| Line 141: | Line 141: | ||

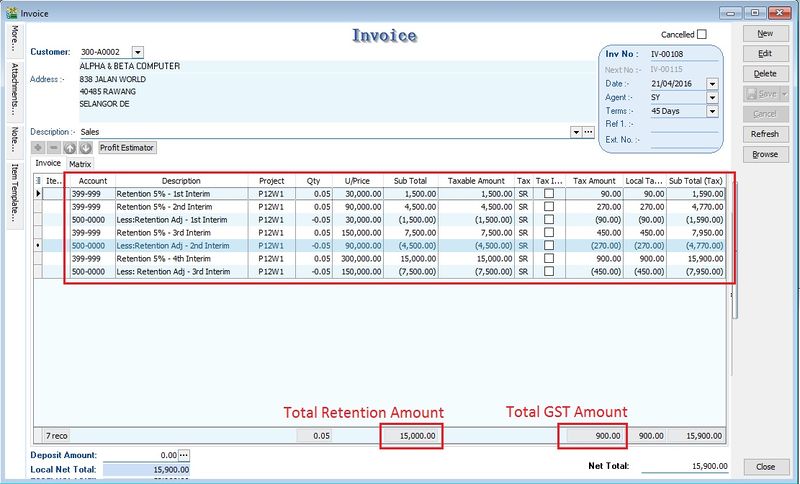

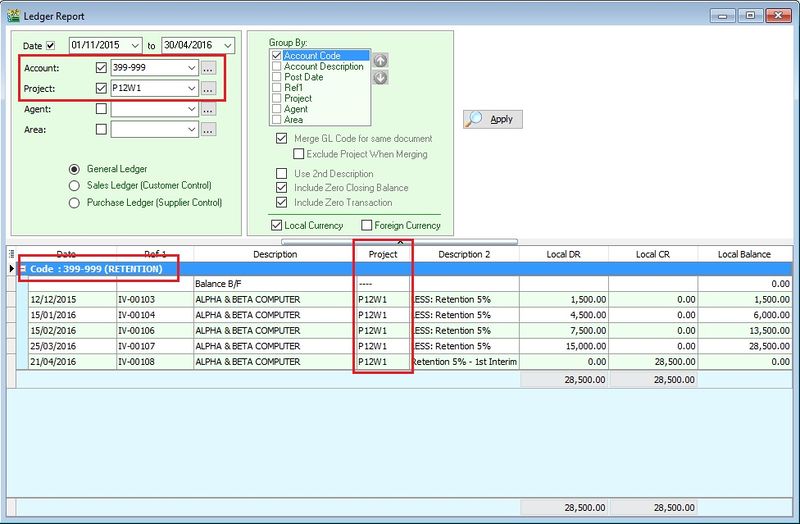

: 1. To check the retention balance report. See the screenshot below.<br /> | : 1. To check the retention balance report. See the screenshot below.<br /> | ||

: 2. If the retention balance is zero, it means the full settlement of retention sum. <br /> | : 2. If the retention balance is zero, it means the full settlement of retention sum. <br /> | ||

::[[File:Construction-GL Ledger-01.jpg | | ::[[File:Construction-GL Ledger-01.jpg | 800px]] | ||

==Highlight Changes== | ==Highlight Changes== | ||

Revision as of 07:47, 11 March 2016

Introduction

- This guide will teach you the way to enter the tax invoice to the Developer from Main Contractor.

- Time to account for GST is at the either of the following:-

- when payment is received;

- when tax invoice is issued;

- if no tax invoice has been issued within 21 days after the certificate of work done is issued.

- We have to look into and show the following items in order to calculate the GST amount in the Tax Invoice:

- Certified value - Progress claim value certified by Architect.

- Retention Amount - the amount of progress payment which is not paid until the conditions specified in the contract for the payment of such amounts have been met or until defects have been rectified.

