| Line 1: | Line 1: | ||

==Introduction== | ==Introduction== | ||

'''Rules:''' | '''Rules:''' | ||

Revision as of 01:31, 3 October 2019

Introduction

Rules:

- 1. Compensation exempted from income tax is RM10,000 x no of years of service.

- 2. Determine the number of completed year of service. For example, employee has serverd for 5 completed year of service

- 1/5/2004 - 30/4/2005 (year 1)

- 1/5/2005 - 30/4/2006 (year 2)

- 1/5/2006 - 30/4/2007 (year 3)

- 1/5/2007 - 30/4/2008 (year 4)

- 1/5/2008 - 30/4/2009 (year 5)

- 1/5/2009 - 25/3/2010 (n/a, less than one completed year of service)

- 3. Tax exemption on compensation

- RM10,000 x 5 years of service = RM50,000

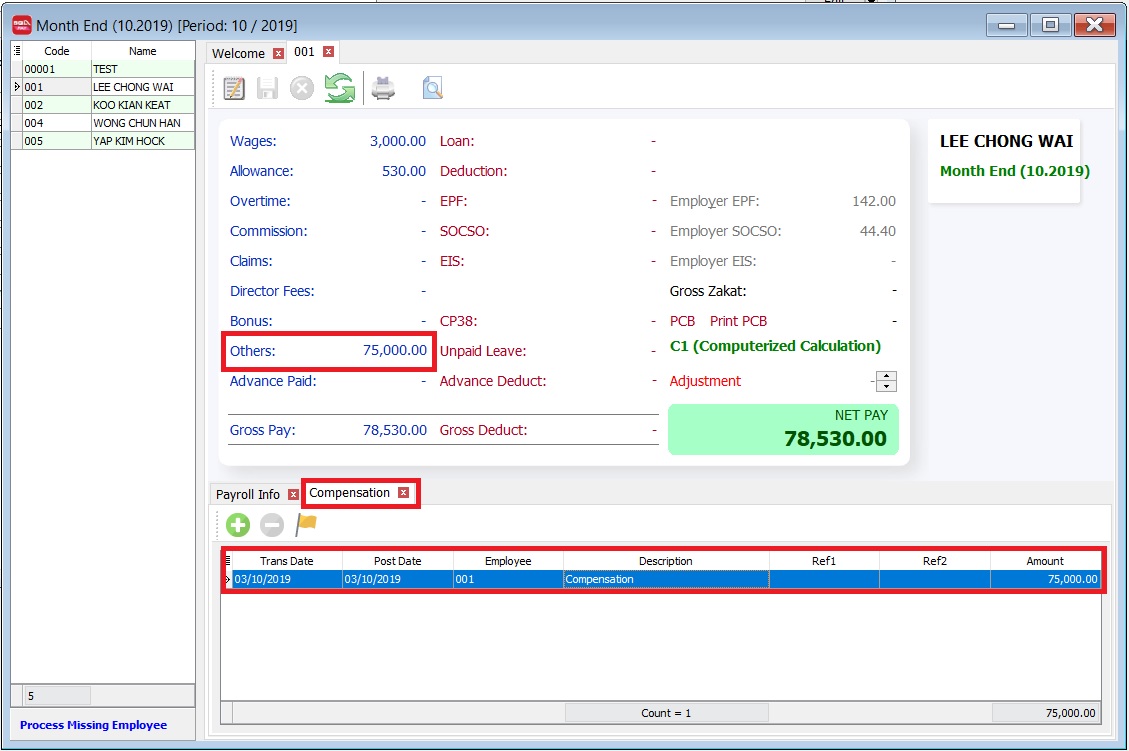

Workings:

- Compensation paid (key in Pending Compensation) = RM75,0000

- Less: Amount of exemption RM50,000.00

- Balance of compensation subject to MTD RM25,000.00

- Balance of compensation of RM25,000.00 after deducting the qualifying exemption will be subject to MTD and the MTD shall be calculated using Additional Remuneration PCB (A) Formula and report in EA form (B6).

