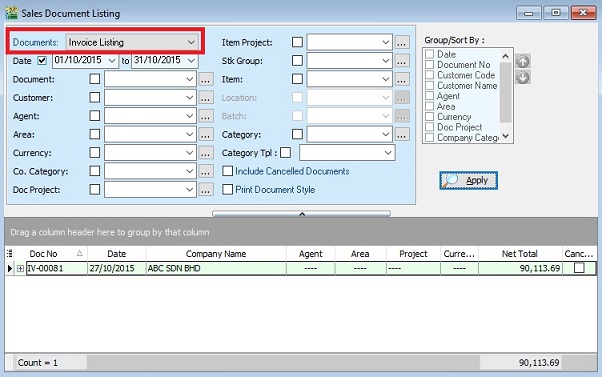

[Sales | Print Sales Document Listing…]

1. Select document to “Invoice Listing” and click APPLY.

2. Click on preview or print. Select the report name “Lampiran B0-Penyata-Pemantauan-SM-Syarikat”.

See also

- Others Customisation