Migration System Features-How to handle the GST Past Documents Opening Balance for Customer and Supplier: Difference between revisions

From eStream Software

| Line 153: | Line 153: | ||

|- | |- | ||

| 10 Aug 2015 || SR || style="text-align:right;"| 902.92 || style="text-align:right;"| 54.17 || style="text-align:right;"| 957.09 | | 10 Aug 2015 || SR || style="text-align:right;"| 902.92 || style="text-align:right;"| 54.17 || style="text-align:right;"| 957.09 | ||

|}<br /> | |}<br /> | ||

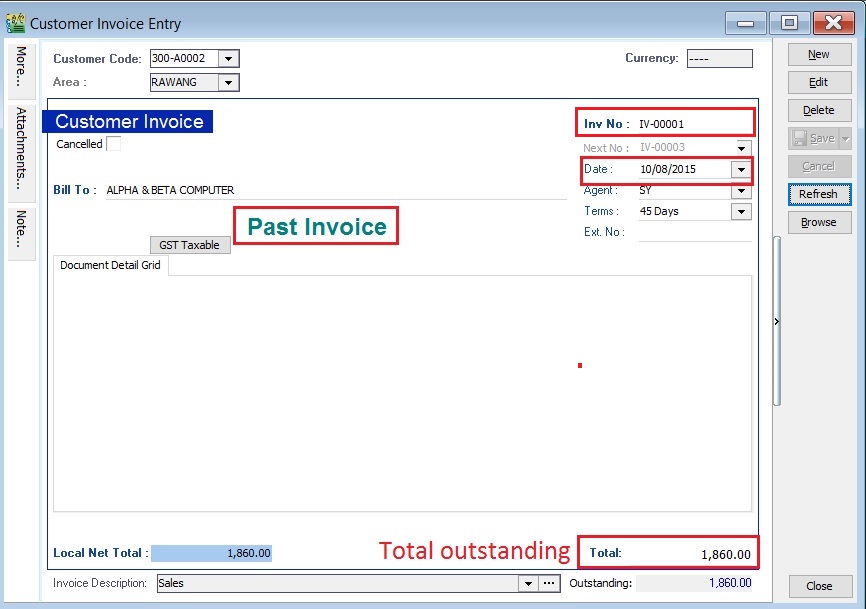

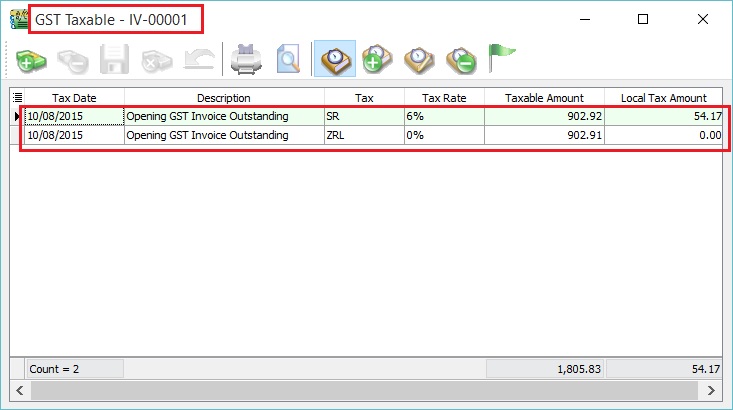

:: See example of '''past GST taxable''' in below screenshot.<br /> | :: See example of '''past GST taxable''' in below screenshot.<br /> | ||

Revision as of 07:59, 28 December 2015

How to handle the GST Past Documents Opening Balance for Customer and Supplier?

