No edit summary |

|||

| Line 35: | Line 35: | ||

==Payment made before the invoice== | ==Payment made before the invoice== | ||

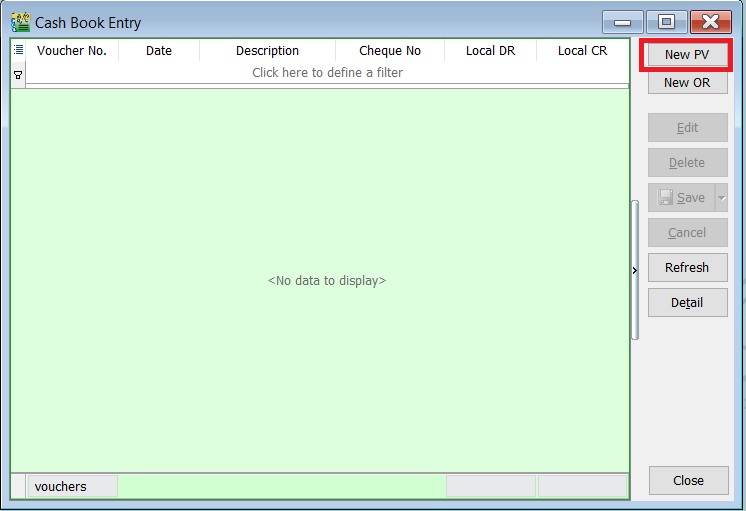

''Menu: GL | Cash Book Entry (PV)...'' | ''Menu: GL | Cash Book Entry (PV)...'' | ||

:1. Click on the '''New''' | :1. Click on the '''New PV''' to create new payment voucher. | ||

