| Line 41: | Line 41: | ||

|- | |- | ||

| GST - IM || style="text-align:right;"| 72.77 || C x 6% = Rm1,212.75 x 6% | | GST - IM || style="text-align:right;"| 72.77 || C x 6% = Rm1,212.75 x 6% | ||

|} | |}<br /> | ||

<br /> | |||

Usually, the forwarder will invoice to the principal company for the following details:- | Usually, the forwarder will invoice to the principal company for the following details:- <br /> | ||

{| class="wikitable" | {| class="wikitable" | ||

|- | |- | ||

| Line 60: | Line 59: | ||

|} | |} | ||

<br /> | <br /> | ||

''NOTE : ''<br /> | ''NOTE : ''<br /> | ||

GST Import can be calculated in different way. It might based on total weight (ie. weight x container) or total meter square (ie,meter square x container). | GST Import can be calculated in different way. It might based on total weight (ie. weight x container) or total meter square (ie,meter square x container). | ||

Revision as of 03:38, 10 December 2015

Import Goods (IM)

Introduction

IM - "Import of goods with GST incurred". It means there is an input tax claimable. Tax rate is 6%.

Purchase of goods from oversea supplier, the supplier invoice received will not incurred GST. However, the GST will be taken place when the goods are discharged out from the port to forwarder warehouse or direct to the buyer. Custom will incurred the GST on the total value stated in K1 form.

GST IMPORTATION OF GOODS (IM)

Tax Code

[GST | Maintain Tax...]

You can found the following tax code available in SQL Financial Accounting.

Tax Code Description Tax Rate % IM-0 Import of goods with no GST incurred (for Foreign Supplier Account) 0% IM Import of goods with GST incurred 6%

Oversea Supplier Invoice

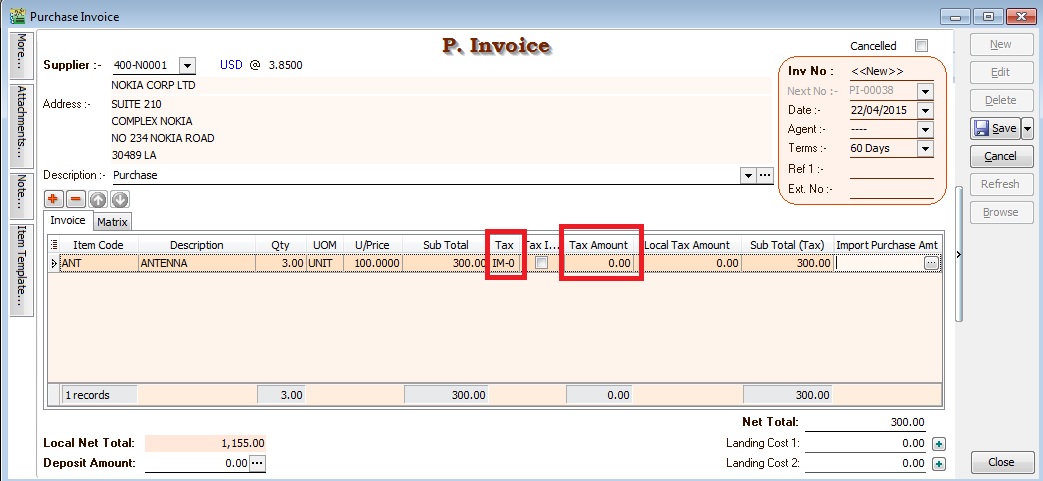

[Purchase | Purchase Invoice...]

1. Create the oversea supplier invoice at Purchase Invoice.

2. Select the tax code “IM-0”. Tax amount = 0.00

2.3 Received Forwarder Notification from K1 /Invoice

Let's said in the K1 form details:-

| Description | Amount (MYR) | Calculation |

|---|---|---|

| Goods Value (A) | 1,155.00 | USD300 x 3.8500 |

| Custom Duty (B) (assumed is 5%) |

57.75 | Rm1,155 x 5% |

| Total Taxable Amount (C) | 1,212.75 | A + B |

| GST - IM | 72.77 | C x 6% = Rm1,212.75 x 6% |

Usually, the forwarder will invoice to the principal company for the following details:-

| Description | Net (MYR) | GST | Gross (MYR) |

|---|---|---|---|

| Est. Duties (Import&/Excise Duty) | 57.75 | ||

| Est. GST Import (RM1,212.75 x 6%) | 72.77 | ||

| Est Duties + GST Import | 130.52 | 130.52 | |

| Duty Processing Fee | 100.00 | 6.00 | 106.00 |

| Total Payable | 236.52 |

NOTE :

GST Import can be calculated in different way. It might based on total weight (ie. weight x container) or total meter square (ie,meter square x container). For example, GST Import = 30,000m2 x 10 containers x 6% = RM18,000.00

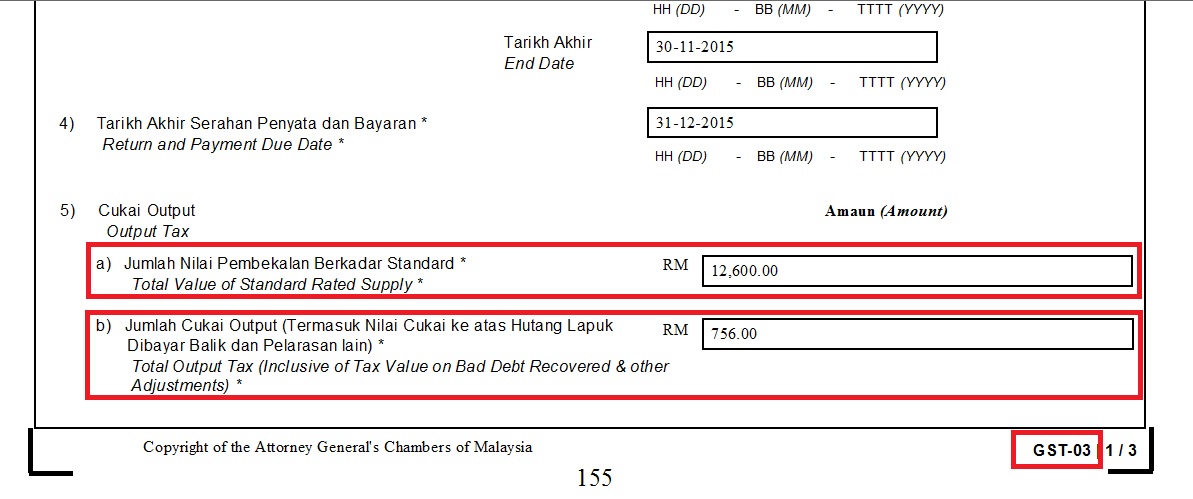

GST Return

[ GST | New GST Return...]

1. Process GST Return for the month

2. Click on print GST-03

RESULTS :

5a Total value of supplies = 12,600.00

5b total output tax = 756.00