Introduction

- To process and close the GST Returns period. You can generate the GST-03 and GAF.

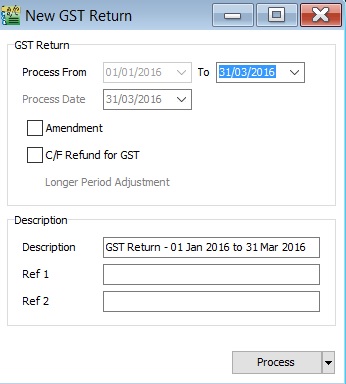

New GST Return

[GST | New GST Return...]

Field Name Field Type Explanation Process From to Date GST Taxable Period,eg. either monthly or quarterly. Process Date Date Date to process the GST Return. Amendment Boolean Ticked. In GST-03, the "Amendment" checkbox will be marked X. C/F Refund for GST Boolean Ticked. In GST-03, the Item 9 Do you choose to carry forward refund for GST? will be marked X in Yes checkbox. Longer Period Adjustment (LPA) Boolean Auto ticked according to the first tax year adjustment. Description String GST Return - Process From Date to Date (by default). Ref 1 String Key-in any reference no. Ref 2 String Key-in any reference no.

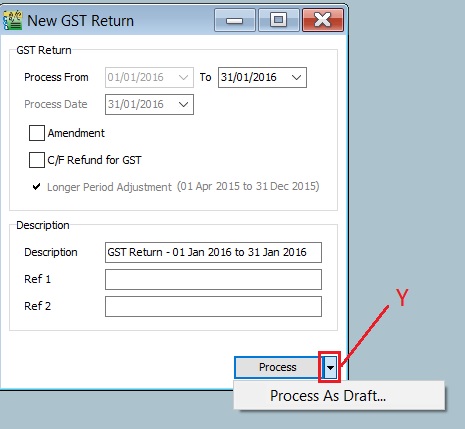

Draft-GST Return

[GST | New GST Return...]

- Introduction

- You are able to draft the GST-03 before the final GST-03 submission by process as draft.

TIPS: You still can amend the documents where the DRAFT GST return generated. You can draft as many before FINAL process the GST Returns for the period.

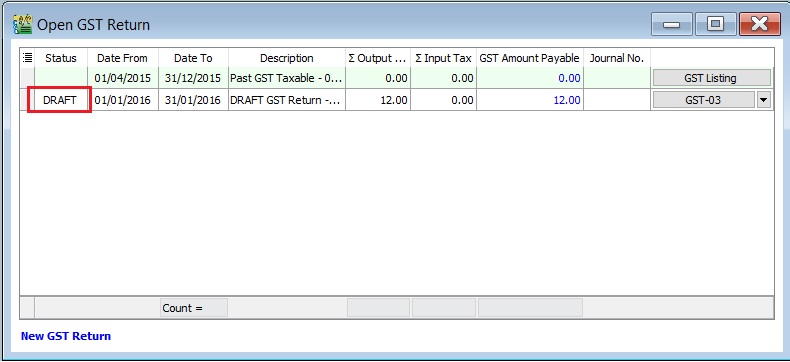

Process GST Returns

[GST | New GST Return...]

- 1. Process GST Return. For example, process from 01/10/2015 to 31/10/2015.