Introduction

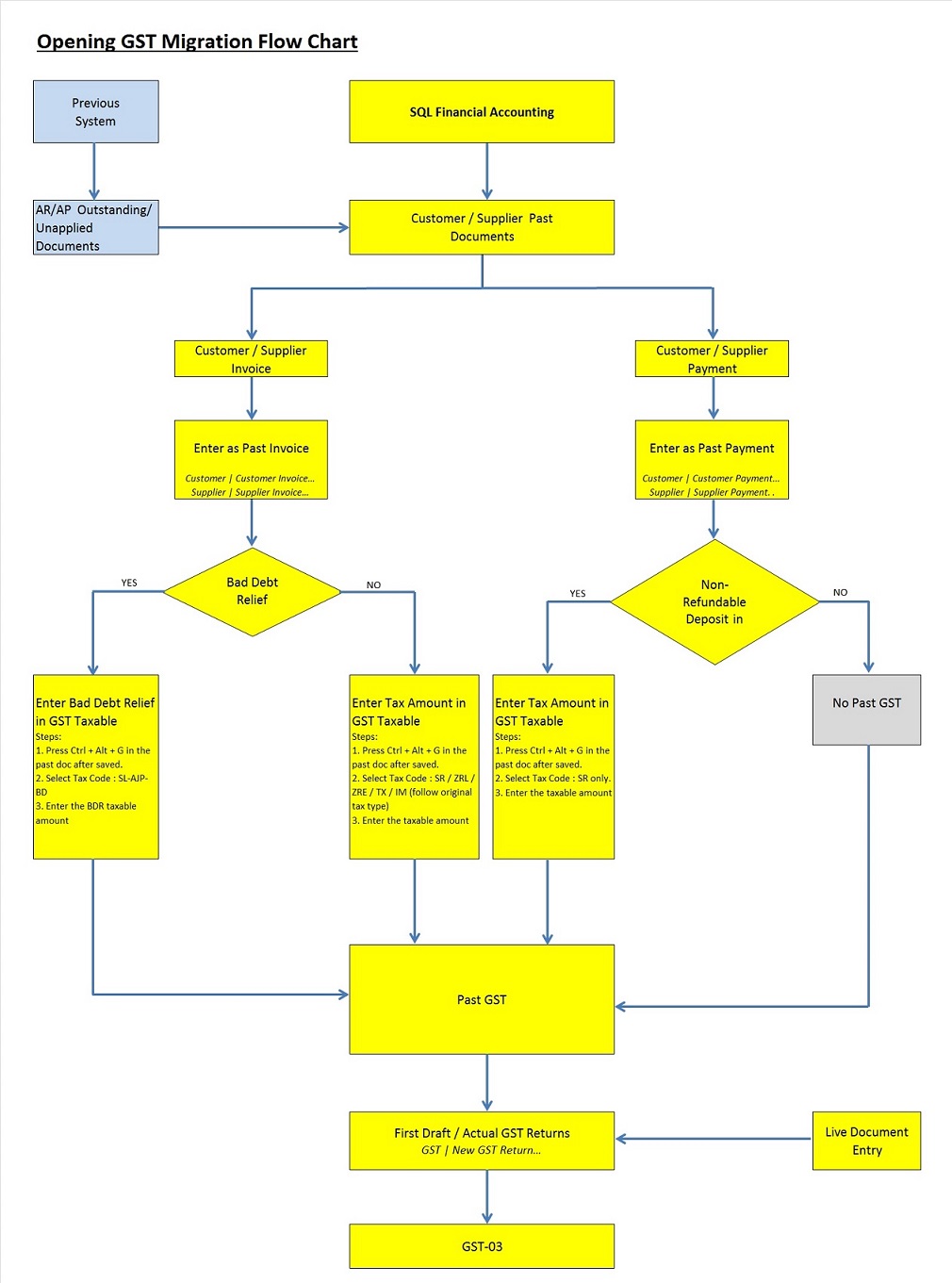

- This guide will teach you the way to handle the past outstanding documents for Customer and Supplier from previous accounting system. We are ensure that the data migration part go smooth with GST matters happened in previous system likes bad debt relief and non-refundable deposit.

How to enter the GST Past Documents?

