(→Sales) |

|||

| Line 47: | Line 47: | ||

| 04 || SEB || Sales Tax Exempted - Schedule B More on Control Product & Medical Product || || B18_B2 | | 04 || SEB || Sales Tax Exempted - Schedule B More on Control Product & Medical Product || || B18_B2 | ||

|- | |- | ||

| 05 || SEC1 || Sales Tax Exempted - Schedule | | 05 || SEC1 || Sales Tax Exempted - Schedule C (Item 1) || || B18_B3 (i) | ||

|- | |- | ||

| 06 || SEC2 || Sales Tax Exempted - Schedule | | 06 || SEC2 || Sales Tax Exempted - Schedule C (Item 2) || || B18_B3 (i) | ||

|- | |- | ||

| 07 || SEC3 || Sales Tax Exempted - Schedule | | 07 || SEC3 || Sales Tax Exempted - Schedule C (Item 3) || || B18_B3 (ii) | ||

|- | |||

| 08 || SEC4 || Sales Tax Exempted - Schedule C (Item 4) || || B18_B3 (ii) | |||

|- | |||

| 09 || SEC5 || Sales Tax Exempted - Schedule C (Item 5) || || B18_B3 (iii) | |||

|} | |} | ||

<br /> | <br /> | ||

| Line 60: | Line 64: | ||

! No !! Tax Code || Description || Tax Rate || SST-02 column | ! No !! Tax Code || Description || Tax Rate || SST-02 column | ||

|- | |- | ||

| 01 || PEC1 || Purchase Tax Exempted - Schedule | | 01 || PEC1 || Purchase Tax Exempted - Schedule C (Item 1) || || B19 | ||

