| Line 185: | Line 185: | ||

| 5 || GST-EN Bad Debt Relief-Unclaimed Letter 2 || English version bad debt relief unclaimed letter format 2 to Director General | | 5 || GST-EN Bad Debt Relief-Unclaimed Letter 2 || English version bad debt relief unclaimed letter format 2 to Director General | ||

|- | |- | ||

| 6 || GST Lampiran 4 - Ringkasan Maklumat Permohanan Tuntutan Pelepasan Hutang Lapuk | Lampiran 4 as requested by Kastam Officer | | 6 || GST Lampiran 4 - Ringkasan Maklumat Permohanan Tuntutan Pelepasan Hutang Lapuk || Lampiran 4 as requested by Kastam Officer | ||

|} | |} | ||

<br /> | <br /> | ||

Revision as of 04:04, 22 December 2015

GST Bad Debt Relief

Introduction

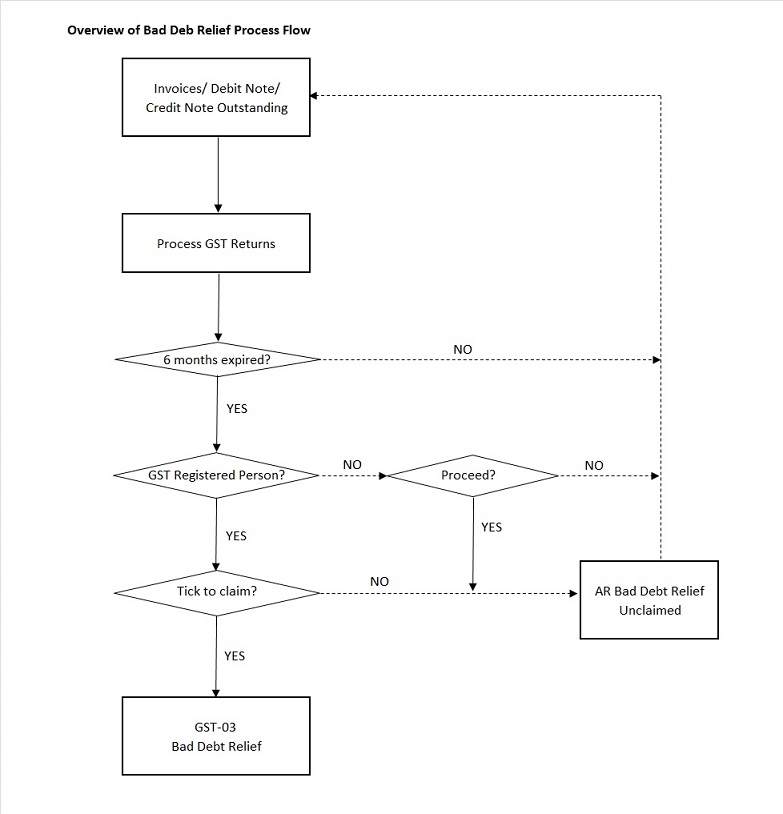

- A taxable person may claim bad debt relief subject to the requirements and conditions set forth under sec.58 of the GSTA 2014 and the person has not received any payment or part of the payment in respect of the taxable supply from the debtor after the sixth month from the date of supply.

- The bad debt relief may be claimed if - (amended on 28 Oct 2015 from DG Decision)

- (a) requirements under s.58 GSTA and Part X of GST Regulations 2014 are fulfilled; and

- (b) the supply is made by a GST registered person to another GST registered person

- The bad debt relief shall be claimed immediately in the taxable period after the expiry of the sixth month from the date of supply. If the bad debt relief is not claimed by the supplier in the immediate taxable period immediately after the expiry of the sixth month, then the taxable person has to notify the Director General (DG) within 30 days after the expiry of the sixth month on his intention to claim at a later date.

- A GST registered person who has made the input tax claim but fails to pay his supplier within six months from the date of supply shall account for output tax immediately after the expiry of the sixth month (s.38(9) GSTA).

- The word ‘month’ in sec.58 refers to calendar month or complete month –

- Example: Invoice issued at 15 th January 2017. For monthly taxable period, the sixth month expires at the end of June and the bad debt relief shall be claimed in July taxable period.