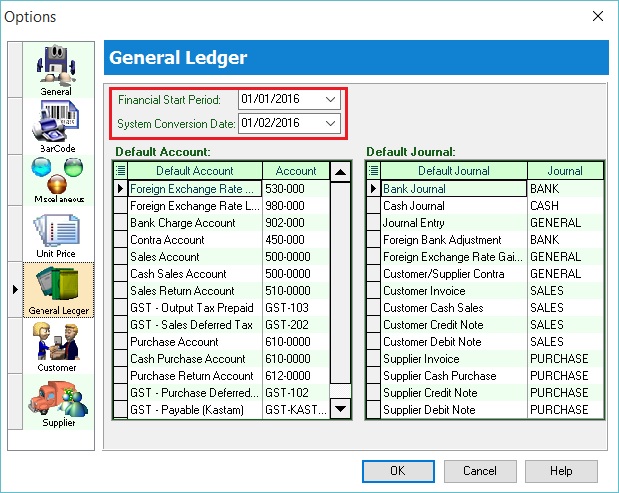

Financial Start Period and System Conversation Date

[Tools | Options...General Ledger]

- 1. Let's said under the Tools | Options... I have set the following:-

- Financial Start Period : 01 Jan 2016

- System Conversion Date : 01 Feb 2016 (Cut-off Date for Opening Entry)

- Financial Start Period : 01 Jan 2016

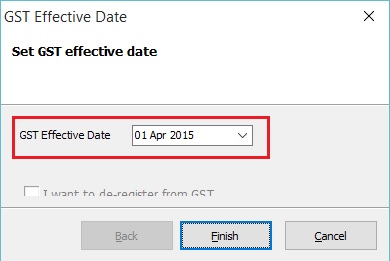

GST Effective Date

[GST | GST Effective Date...]

Enter the Past Documents (AR & AP)