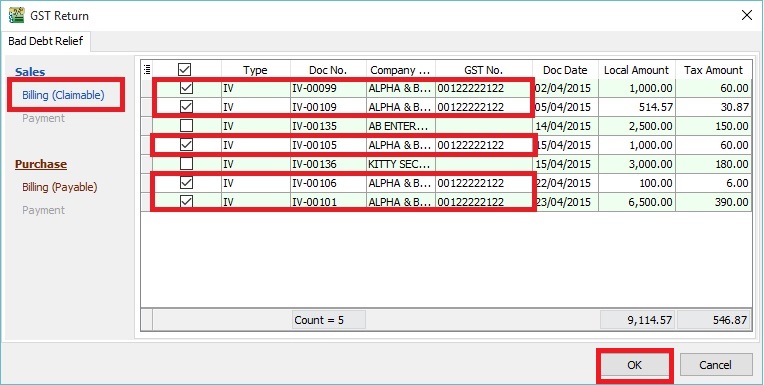

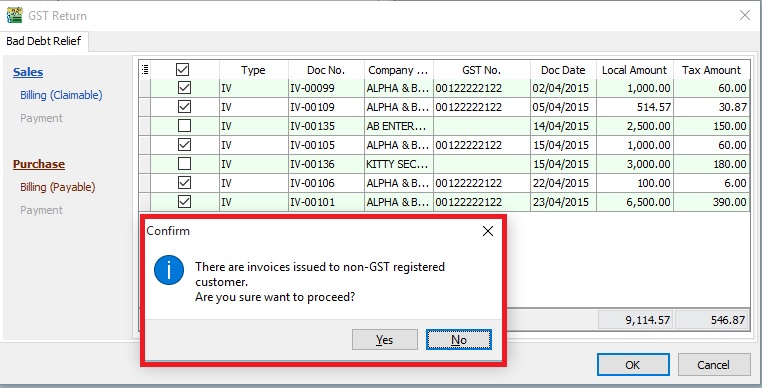

- 2. Bad Debt Relief screen will be prompted (see the screenshot below) if the system found there are outstanding Tax Invoices has expired at 6 months.

- 3. Sales documents from the company has empty GST No will be unticked. You can tick the documents if you think this company is a GST Registered person.

Tips:To avoid to tick the documents manually for GST Registered company, please go to update the GST no at Maintain Customer.

- 4. Press OK if get a "confirm" message prompted (see the screenshot below), it means there are some company do not have GST No.

- 5. If you has confirmed that the company is Non-GST Registered person then you can press YES to proceed.

- 6. Otherwise press NO, you have to update the GST No at Maintain Customer to confirm the company is a GST Registered person before process the GST Return.

GST Listing

[GST | Print GST Listing...]

- Category Others will appeared in GST Listing if there is found bad debt relief (eg. AJS-BD, AJP-BD):

Category : Others Local Amount Local Tax Amount AJS-BD (Output Tax adjustment e.g: Bad Debt Recover, outstanding invoice > 6 months) 17,000.00 1,020.00 AJP-BD (Input Tax adjustment e.g: Bad Debt Relief) 9,114.57 546.87

GST-03

[GST | Print GST-03...]

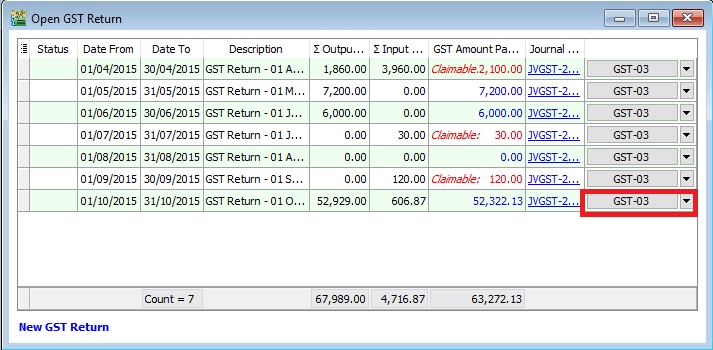

- 1. At GST Return screen, you can direct preview the GST-03 by click on the GST-03 button (see the screenshot below).

- 2. GST-03 result from the above sample data:

GST-03 # Description Amount 5a Total Value of Standard Rated Supply 0.00 5b Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments) 1,020,.00 6a Total Value of Standard Rate and Flat Rate Acquisitions 0.00 6b Total Input Tax (Inclusive of Tax Value on Bad Debt Relief & other Adjustments) 546.87 17 Total Value of Bad Debt Relief Inclusive Tax 9,661.44 18 Total Value of Bad Debt Relief Recovered Inclusive Tax 0.00

Print GST Bad Debt Relief

[GST | Print GST Bad Debt Relief…]