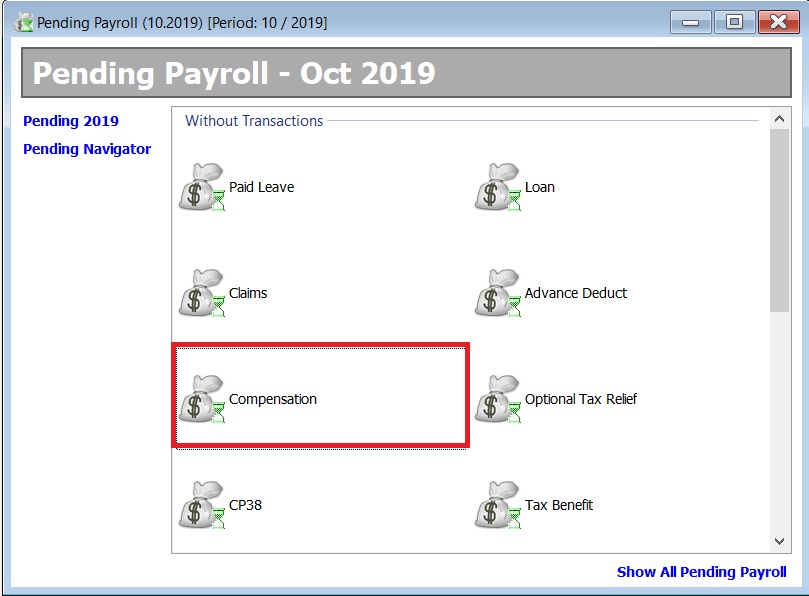

Pending Compensation

[Payroll | Open Pending Payroll...]

Payroll Process

[Payroll | New Payroll...]

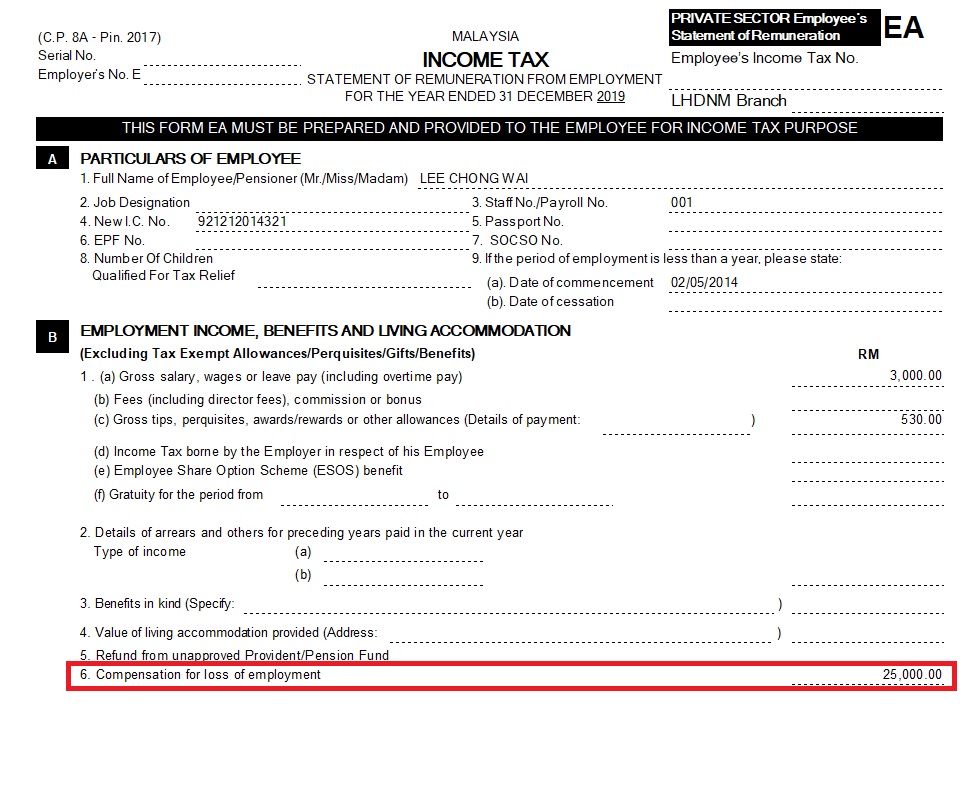

EA Form

[Payroll | Government Reports | Print Income Tax EA Form...]

- Compensation paid = RM75,0000

- Less: Amount of exemption = RM50,000.00

- Balance of compensation will be shown in EA (B11) = RM25,000.00