(Created page with "<big>GST-03 Amendment</big> :''Available from version 781.731 and above'' ==Introduction== :For those company who might asked and self report to RMCD for the GST-03 amendment...") |

|||

| Line 15: | Line 15: | ||

<br /> | <br /> | ||

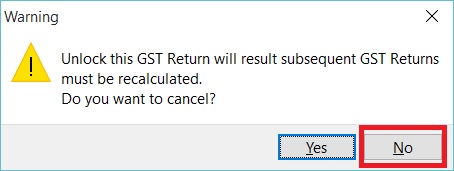

:3. Click on '''No''' to unlock this GST Return. | :3. Click on '''No''' to unlock this GST Return. | ||

::[[File: GST-GST-03 Amendment-03.jpg]] | |||

<br /> | <br /> | ||

'''Important:''' | '''Important:''' | ||

| Line 21: | Line 21: | ||

<br /> | <br /> | ||

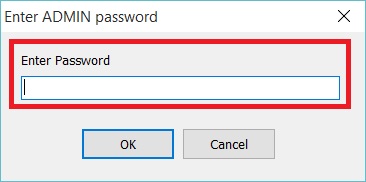

:4. Enter the ADMIN password. | :4. Enter the ADMIN password. | ||

::[[File: GST-GST-03 Amendment-04.jpg]] | |||

<br /> | <br /> | ||

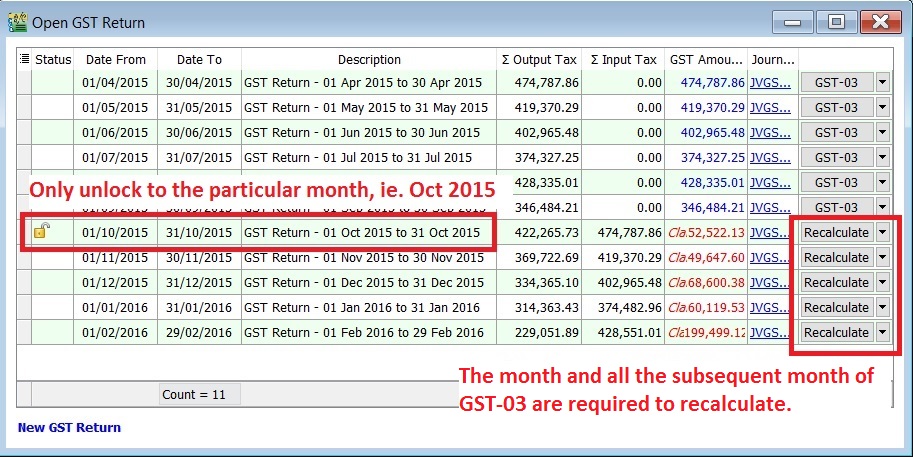

:5. Status will added '''Unlock''' icon. It means users are allow to amend the documents for the month unlock, eg. the documents are able to amend in Oct 2015 only. | :5. Status will added '''Unlock''' icon. It means users are allow to amend the documents for the month unlock, eg. the documents are able to amend in Oct 2015 only. | ||

::[[File: GST-GST-03 Amendment-05.jpg]] | |||

<br /> | <br /> | ||

'''Note:''' | '''Note:''' | ||

The month and all the subsequent month of GST-03 will converted to "Recalculate" action. It is depends on the amendment which might trigger the bad debt relief result changed. | The month and all the subsequent month of GST-03 will converted to "Recalculate" action. It is depends on the amendment which might trigger the bad debt relief result changed. | ||

==See also== | ==See also== | ||

* [[]] | * [[]] | ||

* [[]] | * [[]] | ||

Revision as of 04:03, 2 June 2016

GST-03 Amendment

- Available from version 781.731 and above

Introduction

- For those company who might asked and self report to RMCD for the GST-03 amendment. It could because applying wrong tax code or others reasons. Therefore, this guide will explain the features to perform amendment on the particular GST-03 and re-submit via TAP website.

GST-03 Amendment

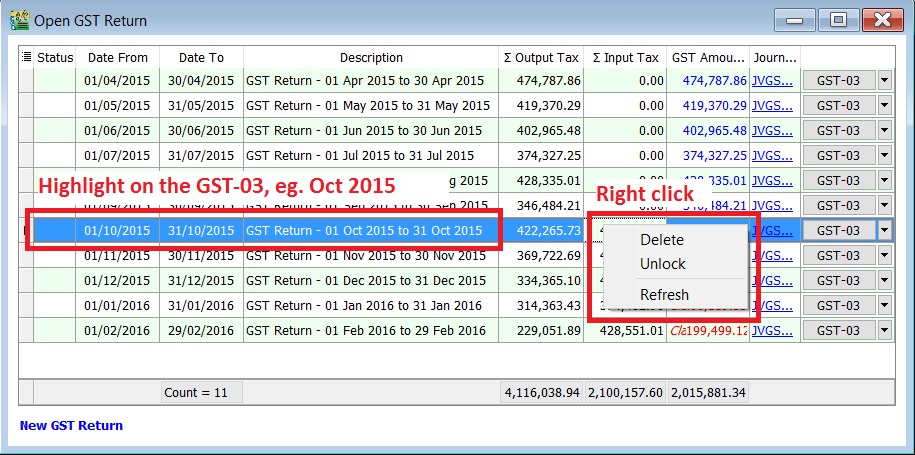

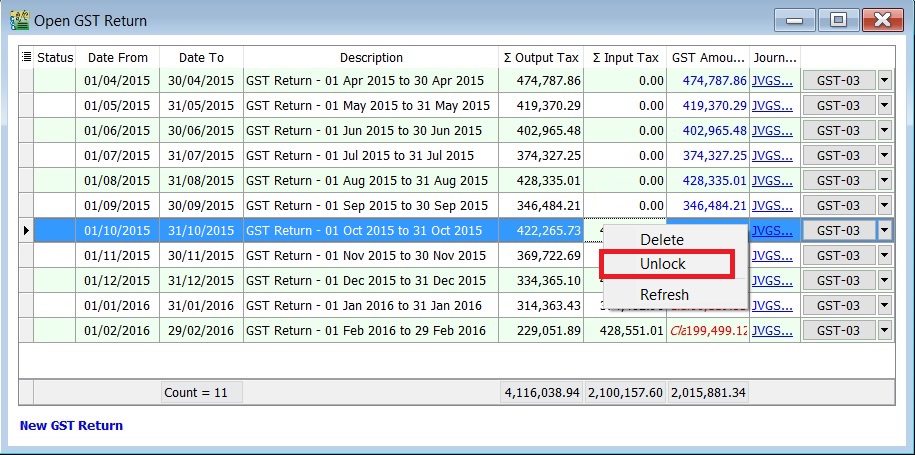

Menu: GST | Open GST Return...

Important: Read the message before take further actions.

- 5. Status will added Unlock icon. It means users are allow to amend the documents for the month unlock, eg. the documents are able to amend in Oct 2015 only.

Note: The month and all the subsequent month of GST-03 will converted to "Recalculate" action. It is depends on the amendment which might trigger the bad debt relief result changed.

See also

- [[]]

- [[]]