| Line 8: | Line 8: | ||

===History New/Updates/Changes=== | ===History New/Updates/Changes=== | ||

20 Oct 2015 | 20 Oct 2015 | ||

* Fix Transfer Document TaxAmt calculate incorrectly if using UDF_ExRate | * Fix Transfer Document TaxAmt calculate incorrectly if using UDF_ExRate <> 1 | ||

* Fix Partial Transfer Qty TaxAmt calculate incorrectly | |||

19 Oct 2015 | 19 Oct 2015 | ||

Revision as of 06:24, 20 October 2015

Introduction

This Customisation is the simple calculation for the Shipping/Forwarding company.

Last Customisation Update : 20 Oct 2015

History New/Updates/Changes

20 Oct 2015

- Fix Transfer Document TaxAmt calculate incorrectly if using UDF_ExRate <> 1

- Fix Partial Transfer Qty TaxAmt calculate incorrectly

19 Oct 2015

- Fix upgrade to Version 721 error.

- Fix Transfer Document TaxAmt calculate incorrectly

14 Oct 2015

- Fix 0Sales Local - Invoice Listing - Level 1 margin not correct

- Convert DocRef3 to UDF_EntCost for 0Sales Local - Invoice Listing - Level 1 Ent column

09 Oct 2015

- Fix OnBeforeSave Script - Partial Delivery Amount calculation revert back to system calculation

- Fix 0Sales Local - Invoice Listing - Level 1 unable to calculate cost

- Add 0Sales Local - Invoice Listing (GST 1) - Forwarding report

- Add Script & UDF Field for Sales Quotation

Modules Require

- DIY Script

- DIY Field

Setting

Maintain User

Untick the Access Right for Prompt Replace Unit Price Dialog under the Group : Sales

Steps

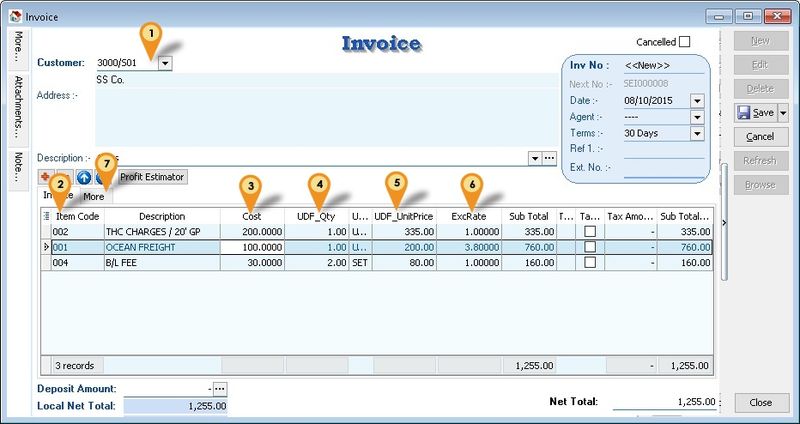

Invoice

- 01. Select Customer Code

- 02. Select Item Code

- 03. Enter the Cost incurred for the selected item code (for the Profit & Loss By Document report)

- 04. Enter Qty

- 05. Enter UnitPrice

- 06. Enter Exchange Rate (if had)

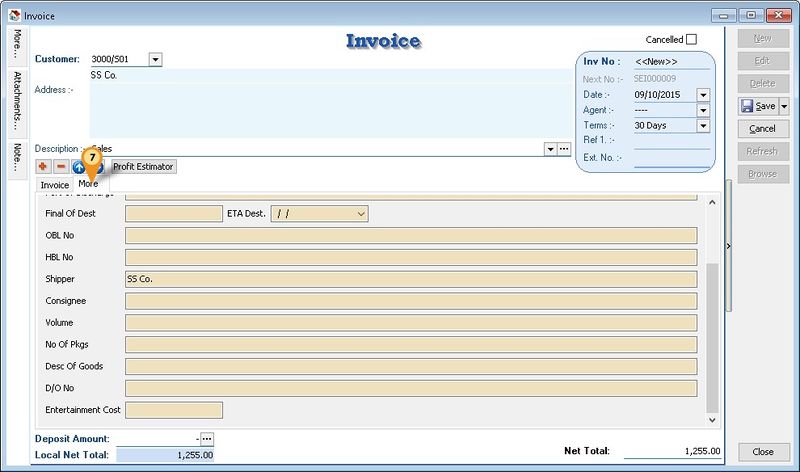

- 07. Click More tab to enter extra/others Information

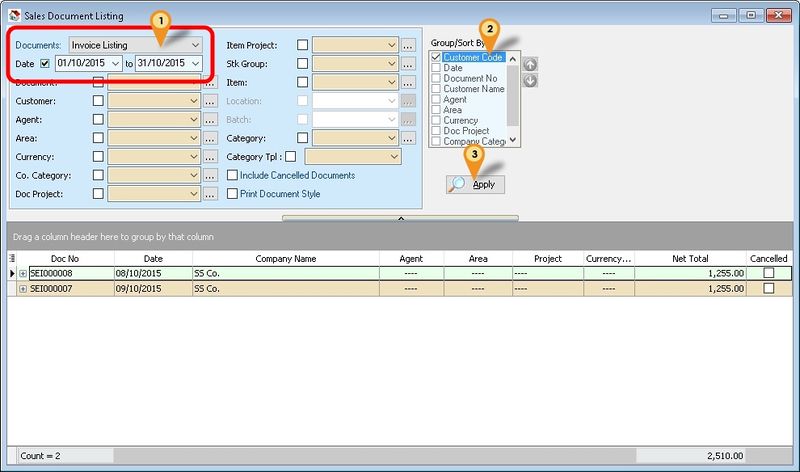

Profit & Loss By Document

- 01. Click Sales | Print Sales Document Listing...

- 02. Select Invoice Listing & Range Date

- 03. Tick Group by Customer Code

- 04. Click Apply

- 05. Press F6 to preview

- 06. Select report name 0Sales Local - Invoice Listing - Level 1

- 07. Click Ok button

See also

- Others Customisation