- Progress payment

- For example, the Progress Payment:-

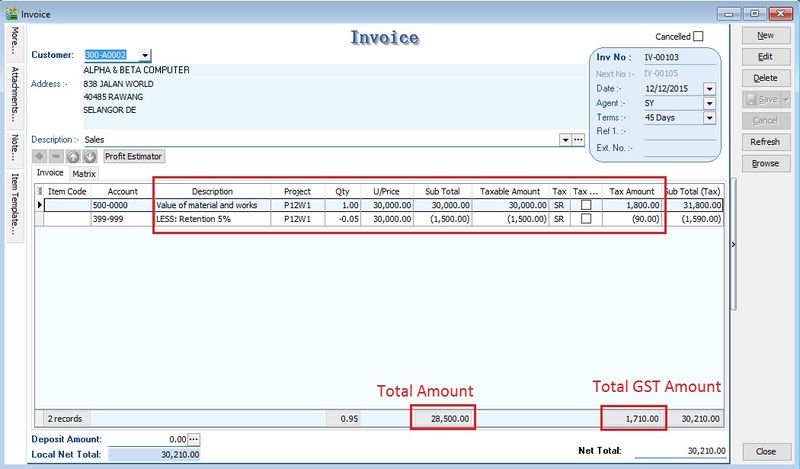

1st interim certificate Amount (Rm) Calculation Value of material and works (A1) 30,000.00 Less: Retention Sum (B1) (1,500.00) Rm30,000 x 5% Amount Paid (excl GST) 28,500.00 A1 - B1 GST Amount 1,710.00 Rm28,500 x 6% (SR)

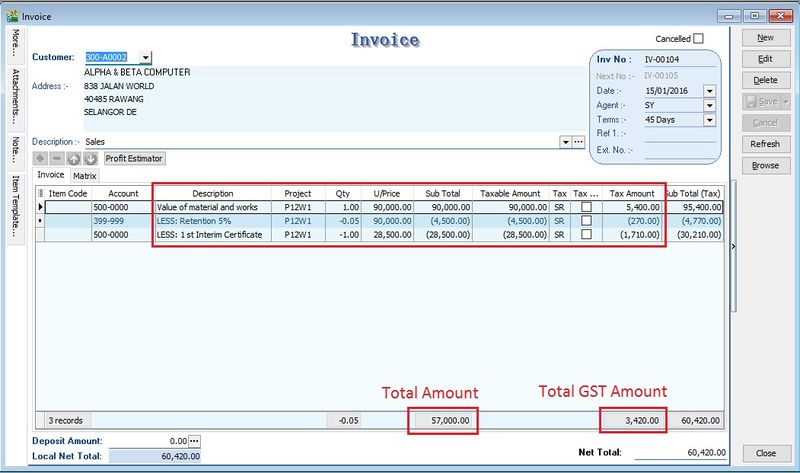

2nd interim certificate Amount (Rm) Calculation Value of material and works (A2) 90,000.00 Less: Retention Sum (B2) (4,500.00) Rm90,000 x 5% Less : 1st Interim Certificate (C2) (28,500.00) Amount Paid (excl GST) 57,000.00 A2 - B2 - C2 GST Amount 3,420.00 Rm57,000 x 6% (SR)

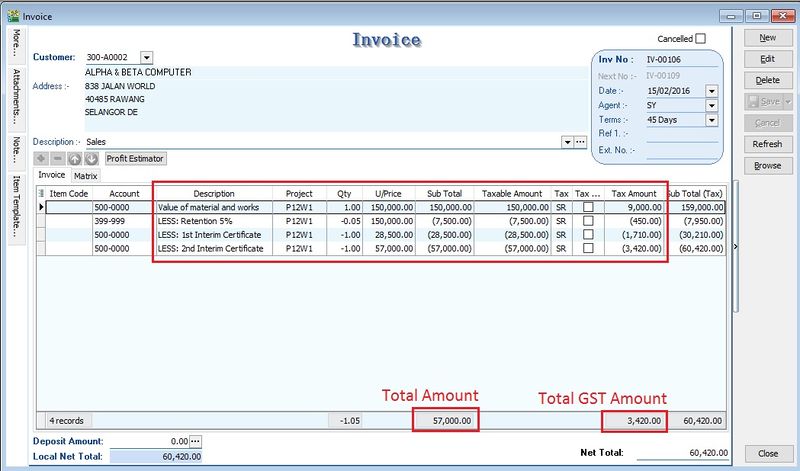

3rd interim certificate Amount (Rm) Calculation Value of material and works (A3) 150,000.00 Less: Retention Sum (B3) (7,500.00) Rm150,000 x 5% Less : 1st Interim Certificate (C3) (28,500.00) Less : 2nd Interim Certificate (D3) (57,000.00) Amount Paid (excl GST) 57,000.00 A3 - B3 - C3 - D3 GST Amount 3,420.00 Rm57,000 x 6% (SR)