::[[File: GST Treatment-RSA-02.jpg]] | |||

::[[File: GST- | |||

<br /> | <br /> | ||

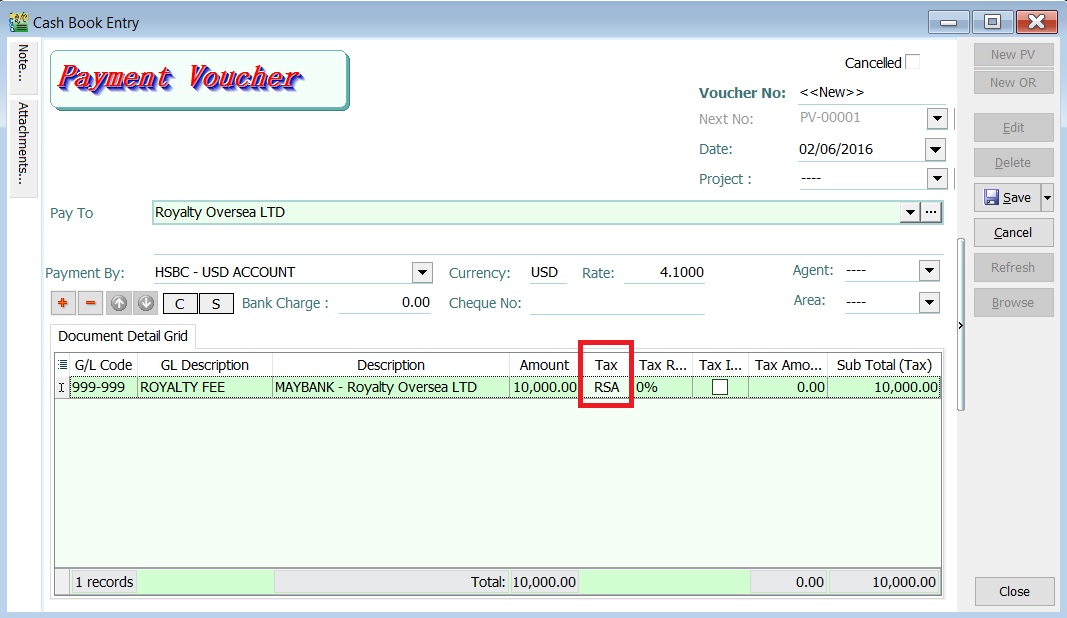

: | :2. Enter the payment date, eg. 02/06/2016. | ||

::[[File: GST- | :3. Select '''RSA''' in tax column. | ||

::[[File: GST Treatment-RSA-03.jpg]] | |||

<br /> | <br /> | ||

'''NOTE:''' | |||

Tax amount will be calculated after process the GST Returns. | |||

<br /> | |||

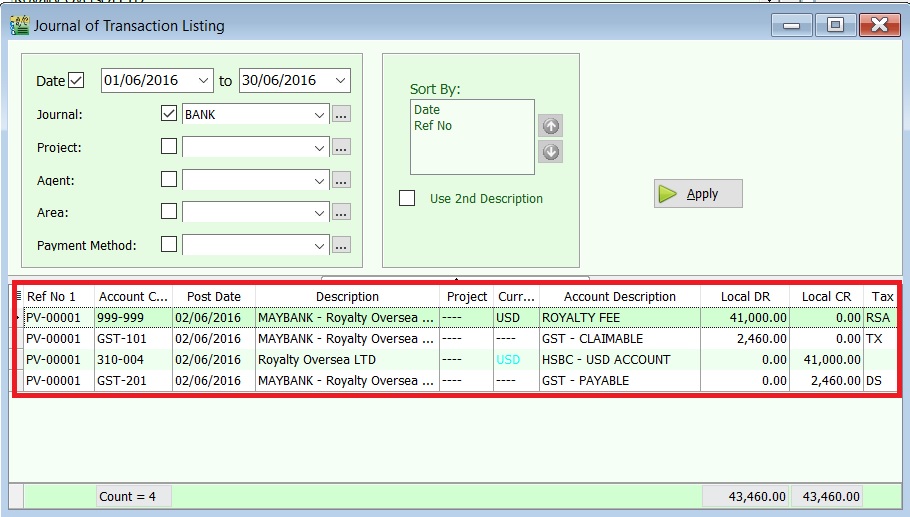

:4. After GST Returns processed, you can check the double entry posting from GL | Print Journal of Transactions Listing... | |||

::[[File: GST Treatment-RSA-04.jpg]] | |||

<br /> | |||

::'''Double Entry - RSA: ''' | |||

::{| class="wikitable" | |||

|- | |||

! Account Code!! Account Description !! Tax Code !! style="text-align:right;"| Local DR !! style="text-align:right;"| Local CR | |||

|- | |||

| GST-101 || GST - Claimable || TX || style="text-align:right;"| 2,460.00 || style="text-align:right;"| 0.00 | |||

|- | |||

| GST-201 || GST - Payable || DS || style="text-align:right;"| 0.00 || style="text-align:right;"| 2,460.00 | |||

|} | |||

==Invoice first payment later== | ==Invoice first payment later== | ||

Revision as of 09:29, 2 June 2016

Introduction

- GST on Imported Services (Sec 13) is accounted by way of the reverse charge mechanism.

- Reverse Charge Mechanism (also known as Self Recipient Accounting-RSA)

- A supplier whoe does not belong in Malaysia and supplies services to a customer in Malaysia does not have to charge GST. However, the customer who received the services is required to account for GST by a reverse charge mechanism.

- The recipient has to pay tax for the imported services he received and the same time claim input tax in his GST return. Reverse charge mechanism is an accounting procedure where a recipient (as the customer) of the supply, acts as both, the supplies and the recipient of the services.

- Example:

- 1. Royalty fee charged in Malaysia by non resident business situated outside Malaysia from Jan - Dec 2016 = USD 200,000

- 2. Date of invoice = 10 March 2016

- 3. Bank prevailing rate = Rm2.50 (Date: 10 March 2016)

- Calculation for GST:

- 1. Consideration for the supply @Rm2.50 = Rm500,000.00 + GST 6%

- 2. GST to be accounted by recipient @6% GST = Rm30,000.00

- RSA:

- Account GST output = Rm30,000.00

- Claim GST Input = Rm30,000.00

- Time of Supply

- 1. When supply are paid for (Date of payment made) - no longer

- 2. Since 01 Jan 2016, which ever is the earlier:-

- a. Payment made; or

- b. Invoice date.

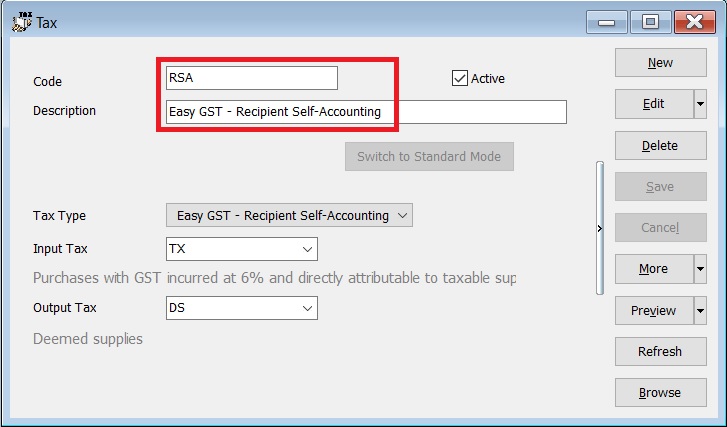

Maintain Tax

Menu: GST | Maintain Tax...

Payment made before the invoice

Menu: GL | Cash Book Entry (PV)...

