Import Goods (IM)

Introduction

- IM - "Import of goods with GST incurred". It means there is an input tax claimable. Tax rate is 6%.

- Purchase of goods from oversea supplier, the supplier invoice received will not incurred GST. However, the GST will be taken place when the goods are discharged out from the port to forwarder warehouse or direct to the buyer. Custom will incurred the GST on the total value stated in K1 form.

GST IMPORTATION OF GOODS (IM)

Tax Code

[GST | Maintain Tax...]

- You can found the following tax code available in SQL Financial Accounting.

Tax Code Description Tax Rate % IM-0 Import of goods with no GST incurred (for Foreign Supplier Account) 0% IM Import of goods with GST incurred 6%

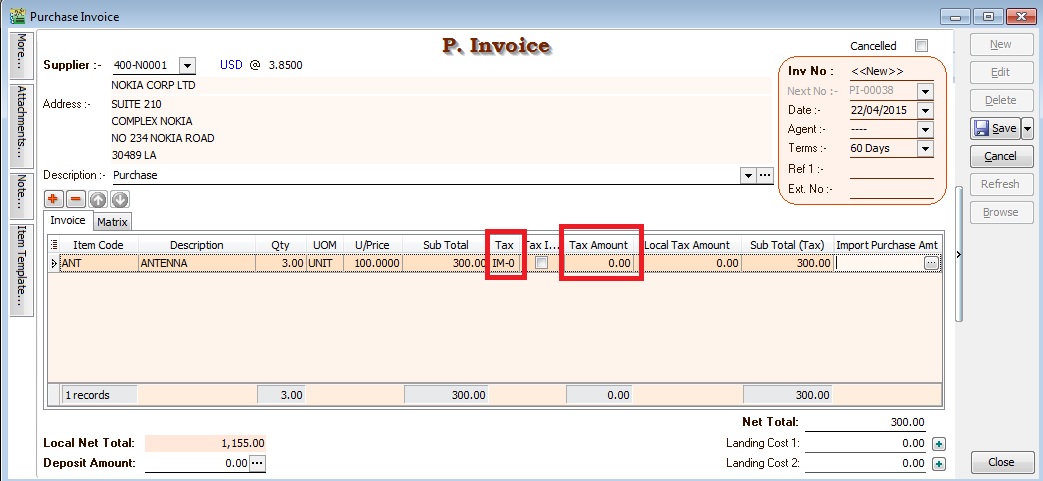

Oversea Supplier Invoice

[Purchase | Purchase Invoice...]

- 1. Create the oversea supplier invoice at Purchase Invoice.

- 2. Select the tax code “IM-0”. Tax amount = 0.00

Received Forwarder Notification from K1 /Invoice

- Let's said in the K1 form details:-

Description Amount (MYR) Calculation Goods Value (A) 1,155.00 USD300 x 3.8500 Custom Duty (B)

(assumed is 5%)57.75 Rm1,155 x 5% Total Taxable Amount (C) 1,212.75 A + B GST - IM 72.77 C x 6% = Rm1,212.75 x 6%

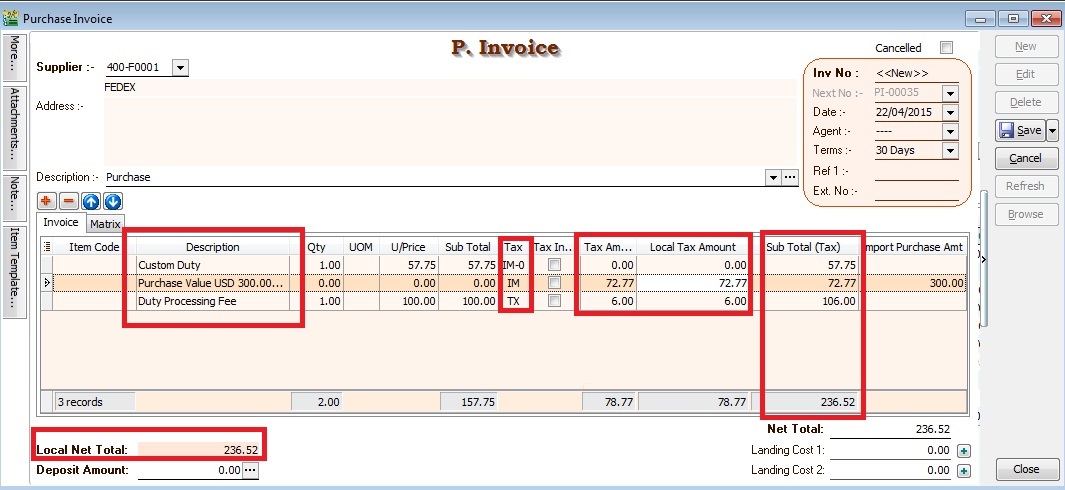

- Usually, the forwarder will invoice to the principal company for the following details:-

