| Line 4: | Line 4: | ||

* Payment Oct 2016 | * Payment Oct 2016 | ||

* Bad Debts Recover - Oct 2016 to Dec 2016 | * Bad Debts Recover - Oct 2016 to Dec 2016 | ||

* Payment Bounce - Jan 2017 | * '''Payment Bounce - Jan 2017''' <== Must to Adjustment on Bounce Period | ||

* Replace New Cheque - Apr 2017 | * Replace New Cheque - Apr 2017 | ||

Revision as of 04:35, 28 October 2016

Scenario

- Invoice Date Jan 2016

- Bad Debts Relief - Jul 2016 to Sep 2016

- Payment Oct 2016

- Bad Debts Recover - Oct 2016 to Dec 2016

- Payment Bounce - Jan 2017 <== Must to Adjustment on Bounce Period

- Replace New Cheque - Apr 2017

Solution

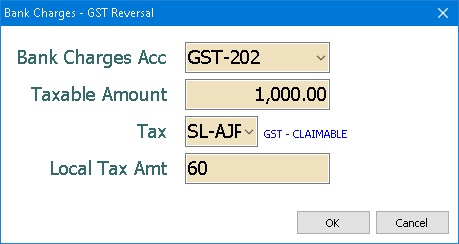

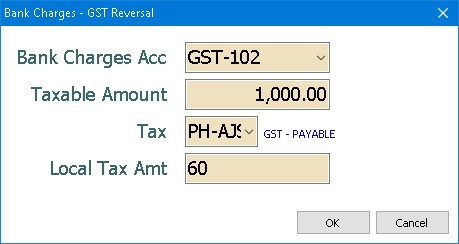

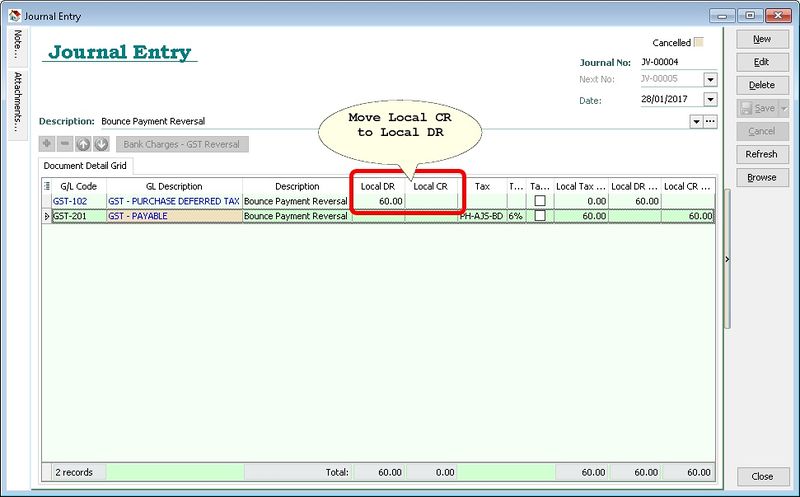

By using the GL Journal Voucher - Bank Charges - GST Reversal button

Customer Side

At GST Period Jan 2017

- DR GST-101 - GST - CLAIMABLE --> (SL-AJP-BD)

- CR GST-202 - GST - SALES DEFERRED TAX

Sample Database - Customer Bounce

Supplier Side

At GST Period Jan 2017

- DR GST-102 - GST - PURCHASE DEFERRED TAX

- CR GST-201 - GST - PAYABLE --> (PH-AJS-BD)