NOTE: Tax amount will be calculated after process the GST Returns.

- 4. After GST Returns processed, you can check the double entry posting from GL | Print Journal of Transactions Listing...

- Double Entry - RSA:

Account Code Account Description Tax Code Local DR Local CR GST-101 GST - Claimable TX 2,460.00 0.00 GST-201 GST - Payable DS 0.00 2,460.00

Invoice first payment later

Menu: Supplier | Supplier Invoice...

- 1. Click on the New follow by select Official Receipt.

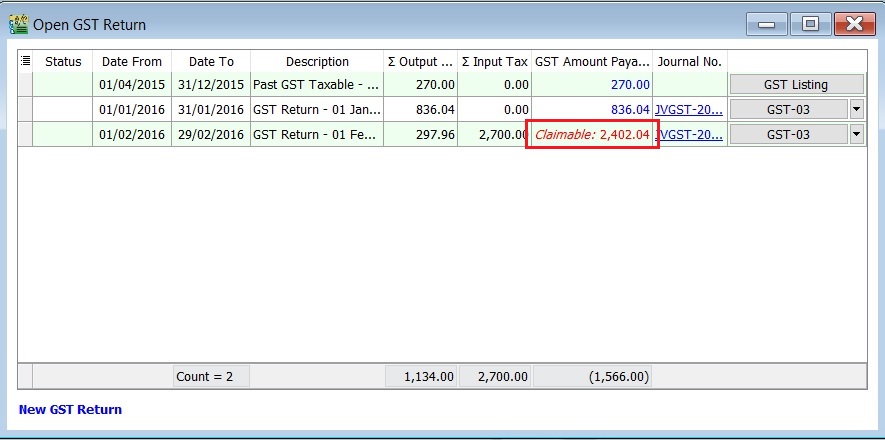

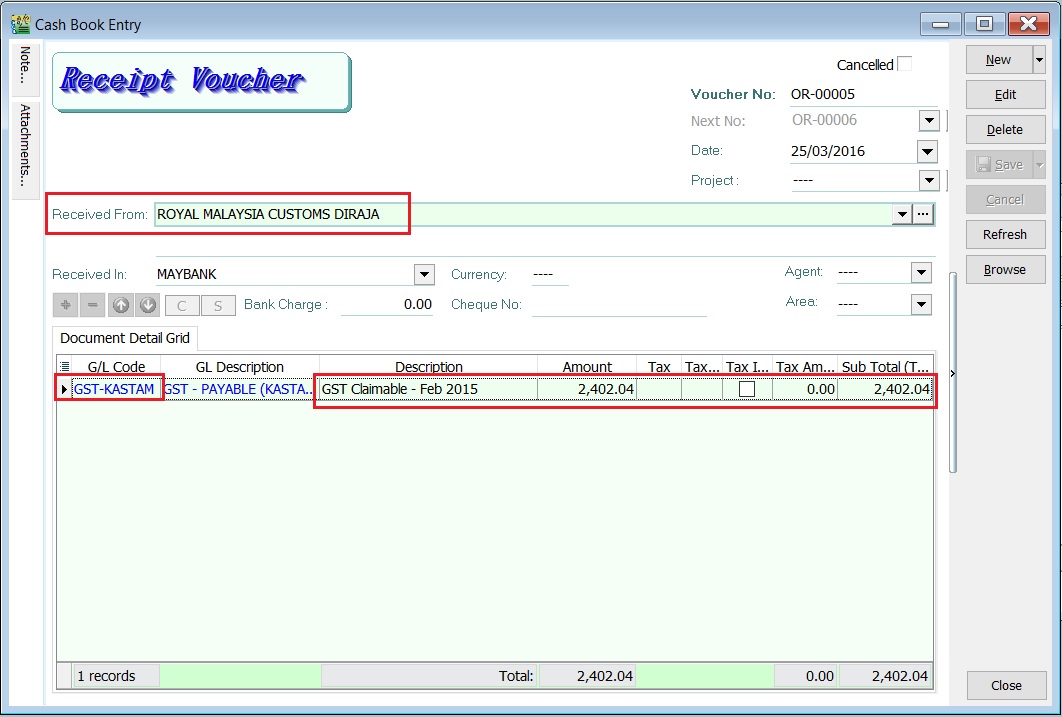

- 2. Enter the ROYAL MALAYSIA CUSTOMS DIRAJA' into Received From field.

- 3. At the detail, select GL Code: GST-KASTAM.

- 4. Enter the description to describe the GST Claimable for the period, eg. GST Claimable - Feb 2016.

- 5. Based on the GST Returns, enter the GST amount claimable (Rm2,402.04) into the Amount column.