Maintain Tax

[GST | Maintain Tax...]

- Below tax code will be AUTO used for Bad Debt Relief matter when process GST Return:

Tax Code Description Tax Acc Entry Explanation PH-AJP-BD Input Tax adjustment e.g: Bad Debt Relief DR GST-Claimable

CR GST-Purchase Deferred TaxFor supplier bad debt relief recovered SL-AJP-BD Input Tax adjustment e.g: Bad Debt Relief DR GST-Claimable

CR GST-Sales Deferred TaxFor customer bad debt relief claim PH-AJS-BD Output Tax adjustment e.g: Bad Debt Recover, outstanding invoice > 6 months DR Sales Deferred Tax

CR GST-PayableFor customer bad debt relief recovered SL-AJS-BD Output Tax adjustment e.g: Bad Debt Recover, outstanding invoice > 6 months DR GST-Purchase Deferred Tax

CR GST-PayableFor supplier bad debt relief payable

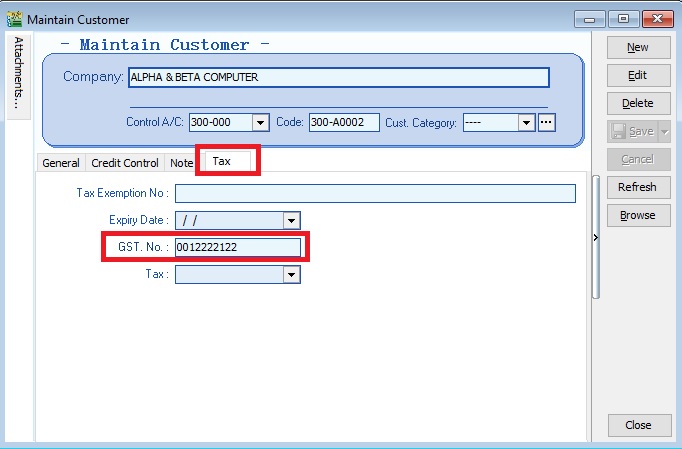

Maintain Customer

[Customer | Maintain Customer...]

- 1. There is one condition to determine the bad debt relief can be claimed if -

- (a) requirements under s.58 GSTA and Part X of GST Regulations 2014 arefulfilled; and

- (b) the supply is made by a GST registered person to another GST registered person

- (a) requirements under s.58 GSTA and Part X of GST Regulations 2014 arefulfilled; and

- 2. Therefore, you need to update the GST No for your customer who is GST registered person. See the screenshot below.

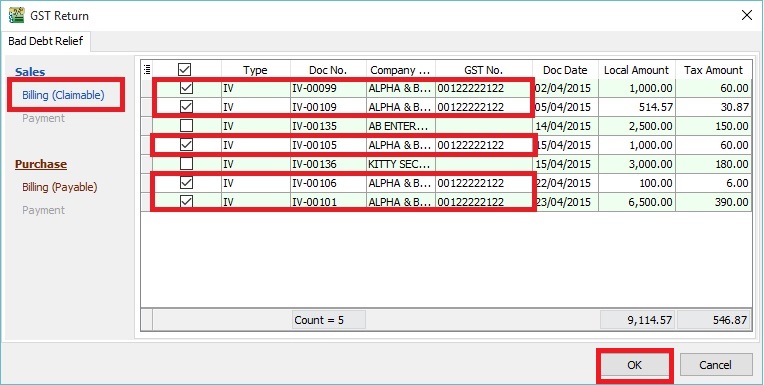

Process GST Returns

[GST | New GST Return...]

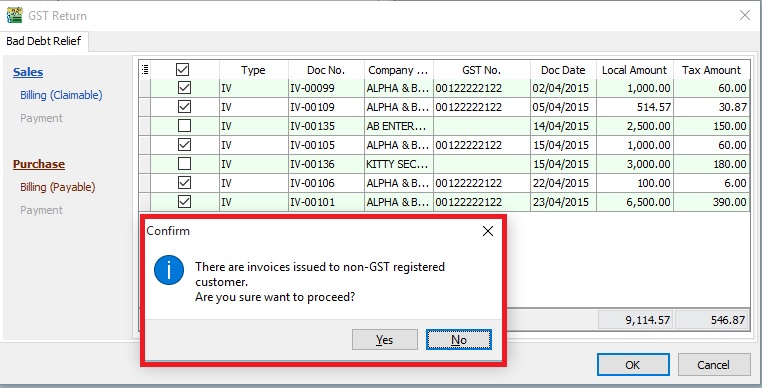

- 1. Process GST Return. For example, process from 01/10/2015 to 31/10/2015.