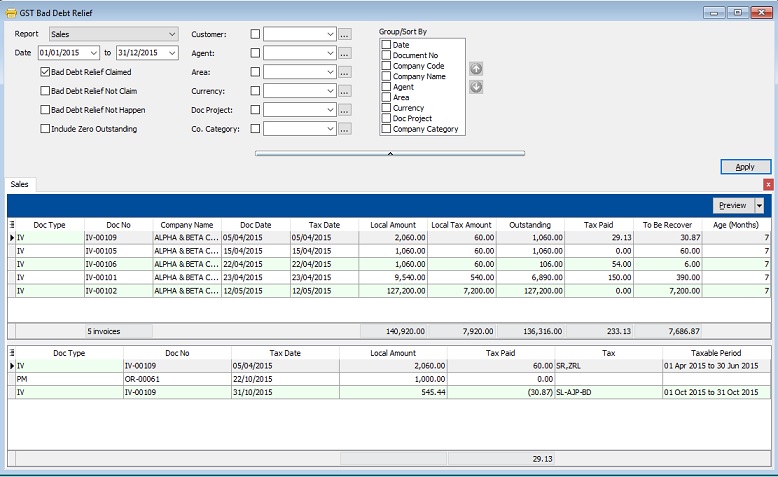

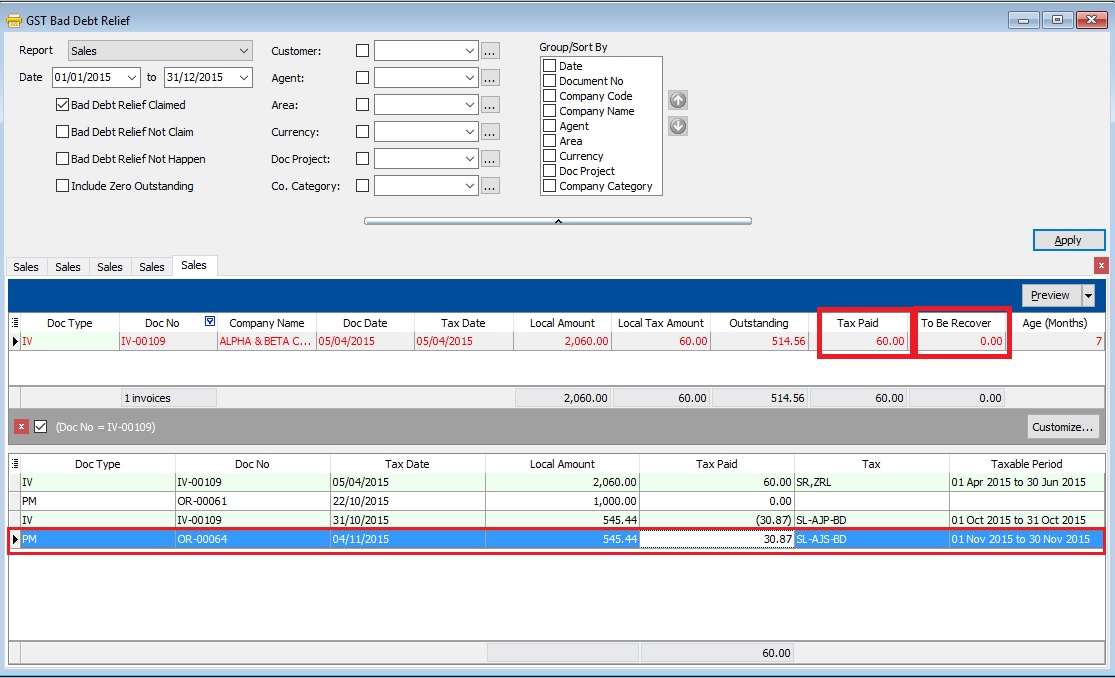

- 2. Let said the IV-00109 has the following details:-

Seq Description Amount Tax Tax Amount Amount with Tax 1 Sales of coconut can drinks 1,000.00 SR 60.00 1,060.00 2 Sales of coconut 1,000.00 ZRL 0.00 1,000.00