|- | |||

| 02 || PEC2 || Purchase Tax Exempted - Schedule C (Item 2) || || B19 | |||

|- | |||

| 03 || PEC3 || Purchase Tax Exempted - Schedule C (Item 3) || || B20 | |||

|- | |- | ||

| | | 04 || PEC2 || Purchase Tax Exempted - Schedule C (Item 4) || || B20 | ||

|- | |- | ||

| | | 05 || PEC3 || Purchase Tax Exempted - Schedule C (Item 5) || || B21 | ||

|} | |} | ||

<br /> | <br /> | ||

Revision as of 10:40, 7 September 2018

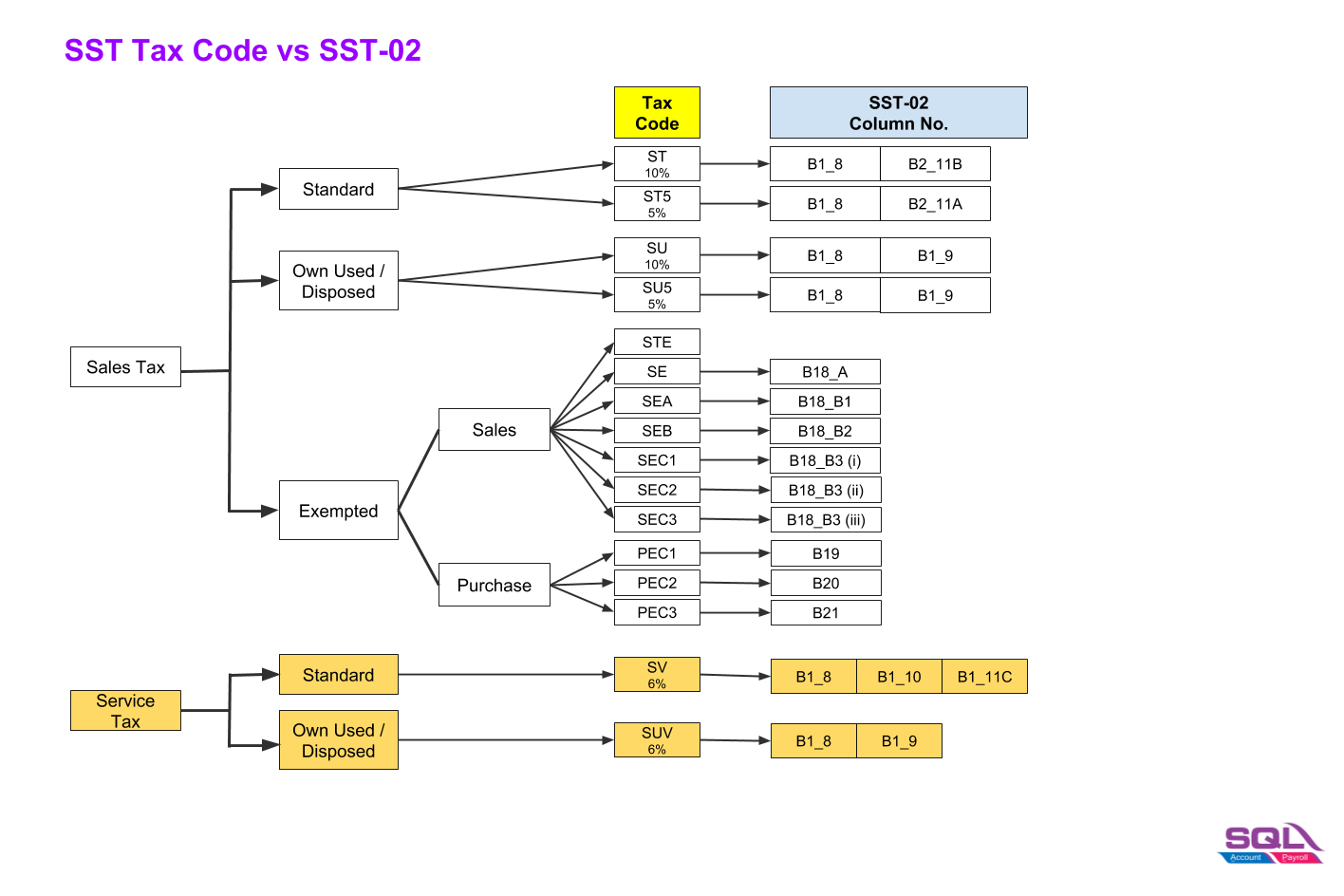

Introduction

- Explain the importance and usage of SST Tax Code reflect to SST-02.

SST Tax Code

- SST tax code consists of Sales Tax and Service Tax.

Sales

1) Standard

No Tax Code Description Tax Rate SST-02 column 01 ST Sales Tax 10% 10% B1_8

B2_11B02 ST5 Sales Tax 5% 5% B1_8

B2_11A

2) Deemed Supply (Own Used/Disposed)

No Tax Code Description Tax Rate SST-02 column 01 SU Goods Own Used/Disposed 10% 10% B1_8

B1_902 SU5 Goods Own Used/Disposed 5% 5% B1_8

B1_9

3) Sales - Exempted

No Tax Code Description Tax Rate SST-02 column 01 STE Sales Tax Exempted 02 SE Sales Tax Export/Special Area/Designated Area B18_A 03 SEA Sales Tax Exempted - Schedule A More on Government & Local Authority Dept B18_B1 04 SEB Sales Tax Exempted - Schedule B More on Control Product & Medical Product B18_B2 05 SEC1 Sales Tax Exempted - Schedule C (Item 1) B18_B3 (i) 06 SEC2 Sales Tax Exempted - Schedule C (Item 2) B18_B3 (i) 07 SEC3 Sales Tax Exempted - Schedule C (Item 3) B18_B3 (ii) 08 SEC4 Sales Tax Exempted - Schedule C (Item 4) B18_B3 (ii) 09 SEC5 Sales Tax Exempted - Schedule C (Item 5) B18_B3 (iii)

4) Purchase - Exempted

No Tax Code Description Tax Rate SST-02 column 01 PEC1 Purchase Tax Exempted - Schedule C (Item 1) B19 02 PEC2 Purchase Tax Exempted - Schedule C (Item 2) B19 03 PEC3 Purchase Tax Exempted - Schedule C (Item 3) B20 04 PEC2 Purchase Tax Exempted - Schedule C (Item 4) B20 05 PEC3 Purchase Tax Exempted - Schedule C (Item 5) B21

Service

1) Standard

No Tax Code Description Tax Rate SST-02 column 01 SV Service Tax 6% 6% B1_8

B1_10

B2_11C

2) Deemed Supply (Own Used/Disposed)

No Tax Code Description Tax Rate SST-02 column 01 SUV Service Own Use 6% 6% B1_8

B1_9