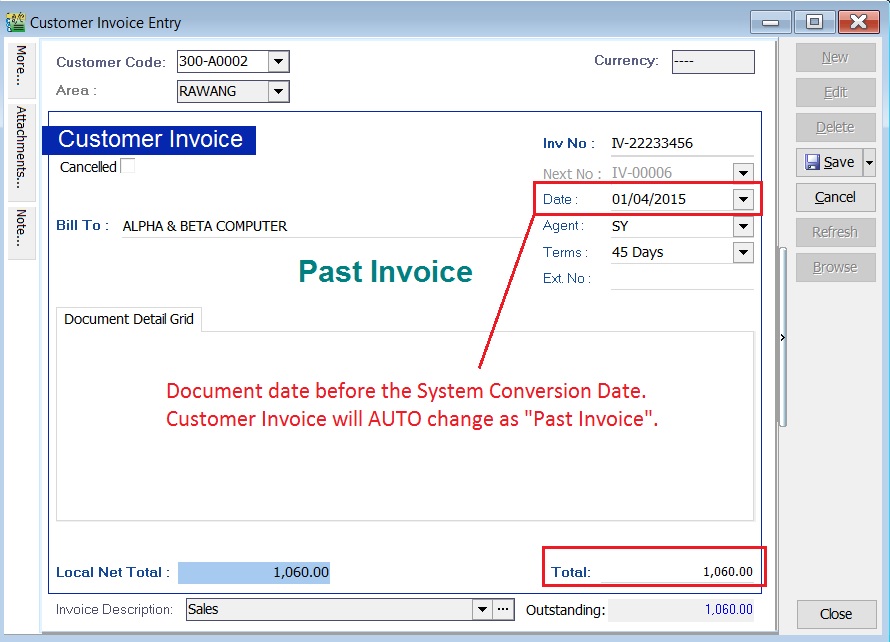

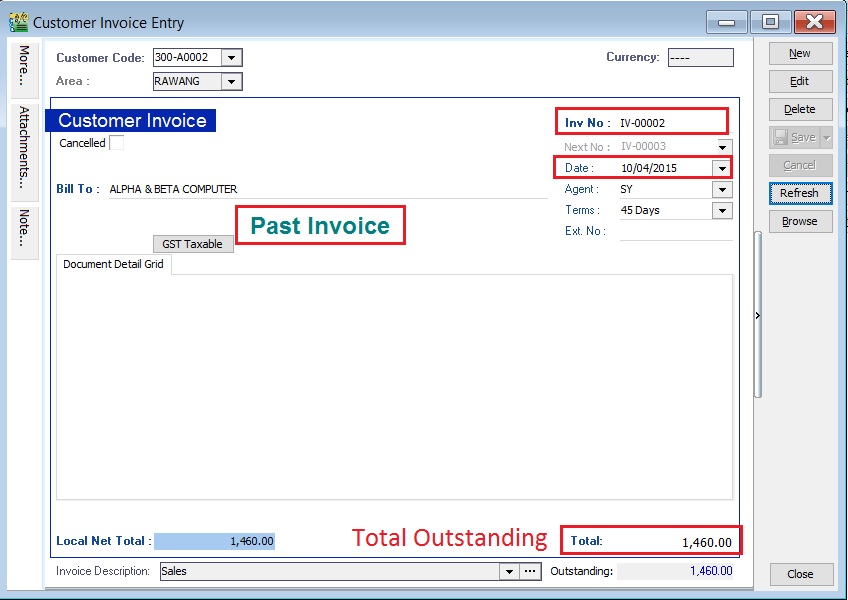

- 1. Create new customer/supplier invoice.

- 2. Enter the Invoice No.

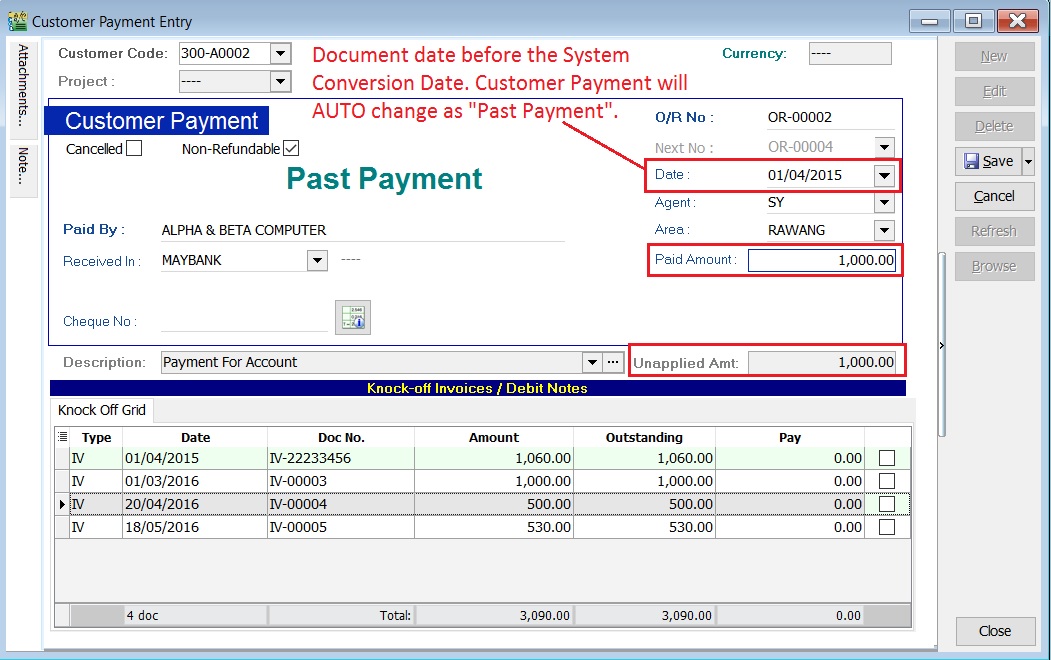

- 3. Enter the Original Invoice Date. Date before the system conversation date, the document will converted to "Past Invoice" automatically.

- 4. Enter the Outstanding Invoice Balance into Total.

- 5. Save it.

- 6. See screenshot below.

- 7. Take note to the below table.

Action Where to Enter? To enter the Customer Past Tax Invoice a. Go to Customer / Customer Invoice...

b. Refer the above step 1.To enter the Supplier Past Tax Invoice a. Go to Supplier / Supplier Invoice...

b. Refer the above step 1.To enter the Customer Past Non-Refundable Deposit a. Customer / Customer Payment...

b. Refer the above step 1.

c. Tick the Non-Refundable checkbox.