Description Net (MYR) GST Gross (MYR) Est. Duties (Import&/Excise Duty) 57.75 Est. GST Import (RM1,212.75 x 6%) 72.77 Est Duties + GST Import 130.52 130.52 Duty Processing Fee 100.00 6.00 106.00 Total Payable 236.52

NOTE :

GST Import can be calculated in different way. It might based on total weight (ie. weight x container) or total meter square (ie,meter square x container). For example, GST Import = 30,000m2 x 10 containers x 6% = RM18,000.00

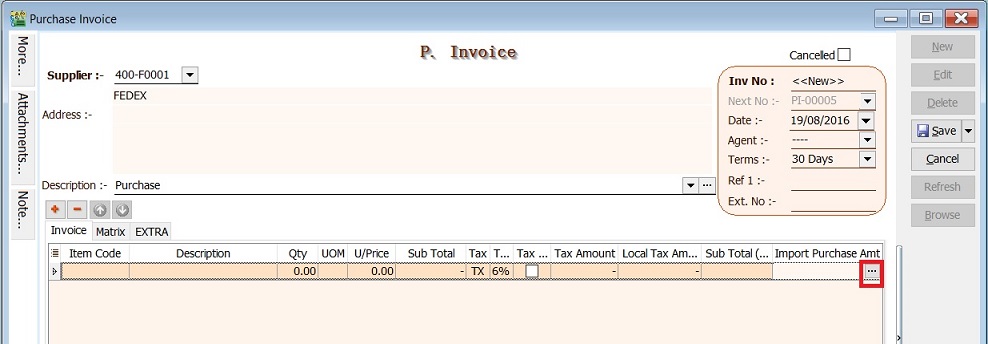

Forwarder Invoice Entry (Purchase Invoice)

[ Purchase | Purchase Invoice...]

- 1. Select the forwarder supplier code in Purchase Invoice.

- 2. Insert the following fields:-

- Import Curr.Code (for display only)

- Import Curr Rate (for display only)

- Import Purchase Amt (GST Import input)

- Tax Amount

- Local Tax Amount

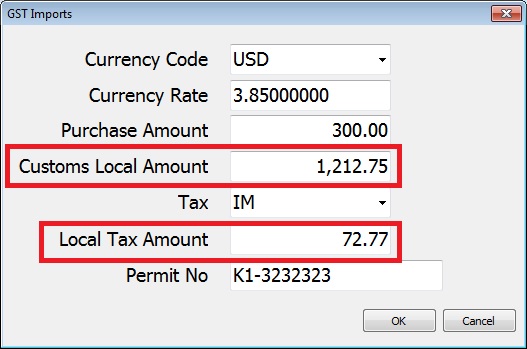

- 4. You have to input the info according to 2.3. Received Forwarder Notification from K1 /Invoice example.

Field Name Input Value Explanation Currency Code USD Currency to the goods purchased Currency Rate 3.85 Follow K1 exchange rate Purchase Amount 300.00 Goods foreign value as stated in K1 form Custom Local Amount 1,212.50 Follow K1 total taxable amount.

Formula = Purchase Amount + Custom DutyTax IM 6% Tax Amount 72.77 1,212.75 x 6% Permit No K1-3232323 Key-in the K1 no.

- 5. After press OK to exit the GST Import screen, the purchase invoice item description will be updated as “Purchase Value USD 300.00@3.8500 = RM 1,155.00, Permit No: K1-32323232” from the GST Import entered.

- 6. Below is the sample of Forwarder invoice entry.

Special Case: Purchase of Machinery from oversea

CASE 1

- Let said the oversea supplier has send the bill amount USD15,000 (USD15,000 x 4.2 = Rm63,000 will recorded in the Account Book).

Understand that Custom will use GST valuation to compute the GST amt and stated in K1 form. Assume that GST Valuation after custom duty = Rm75,000 and GST amt Rm75,000 x 6% = Rm4,500.

Question:

Which amount should I reported in GST-03 item 16 Capital Goods Acquired? Rm63,000 or Rm75,000?

Answer from RMCD:

GST-03 item 16 Capital Goods Acquired = Rm75,000.

How to handle this in SQL Accounting?

1. Oversea supplier bill enter at purchase/supplier invoice as usual.

- DR Machinery Rm63,000

- CR Oversea Supplier Rm63,000

Highlight Changes

| Date | Initiated by | Remarks |

|---|---|---|

| 28 March 2015 | Loo | Initial document. |

| 22 April 2015 | Loo | Update K1 and new screenshot |

| 24 June 2015 | Loo | For forwarder invoice, tax code IM should refer to Local Tax Amount instead of Tax Amount. |