- 2. Bad Debt Relief screen will be prompted (see the screenshot below) if the system found there are outstanding Tax Invoices has expired at 6 months.

- 3. Sales documents from the company has empty GST No will be unticked. You can tick the documents if you think this company is a GST Registered person.

Tips:To avoid to tick the documents manually for GST Registered company, please go to update the GST no at Maintain Customer.

- 4. Press OK if get a "confirm" message prompted (see the screenshot below), it means there are some company do not have GST No.

- 5. If you has confirmed that the company is Non-GST Registered person then you can press YES to proceed.

- 6. Otherwise press NO, you have to update the GST No at Maintain Customer to confirm the company is a GST Registered person before process the GST Return.

GST Listing

[GST | Print GST Listing...]

- Category Others will appeared in GST Listing if there is found bad debt relief (eg. AJS-BD, AJP-BD):

Category : Others Local Amount Local Tax Amount AJS-BD (Output Tax adjustment e.g: Bad Debt Recover, outstanding invoice > 6 months) 17,000.00 1,020.00 AJP-BD (Input Tax adjustment e.g: Bad Debt Relief) 9,114.57 546.87

GST-03

[GST | Print GST-03...]

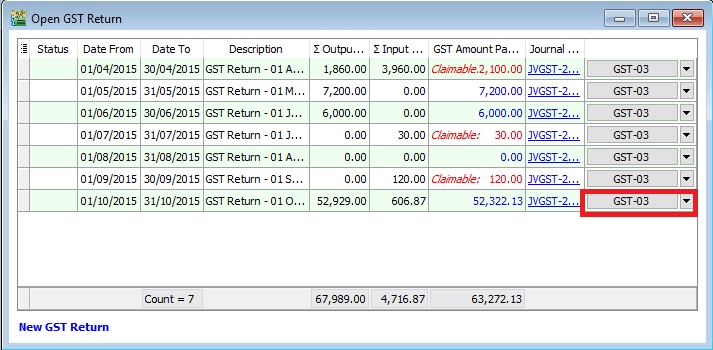

- 1. At GST Return screen, you can direct preview the GST-03 by click on the GST-03 button (see the screenshot below).

- 2. GST-03 result from the above sample data:

GST-03 # Description Amount 5a Total Value of Standard Rated Supply 0.00 5b Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments) 1,020,.00 6a Total Value of Standard Rate and Flat Rate Acquisitions 0.00 6b Total Input Tax (Inclusive of Tax Value on Bad Debt Relief & other Adjustments) 546.87 17 Total Value of Bad Debt Relief Inclusive Tax 9,661.44 18 Total Value of Bad Debt Relief Recovered Inclusive Tax 0.00

Print GST Bad Debt Relief

[GST | Print GST Bad Debt Relief…]

