No edit summary |

|||

| Line 80: | Line 80: | ||

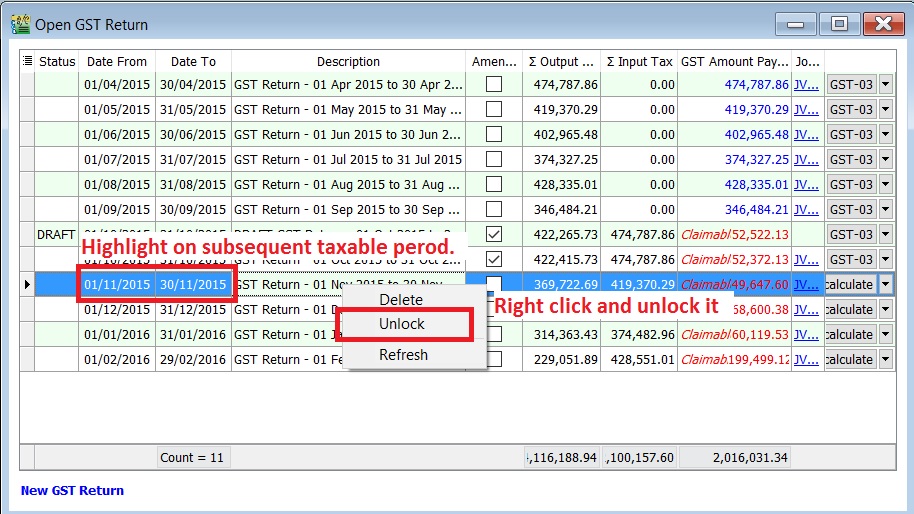

==How to unlock the subsequent taxable period for amendment?== | ==How to unlock the subsequent taxable period for amendment?== | ||

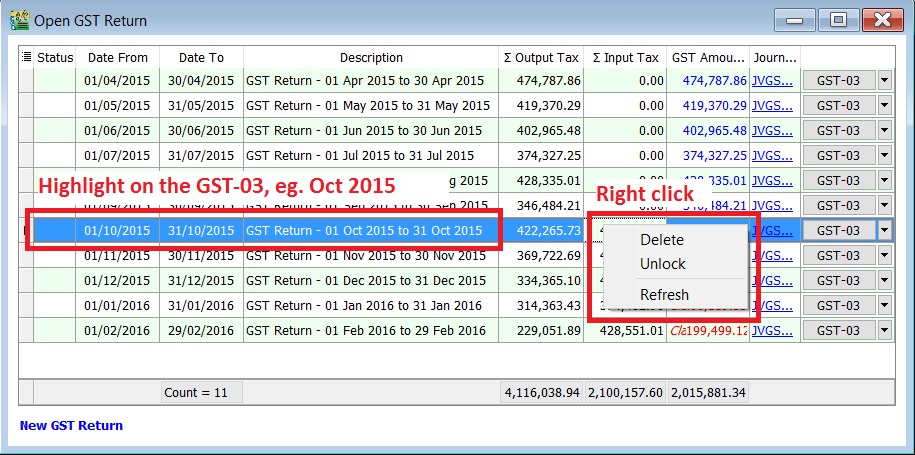

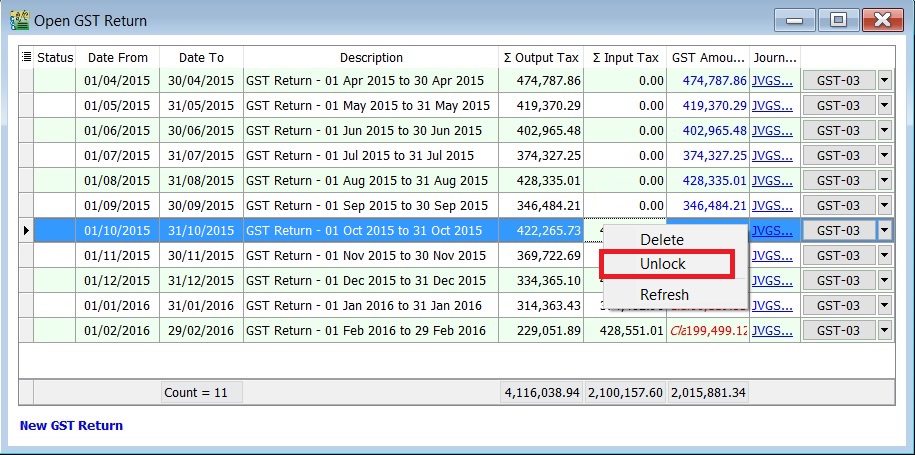

:1. Highlight the subsequent GST-03, eg. 01 Nov - 30 Nov 2015. | :1. Highlight on the subsequent GST-03, eg. for subsequent taxable period is 01 Nov - 30 Nov 2015. | ||

:2. Right and '''unlock''' it. | :2. Right and '''unlock''' it. | ||

::[[File: GST-GST-03 Amendment-13.jpg]] | ::[[File: GST-GST-03 Amendment-13.jpg]] | ||

Revision as of 07:17, 2 June 2016

GST-03 Amendment

- Available from version 781.731 and above

Introduction

- For those company who might asked and self report to RMCD for the GST-03 amendment. It could be because of applying wrong tax code or others reasons. Therefore, this guide will explain the features to perform amendment on the particular GST-03 and re-submit via TAP website.

