(Created page with "=1. General Setting= ==Can I Change the Service Tax Type to Accrual Basis?== : By Default System will use as <span style="color:#0000ff">Payment Basis</span> for Service Tax...") |

No edit summary |

||

| Line 1: | Line 1: | ||

=1. | =1. GL= | ||

=2. Customer/Sales= | |||

=3. Supplier/Purchase= | |||

=4. Stock= | |||

=5. Production= | |||

=6. SST= | |||

==Can I Change the Service Tax Type to Accrual Basis?== | ==Can I Change the Service Tax Type to Accrual Basis?== | ||

: By Default System will use as <span style="color:#0000ff">Payment Basis</span> for Service Tax Type | : By Default System will use as <span style="color:#0000ff">Payment Basis</span> for Service Tax Type | ||

Revision as of 03:10, 29 May 2019

1. GL

2. Customer/Sales

3. Supplier/Purchase

4. Stock

5. Production

6. SST

Can I Change the Service Tax Type to Accrual Basis?

- By Default System will use as Payment Basis for Service Tax Type

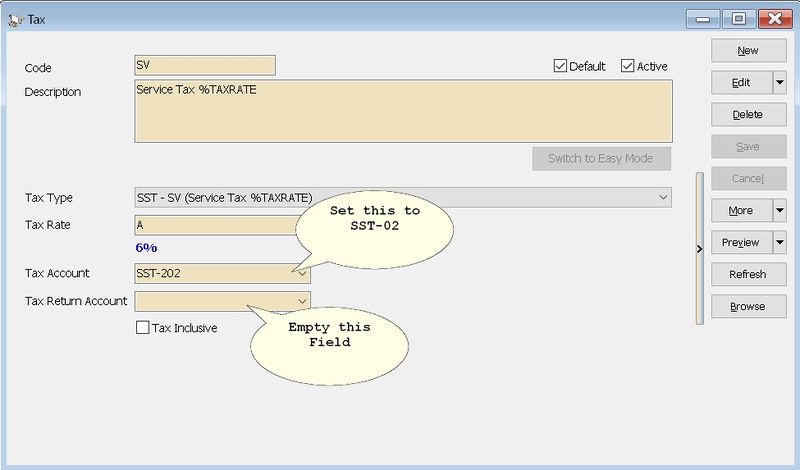

- To change to Accrual Basis(i.e. Pay Kastam even no payment), Just Set as below

Why preview my SST-02 report is no value even at screen had amount?

- Make sure you had enter your Service Tax and/or Sales Tax No. in File | Company Profile

I have use tax code (ST5) for the sales invoices but it does not appear in SST-02 but found in SST-02 listing

- Make sure you had enter your Sales Tax no instead of Service Tax no in File | Company Profile

Why Some Service Tax Transaction not shown in SST-02 even the document is fully paid?

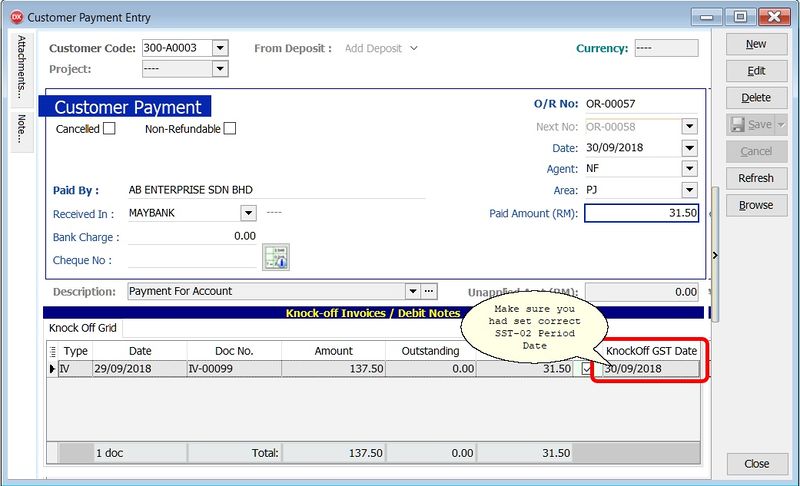

- Make sure you had select correct Knock Off Date in the Customer Payment