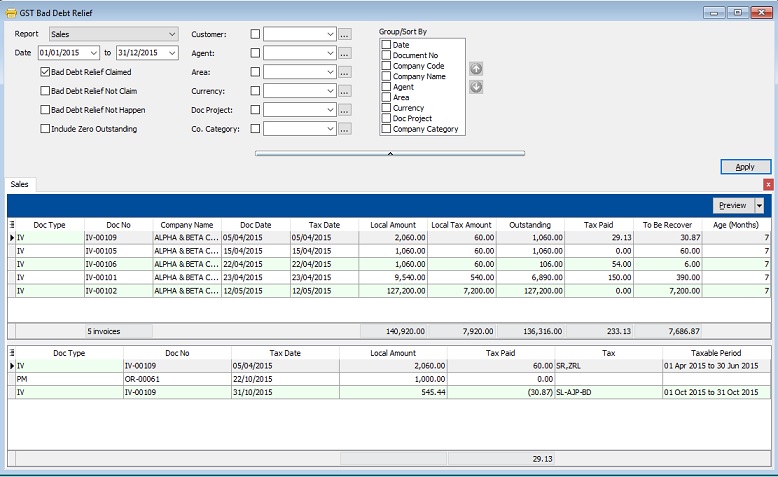

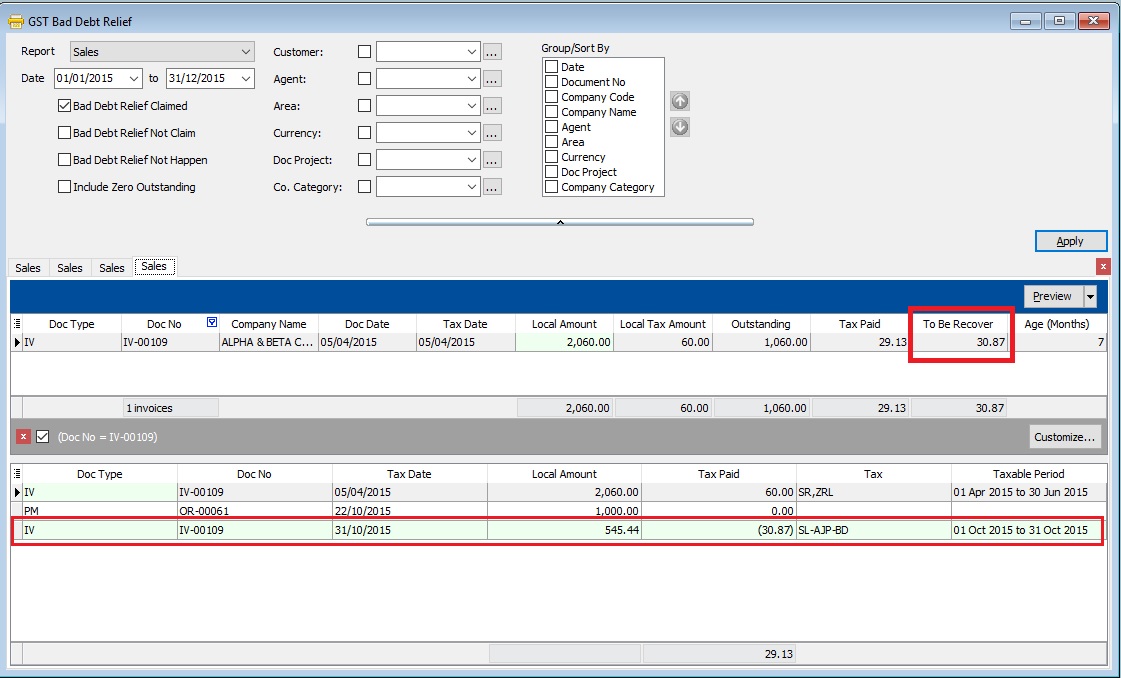

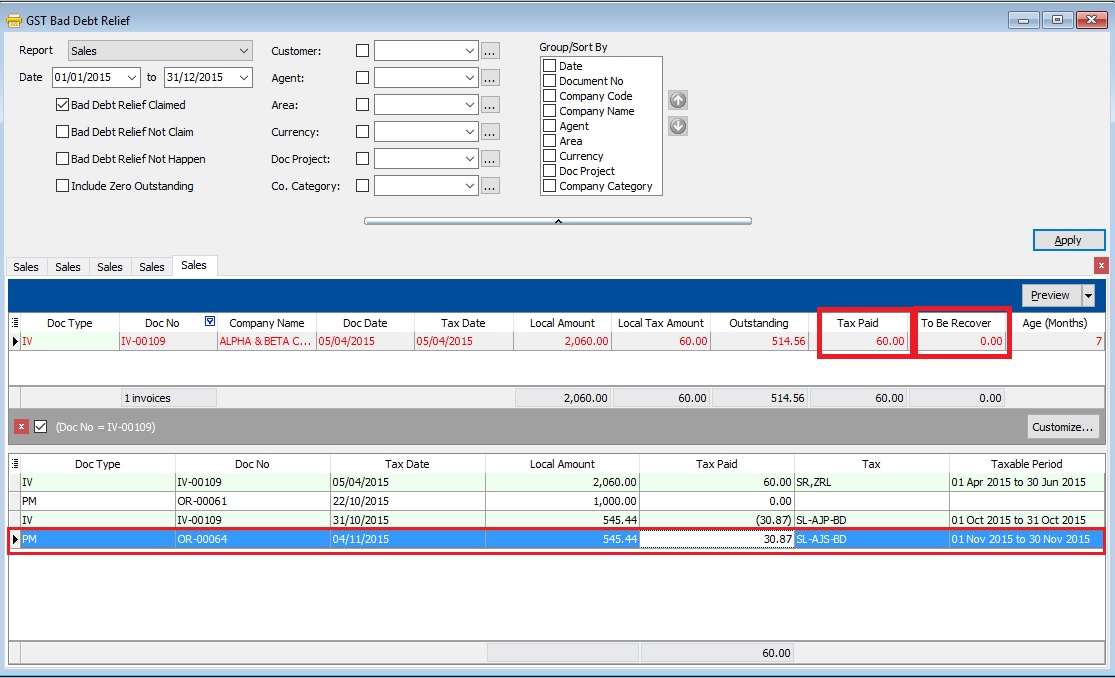

- 2. Let said the IV-00109 has the following details:-

Seq Description Amount Tax Tax Amount Amount with Tax 1 Sales of coconut can drinks 1,000.00 SR 60.00 1,060.00 2 Sales of coconut 1,000.00 ZRL 0.00 1,000.00

- 3. From the below report, it tells you that the bad debt relief claimed and to be recover at Rm30.87 for IV-00109. You can found at the detail that the bad debt relief claimed at Taxable Period 01 Oct 2015 to 31 Oct 2015.

- 4. After the IV-00109 has been full settlement in month Nov 2015, you will found the full tax paid Rm60.00 and to be recover will be shown as 0. You can found at the detail that the bad debt relief recovered at Taxable Period 01 Nov 2015 to 30 Nov 2015.

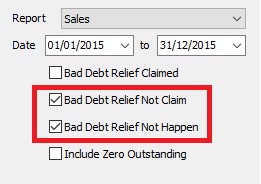

- 5. There are some option can choose to apply the GST Bad Debt Relief for further checking:

- Sales

Checkbox Explanation Bad Debt Relief Claimed GST bad debt relief that you HAVE TICKED to claim on outstanding invoices when process your GST returns. Bad Debt Relief Not Claim GST bad debt relief that you DO NOT TICKED to claim on outstanding invoices when process your GST returns. Bad Debt Relief Not Happen Outstanding invoices the GST Amount not expired at 6 months GST bad debt relief. Include Zero Outstanding To include the outstanding invoices are zero.