GST-03 Amendment

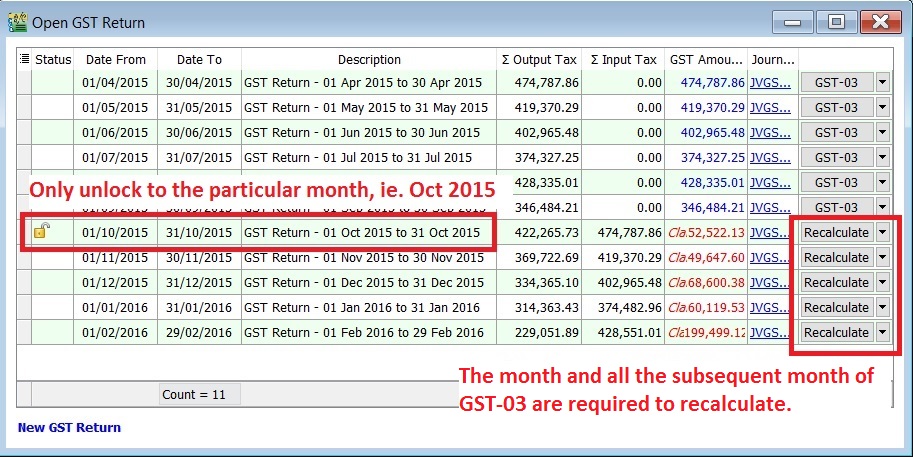

Menu: GST | Open GST Return...

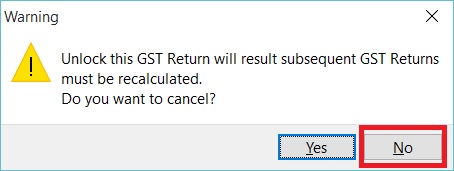

Important: Read the message before take further actions.

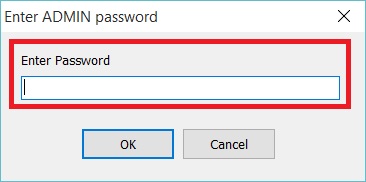

NOTE: ADMIN password only

- 5. Status will added Unlock icon. It means users are allow to amend the documents for the month unlock, eg. the documents are able to amend in Oct 2015 only.

NOTE: 1. The month and all the subsequent month of GST-03 will converted to "Recalculate" action. It is depends on the amendment which might trigger the bad debt relief result changed. 2. All the subsequent month of GST-03 are not allow to amend the documents (eg. invoice, credit note, supplied invoice, etc), unless you have Unlock it.