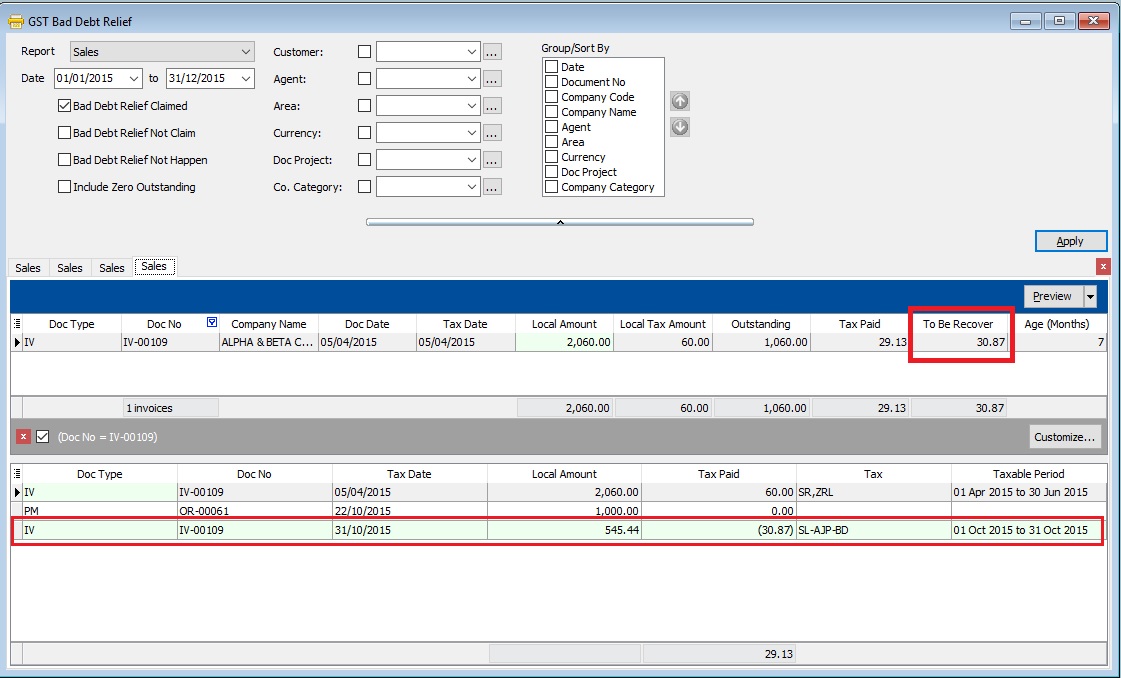

- 3. From the below report, it tells you that the bad debt relief claimed and to be recover at Rm30.87 for IV-00109. You can found at the detail that the bad debt relief claimed at Taxable Period 01 Oct 2015 to 31 Oct 2015.

- 4. After the IV-00109 has been full settlement in month Nov 2015, you will found the full tax paid Rm60.00 and to be recover will be shown as 0. You can found at the detail that the bad debt relief recovered at Taxable Period 01 Nov 2015 to 30 Nov 2015.

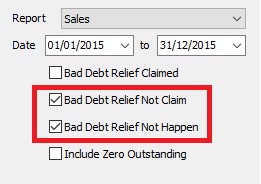

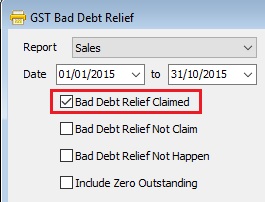

- 5. There are some option can choose to apply the GST Bad Debt Relief for further checking:

- Sales

Checkbox Explanation Bad Debt Relief Claimed GST bad debt relief that you HAVE TICKED to claim on outstanding invoices when process your GST returns. Bad Debt Relief Not Claim GST bad debt relief that you DO NOT TICKED to claim on outstanding invoices when process your GST returns. Bad Debt Relief Not Happen Outstanding invoices the GST Amount not expired at 6 months GST bad debt relief. Include Zero Outstanding To include the outstanding invoices are zero.

- Purchase

Checkbox Explanation Bad Debt Relief Paid GST bad debt relief have paid on the outstanding supplier invoices when process your GST returns. Bad Debt Relief Not Pay GST bad debt relief not pay yet on the outstanding supplier invoices. It could be due to late receive the supplier invoice. Bad Debt Relief Not Happen Outstanding invoices the GST Amount not expired at 6 months GST bad debt relief. Include Zero Outstanding To include the outstanding invoices are zero.

- 6. Click Preview button. You can found the following report list.

# Report Name Usage 1 GST Bad Debt Relief - Sales GST Bad Debt Relief Listing with detail based on the checkbox ticked. 2 GST-BM Bad Debt Relief-Unclaimed Letter 1 Bahasa Malaysia bad debt relief unclaimed letter format 1 to Director General 3 GST-BM Bad Debt Relief-Unclaimed Letter 2 Bahasa Malaysia bad debt relief unclaimed letter format 2 to Director General 4 GST-EN Bad Debt Relief-Unclaimed Letter 1 English version bad debt relief unclaimed letter format 1 to Director General 5 GST-EN Bad Debt Relief-Unclaimed Letter 2 English version bad debt relief unclaimed letter format 2 to Director General 6 GST Lampiran 4 - Ringkasan Maklumat Permohanan Tuntutan Pelepasan Hutang Lapuk Lampiran 4 as requested by Kastam Officer

TIPS 1 :

To print the bad debt relief unclaimed letter, you must tick both "Bad Debt Relief Not Claim" and "Bad Debt Relief Not Happen" to apply and preview.

TIPS 2 :

To print the Lampiran 4 - Ringkasan Maklumat Permohanan Tuntutan Pelepasan Hutang Lapuk, you must tick "Bad Debt Relief Claimed" only to apply and preview.