Enter the GST Taxable for Past Documents (AR & AP)

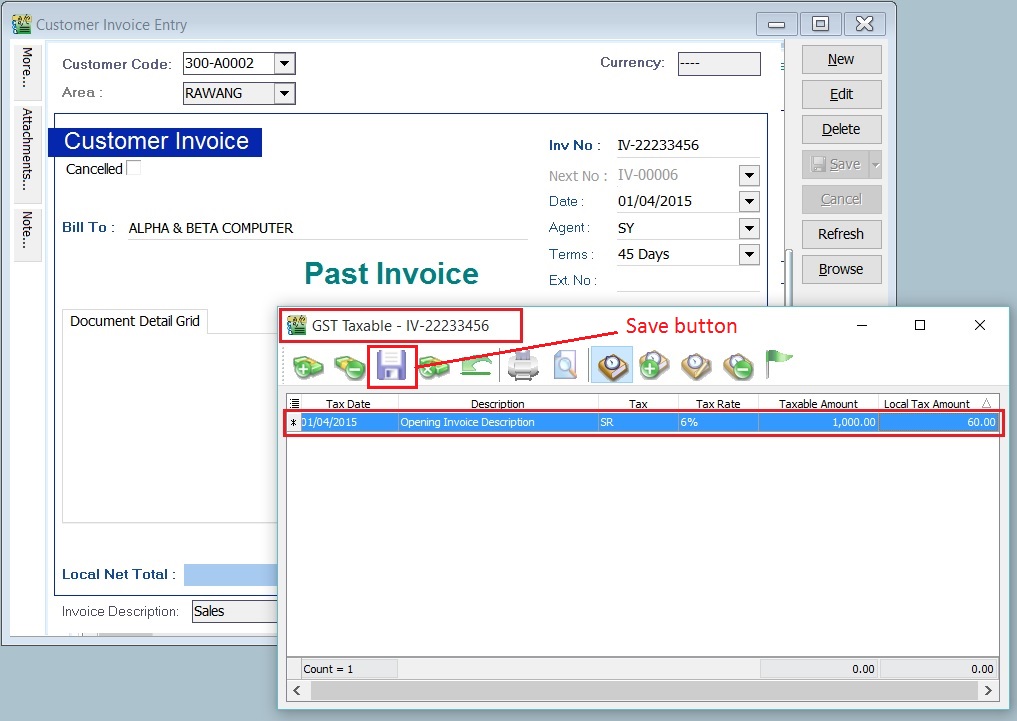

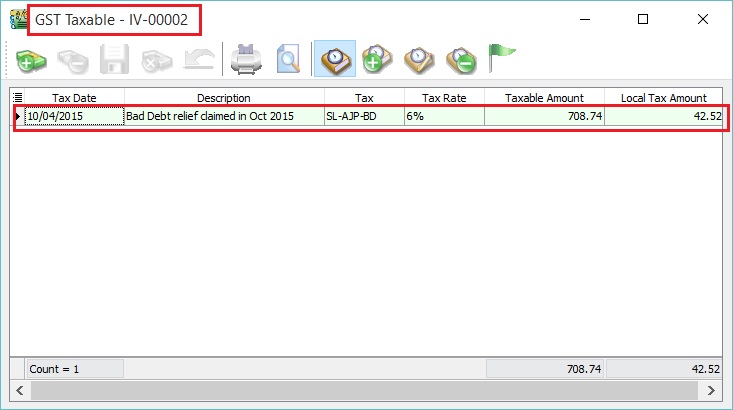

- 1. Open the past tax invoice document.

- 2. Press CTRL + ALT + G.... You able to assign the tax code (SR / ZRL / ZRE / TX / IM...etc), the taxable amount (eg. Rm 1,000.00) and the tax amount (eg. Rm 60.00) for past document.

- 3. Save it.

- 4. See screenshot below.

- 5. Take note to the below table.