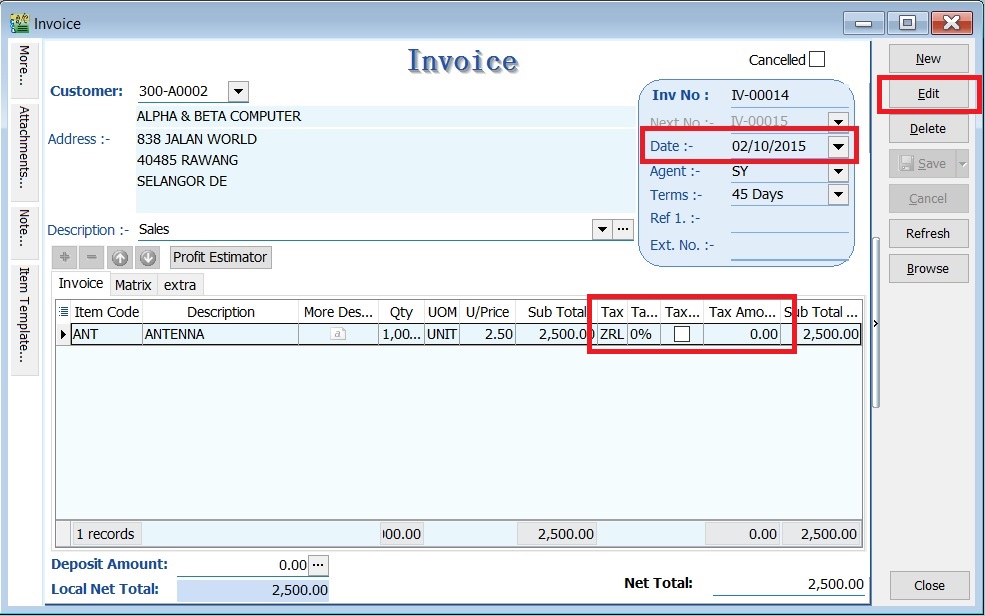

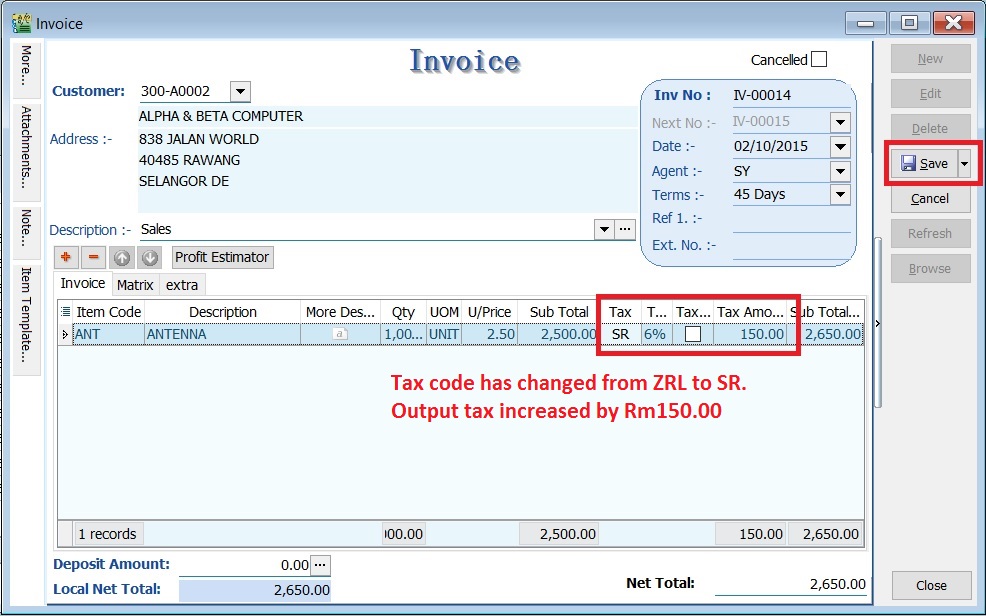

- 6.For example, to correct the tax code from ZRL to SR for the invoice amount Rm2,500.00.

NOTE: Unlock GST-03 is allow you to edit the documents only.

- 9. Press ok to proceed.

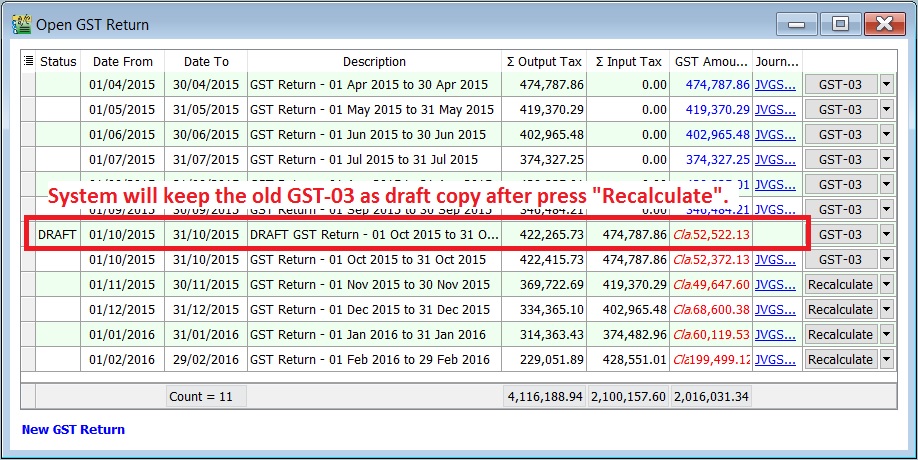

- 10. A draft copy of GST-03 for Oct 2015 will create automatically. A previous GST-03 before perform any amendment to the taxable period will converted as DRAFT status.

