Introduction

Is External Shareware Program which Convert Sales to Purchase Module or vice versa which exported from SQL Accounting

Normally is use to Export Data From SQL Accounting Database A from Document Type A (Eg Sales Invoice) & Import to SQL Accounting Database B as other Document Type (Eg Purchase Invoice)

Limitation

- Only support 1 Company Code (i.e. 1 batch 1 Company Code)

- Both Source & Target must had Same Itemcode

Import Program

- Version (5.2.1.7) - 05 Dec 2020

- https://www.sql.com.my/downloadfile/Fairy/SQLAccSLPHV5-setup.exe

- MD5 : 354B803A806AF235678C29A56DAA966E

History New/Updates/Changes

--Build 7--

- Upgrade to Version 5.2.1.

- Enable Quick Customise Layout for Grid.

- Empty Item Code should by pass from Verify.

- Allow User Override Header Description.

- Enable Support Unicode

--Build 6--

- Fixed Import Sales/Purchase CN & DN Error.

--Build 5--

- Upgrade to Version 5.2.

- Add Option Use My Maintain Supplier/Customer Information for Sales/Purchase Import.

- Enable support Running In Windows Limited User.

--Build 4--

- Fixed Shown TaxCode Even Original no TaxCode.

--Build 3--

- Fix TaxRate Not Import

- Fixed Import Customer/Supplier prompt bad variance type.

--Build 2--

- Enable Support Version 5 SQL Accounting

- Add Maintain Tax

--Build 1--

- Fix unable to register Database

Todo

Settings

In SQL Accounting

- 01. May refer to Point 2 at Things To Consider Before Import/Post

- 02. Make sure this option is Tick under Tools | Options | Customer

- Perform Tax/Local Amount Rounding

In SLPH Import

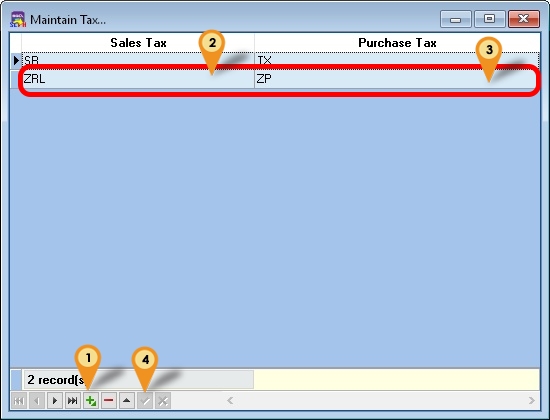

Menu : Tools | Maintain Tax

- 01. Click New/Edit to Insert or update

- 02. Select Sales Tax Code

- 03. Select Purchase Tax Code

- 04. Click Post/Save

Steps

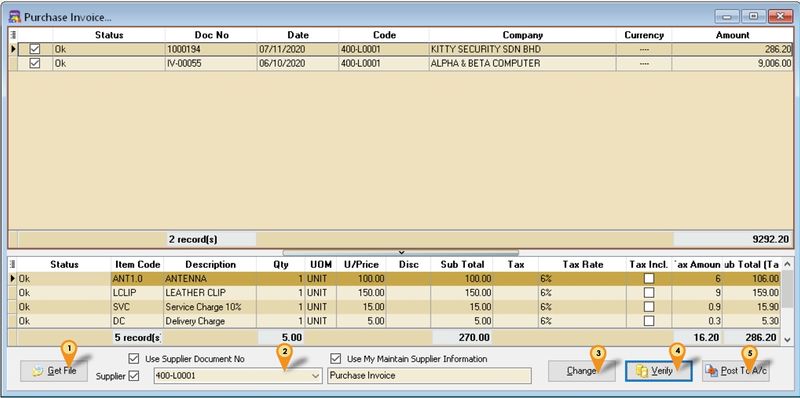

Menu : Purchase | Purchase Invoice...

Below steps is example to import Purchase Invoice

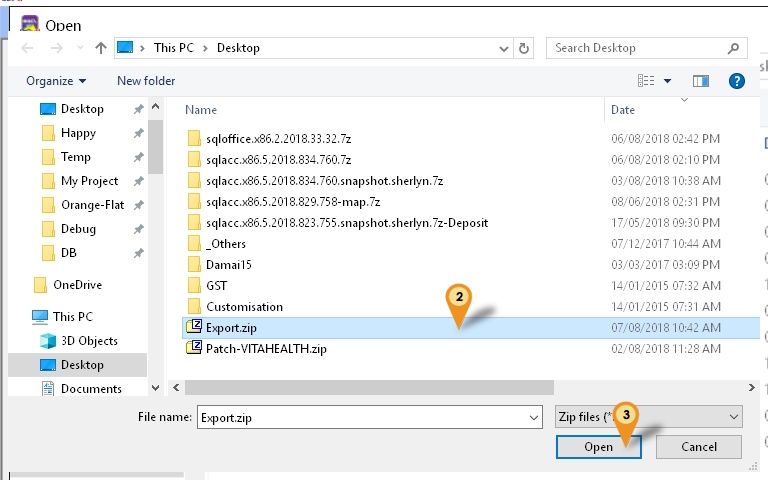

- 01. Click Get File button

|

- 02. Select the Zip file (exported from SQL Export V5)

- 03. Click Open

- 04. Select Supplier Code to update

- 05. Click Change Button

- 06. Click Verify button

- 07. Click Post to A/c Button

See also

- FAQ

- Others Customisation