Introduction

- To analyse the detail of GST transactions group by tax type. It can be use to check against with GST-03.

GST Listing

[GST | Print GST Listing...]

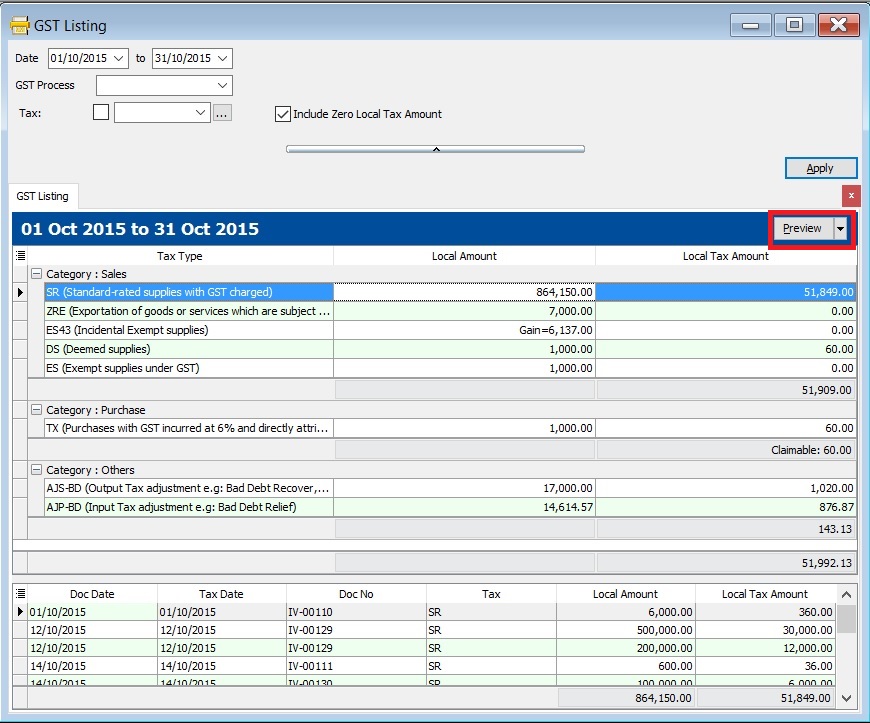

GST Listing-Parameter

Parameter Type Explanation Date Date To range the date to retrieve the data after apply it. GST Process Lookup To select the GST Process period. Tax Lookup To select the tax code. Include Zero Local Tax Amount Boolean To show the zero local tax amount.

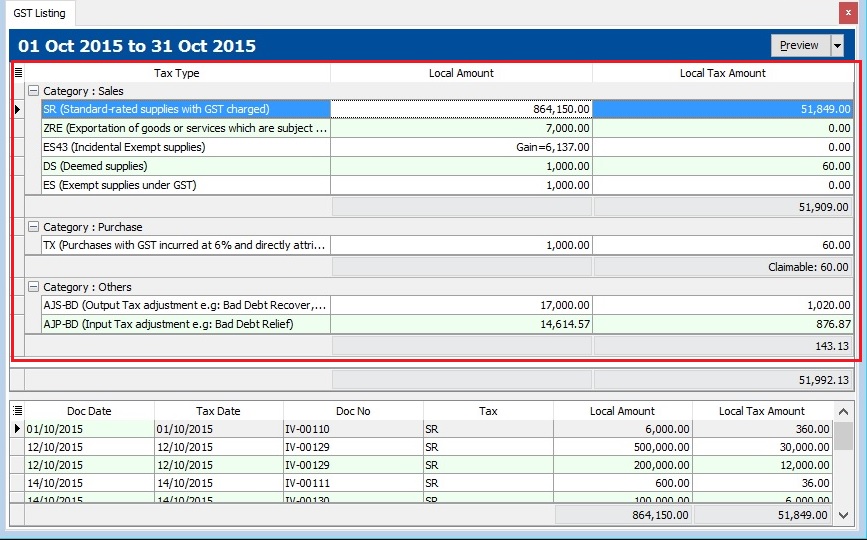

GST Listing-Main Data

- 1. Select the date range or GST Process

- 2. Select the tax if you would like to get a particular tax code GST listing.

- 3. Click on APPLY.

- 4. See the below screenshot.

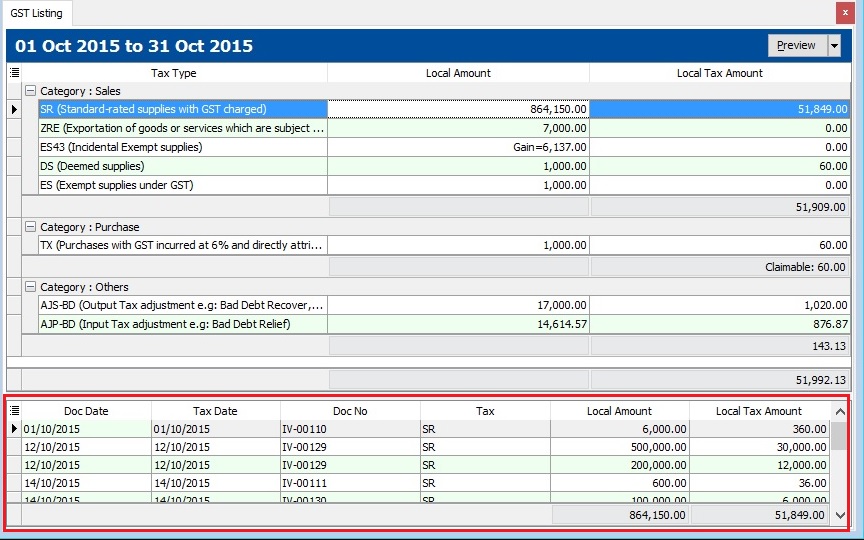

GST Listing-Detail Data

- 1. Point on the Tax Type, eg. SR.

- 2. You can see the breakdown detail in documents level. See the below screenshot.

Reports

No. Report Name Purpoase 01 GST Detail 1 To show the document description in GST Listing. 02 GST Detail 2 To show the document item details description in GST Listing. 03 GST Detail 3 - GST-03 To show the GST-03 details in GST Listing. 04 GST Lampiran 4 - Ringkasan Maklumat Permohanan Tuntutan Pelepasan Hutang Lapuk Lampiran 4 as requested by Kastam Officer 05 GST Lampiran 2 GST form not compulsory to print and submit. It is upon as requested by RMCD. 06 GST Listing - Yearly GST Analysis To analyse the yearly tax amount and taxable amount. 07 GST Summary Sheet - MY GST Summary Sheet format.

NOTE: From Doc Types in GST Listing Detail are consists of: 1. _A = Unclaimable Non-Incidental Exempt Supplies (TX-N43) 2. _B = Unclaimable TX-RE 3. _C = Annual Adjustment Non-Incidental Exempt Supplies (TX-N43) 4. _D = Annual Adjustment TX-RE 5. _X = Realised Gain Loss