- Purchase

Checkbox Explanation Bad Debt Relief Paid GST bad debt relief have paid on the outstanding supplier invoices when process your GST returns. Bad Debt Relief Not Pay GST bad debt relief not pay yet on the outstanding supplier invoices. It could be due to late receive the supplier invoice. Bad Debt Relief Not Happen Outstanding invoices the GST Amount not expired at 6 months GST bad debt relief. Include Zero Outstanding To include the outstanding invoices are zero.

- 6. Click Preview button. You can found the following report list.

# Report Name Usage 1 GST Bad Debt Relief - Sales GST Bad Debt Relief Listing with detail based on the checkbox ticked. 2 GST-BM Bad Debt Relief-Unclaimed Letter 1 Bahasa Malaysia bad debt relief unclaimed letter format 1 to Director General 3 GST-BM Bad Debt Relief-Unclaimed Letter 2 Bahasa Malaysia bad debt relief unclaimed letter format 2 to Director General 4 GST-EN Bad Debt Relief-Unclaimed Letter 1 English version bad debt relief unclaimed letter format 1 to Director General 5 GST-EN Bad Debt Relief-Unclaimed Letter 2 English version bad debt relief unclaimed letter format 2 to Director General 6 GST Lampiran 4 - Ringkasan Maklumat Permohanan Tuntutan Pelepasan Hutang Lapuk Lampiran 4 as requested by Kastam Officer

TIPS :

To print the bad debt relief unclaimed letter, you must tick both "Bad Debt Relief Not Claim" and "Bad Debt Relief Not Happen".