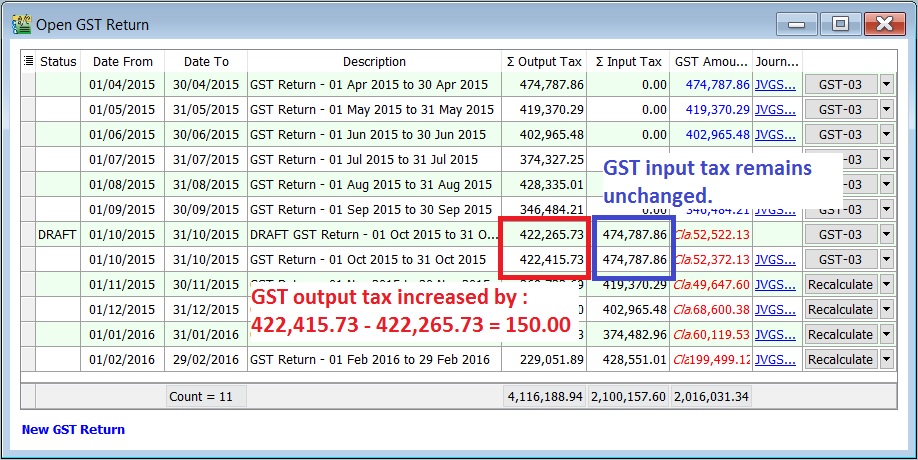

- 11. You can see the comparison between the draft (from Recalculate) and the Final GST-03 for the taxable period of Oct 2015.

Status Taxable Period Total Output Tax Total Input Tax 01 Oct - 31 Oct 2015 422,415.73 474,787.86 DRAFT 01 Oct - 31 Oct 2015 422,265.73 474,787.86 Increase/Descrese (-) 150.00 0.00

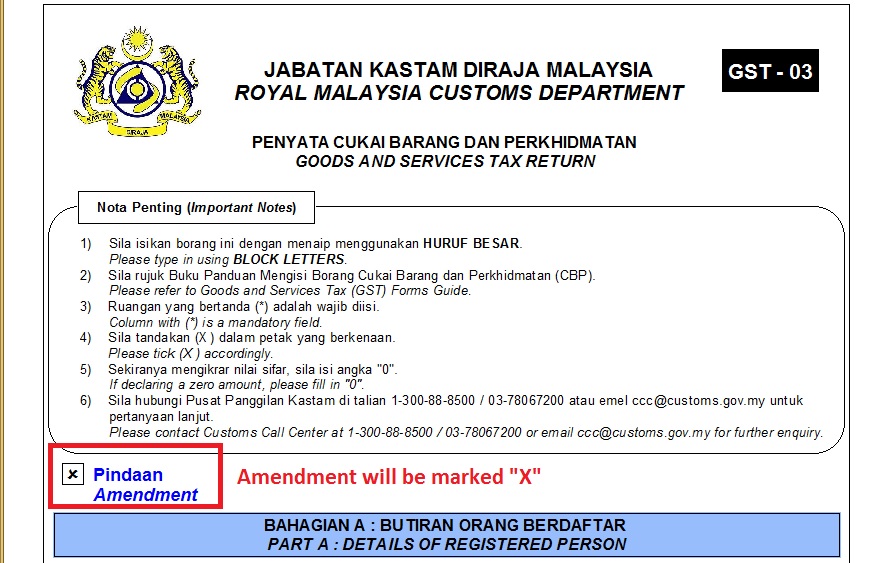

How to know the GST-03 has performed amendment?

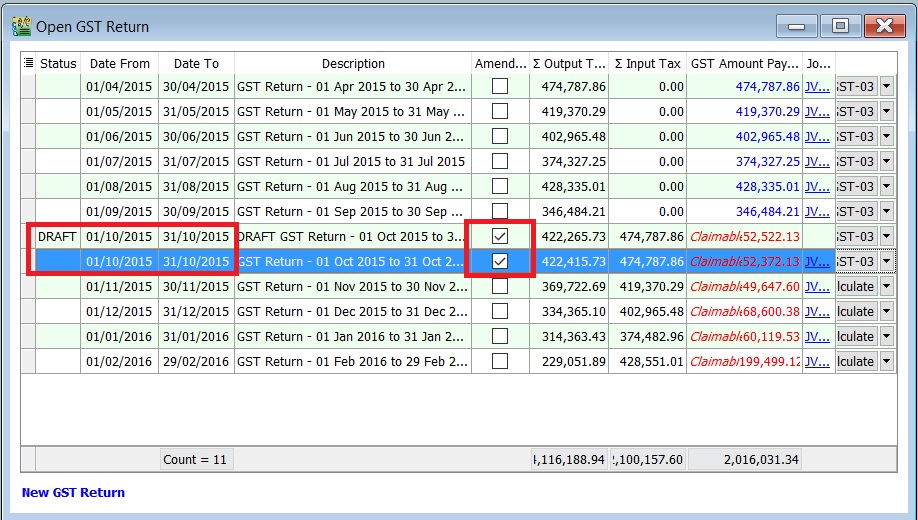

- 2. At the GST Returns, insert a grid column named Amendment. Usually, you will found the ticked on the amendment column for both DRAFT and final GST-03.

How to unlock the subsequent taxable period for amendment?

- 1. Highlight on the subsequent GST-03, eg. for subsequent taxable period is 01 Nov - 30 Nov 2015.

- 2. Right and unlock it.