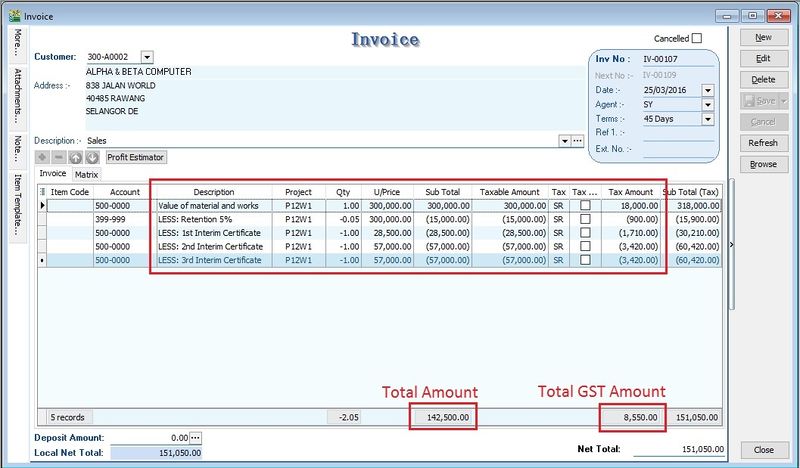

4th interim certificate Amount (Rm) Calculation Value of material and works (A4) 300,000.00 Less: Retention Sum (B4) (15,000.00) Rm300,000 x 5% Less : 1st Interim Certificate (C4) (28,500.00) Less : 2nd Interim Certificate (D4) (57,000.00) Less : 3rd Interim Certificate (E4) (57,000.00) Amount Paid (excl GST) 142,500.00 A4 - B4 - C4 - D4 - E4 GST Amount 8,550.00 Rm142,500 x 6% (SR)

- Lastly, the sum of retention will be invoiced after the full inspection of work done.

Retention Sum Amount (Rm) Calculation 1st Interim Certificate (R1) 1,500.00 2nd Interim Certificate (R2) 3,000.00 Rm4,500-1,500 3rd Interim Certificate (R3) 3,000.00 Rm7,500-4,500 4th Interim Certificate (R4) 7,500.00 Rm15,000-7,500 Total 15,000.00 GST Amount 900.00 Rm15,000 x 6% (SR)

Tax Invoice Entry

[Sales | Invoice...]

- 1. Click New.

- 2. Enter the detail as per below example screenshot.

NOTE: GL Account : 399-999 - Retention (Create under the Current Asset) You have to adjust each progress retention sum by less the previous progress retention sum and reverse back to the account use for the value of material and works.

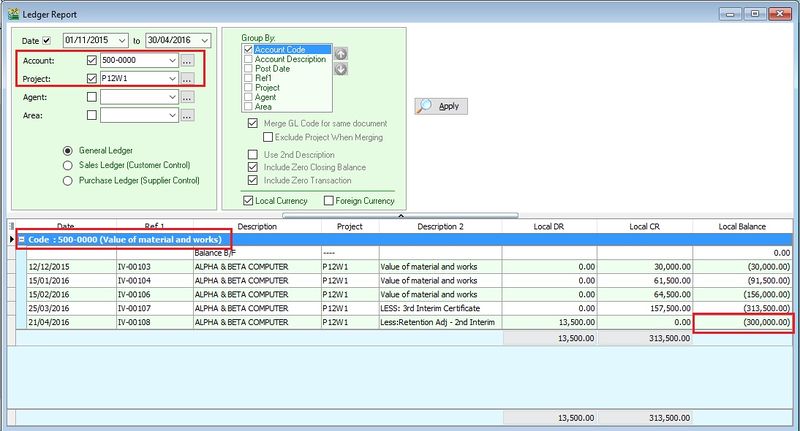

Value of Material and Works Report by Project

[GL | Print Ledger Report...]

- 1. To check the total value of material and works balance report. See the screenshot below.

- 2. You can see the total value of material and works adjusted with final result: Rm300,000.

Retention Report by Project

[GL | Print Ledger Report...]

Highlight Changes

| Date | Initiated by | Remarks |

|---|---|---|

| 12 December 2015 | Loo | Initial document. |

| 16 December 2015 | Admin | Correct the retention sum to Rm15,000 |