Action Where to Enter? To enter GST Taxable for the Customer Past Tax Invoice a. Go to Customer / Customer Invoice...

b. Refer the above step 1.

c. Tax code commonly apply to this matter is SR / ZRL / ZRE / SL_AJP-BD (for bad debt relief claimed as input tax in old system).To enter GST Taxable for the Supplier Past Tax Invoice a. Go to Supplier / Supplier Invoice...

b. Refer the above step 1.

c. Tax code commonly apply to this matter is TX / IM / PH_AJS-BD (for bad debt relief paid as output tax in old system).To enter GST Taxable for the Customer Past Non-Refundable Deposit a. Go to Customer / Customer Payment...

b. Refer the above step 1.

c. Tax code commonly apply to this matter is SR.

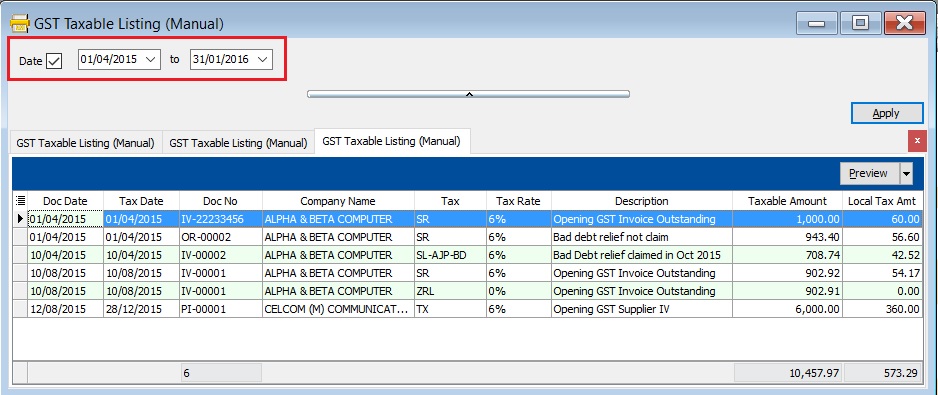

Past Documents GST Taxable Listing

[GST | Print GST Taxable Listing (Manual)...]

- 1. Select the date range to apply.

date from (GST effective date) and date to (before the system conversion date).

- 2. See screenshot below.

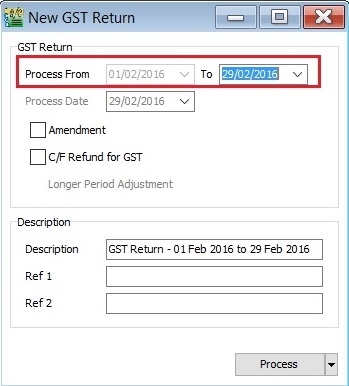

GST Returns

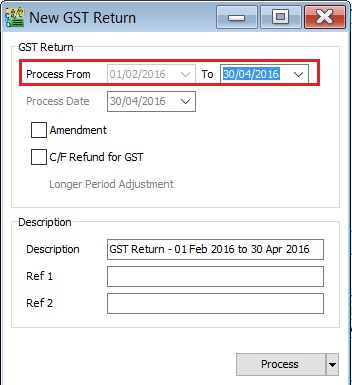

[GST | New GST Return...]

- 1. Select the date range. See screenshot below.

- b. Quarterly (eg. 01/02/2016 - 30/04/2016)

- 2. Click to Process.

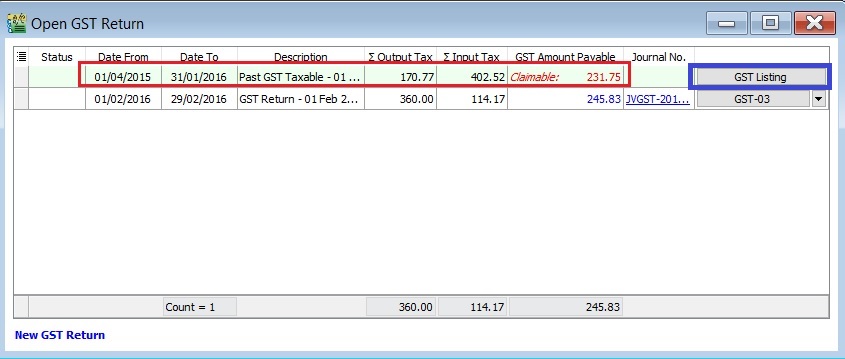

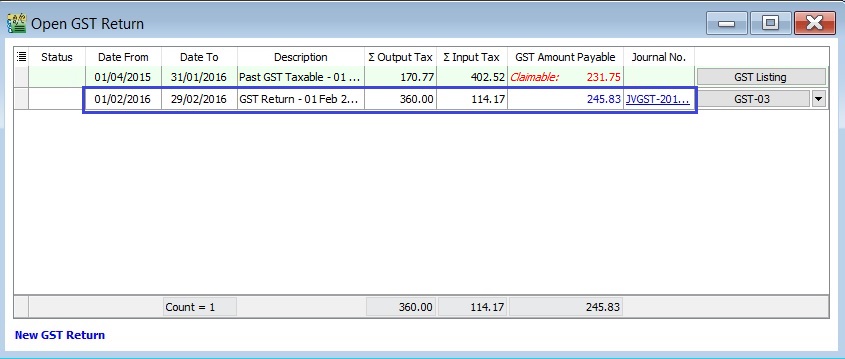

- 3. Past GST transactions will generated automatically after click Process. See below screenshot.

Tips: To check the past GST listing, click on GST Listing button.

SPECIAL CASES

Case 1: Claim bad debt relief based on the outstanding in SQL Accounting

- 1. Old System

- a. Invoice:

- Invoice No: IV-00001

- Invoice Date: 10 Aug 2015

- Invoice Doc Amount: 2,060.00

- Invoice Details:

Tax Local Amount Local Tax Amount SubTotal SR 1,000.00 60.00 1,060.00 ZRL 1,000.00 0.00 1,000.00 Total 2,060.00

- b. Payment:

- OR Date: 20 Aug 2015

- Knock-Off Amount: 200.00

- c. Invoice Outstanding: 1,860.00

- 2. SQL Account

- a. Past Invoice:

- Past Invoice No: IV-00001

- Past Invoice Date: 10 Aug 2015

- Past Invoice Total: 1,860.00

NOTE: User should key-in the total outstanding in the Past Invoice, eg. 2,060.00 - 200.00 = 1,860.00.

- b. Past GST Taxable Detail:

Tax Date Tax Taxable Amount Local Tax Amount SubTotal 10 Aug 2015 SR 902.92 54.17 957.09

Case 2: Bad debt relief claimed and partial recover in Old System; partial or fully recover in SQL Account

- 1. Old System

- a. Invoice:

- Invoice No: IV-00002

- Invoice Date: 10 April 2015

- Invoice Doc Amount: 2,060.00

- Invoice Details:

Tax Local Amount Local Tax Amount SubTotal SR 1,000.00 60.00 1,060.00 ZRL 1,000.00 0.00 1,000.00 Total 2,060.00

- b. Payment #1:

- OR Date: 20 April 2015

- Knock-Off Amount: 200.00

- Bad Debt Relief:

Tax Date Tax Local Amount Local Tax Amount 31 Oct 2015 AJP-BD 902.92 54.17

- c. Payment #2:

- OR Date: 01 Nov 2015

- Knock-Off Amount: 400.00

- Bad Debt Recover:

Tax Date Tax Local Amount Local Tax Amount 01 Nov 2015 AJS-BD 194.18 11.65

- d. Invoice Outstanding: 1,460.00

- 2. SQL Account

- a. Past Invoice:

- Past Invoice No: IV-00002

- Past Invoice Date: 10 April 2015

- Past Invoice Total: 1,460.00

NOTE: User should key-in the total outstanding in the Past Invoice, eg. 2,060.00 - 200.00 - 400.00= 1,460.00.

- b. Past GST Taxable Detail:

Tax Date Tax Taxable Amount Local Tax Amount SubTotal 31 Oct 2015 SL-AJP-BD 708.74 42.52 751.26

NOTE: User is not allowed to key-in payment #1 and payment #2 in SQL Account. Outstanding Taxable amount = 902.92 (Payment #1) - 194.18 (Payment #2) = 708.74 Bad debt relief not recover = 54.17 (Payment #1) - 11.65 (Payment #2) = 42.52 Any current payment knock-off to the above invoice will automatically treat as bad debt recover in next taxable period.